It's Just Math

Give It A Try

Some things never go out of style. One of them is math.

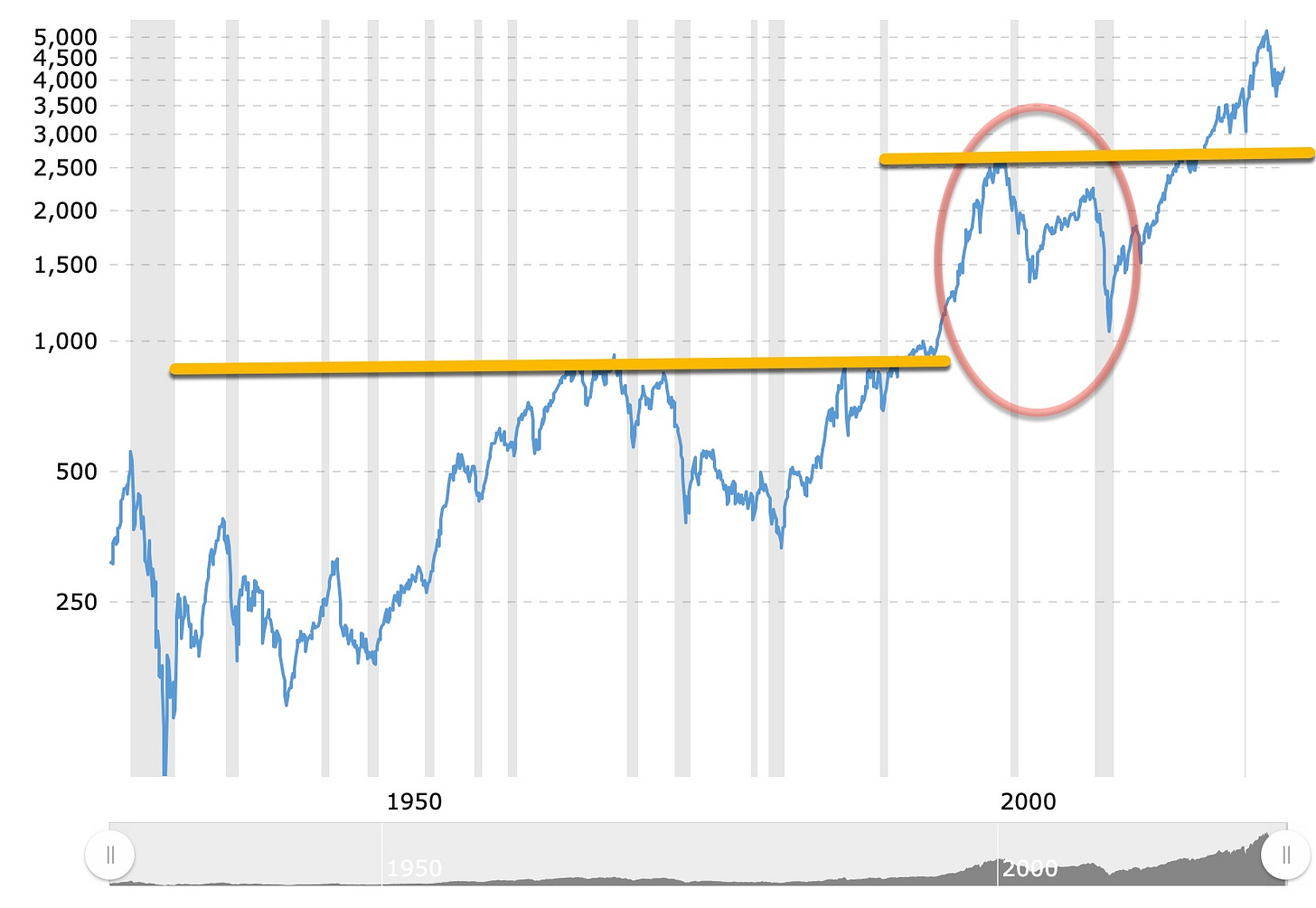

I must admit, I get a kick out of today’s experienced traders, you know the ones that go back to maybe 2008-2009, the last true economic buying opportunity. Collectively, until late 2021, except for COVID-19, there was not a significant market downside, or even a correction since the Lehman Brothers fiasco.

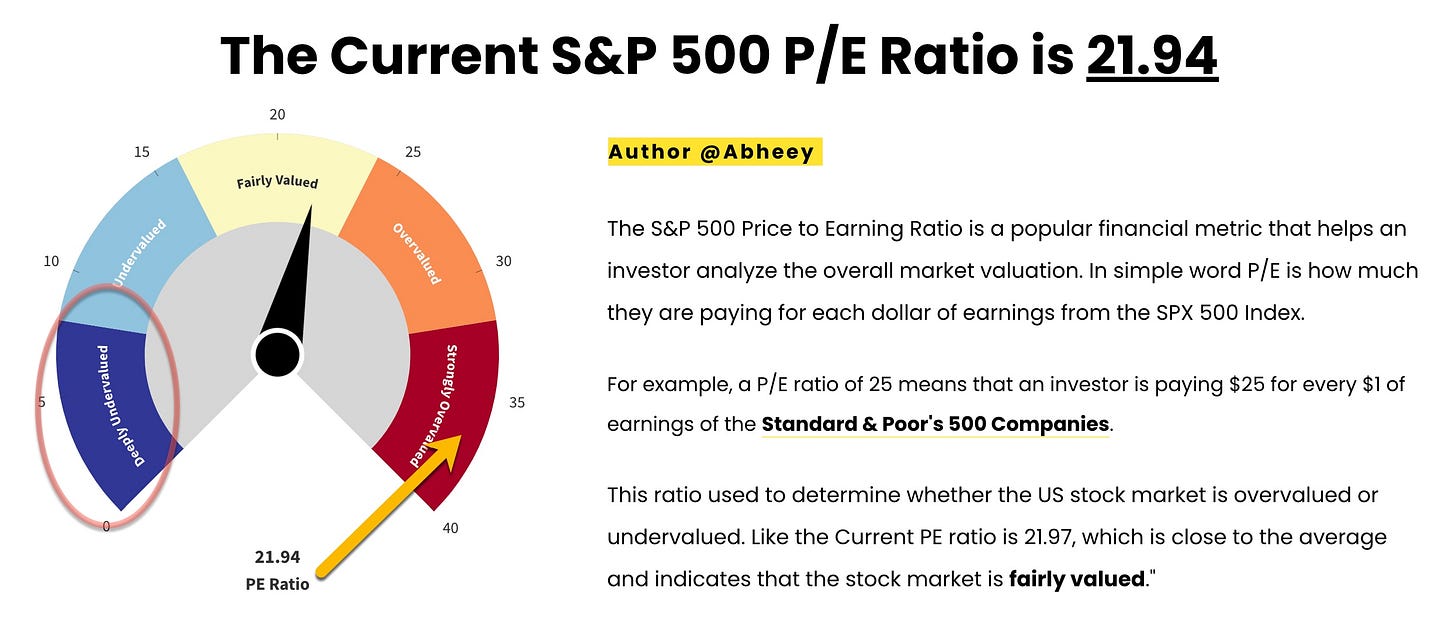

The answer to market direction isn’t found in the technical charts; they are there for verification and prognostication. We use them but more so, let’s start with “just the math”. What do we mean by math? On the basic side let’s just look at two ratios; the S&P 500 P/E ratio and a valuation model, any will do.

For the last fifty plus years these ratios, together with inflation and the interest rate trend, form our view from “5-Miles Up”. Simple, yes but beware, the times they are a changing.

During my career the mean S&P P/E is about 17½. When I began my career, it hovered around 8½; recently it even ran up to the low 40s. How this happened would be a great thesis topic unfortunately the data necessary to mathematically conclude anything is outside of my reach. Perhaps the sheer excess number of “buyers”, with a cell phone and Robinhood account, caused this bubble. They are about to do it again. Regardless, it’s the math; S&P P/E ratios don’t fly in rarified air when interest rates and inflation are at these levels.

Let’s not forget about “valuations” and as quipped, pick any one you want to. Now let me take you way back to when you learned about “fractions”, that’s right, numbers one above the other with a horizontal line in between. What happens to the valuation if a number in the “denominator” of the fraction increases; right, it gets smaller. Interest rates occupy such a position in the fraction, the denominator. Regardless of the model you choose, with interest rates higher; valuations are lower. Even the S&P 500 ratios will reflect this. We are in a period of high interest rates more than likely for a longer period of time; valuations are going to be stuck at lower levels; it’s just the math.

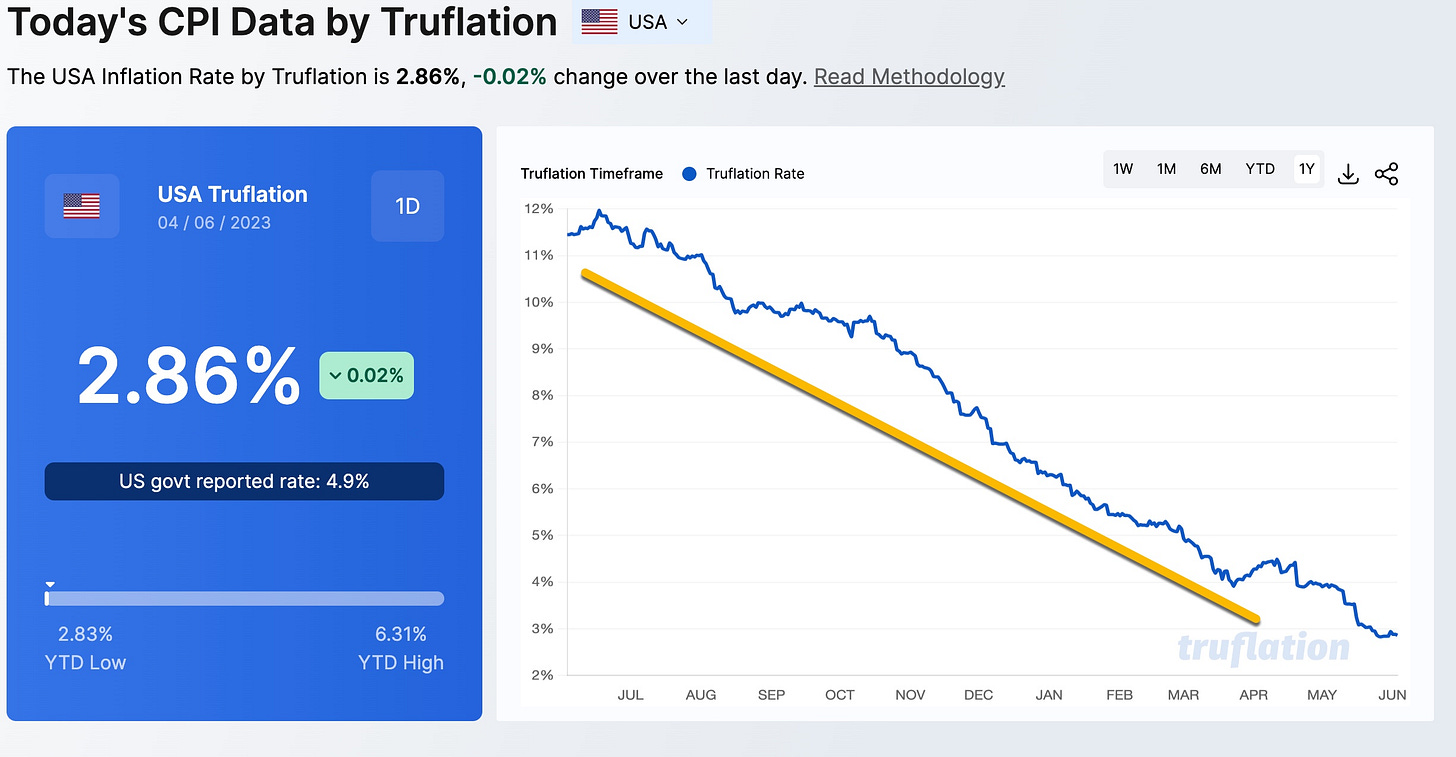

Other Modern Day Inflation Indices

There are a few new entries to the “inflation index” arena that caught my attention. In the next couple graphics, they’re illustrating a “number” far lower that the CPI index we’ve come to know and love. I find them interesting but remember, they’re the “new kids” on the block and I doubt they’ve made it to the Fed’s radar screens.

Adobe Digital Price Index

Adobe shows that prices for electronics are much lower than prior months. That kind of makes me wonder how the tech stocks have rallied as much as they have; the lack of breadth kills so maybe this recent rise is a bear trap, who knows. Consistent with the CPI, apparel and groceries, the embedded forces of “inflation” rose confirming what the Fed is looking at. Again, use this information as you see fit; for me it’s just another indicator to keep my eyes, both of them, on.

Truflation CPI Data Indicator

Truflation illustrates that post the peak number of last July, which registered in at 3% higher than the CPI reported, is now 2% less than the CPI says it is. Not sure exactly why but again, use this information as you see fit; for me it’s just another indicator to keep my eyes. It’s time for me to dig into this number a little more deeply but time is not something I have on my hands. Hopefully get to it before month’s end.

Regardless, simple math is really all it takes; a little hands-on experience doesn’t hurt either. Take your time to open up to others, regardless of their skill set, it’s invaluable. I do that here all of the time; you never know what you’re going to learn and discover next. One thing you can count on, if I stumble across something interesting that may be predictive we’ll let you know.

I’m looking forward to the release of “Oppenheimer” this summer. In speaking to my grandkids over the weekend, ages 9 through 14, none of them knew of the “Manhattan Project” but were fully aware of how to use AI on their smart phones. It would be nice if maybe those phones got a “little smarter”, eh?

Einstein best summed it up with a few of the following quotes; “artificial intelligence is no match for natural stupidity”; “the difference between stupidity and genius is that genius has its limits”; “only two things are infinite, the universe and human stupidity, and I'm not sure about the former”; and without a doubt my favorite; “great spirits have always faced violent opposition from mediocre minds”.

I’m here to teach from my 55+ years of hands-on industry experience. I look forward to learning something new every day. If I have brought something new into your life, how you use that space between your ears, I’m happy. Thanks for making me happy.

Everyone learns at their own pace. If you pick everything up first time through, great but if not email me at david@thetickeredu.com so I can further help.

Here’s one you’ve probably never heard of. Landscape is a British band, best known for the 1981 hit "Einstein A Go-Go". The group began experimenting with computer-programmed music and electronic drums in the late 1970s and early 1980s. Einstein’s contribution to the world transgressed mathematics through philosophy. That’s just the way he processed information “between his ears”. Give it a try.