The next great recession is on it’s way. If you read and listen to as much “information” as I do, you’ll quickly understand and realize that no one knows exactly what’s going to happen next let alone when. More so, as will be discussed in tomorrow’s article, which of the many available indicators are predictive versus which should be altered, changed or ignored. It is a process I’ve undertaken for years and one that is not for the faint of heart. The world is constantly changing as is the way and rate that economic information, some newly minted, is delivered. That’s one of the reasons I follow what “most people” follow; the trends are real but it’s often how and when the information supporting them are delivered; especially to whom they’re reported and then received.

What Information Do We Have

Some prognosticators report that “leading indicators” of the US economy continue to signal an imminent recession. Others suggest that “coincident indicators” are mixed, and some “lagging indicators”, most notably employment, are still showing strength. So put that info into your “Magic 8-Ball”, shake it up and see what you come up with. Therefore, it isn’t clear whether or not a recession has commenced. Also, high-profile parts of the stock market are muddying the water by trading as if a “soft landing” is the most likely economic outcome over the next several months but again, the crystal ball is a little bit cloudy

The ISM Manufacturing New Orders Index recently made its cycle low in January of 2023 then returned to these levels once again last month. It’s been years, not since the early 1970s, that this ISM Index has been as low as it is today without the US economy either being in recession or about to enter a recession.

The yield curve remains inverted and not just by a little bit, it’s extremely inverted in a way that monetary conditions have become tight enough to virtually guarantee that an “official recession” is on its way. That will prove itself out once the yield curve does a 180 and reverses itself from a flattening to steepening pattern. We’re not quite there and more than likely, since other countries are still raising rates, the Fed may follow later this month further delaying the change.

The yield curve is primarily driven by the flow of capital, the monetary inflation rate. It lags the monetary inflation rate at major turning points. Yield curve reversals quite often follow a major upward reversal in the monetary inflation rate. Today’s monetary inflation rate has not shown any signs that it’s ready to reverse upward exacerbated by the debt crisis deal that resolved short term problems but in essence just “kicked the can down the proverbial road”. In short, monetary conditions for a yield curve reversal are not yet in place. This could very well happen with the expected flood of new debt the Treasury will issue over the next few months. Still, it’s not in the numbers at this time so we wait.

A US economic recession “may have begun”, but it’s now a bit more likely that it won’t begin until the third quarter of this year. Your guess is as good as mine; I’m just here to ferret out the interesting and informative details of what I read and listen to and like I said, the crystal ball is still a little cloudy.

Initial Jobless Claims

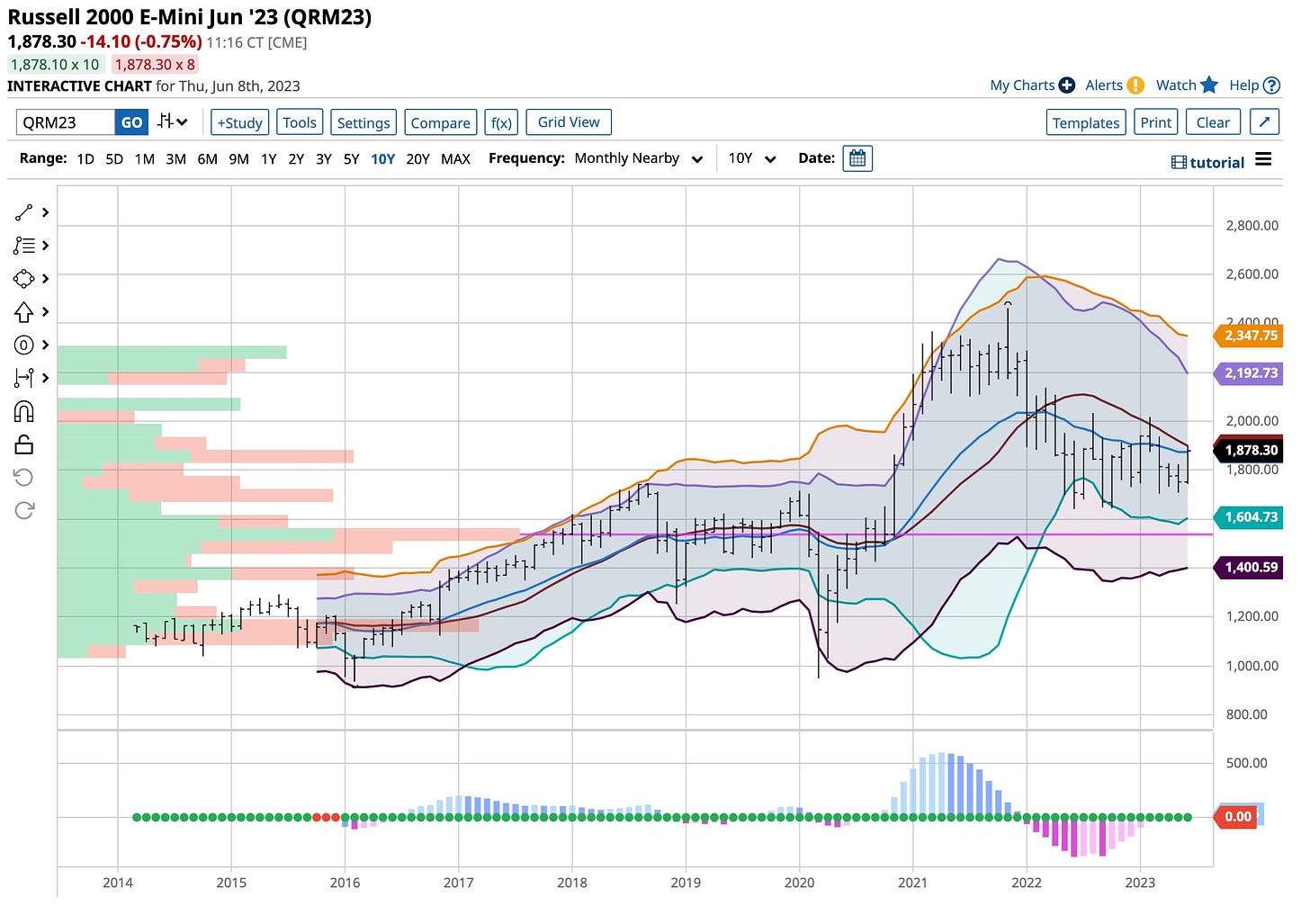

Jobless claims came in higher than expected this morning but not by any means at a staggering amount. It’s a weekly number so traders pay a little more attention to it and so they did. Cross currents reflecting the Dollar’s decline, naturally the foreign currencies moved higher, gold, copper and a few agriculture contracts did as well. It seems to set the stage for the proverbial “pause” we’re looking for from the Fed next week that should be complimented by a better CPI report than in months past. With that in mind I registered a small profit in my Russell 2000 Index trade and can happily report in that I’m “flat”. I don’t trade much so “flat” is where I usually sit, after all not having a position is a position. Uncertainty kills and coupled with summer being here there’s better things to do rather than attempt to be right every day.

The Fed has raised rates I believe for ten consecutive periods. Albeit a little late, they should sit back and assess the effect of what those increases have produced. Some out there suggest they’ll just skip a meeting and raise again going forward. While that is no really something I remember ever happening from my memory banks, in today’s all to “let’s see what happens” world one never knows. Pausing then once again raising rates would signal a continuation of the inverted yield curve and quite frankly, it’s the yield curve that’s going to guide how and when I move into bonds. So for me it’s back to work.

There’s a couple quotes I’ve used that ring true once again today, “everything comes to those who wait as long as they work like hell while they’re waiting” and “I’d rather be lucky than good and the harder I work the luckier I get". I’m blessed by the friends and family that surround me and the mentorship of those I admire. One such person, after throwing a couple compliments my way, asked me a question, “who am I writing for”? Over the last couple months, as I’ll do with any new venture, I answered that one with a couple thoughts; the first was everyone. That required a second subset reaction of how. With that in mind coupled with realizing how time consuming it is the learn how to invest and trade I’ve started to write courses. The knowledge of what I want to teach is embedded in my brain; learning how to first record and edit it before logically presenting it to you on today’s Internet is challenging for anyone, especially a 68-year old but I’ll get there. So that gives you an idea of what’s on my plate this summer and you’re the reason why. I’ll keep you in the loop.

I want to give a shout out to someone and something that put a smile on my face from ear-to-ear yesterday. Forty-five years ago, while working at E.F. Hutton with my Dad, I recommended a friend of mine be hired. He was a perfect fit for the industry; I was right. Ironically, a couple weeks ago he ran across one of my posts and yesterday we rekindled; as stated the smiles were apparent. We are going to get together later this summer when I’m back in the ‘Burgh for my 50th high school reunion and I can’t wait. He thanked me for his start in the industry; it’s just my nature and should be yours as well to take such actions besides, he did it and proved me correct. I hope all of you can do the same with what I’m putting together; that will put a smile on my face as well. In any case, Ahmie, it was a pleasure to talk to you yesterday. I only have one request; can you make a batch of those Chinese “egg rolls” you were always famous for when we first met? That would make our “circle of life” complete.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

Here’s one for you and yours Ahmie, from me and mine, some of whom have passed on but will never be forgotten. Looking forward to seeing you again; keep in touch.