I’m not a trader. I’m a long-term investor and hedger. It works. After more than half a century, I don’t need statistics to prove that most traders end up broke. Sure, you have a couple of winners you can brag about on the golf course or at the dinner table, but face it, when it comes to making money, macroeconomic, geopolitical, geoeconomic, and game theory are the ways we make decisions. You should, too.

Liquified Natural Gas Rules Our Plan

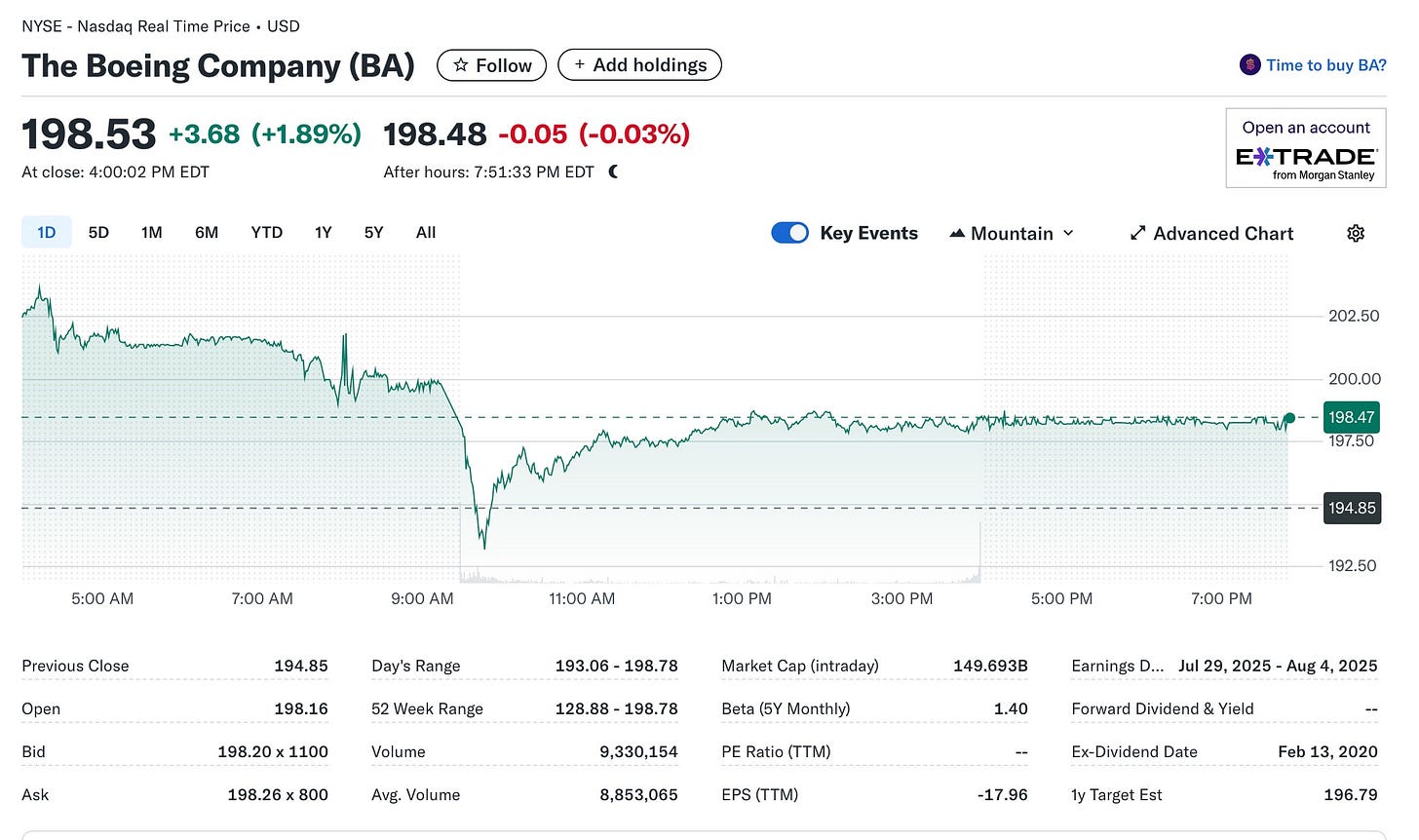

I was up overnight, like I am most Monday mornings. I’ll be honest, I traded out of a few shares of Boeing (“BA”) as the early run higher was just too tempting to pass up on. I could have done the same with a few others but this party is just getting started. I trust Trump has an endgame strategy, you know, one where he says, “buy my oil and gas,” but who knows. If you have any questions, read his books. He talks out loud.

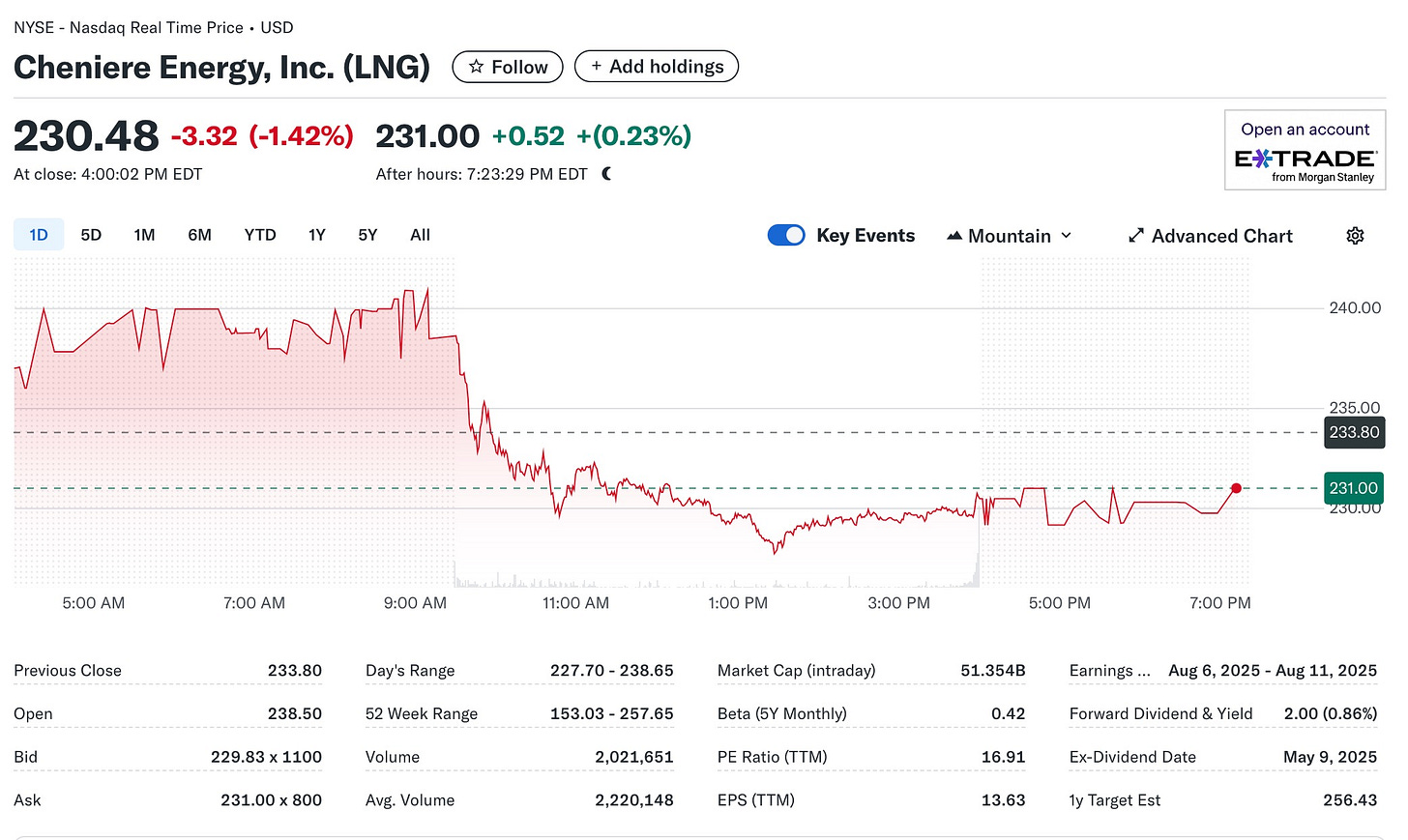

Natural Gas hit the crapper today. It happens after a 5% move higher. It set me up well to sell a few naked puts on Antero, Cheniere, Conterra, EQT, and a few more. All of these holdings, including Peabody, make up 7% to 8% of my holdings in the Roth IRA account we advise. Add in my Buffett favorite, Occidental Petroleum, and one I added late last week, Venture Global (“VG”), and it’s about 10%. They better go up, eh?

In addition, we reduced our cash holdings and bought more TLT and 30-year bonds. It is all part of the plan. Make money by taming “inflation,” and Powell has lower rates. Let Trump do his thing on trade and getting that “beautiful bill” passed, and on a true game theory basis, we’re in the driver’s seat. I wish I still had that 1969 Jaguar XKE.

I’m not putting these thoughts to paper for fun. These are real decisions, and I trust you are listening. Did you see Tesla today? It’s going much higher, so get on board for the Musk train. There’s more, but it takes time. Enjoy your evening.

Time is on my side, and it is on the side of The Stones. I’ve got more than a decade of listening to them, Beatles and CSN too, so I’m in no rush to do anything. I think my LNG play is timely, but remember, I’m usually early. I know how to manage risk. I put time on my side, and it works for me. Remember, options expire.