I read a lot; counted over 17 sources yesterday and overnight. I listen quite a bit as well. What’s the quote, “believe half of what you see and nothing of what you hear”; I’ll buy that one. Some attribute it to Edgar Allan Poe, just a slightly different version, “believe nothing you hear, and only one half that you see”; either way it’s probably the best definition of “fake news” that exists in today’s world at all levels. We all are the true victims.

Like differences in the reporting of “facts” by today’s so called media “journalists”, I’m beginning to note that some of my regular “reads” tend to support one economic side of the equation versus the other. One observation I can make is that they’re consistent but not those pretending to be analysts; the soothsaying journalists. I seldom believe anyone anymore but some do report reliable facts; I try to separate their work from their opinion then decide on its validity for myself. It gets harder every day.

A couple interesting tidbits were posted overnight; (1) earnings for the S&P 500 came in lower for the second quarter in a row so we officially have an “earnings recession”, until they change that definition. Second, and you’ll hear more about this issue when I finish my research on an article my buddy Brandon Donahue forwarded to me about the exploding “municipal” debt crisis in China; the Brits are becoming more hesitant making investments there. Upwards of 40%+ of those surveyed have decided against it, significantly higher than the single digit results of recent reporting periods. There’s a lot to digest with respect to what I’m uncovering but my hope is to be complete in my analysis before the new Chinese ambassador meets with Biden and hopefully not just to hand the “big guy” his regular “dividend” check from Hunter’s investments. Surely I jest but remember, there’s truth in sarcasm.

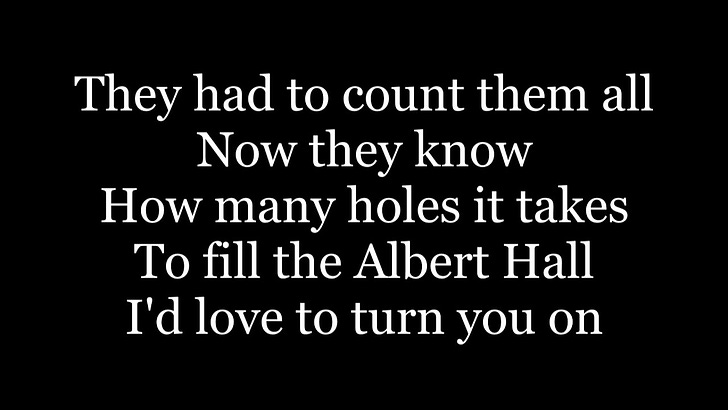

Continuing my week of reflection, what you see or hear is not always what you get. I was up most of the night working on my business plan for The Ticker EDU and just listening to some “old” favorites. I’m truly a “child of the 1960s” and it shows. I’ll start with a lesser known Beatles tune,”A Day In The Life” and take you right to the line “and somebody spoke and I went into a dream”. So consistent with the stanza I “woke up, fell out of bed, dragged a comb across my head . . . found my way downstairs and drank a cup” then started thinking to myself what’s real and what isn’t. It’s basically the task I face every day as I decipher the plethora of macroeconomic, geopolitical information that’s processed “between my ears”. It’s become more daunting every day as there’s very little consistency as to what and more so how and where it’s reported. It was simpler years ago but with today’s incessant flow of information, coupled with the need to determine what is real versus what is an illusion, it’s become work.

So as the Moody Blues asked, “what’s real and what is an illusion”. Good question, one we all need to deal with every day and not only in our investment and trading worlds. As quoted, “but we decide which is right and which is an illusion” need be addressed. In order to handle a task of this nature you best understand yourself first, how you fit into this world as you know it”. Damn they really knew how to write lyrics years ago.

"Late Lament"

Breathe deep the gathering gloom,

Watch lights fade from every room.

Bedsitter people look back and lament,

Another day's useless energy spent.

Impassioned lovers wrestle as one.

Lonely man cries for love and has none.

New mother picks up and suckles her son.

Senior citizens wish they were young.

Cold-hearted orb that rules the night

Removes the colors from our sight.

Red is grey and yellow white,

But we decide which is right

And which is an illusion.

Clarity is what I seek in anything I do. Reflection is a methodology I use to get there. I take the time to question more than the factual matrix of what is presented. Today one needs to check the source and not just what’s “told” to you on OpenAI or the several other chat bots available; they’re as biased as any source you choose. Illusions are best avoided, you decide what’s right.

This “ramble” wouldn’t be complete without Jefferson Airplane’s “White Rabbit”. My first thought was to put on my Mad Hatter’s costume and do a take off on one of my favorite past posting, “Really”. My better half said “don’t you dare”; I’ll sneak it in at a later date. “Alice's Adventures in Wonderland / Through the Looking-Glass” helped to make me what I am today. So did “The Fountainhead” by Ayn Rand but for today let’s deal with Lewis Carroll’s masterpiece. There’s one quote from the Mad Hatter that’s stuck with me for years:

“If I had a world of my own, everything would be nonsense. Nothing would be what it is, because everything would be what it isn't. And contrary wise, what is, it wouldn't be. And what it wouldn't be, it would. You see?”

That’s what we’re faced with as we attempt to traverse the world we live in. As Grace Slick sings in “White Rabbit”; go ask Alice when she’s ten feet tall then come back to the Moody Blues’ “Late Lament” and realize, it’s all an illusion. More importantly it’s your illusion.

As I’m doing this week, take some time for reflection. I’ll continue tomorrow talking about the most influential person to ever effect my life, my Dad. Tomorrow would’ve been his 95th birthday. A good friend and mentor of mine just lost his Dad. When we spoke yesterday I could “hear” the “tears” in his eyes and the “smile” across his face. Like me, my Dad was not just my Dad, he was my best friend. There is much in life far more important than making money. Being right and accomplishing something others cannot are both up there as is giving back to others. Dad taught me that as well; never grow up; not like Peter Pan but to enjoy what surrounds you; now where’s Tinkerbell?

He always taught me to be thankful for what you have so my “thanks” go out to you all for making this venture a true “adventure”; it’s fun and I appreciate your true interest; it’s only just begun. Lest I forget, happy 68th birthday Ross . . . and many more.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Thanks to all of you who have adopted what is being created and presented; we’re humbled by the response and referrals. Again, let me know what you want to learn, I’m all ears.