From time to time I’ll post both here and on LinkedIn. I “strongly” suggest you join LinkedIn. First of all, it’s free. Second of all, it’s very good across all spectrums in this investment world. I also suggest you take a look at The Ticker and learn from my 55+ years of experience.

While we are at it, check out Zacks, especially now that it is “earning’s season”. I’ve used Zacks for years and you should too. It comes with a cost but it is a solid “go to” source. For many investors, earnings season has become an extraordinary time of the year. Earnings are important because those who are "in the know" realize it's a great time to make money. In fact, it’s become one of the most highly anticipated occasions on the calendar for the market as a whole.

Earnings season refers to the quarters when the financial reports of “publicly” traded companies are released to investors and the general public. It takes place in January, April, July, and October. As a result, there is a feeding frenzy for this “financial” data, leading to a tsunami of forecasts and expectations from analysts. You must act early to discover the secrets of the pros so you can capture serious potential gains.

The profitability of earnings season is high because organizations are legally required to state their financial status honestly and objectively. The sheer volume of investors making decisions based on earnings reports is why these reports are a very significant factor moving stock prices.

Fortunately, Zacks has created a new report that shares the secrets of the process so you can profit. It also reveals the top six stocks you should be aware of before their accounts are made public. Check Zacks out. It’s well worth your while.

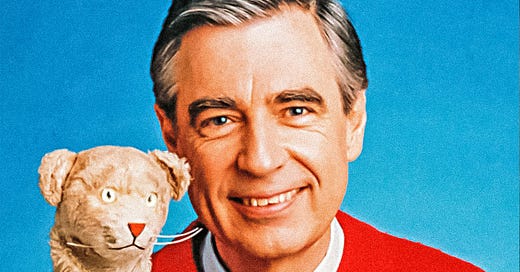

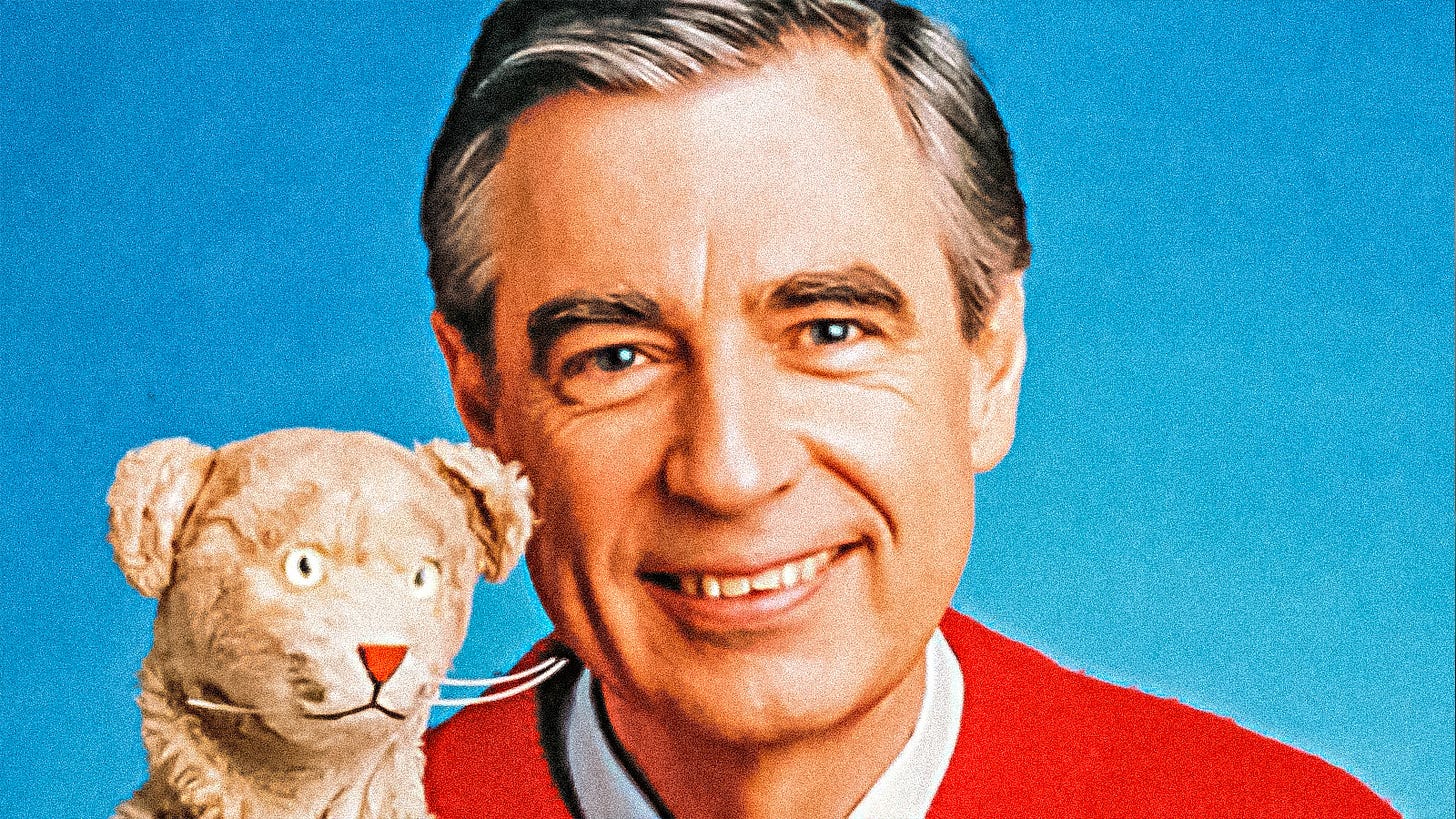

Fred Rogers Would Love Today’s Market

Most remember Fred Rogers as Mister Rogers from “Mister Rogers’ Neighborhood”. I remember him better as a client. Not only was he an active trader, he was damn good. A position investor and hedger, he was a Graham & Dodd, Warren Buffett follower. I knew him to use most of the same tools that illustrated his decision making abilities. In short, Fred had a plan that he stuck to and executed. That’s what we try to teach. It would be nice if everyone listened but in this investment and trading world they don’t.

I also remember Eddie Murphy. He often sat with me in Englewood, New Jersey at the local Starbucks, secluded in the back of the establishment, just hiding, enjoying a latte and shooting the breeze. He had it all together. He was not a client but it was obvious he was a student of the financial markets. Who could ever forget his SNL rendition of “Mister Robinson’s Neighborhood”. Here’s one he reprised in 2019.

I bring this up for reason. If you live long enough you experience many differentiated memories that when examined and analyzed all tie together. It’s all happening again. History unchecked repeats itself. Many of you out there are critical of Jerome Powell. I do not share your opinion. In my book he’s the second best Fed Chairman we’ve had since the days of Paul Volcker. History, as experienced in the late 1970s / early 1980s, is back. It’s true, the Federal Reserve is often behind the “eight-ball” more often than not simply based upon its own mistakes. Volcker had to act as he did because those who preceded him failed miserably. Powell is in the same position but he is doing it right. Given this is a politically motivated time, his place in history has yet to be ‘set in stone’ but so far he is chiseling a pretty good statue. Let’s hope he isn’t going to eat too many of “Yellen’s Mushrooms”. I hear they are coming to the supermarket soon.

So What’s Happening In My World

Like always my ears and eyes are open to change. In today’s markets that is important but in the same breath it changes, you have to “monitor” everything regardless of the type or style of investor or trader you are.

As a long term position investor and hedger I look to maintain a couple core positions and trade around them. I’m more boring than not with respect to what I manage. That is a good thing but it doesn’t mean I’m always right. The market rules, I just react.

Today, inflation raised it’s “ugly” head. It’s only running at a 3%+ clip but that follows a period of double-digit growth. That’s not good as the largest portion of my position is unhappy. One rule I follow is always having a “cash stash” handy for these times. In this case, the cash is earning a little less than 5% so I’m a little like Alfred E. Neuman, “What Me Worry”.

I do not suggest any of you follow my lead here but understand, I am very long term in nature. The problem I have is not knowing when my intentions will come to fruition. I find that to be part of life. It is my belief that interest rates, over time, will return to a normal curve type. Right now the “curve” is inverted. That often signals recession but that has not as of today happened. Higher rates have a negative effect but again I’m a hedger and a good one at that.

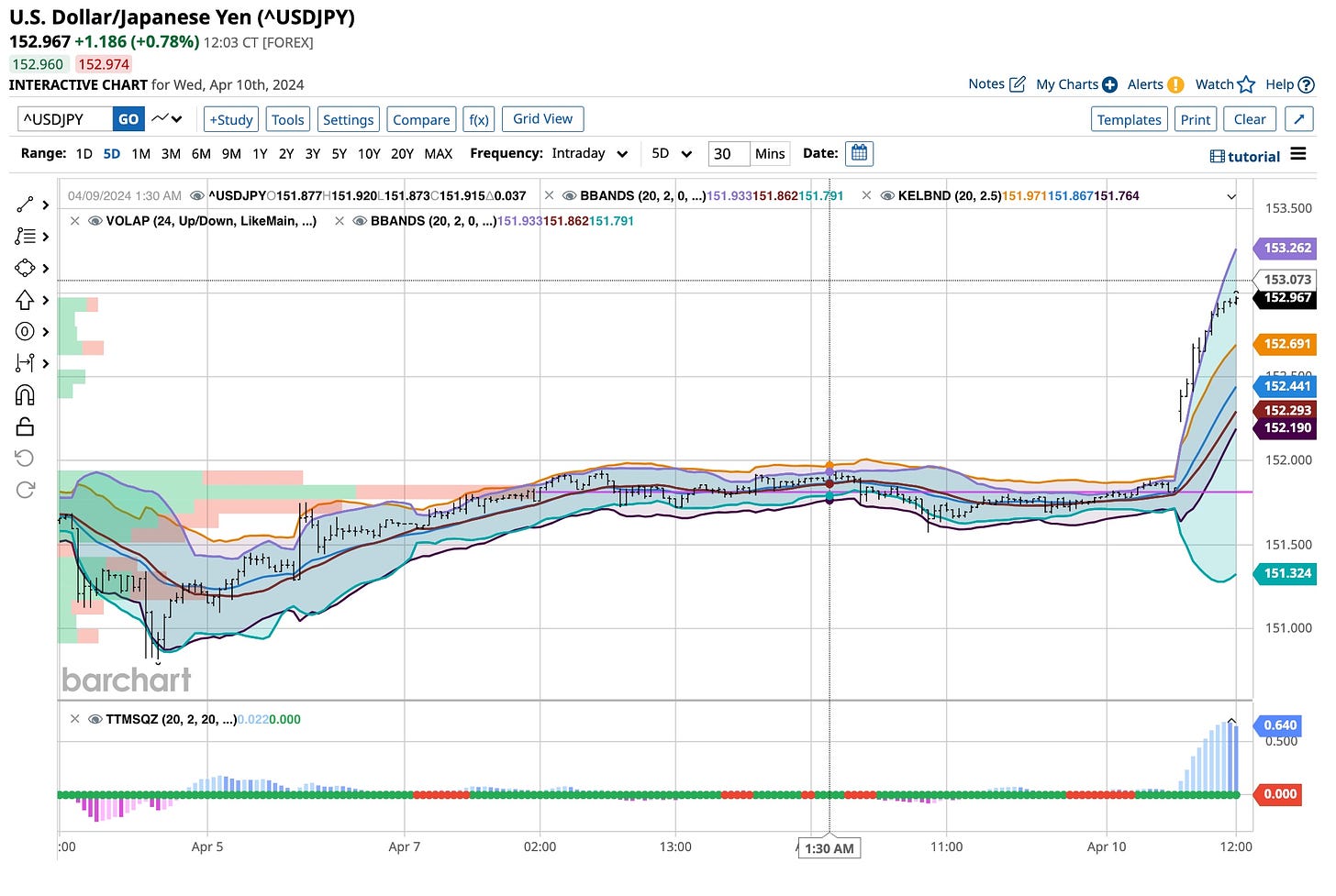

I have a large position in the Yen looking for its conversion versus the U.S. Dollar to drop from the 150+ level to around 125. With today’s move higher, my current position is down a couple points. Over the coming days I’ll add to that position and do what I do best, wait. The same thing is true for the 30-year treasury. I’m profitable there but in hindsight, I wish I had sold more when it recently ran higher. I did not so I’m now looking to add to that position as well. No one is perfect and that’s a rule I live by. You should too, it’s inevitable.

Otherwise everything is going pretty much as planned. The “metals”, hopefully in the cusp of consolidating, are significantly higher than my entry point. Silver and copper have augmented my gold bullion position allowing me to wait to liquidate a portion of that position. Stocks, you know those “out-of-favor” brand named securities, have done well but always need to be “watched” especially during earnings season.

Rebalancing is perhaps the most important activity in my “playbook”. That is where I “cover my mistakes” and they happen. Not everything I buy or suggest goes higher. It is a fact of life, learn how to handle it. Take a few bucks out of your winners and add that to your losers. If you don’t have losers you are fooling yourself. Learning how to lose is an important tool. We provide a segment on losing in the first course we offer in The Ticker. Learning how to lose is important. We do it all the time.

That’s pretty much it for today. The grass, or better called the “weeds” are growing far too quickly so I need to use my “Tesla” mower to cut the backyard. Then there’s a trip to the grocery store to buy a few more berries. Look, I’m just like you folks. Life’s good as long as you have a balance.

You might not remember Fred Rogers as I do but undoubtedly, if you were raising a few kids during his tenure you remember his show. It’s a beautiful day in this world we live in and hopefully in the neighborhood you reside in. Life can throw curves at us from time to time but being resilient in the face of adversity is the answer. Since birth I have always had the ability to remove “things” I cannot control from my life. It is not that I don’t deal with them, I do every day. If at times something comes to fruition and I can do something to handle them better I act. Otherwise I wait. Patience is often the answer to everything. Practice patience, especially when you are losing, it works.