Slogan or not this one rings true, “sell in May and go away” it’s followed. Whether it happens again this year, who knows but from what I sense it will.

In tonight’s dissertation the words unremarkable, rangebound and an inevitable short squeeze were used to describe last week. The street’s significantly reduced earnings estimates were topped, inflation meandered at all too high levels, Japan sent us a head fake and Amazon didn’t know if it was coming or going.

Next week, between the 1/4% expected raise in rates together with the US jobs report we have more of the same; expectations are pretty much etched in stone. Inflation is far too high for things to change and the unemployment rate is far too low to change that. So more of the same. What the market, or at least the traders will do is anyone’s guess, but the investors are going to stick with a risk free 4%+ return.

Other than the following chart you’re going to have to take 20 minutes of your time and actually listen to what I have to say. There’s a few gems in there, especially at the end so click and listen.

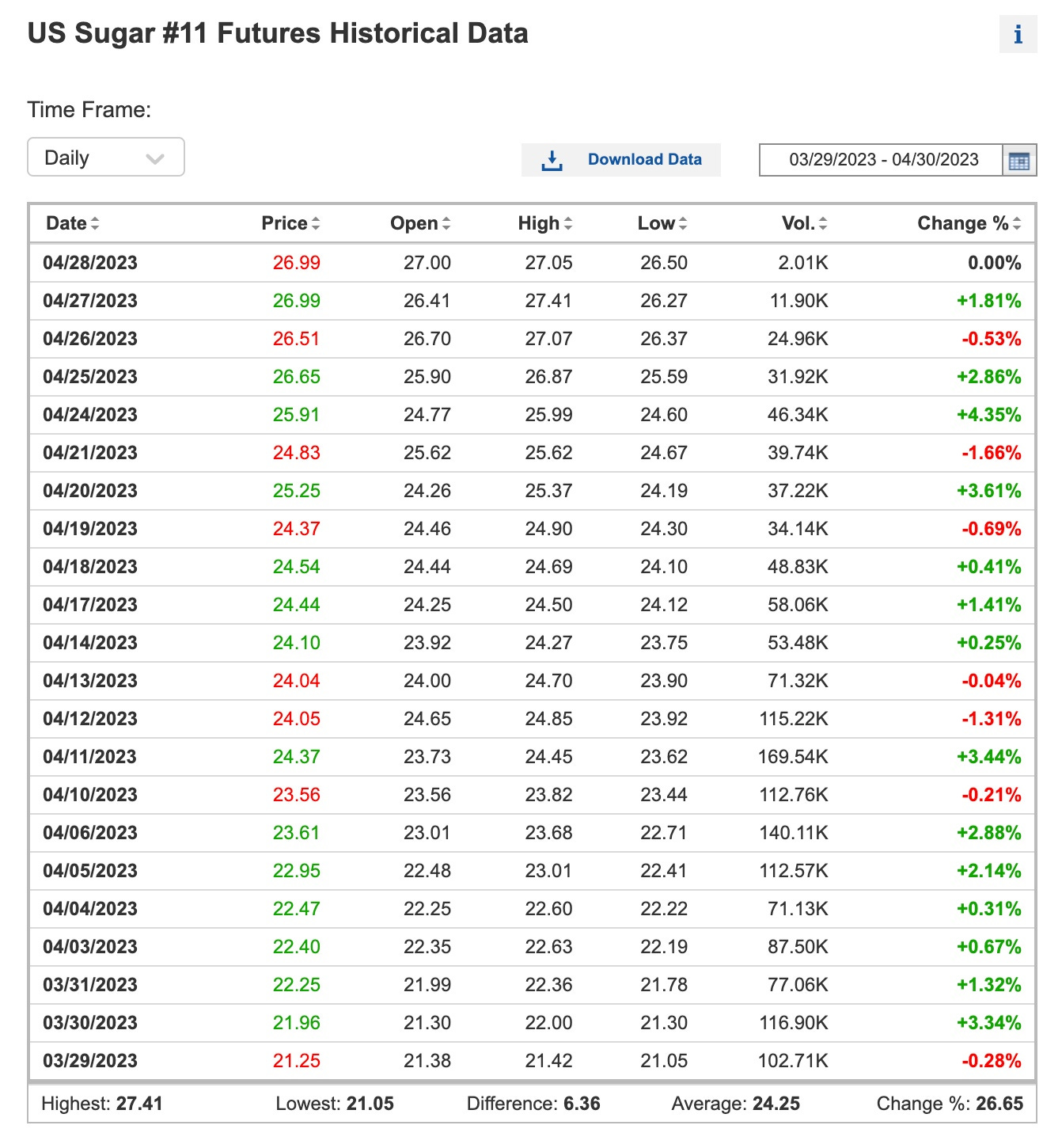

What I’m going to present below is something most of you didn’t know exists or never used. If you are a Position Trader you should. Sugar has been on a dramatic run due to constant demand but in this case due to reduced supply. No matter how you look at it, agricultural commodities grow and are harvested every year. Only once have I seen two bad years of crop production in the sugar markets and the future price models suggest it’s not happening.

First, sugar sold off pretty hard on Friday.

Second, like all commodities, especially agricultural ones, prices tend to revert to the mean for two reasons. Agricultural crops grow each year and when prices skyrocket, farmers tend to grow more to take advantage of the increased prices. It’s only natural as farmers are business people. I bet some are out there hedging the higher prices for next year knowing that when the crop comes in they’ll be happy with numbers in the 20s. Remember that’s why futures exist, not because speculators want to make a quick buck.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at dzimmer@substack.com so we can further help.

Lots of changes happening here at The Ticker and it’s all because of you. Thanks and stay tuned . . . and while you’re at it enjoy one of my David Bowie favorites.