Summer is upon us. That often brings uncertainty. In my book, the future is clearer than it has been for years. Yes, a presidential election is upon us, the Fed is battling inflation and millennials spend money they don't have. So what’s changed? You have to dig a little deeper for that. I’ll fill you in at the end only after we discuss “futures”.

The Ticker was established to teach everyone from my 55+ years of experience. We’ve set up three courses: foundation, bricks and mortar. They are essential. Over the past year, I’ve talked about foundation. Today I’ll start on the bricks and futures are first.

What’s A Futures Contract

Commodity futures contracts are contractual agreements to “buy or sell” a specific quantity of a commodity. It’s accomplished at a predetermined price, with delivery and settlement taking place on a future date. Contracts allow market participants to manage price risk or speculate on future price movements.

The actual futures contract is directly based on the “specific commodity”, crude oil, gold, corn, or natural gas. Each commodity has its specifications, like contract size, quality, and delivery location. Here’s a couple characteristics to be aware of:

Contract Size: The quantity of the underlying commodity traded in each futures contract. Crude oil contracts represent 1,000 barrels of oil while a gold futures contract represents 100 troy ounces of gold.

Contract Price: Specifies a price where commodities are bought or sold. Known as the “futures price or contract price”, it’s the agreed-upon price for the future delivery of the commodity.

Price Fluctuations: Prices are subject to ‘daily’ fluctuations in price determined by market supply and demand dynamics. Fluctuations are often limited by price limits or circuit breakers set by the exchange to manage volatility.

Contract Expiration: Futures contracts have a specified expiration month or a delivery month indicating when the contract expires. At expiration time, the contract is settled through physical delivery of the commodity or cash.

Long & Short Positions: There are just two position types; “long and short”. A long position is taken by someone agreeing to “buy” the commodity at a future date, expecting the price to rise. A short position is taken by someone agreeing to “sell” the commodity, anticipating a decline in the price.

Trading on Exchanges: Futures contracts are traded on exchanges, the Chicago Mercantile Exchange or the Intercontinental Exchange. Exchanges provide a centralized marketplace for buyers and sellers to trade.

Futures contracts are standardized concerning quantity, quality, and delivery based on the terms and conditions of the basic underlying commodity. This ensures that all market participants are trading the same thing. Futures have a specified delivery month or contract expiration date when physical delivery occurs. Most settle in cash versus physical delivery based on the difference between the final contract price and the actual prevailing market price at the time of expiration.

Futures trading involves the use of margin, a “percentage” of the contract value that traders deposit as collateral. Margin is a financial safeguard to ensure that traders fulfill their obligations. Margin requirements vary based on the actual commodity and specific exchange. Futures contracts also provide “leverage” allowing traders to “control” a larger contract value with smaller amounts of capital. This amplifies the potential profits and losses.

Futures markets provide an actual “platform” for price discovery. Buyers and sellers determine the actual market price of the commodity. This price transparency assists market participants in making better-informed trading decisions. Commodities are used for risk management purposes and producers and consumers of commodities “hedge” pricing risk by taking opposite positions in futures contracts, locking in a desired price for future delivery.

Commodities attract “speculators” and investors seeking to profit from these price fluctuations as well. These participants have absolutely no underlying need for the physical commodity but trade for potential gains.

Commodity prices are a “leading” indicator of economic activity reflecting shifts in global demand, supply disruptions, inflationary pressures, and market sentiment. Commodity markets are closely monitored by those who make economic forecasts and trends. Commodity markets facilitate international trade through transparency, liquidity, and efficiency and contribute to smoother functioning supply chains.

Supply and demand impact price. The factors affecting supply are production levels, inventories, transportation advancements, and regulatory policies. Demand factors are growth, population, consumer behavior, economic activity, and all governments.

World macroeconomics, global economic growth, inflation and interest rates, and monetary policies, impact the prices of commodities. Real economic growth drives demand for commodities in all sectors, especially construction, infrastructure, and manufacturing.

Geopolitical events affect prices. Political instability, wars and conflicts, sanctions, trade disputes changes in government policies disrupt supply chains. Geopolitical tensions lead to supply disruptions and cause prices to rise and fall. Weather plays a major role in commodities. Weather conditions like droughts, floods, hurricanes, or frost damages crops reducing yields, leading to decreased supply and higher prices. Favorable conditions result in bumper crops and increased supply lowering prices.

From five miles up, this is but a taste of what you will learn taking The Ticker course. What’s presented above is a sample of what we teach to kick off the “bricks” section. I know how important it is to have a strong foundation. That’s where we start. We then turn our attention to futures, stocks, bonds, ETFs, and options. These are the “bricks” that we fit together in the final section, the “mortar”. For a limited time, The Ticker is offering you everything, a $1,000 value for just $99. The response has been tremendous but we know it takes time to learn. It’s a marathon, not a sprint. Nonetheless, sign up and learn at your own pace. I’ll be right there beside you. Take us up on our offer and join us. You won’t regret it.

So What Have I Just Dug Up

I’m not just doing this for my health. Between bringing you the “news”, building The Ticker, and teaching AI robots how to think, I’m busy. I am not so busy that I neglect to listen and watch There were a couple of “interesting” tidbits on Friday that caught my attention.

China Stopped Buying Gold

The People's Bank of China (“PBOC”) reported no change to its gold holdings in May in data released on Friday, ending its one-and-a-half-year-long buying spree. Given that the rally that has seen gold hit record highs has relied on central bank purchases, particularly by China, gold prices sold off by over $50 per ounce on Friday.

China's central bank has been purchasing gold since November 2022. The May data indicates that the PBOC's gold holdings remained steady at 72.8 million ounces. The World Gold Council reported that the first quarter of 2024 saw the strongest increase in global central bank gold purchases since records began in 2000, with China being the largest contributor.

The PBOC's decision to pause at a time when gold prices are at a peak seems to have been a catalyst for the market's reaction. Analysts said that without purchases from central banks and sustained consumer demand, the rally in gold prices is vulnerable and that better opportunities to enter the gold market may present themselves before the end of the year.

Softer Growth Is Upon Us

The bond market’s pricing in much softer growth lately. One of the factors weighing on yields is this week’s news that US job openings fell to the lowest level in over three years, an early warning of softer economic conditions ahead. Listen, or else.

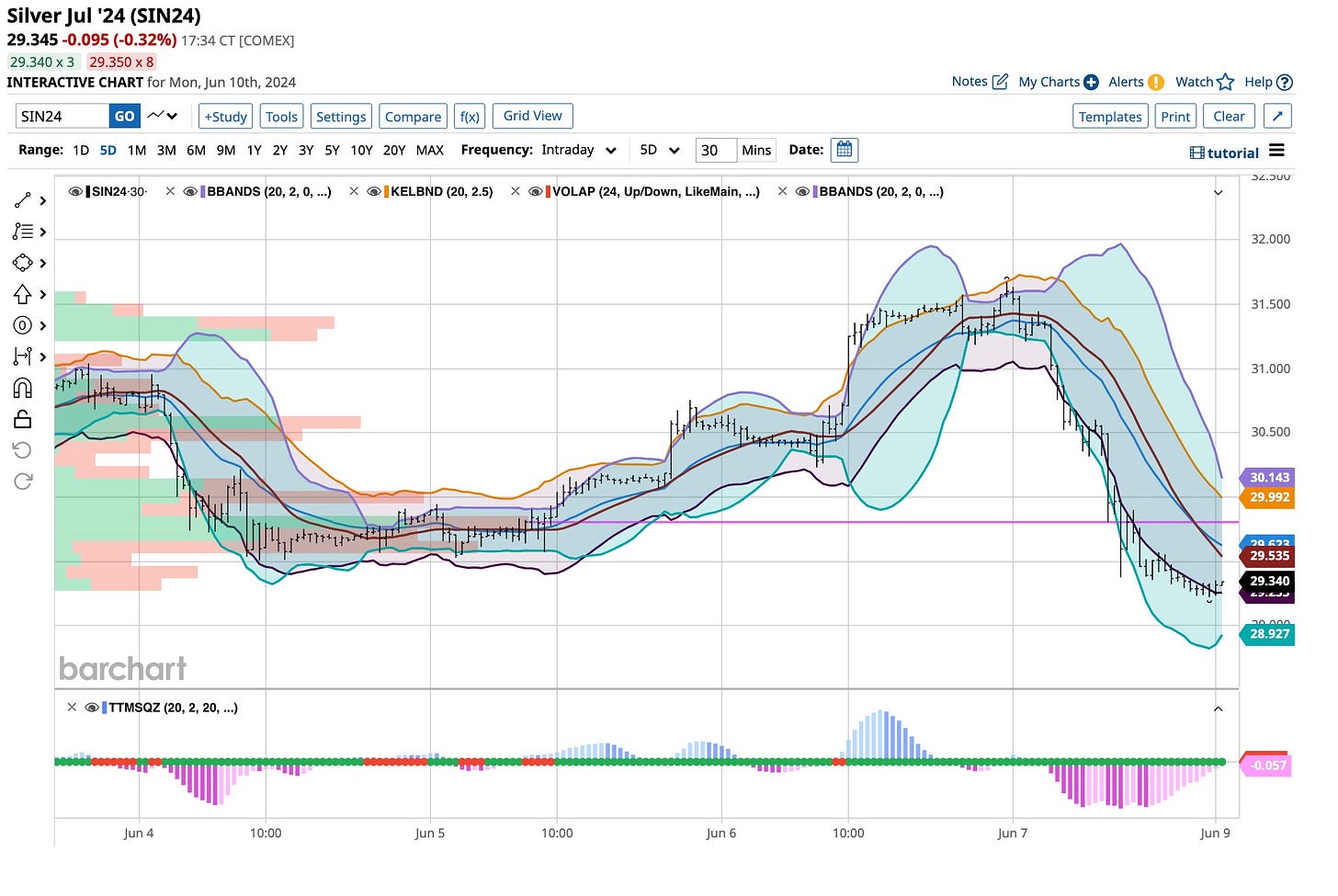

So, I’ve been long the U.S. Treasury market for more than a year. Despite a “hurry up” and wait for psychology, while earning 5%+ I’m holding strong. That’s not what I did with my metals last week. I was up almost 35% on my silver futures. Trailing stops are very important in preserving profits. I’m out of Silver just like I moved out of Copper. Nothing goes straight up or down. I’ll be back in both but for now, I’m sitting on a big pile of cash earning 5%+. I’m not worried, it’s summer.

“Should I Stay Or Should I Go” by The Clash says it all. I’m sitting on a pile of cash. I have been an active buyer of Boeing but few other securities are attractive right now. I’ve been adding to my “pile of cash” by selling covered calls and that’s not going to stop. I started selling “in-the-money” calls. They’re now “out-of-the-money” calls and more than likely I’ll simply wash, rinse and repeat. It “ain’t” broke so I’m not going to fix it. So a couple of things to remember, (1) use trailing stops; (2) cut your losses short and let your winners run; and (3) take advantage of our limited-time offer to join us on The Ticker. Follow these thoughts and become better investors or traders, guaranteed.