T’was the Monday before Thursday’s “before-the-market-opens” earnings report and all through the house . . . sounds like a good start and a better time to learn a little bit about options, eh? I’ve been heavily involved in the “options” world for more than 50 years. I remember the very first time a client of my Dad’s wanted to sell three covered calls against his long position in U.S. Steel. It was a good thing that USX was based in my home town of Pittsburgh. I was able to get the “Treasurer of USX” to take the buy side of the transaction and the rest is history. All of the options expired worthless and my Dad’s client was happy. I was too and on my way in a direction I’ve built upon over the years. Let’s see what I can teach you this week about how I use options to protect my almost 40% overall upside profit in Dollar General over the last five to six months.

I like turnaround companies especially when they are guided by solid management. It is even better when “the street” is throwing the “baby out with the bathwater”. Such is and was the case with Dollar General late last year and after reviewing many stocks in the “dumper” I reacted and went long just like I did with Disney (“DIS”). Well, so far so good but there’s always work to be done. I’m going to talk about various strategies I will consider this week, in addition to a simple rebalancing of a winning position that I do all of the time. You must monitor and you must rebalance if you seek success.

What If I’m Wrong

This is always the way I look at securities owned in the portfolio. It’s a good thing that I am usually early. Some of my best trades, especially in the futures world, come when I have identified trades too soon. I have lots of capital to work with so if I’m wrong I simply average my trades as the underlying future moves against me. That is a story and strategy I’ll teach at another time but those who follow me, especially when we’re trading the Japanese Yen versus the Dollar, know how well it works. Let’s get back to Dollar General.

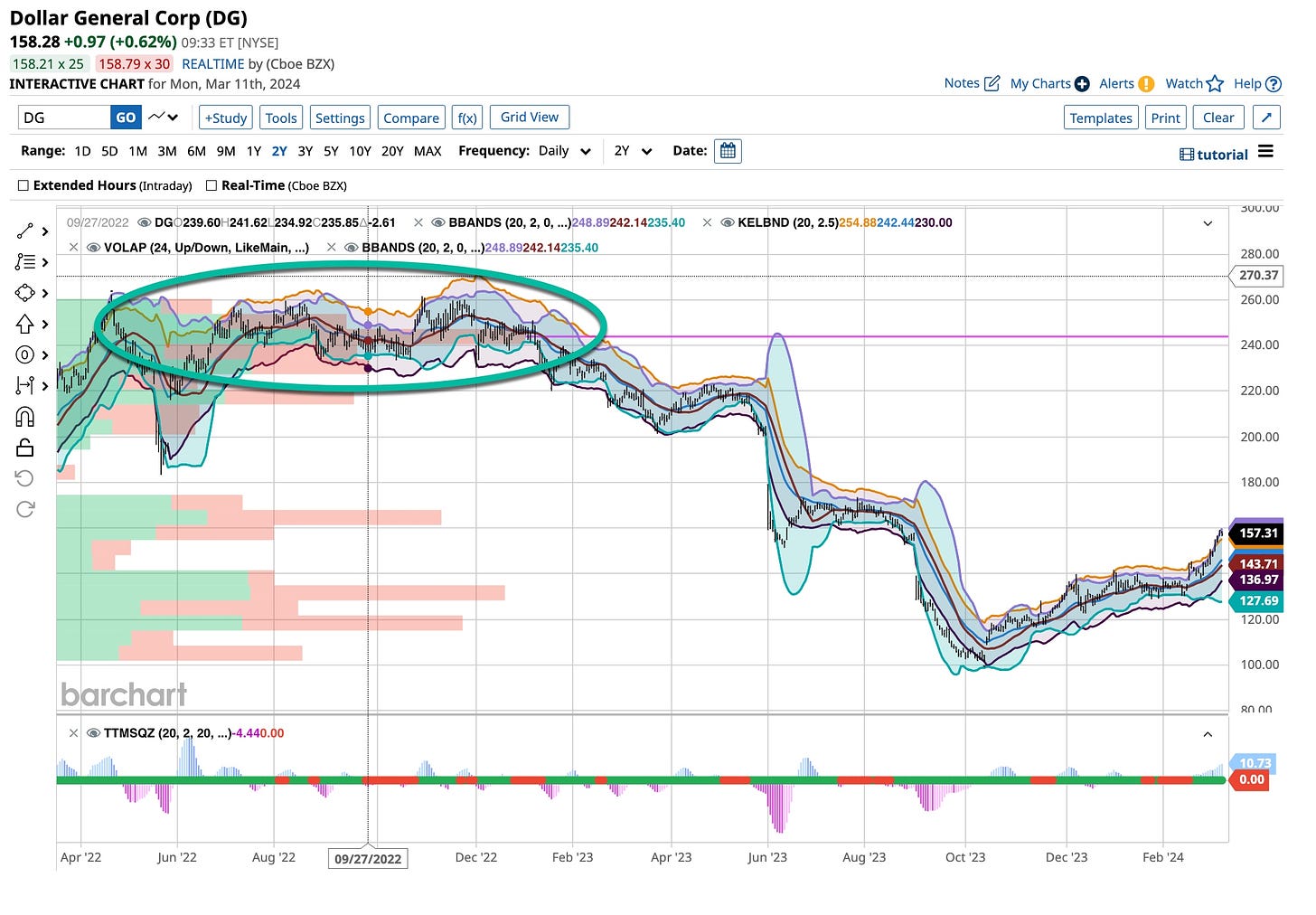

From a high of about $250 a share, the ‘proverbial’ began to “hit the fan”. Management made a mistake like many in the retail space had done. Too many low-priced discount retailers were too quick to entertain the “self checkout” method as the minimum wage increased. Dollar General was one of them, for shame, but thanks for the opportunity. Patience is a virtue and I just sat back and waited. When the stock had crashed back to earth, more than 50% lower than its 2023 starting point, coupled with “the street” beating its performance up, it hit my radar. I started buying well ahead of the “herd”.

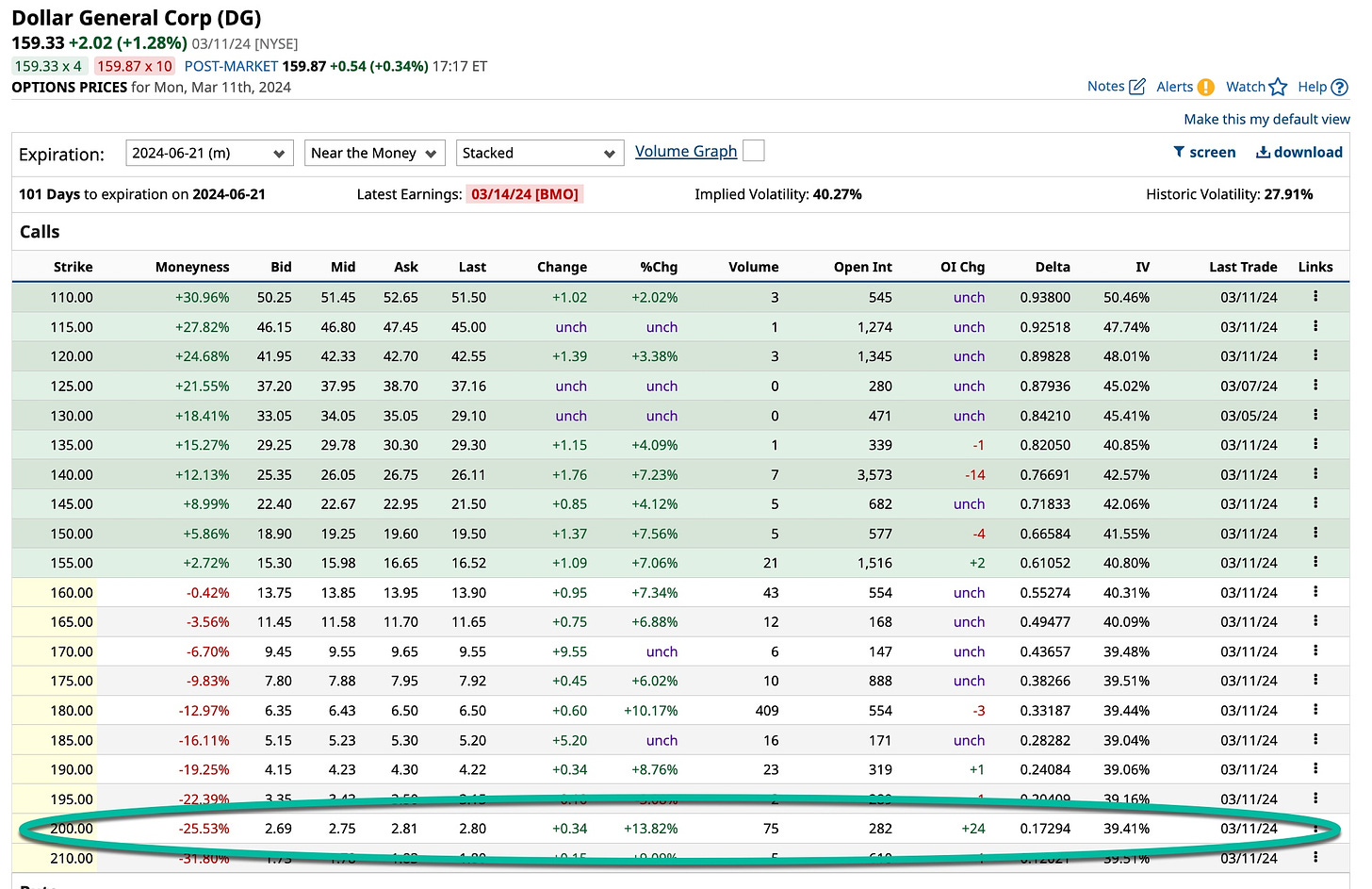

But earnings are due this week and “the street” is back in its normal, negative way. It might be that they are “right” so to simply protect my gains, again other than to just rebalance the position, I’ll look at two “basic” option strategies to start. These are the two easiest option strategies I’ll talk about but remember, this week’s action is a great opportunity for me to also teach you the “upper level” option strategies that are near and dear to my heart. I’ll get much “fancier” over the next couple days with “spreads” and more but for now let’s see if this sinks in. Let’s just look at simply “selling” some covered ‘out-of-the-money’ calls and / or “buying” some ‘near-the-money’ puts.

We are blessed to have a plethora of higher priced ‘out-of-the-money’ calls given that the stock hit much higher prices in early 2023. That gives me not only the opportunity to rake in “call” premiums, I am also fortunate to have a lengthier range based upon time itself.

Dollar General ended at $159.33 today, before heading higher in ‘aftermarket’ trades, up $2.02 from it’s Friday close. I circled the 2024 June 200 calls with an open interest of 282 but note, they traded 75 contracts today. Only the 2024 June 180 calls traded a few more, 409 to be exact, so take that fact into consideration as well as you pick out your strategy for this week’s ‘protective’ trade. Remember, I like to employ the longer term option contracts when I trade and selling covered calls is no different than when I buy things like VIX calls. Now let’s take a look at the put side of the equation.

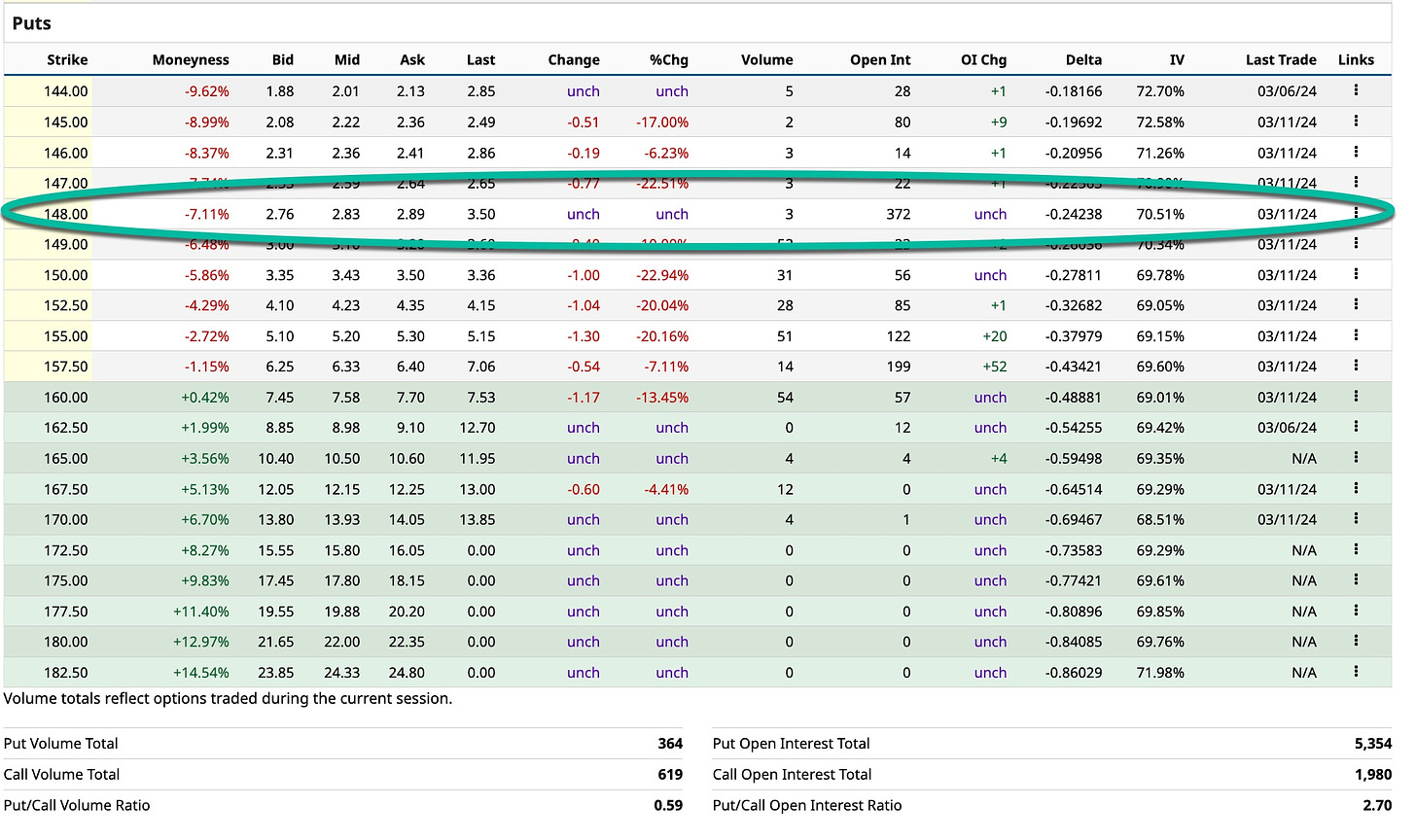

The put side is much easier. I’ll pretty much stick with the near term options closer to the money. Hell, with “one week’ options taking shape in today’s market the way they are, the CBOE makes it easy now a day. We didn’t have this luxury years ago so take a bit if time and say “thank you”. Remember a little kindness goes a long way.

I picked out the 2024 March 148 put that expires on Friday, March 22nd for a couple of reasons. First, it has the highest published open interest. Second, since I’ll be on the “buy side” put wise, the amount I look to sell the 2024 June 200 calls for equates to the amount I’ll spend on the puts. So what does that mean.

For what amounts to “no or little” cost, to the exclusion of time, I have picked up a bit of “insurance” in case the numbers, or “the street’s” reaction to them, is negative. My cost basis on Dollar General is much lower so I’m willing to risk the stock heading a bit lower. In all sincerity my thought is that between now and next year the stock will head much higher, probably back to the $200+ level but in today’s market no one ever knows and “crystal balls” exhibit a bit of cloudy haze in todasy’s market.

So that’s the “easy” stuff, covered calls and protective puts. Having weekly short term puts makes it even easier. For some of you ‘risk’ takers, one of whom just might be me, the 2024 March contract series expires this coming Friday. They are worth a ‘look’ but in reality, I’m trying to teach you something useful, not entirely speculative but don’e be surprised to see me looking at them as earnings day gets closer.

I’ll be back tomorrow with a few ideas on how to work with “bull, bear and calendar” spreads. I’ll finish off my educational series with straddle and strangle spreads for my Wednesday “dissertation” then give you an idea of what to expect. Remember, we have an introductory course on options coming to get you started at www.tickeredu.com in the near future. Keep in mind, opportunities to teach in this manner do not happen all of the time but with our One-On-One online tutorials you’ll be first in line when they do arise.

Best always and thanks for your patience. I’m heading off to dinner then I’ll hopefully get more sleep tonight than I did last night. Europe was active last night as it usually is early Monday morning for us Texans. Maybe tonight it will be a bit quieter.

I loved and still adore “The Clash”. I love Saul Hudson, better known as “Slash” too but that’s a story for another day, especially the time I had a couple beers with him after a stellar performance. “Should I Stay or Should I Go” says it all and it is a little bit schizophrenic in nature as are today’s markets. I can “pick ‘em” with the best as I am a very patient reader, listener and above all “market timer”. You’ve been the best audience I could ever hope for and it is my pleasure to give back a little of my more than 55+ years of experience. With this type of article, and those that follow, I’m doing my best to teach. It doesn’t happen all that often so enjoy it and if time allows, tell all of your friends to check it out. While you are at it, tell your enemies as well.