It’s a big world out there. As a macroeconomic geopolitical position trader you’ll more often than not find me awake, “bright eyed and bushy tailed” while most of the rest of you are getting your “beauty sleep”. There’s not a rerun of “Law & Order”, “Seinfeld”, “M.A.S.H” or “Family Feud” I haven’t seen, some several times over. It’s really quiet between the hours of 1:00 AM and when the sun rises down here in Texas with a lot of news, economic reports, international commentary and more crossing the “threads” all night long.

Many of you have asked me how I make my decisions. Seems to me that it is a pretty good week to give you an idea just where it all starts; overnight, especially with all of what’s about to “hit the fan” doing just that “hitting it”. Quite frankly the two critical reports this week that interest me the most are (a) China’s industrial production and retail sales numbers late Wednesday followed by the (b) BoJ’s interest rate decision on Thursday, same “Bat Time”, same “Bat Channel” as Batman, Adam West would say in the late 1960s. I watch too many reruns. since history repeats itself, it’s appropriate.

Sure, Tuesday kicks off with the two-day Fed meeting post a couple inflation related reports from Europe and the United States. The Fed will either pause or go 1/4 higher Wednesday but again, it’s Powell’s words that will matter. Truflation, Adobe Digital Price Index and more than 80% of what I read suggests a pause. If that were the case, the Dollar would head lower, Gold and Treasuries would run higher, the indices would continue their already lofty runs higher and agricultural commodities would bounce off of recent lows. So far the agricultural futures, corn in particular, and the indices have confirmed but with a current S&P 500 P/E Ratio bumping 25 it’s probably a top. Despite the indices closing up on Monday the VIX also closed higher and VIX traders are the best I know at picking tops. My sense is that they’re getting closer but with so much news on the table there could be another upside “wick” on the way post the Fed decision on Wednesday before a top forms. The “Magic 8-Ball” is still on the fritz so like you I’ll just wait and see. There’s a lot of data yet to come this week.

So let me ask you, what did you learn from that last paragraph? I can sum it up in one word, “relationships”. No, not the interpersonal or “inter-whatever” kinds encircling the world today. The ones where if “A” does something then “B” reacts. That’s what, in a nutshell, I look for. In one of the actual courses “under construction” I navigate through years of history of these relationships as if there’s anything that repeats itself, fundamentally and technically, it’s “relationships”. Regardless it’s almost time to react and if trading patterns are consistent with recent “reporting days” things will first go one way before they revert and go in the opposite direction. Have fun deciding what comes first, the “chicken or the egg”. It’s too much for me to participate in; I’ll just be sitting back and taking it all in.

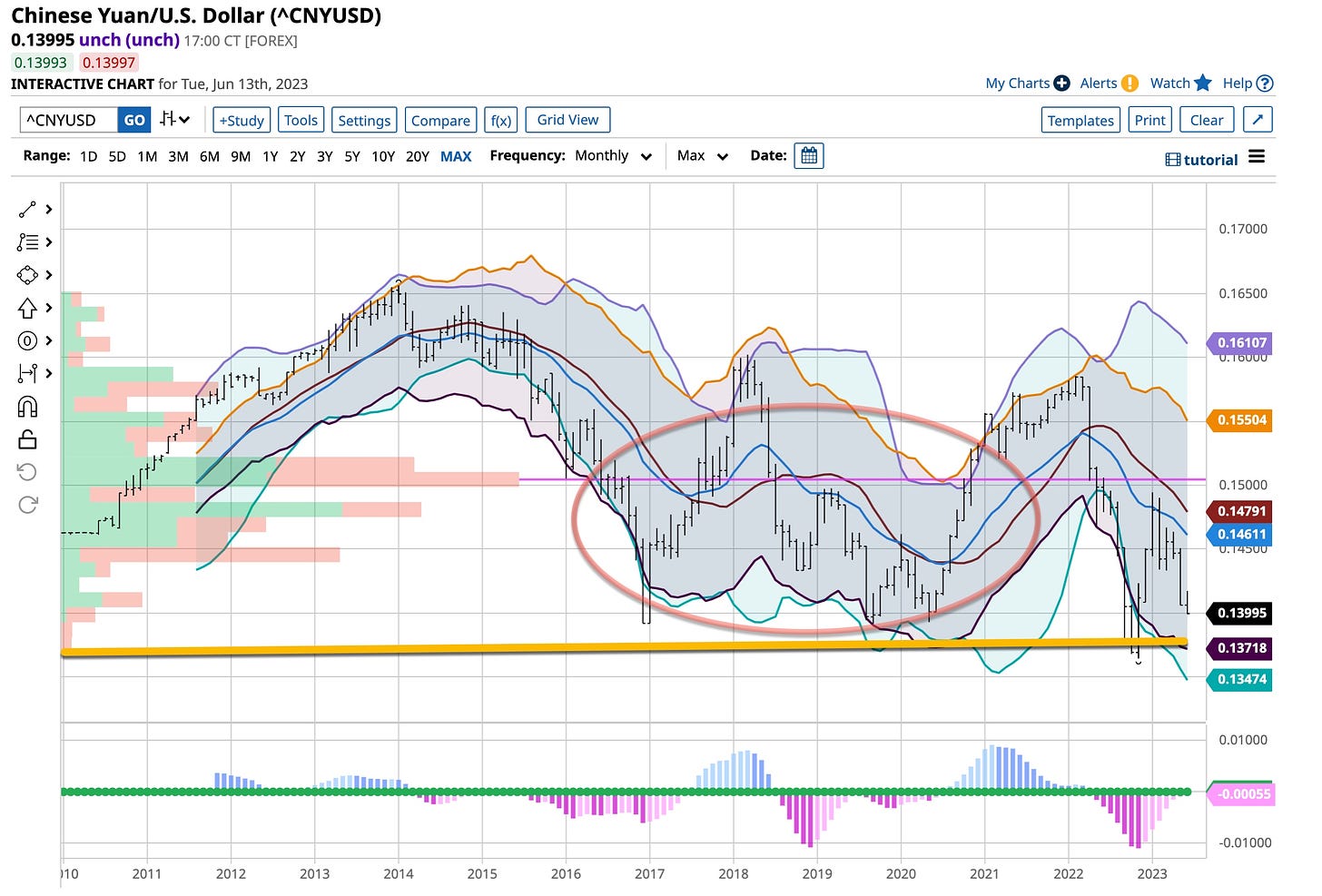

Regardless of CPIs and what Powell and his henchmen do on Wednesday afternoon I will be watching the Chinese industrial production and retail report. Deflation is by far one of the worst things to strike an economy. For the last two years China’s real property and development markets have been in turmoil putting straining their once stable municipalities . That particular economic segment, from recent articles I’ve read, comprises about 25% of China’s reported GDP. Looks like China has no choice but to follow Japan and lower its interest rates which will be released next Monday. That expectation has proven itself out to a degree with the Yuan diving even against a U.S. Dollar that has been more or less flat to down against other major currencies and is expected to weaken post Powell talking. China’s PBoC interest rate decision of early next week is going to be interesting. Relationships will do that to you; when “A” goes one way “B” goes in another direction, like clockwork.

I don’t want to see an expanded period of price decreases accompanied by decreases in retail sales. That means people expect prices to go lower and that’s what deflation is all about. It’s not good for any entity, especially those corporations that are subject to reporting quarterly earnings.

Well, since this is the kick off of The Ticker Thoughts let me give you a stock I like and then a couple sites where you can do your own due diligence. I’m not going to sit here are do your work for you. I’d rather teach you how to fish versus just giving you a fish. Beside, I hate fish.

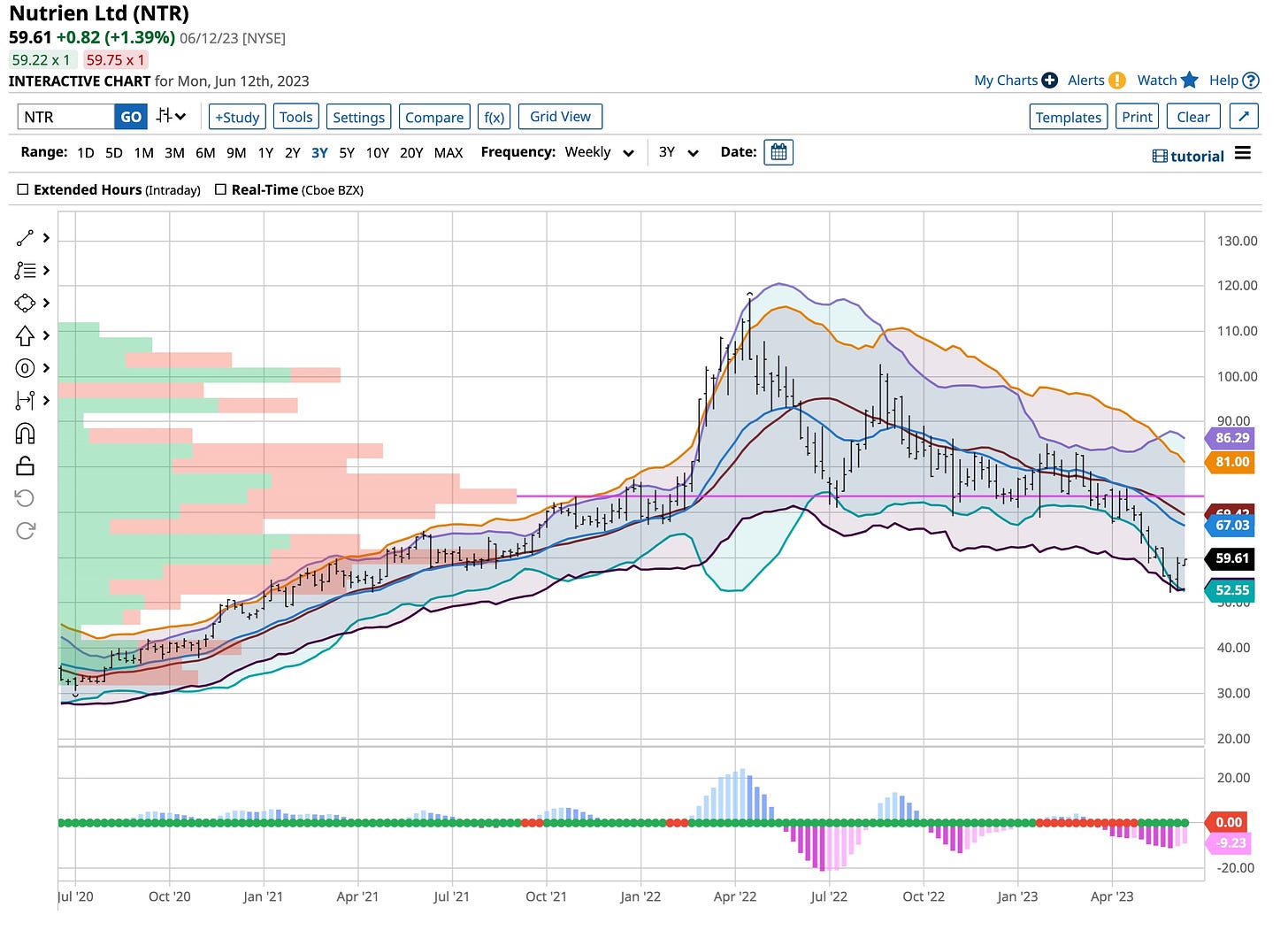

The company is Nutrien Ltd. a Canadian based fertilizer company based in Saskatoon, Saskatchewan. It is the single largest producer of potash and third largest producer of nitrogen fertilizer in the world. It’s P/E is slightly below 5. It pays a dividend of $2.12 for a yield of over 3.5%. My kind of stock in this kind of environment. Great, seasoned management team as well but again, you decide.

Due your own due diligence using Barchart, Finviz or Investing.com. It’s not too hard to learn how to use any of these stock analyzers in circulation today. As a matter of fact, a recent article plugging Investing.com’s recent entry is available. Just click here and “go fish” for yourself; got any *8s”?.

Hope you enjoyed this introductory, nocturnal The Ticker Thoughts post. I’m up just watching “paint dry” so what the hell; I’ll type while I think. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s embedded in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself as you are witnessing.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

I’ve “Got A Feeling”, like the Black Eyed Peas had, that “tonight’s going to be a good night”. Hopefully waking up to something you’ll be able to react to will be as well. To a great day for all. BTW I usually sleep in; like a cat, when the sun comes up it’s time to sleep . . . they taught me well . . . especially Leo.