What a wonderful vacation, eh? Rain got in the way down here in the Lone Star State but all things considered, we need the rain. Given all of the political rhetoric out there just trying to make sense of who is saying what and why is a task. I hope Joe Biden is the candidate until he isn’t. Both can happen but it’s above my pay grade. I’ll keep an eye and ear on the scenario and interpret events as they happen.

All things considered, and except for earnings and inflation, there’s not a whole lot to react to. Changes are taking place in Europe and more than likely there will be change here as well but what that will be remains uncertain. I seldom act on uncertainty. It’s not a good idea to guess. Unfortunately, most traders and investors like to guess. That is not in my playbook and should not be in yours as well.

That doesn’t mean to do nothing. That doesn’t work either. Take a page out of my plan and be sure the action you are taking makes sense. For me, it is simple and something I’ve done for years. I buy Amazon. From the work I’ve done recently, I’m buying more than I have in the past. Here’s why.

I Buy What I Use

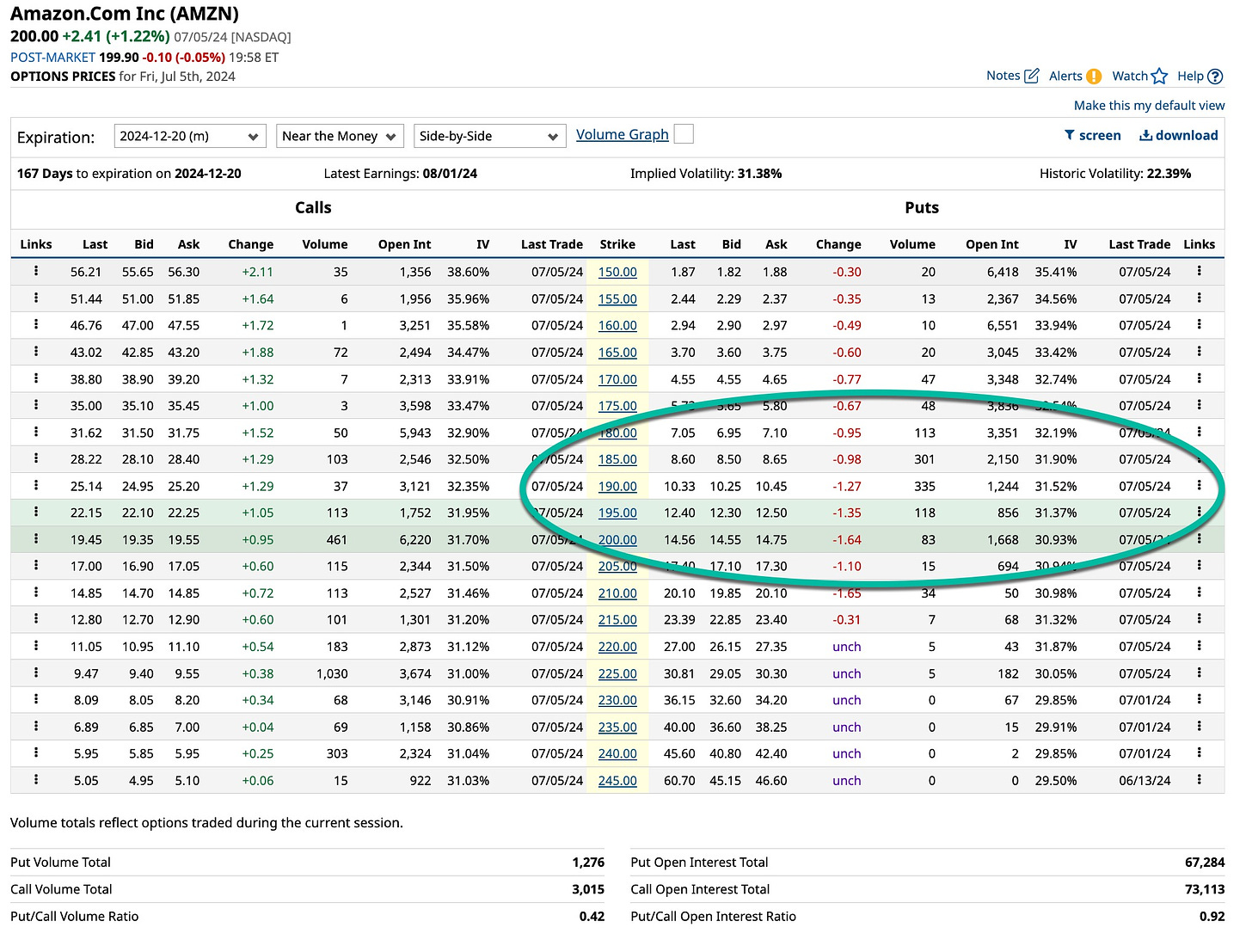

Again, other than trying to spend my pile of cash I’m pretty happy with what I own. I am a patient person. Sometimes I’m a little too patient. I’ve owned Amazon for years. I’m an interest-rate buyer, I like turnaround stocks and those that pay good dividends. Together with gold bullion, these investments comprise about 65% to 70% of my total holdings. I sell covered calls to buttress income. I sell naked puts to purchase stocks. I like it when time is on my side and premiums disappear. You should as well but there are times to simply buy good stocks. It’s time to buy more Amazon.

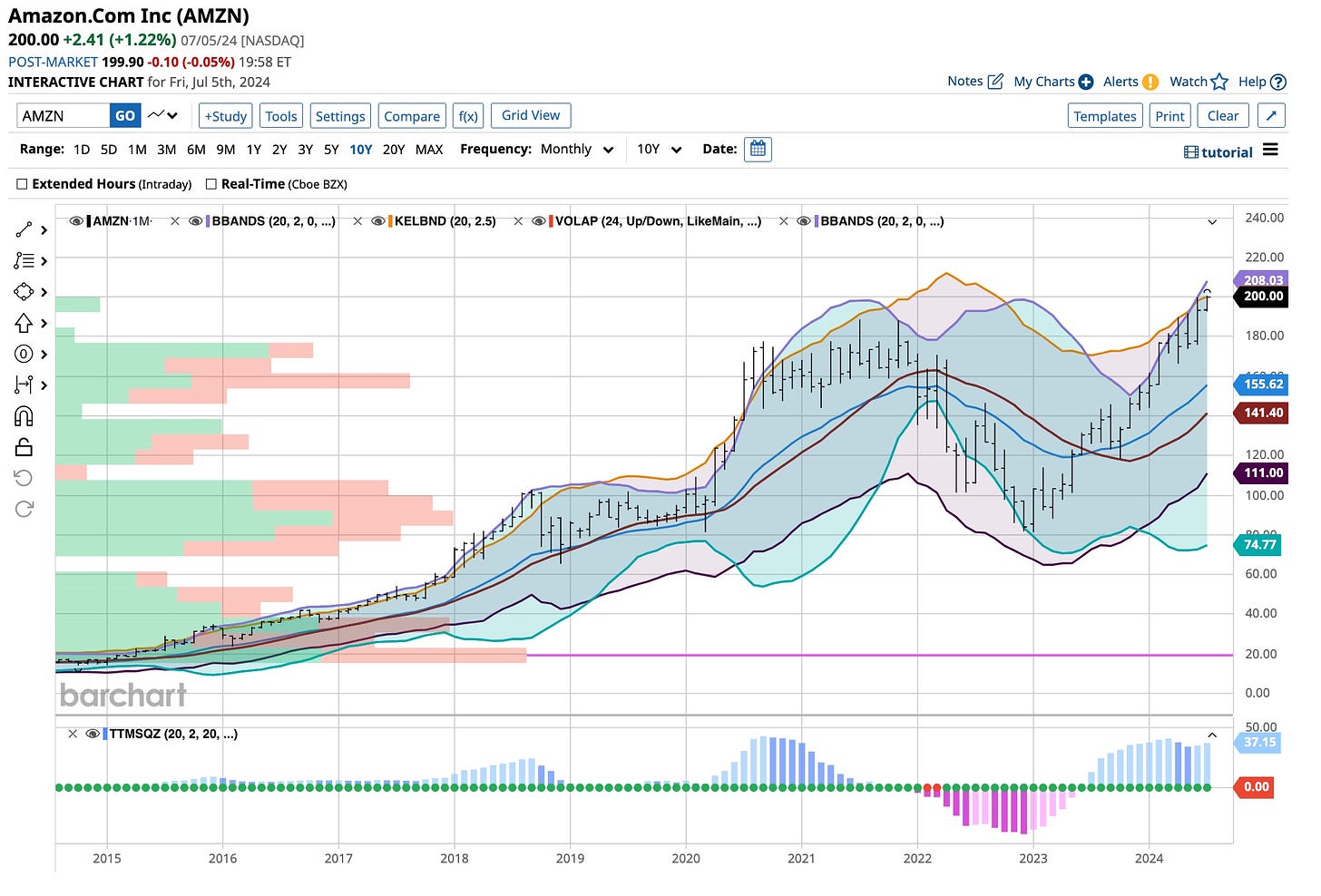

Amazon stock closed at a record peak of $200 on Friday. Shares have outperformed the broader market so far this year, climbing roughly 32%. With a valuation of $2.08 trillion, the Seattle, Washington-based tech giant is the fifth most valuable company listed on the U.S. stock exchange.

Amazon has been “green” in July for 15 of the last 20 years, with an average return of +4.9%. This consistency highlights July as a particularly favorable month for Amazon's stock performance. Amazon is slated to release its second quarter financial results on Tuesday, July 30 at 4:00 PM ET. Earnings estimates have been revised upward 24 times compared to just four downward revisions so “Wall Street” grows increasingly bullish on the e-commerce and cloud giant.

Consensus calls for Amazon to post earnings per share of $1.01, surging 55.4% from EPS of $0.65 in the year-ago period. Revenue should climb 10.6% to $148.6 billion, as its cloud computing and advertising businesses continue to grow. Amazon's annual Prime Day event, scheduled for July 16-17, is expected to generate significant sales and boost the company's revenue. This strong financial standing, combined with its growth initiatives, makes Amazon a compelling addition to any investment portfolio.

So I’m on board folks and will continue to add shares every chance I get. That means I will be selling naked puts and buying shares on dips. It’s not a very complex strategy. I have used it for years and it works but I don’t abuse it. Before deployment, everything is in place as it is with Amazon. Still plenty of powder “dry” but for now I am putting a bit of my cash to work. You should too.

Remember Pink Floyd? I do. One of the best concerts I ever witnessed. I can actually remember it. That’s a good thing. It’s hard to believe it’s been fifty years since I first saw them. It’s not hard to remember all of their songs, especially this one. Money is important. There are two ways to increase it, make it and don’t spend it. It’s not hard to make money. In today’s day and age, it’s harder not to spend it all. Prices are going higher daily and people are more impressed about letting their friends know how well they are doing. Not me, nope. I don’t care what others think and I never have. It’s best to keep them wondering, eh? That’s how I do it. How about you?