There are many times I profess to sit on my hands. While “Nike” is on tap later today with its earnings release, other than just watching paint dry, tonight’s highlight on the debate stage, followed by tomorrow’s inflation numbers will be enough to take us past Independence Day. Summer is what it is and verifies that three positions exist, short, long, and flat. I love flat, I preach flat and I believe in flat, especially during summer.

When you cannot determine a direction, any direction, take your money off the table. I find that safety works, especially when you can earn 5% by watching the grass grow. It is going to take more than what’s apparent to everyone in today’s marketplace to make me move one way or another. That’s fine with me especially since I manage Roth IRAs where paying taxes is a thing of the past. Risk is not something I need to take. Simply applying logic and being consistent with my approach and plan augments the emotion I demonstrate best, patience.

Which Way Will Nike Go?

That’s an easy question to answer. The stock is going to do one of three things, either it will go up go down, or stay the same. I told you it was an easy answer. Arriving at an approach of how to position myself and my position in this turnaround stock was more difficult.

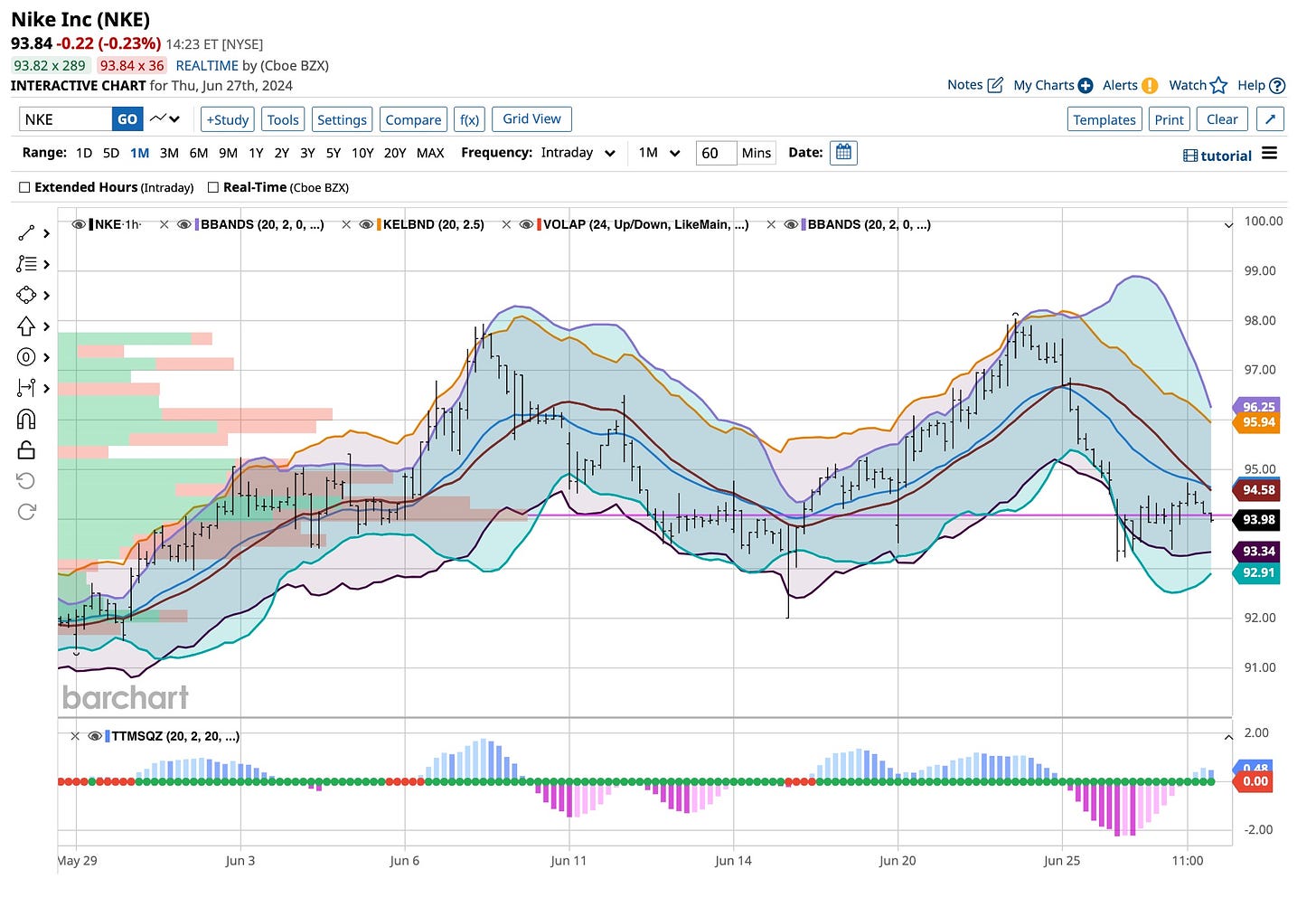

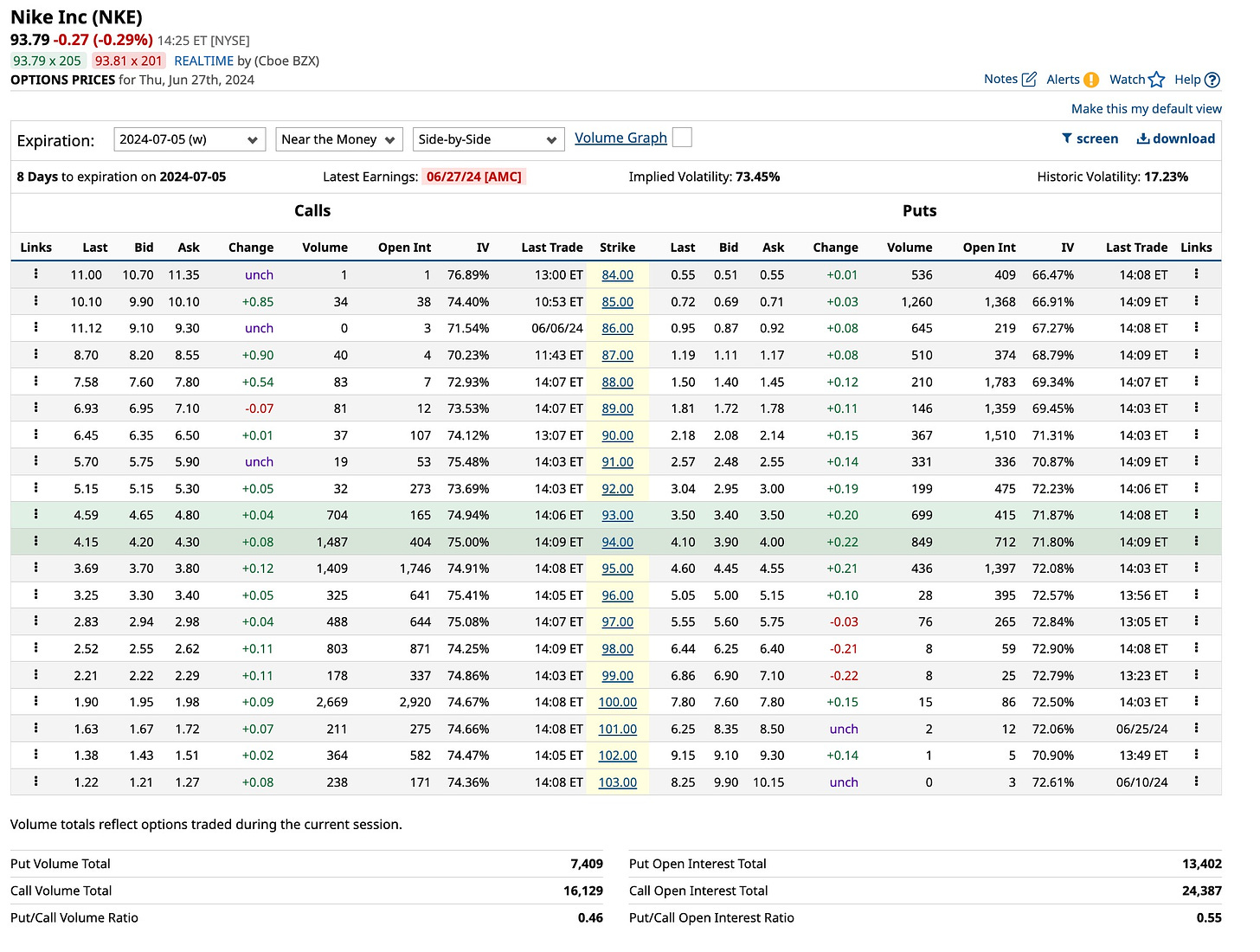

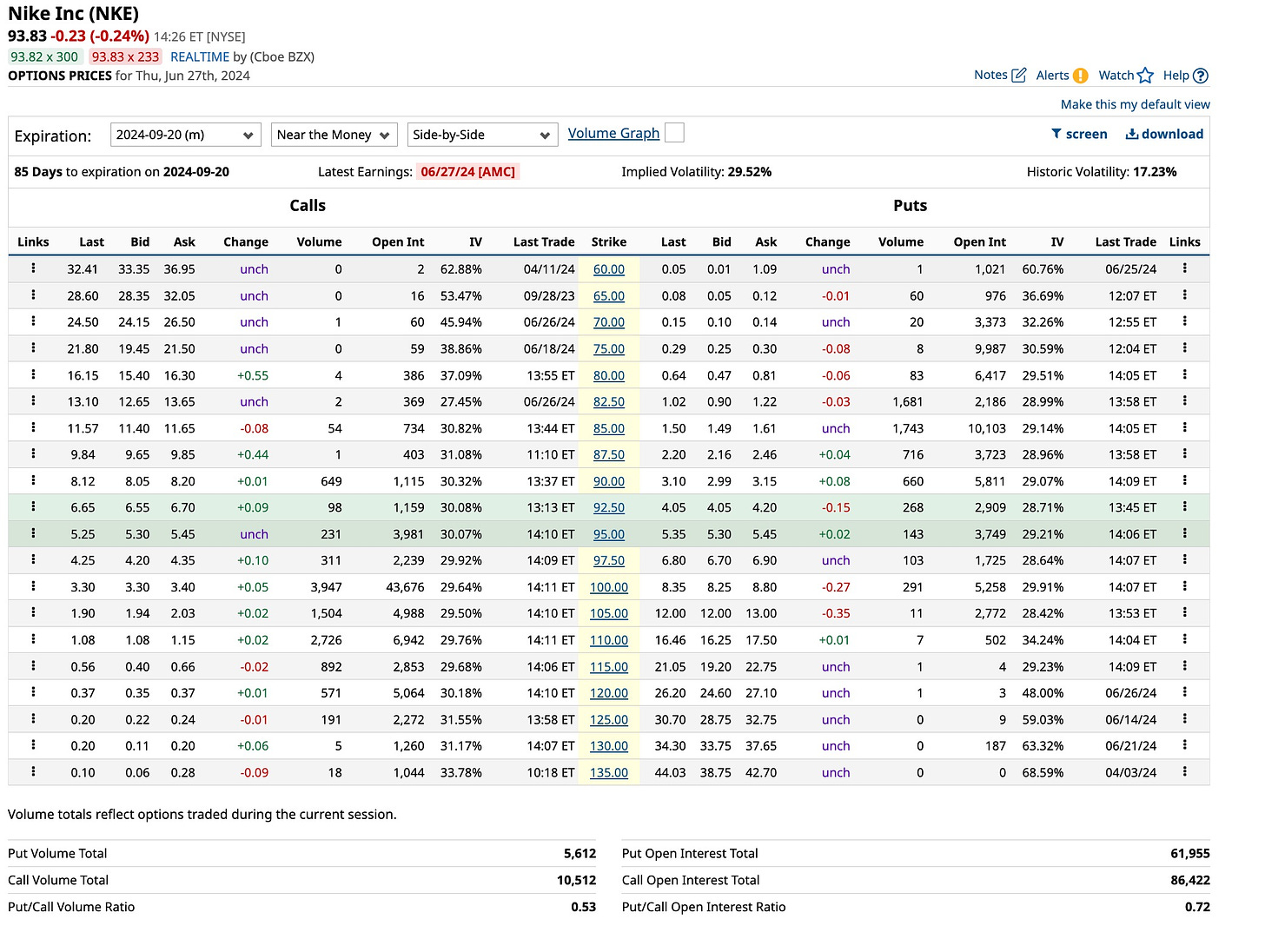

Face it, everyone wants to be right. In this case, at best, I’m unsure. I can see Nike on the upside if it beats numbers, predicting better performance going forward but there is this “thing” called China that gets in the way. The Chinese economy is not acting in a positive manner and Nike depends on China. With that in mind, I’m going to put on my “hedger” hat and buy very short-term ‘at-the-money’ put options and pay for them by selling two to three-month ‘out-of-the-money” call options. Here is exactly what I’m doing. I’m a chicken at heart but I’d rather be safe than sorry. How about you?

Which Way Will The Debate Go?

My initial assumptions for tonight’s “main event” remain unchanged. I do not expect too much. It’s early in the schedule and there’s much more to come. Both “camps” in this battle are entrenched behind their respective candidates. The fringes are targets like always but again, it’s premature for “independents” to make a firm decision.

Facts matter. Correct facts matter more but how they are presented and spun will be an issue. Immigration, inflation, and the economy should be at issue but others will more than likely take center stage. Both candidates have their weaknesses. Chances are opponent comments will elicit negative reactions but that is expected. How they are phrased and communicated will be assessed and differentiated.

Democracy’s on the table but remember, we are a republic. The constitutional framers understood from the start that differences between the various populations existed. In this way, protecting the rights of all took center stage. It still does. True separation of power between the three governmental segments is an issue I’d love to hear discussed but that’s unlikely due to the nature of the process.

So, be like me and my better half tonight. Two bowls of popcorn are ready to be eaten. We’ll be “flies on the wall” watching and listening to what happens before we’re told what it all means in the “spin” room. Like I began, it’s early but it’s a start.

Which Way Will Inflation Numbers Go?

I’ve never been one to give one month’s report more credence than another. It’s true again but there’s a caveat. Inflation in some sectors appears to be cooling. A problem remains because prices are still rising. Hey folks, what did you expect?

For more than a decade inflation was nonexistent. Naturally, inflation will enter the system with a vengeance but this time the powers that controlled the decision-making blew it. Don’t simply blame it on COVID-19. Sure, it played a role. Whenever printing presses run around the clock, pumping excess money into an already-inflated system you’re going to perpetuate and enhance higher prices.

Choosing to pursue a changing economic environment that raises basic prices for all makes matters worse. Consumers borrow tomorrow’s dollars to buy today’s products before the prices go higher. Until that trend changes and the printing presses are just turned off, any given monthly report is specious at best.

And Now We Rest

No, we don’t and it’s all your fault. Thanks for keeping us busy. During the months of July and August, we’ll finish off the contents of The Ticker as you’ve requested. Like anything else, if it’s good it takes time. So sit back and enjoy. If you want information ahead of others join us at The Ticker but above all, enjoy your summer.

Which way did he go? Sorry folks, I couldn’t help myself. There are a couple of videos that “fit” today’s article so I included both. No, I’m not a big fan of the administration but that’s no mystery. I’m not at all happy with the presidential candidates today. We could have done better but then again, there are many things we can do better.

So which way do we go, George? We know the mistakes we’ve made economically and ardently search for a “way out”. I’m almost 70 years old and since Paul Volcker that is what I’ve looked for. Powell is not perfect but he inherited problems that would take years to fix. So maybe the question should be, “Which way do we go, Jerome”? If you are like me you’re going to have these questions front and center. I’d like to know your thoughts. Let me know.