The best parts of what I do are watching, listening, reacting, and writing. Each day is different. When I hit this keyboard, I’m never certain what the final product will be. That’s a good thing.

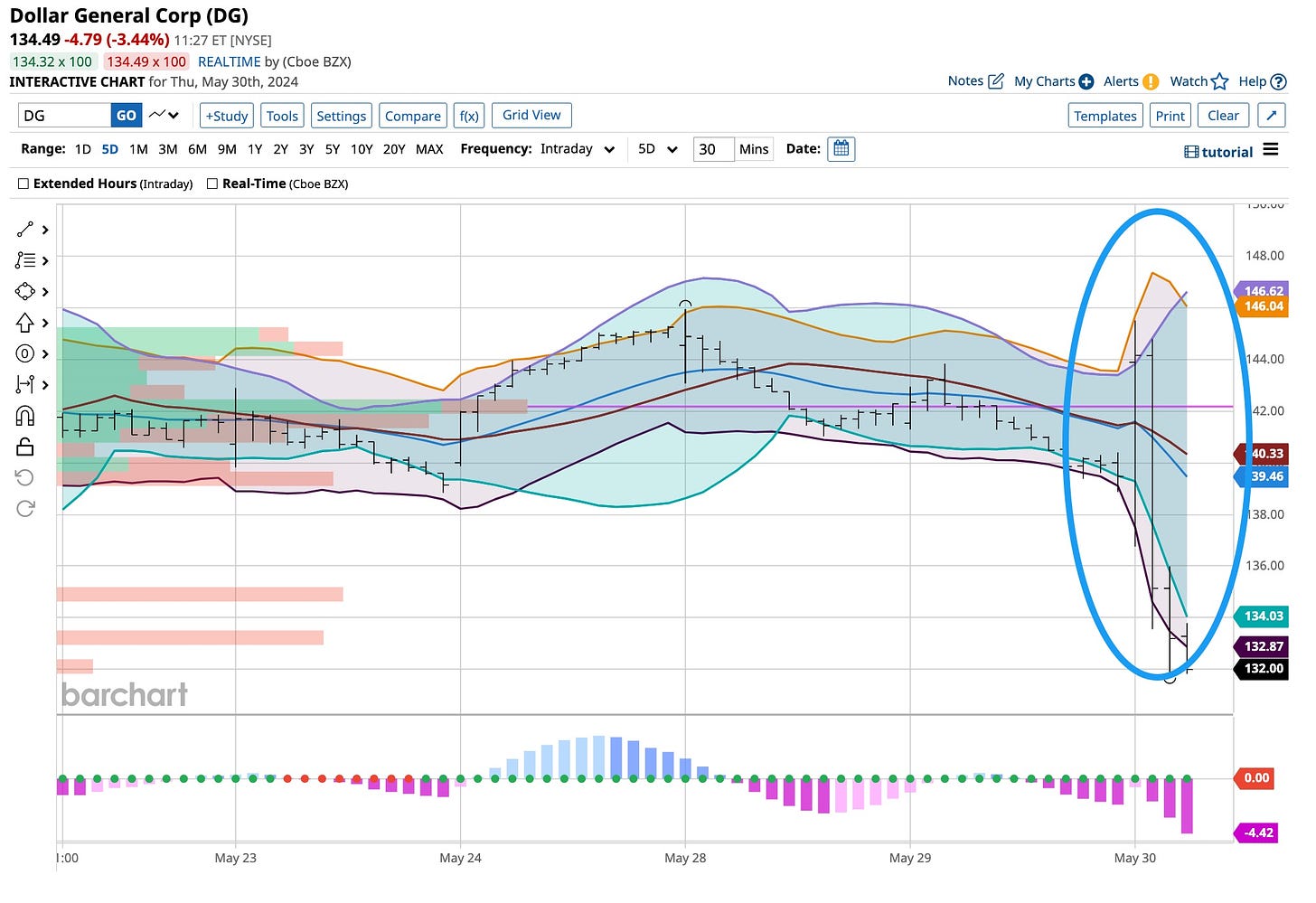

Dollar General beat “street” estimates for the first quarter. I “protected” my position against the future, not the past, and the corporate conference call was less than rosy. I will watch for the final result, take the appropriate action, and report back later using LinkedIn and The Ticker. In the future, The Ticker is going to be our “go-to” source for what I see happening so check it out and join us during our introduction.

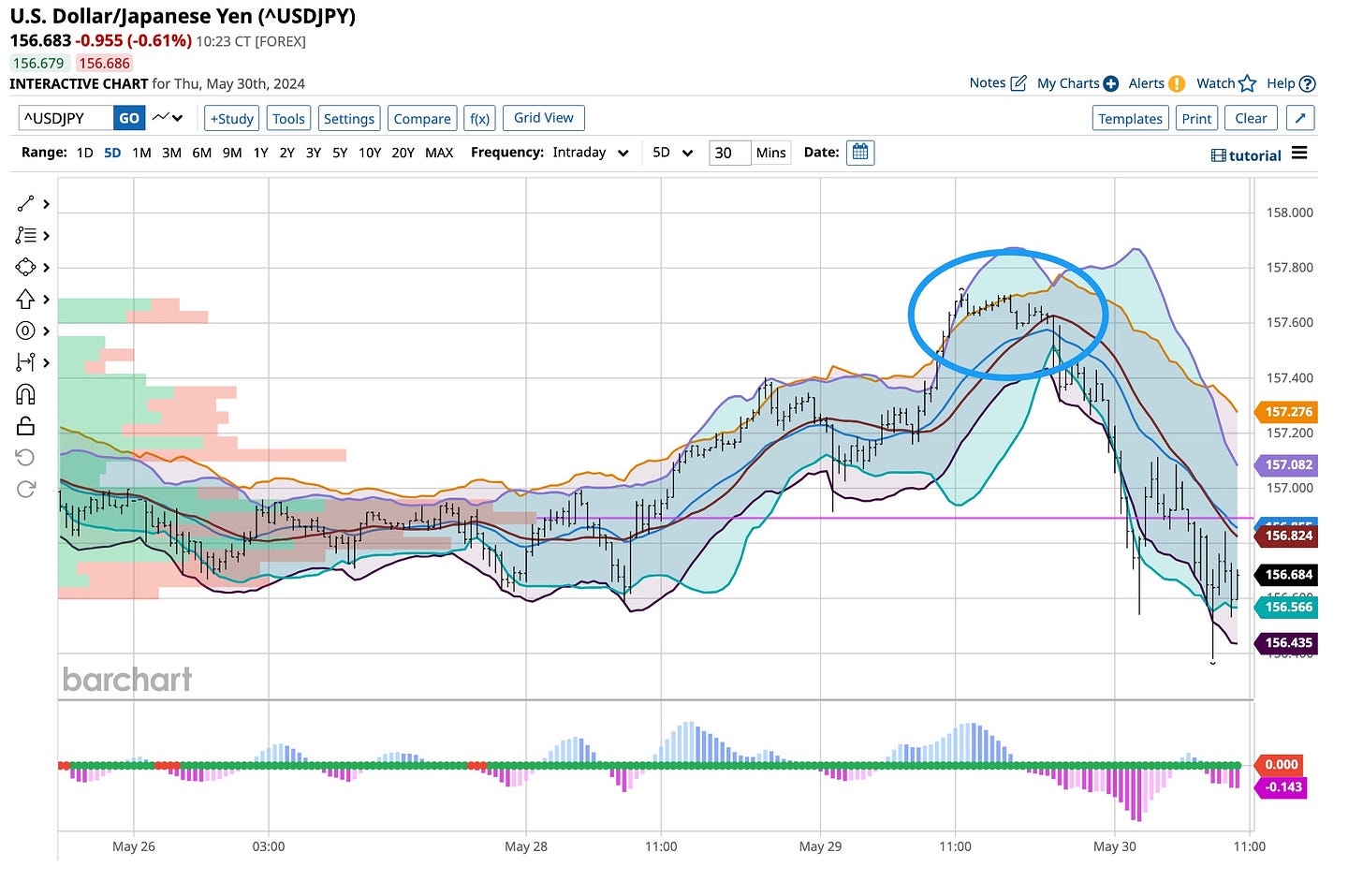

I’m sitting on a pile of cash futures-wise. Trailing stops for copper were hit and I am on the sidelines. Other than initiating a long position on the Japanese Yen, expecting to see a move against the Dollar, the only open position on the books is silver. That may change so stay tuned.

Inflation & Trade Deficits Don’t Work Well Together

I’m a long-term position trading investor and hedger with a fundamental bend. When it comes to analyzing the world, macroeconomics is my “science” of choice. For years we have heard the dreaded “recession” word. With today’s reports, I’m starting to hear it more often.

Creditworthy consumers, spending tomorrow’s Dollars today have kept our economy rolling but that’s changing. Pending home sales dropped a whopping 7.7% in April, far greater than the 0.6% estimate. That’s not good, especially at this time of year. There’s even worse news to report as our monthly trade deficit soared to a record 99.4 billion. Couple that with rising tariffs on an already-stretched consumer and problems arise. Corporations pass rising tariff costs on to consumers protecting their bottom line. It is not possible, as an importing nation, to avoid buying overseas merchandise. Seems like we are stuck and that spells bad news despite the amount of money being thrust into our economy by an administration only interested in winning an election.

The Federal Reserve has been unable to “cool” inflation, especially given the influx of money being pumped into our economic system. Despite rampant printing of Dollars, the first quarter estimate for GDP came in at a paltry 1.3%. That’s not good. It spells a strong chance that a “recession” is on its way and Biden’s team doesn’t want that.

Recession Alters The Landscape

With a little more than five months between now and the presidential election, Biden, or whomever the Democrats will run, is in trouble. Given the abysmal nature of what they’ve supported, the last thing they want to see is a declining GDP but that is upon us. The Federal Reserve doesn’t want to see it in one way. In another, they’ve helped to make it happen and look forward to it.

The Fed kept interest rates high with the hopes of bringing “inflation” under control. They’ve suggested that the unemployment rate needed to approach the 5% level but it is stuck around 4%. One thing recessions bring is higher unemployment rates but in the same breath, they bring lower rates and a weaker Dollar. I sense that Chairman Jerome Powell is in his glory. If I were him I would be too but all I can do is react.

I’ve been a buyer of 5% U.S. Treasuries for years. I own lots of gold bullion. I think silver is heading higher and the Yen is going to strengthen so I’m set. Stocks should tumble so my “covered calls” and “protective puts” should protect me. Watching the market’s movements is a daily vocation for me so stay tuned. It can change on a dime.

I’m going to get back to work but I wanted to get this out to everyone, Remember, I will do my best to update on LinkedIn and The Ticker later today. For now, I’m just going to continue to watch, listen and learn. You should too.

The Who was ahead of its time when it released “Tommy Can You Hear Me” on May 17, 1969. A masterpiece then and still significant today. Its message is clear and one that everybody should watch, listen to, and above all learn. No one has a “crystal ball” that is right all of the time. Economics changes, and perceptions of what’s next vary. I attached myself to “Tommy” as I love pinball. Other than being a low-handicap golfer in the past, my favorite activity was playing that “silver ball”. If the “Addams Family” pinball machine didn’t exist the world would be incomplete. Keep watching, listening, and more. It’s important.