Like everyone else, I learn more from my losses and mistakes. Face it, no one’s perfect. If you find someone who claims they are, change the channel. Jim Cramer thinks he is ideal, but he’s not. Neither is Wells Fargo, so when both say sell, it’s usually a “damn” good buy signal.

If you have been following me, you know that I like to buy “brand-name” stocks when they are in the “crapper.” I’m patient, usually early, and don’t mind waiting. Over time, I’m going to be right, but when it takes longer than six to nine months I look for good reasons why.

Boeing Is A Revenue Play

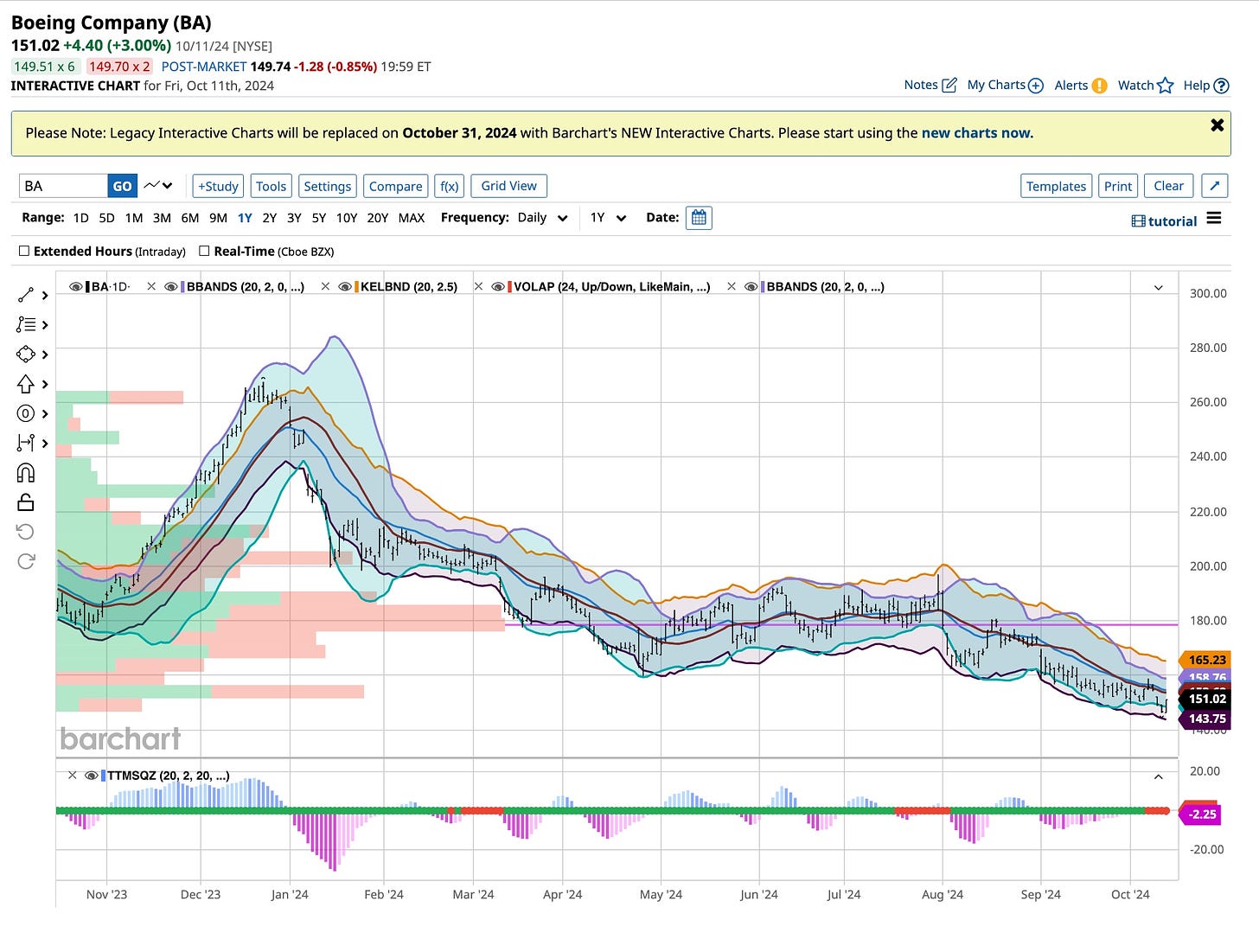

I have been a regular buyer of Boeing (“BA”) as well as a “seller” of both covered calls and naked puts. I use the puts to acquire shares below the current market price. I use the covered calls to bring in extra income on the shares owned. That being said, stock wise, Boeing is my third largest position, and I’m down about 6%. It happens. The best plans are filled with uncertainty and that’s what I’m dealing with here.

Boeing’s turnaround is a revenue game. So far, they’ve done a terrible job resurrecting their cash flows. They’ve made it worse. I’m concerned that the only way out of these problems is a secondary stock offering or issuing additional debt. Neither one is good, but management’s back is up against the proverbial wall. I’m not as concerned about the strike. I am concerned that they’re not selling planes.

It takes up a great deal of my time to manage what has become a “monster.” That’s the real drawback of being wrong. Good thing for me, this one is the only problem I have. How about you, are there issues like this in your portfolio?

Oil & Agriculture Is Hedged

You are all familiar with how I use longer-term VIX calls to cover the inherent risk of markets heading lower. It’s going to happen, but no one knows when. The “herd” will often be on the wrong side, so buy when they sell and sell when they buy. Otherwise, I’m a long-term investor in oil and agriculture in simple, risk-averse ways.

I own Occidental Petroleum (“OXY”) and Coterra Energy (“CTRA”) to hedge oil and Nutrien (“NTR”) to hedge agriculture. I like dividends. I like well-run companies. How exactly you make investments of this nature is personal. For me, I stick with leaders in their fields and management. Again, I’m patient. Not everything in my managed Roth IRAs is going to go much higher immediately, but over time they’re going to perform much better than not.

GHL Here We Come

I do not make decisions quickly. I want you to learn that. Patience is very imperative. I see where making the right choice is often not the cheapest business decision. In our case, switching to GHL to teach what The Ticker offers was essential. It’s not cheap, but without a doubt, it’s going to save everyone time and allow communication to be better than ever.

Keep an eye on this site. As we know better when we’ll release the much-improved site, we will let you know. Until then, on a universal basis, we’ll do our best to keep you all informed about what I’m thinking. When you think about that, it’s scary, but what can I say? Be well, and thanks. Remember to vote. It’s important.

I’ve always liked British people. Face it, they talk funny, but their music, theatrics, and, above all, their politics are trend-setting. I’m a Beatles fan. My Dad was a Beatles fan, and his Dad could play all of their songs in Ragtime. Damn, we had some great basement parties where Lennon and McCartney ruled. As they sang, “I’m A Loser,” and I’m proud of it. I’m honest, ethical, and realistic. I learn more from my mistakes. How about you?