Well the “almighty” Powell and his Federal Reserve have spoken. Not exactly the “big stick” many were expecting or hoping for but at least the Fed didn’t raise rates so let’s call it a “draw”.

Being as busy as I am, let’s get right to the facts of what was just ‘publicly’ announced and the “street’s” reaction. If you have been reading, really taking to heart what I have been posting, there were no surprises just observations consistent with past rhetoric.

Targets Are Meant To Be Guidelines

For as long as I can remember, the Federal Reserve has targeted the acceptable rate of inflation to be 2%. To me that served as a “two-way” street. For the longest time rates were running below 2% and they kept on pumping money into the system. Today, with the same 2% target out there, they allege to be pulling money out of the system. I give up. Is that 2% target a real objective or is the Fed just using it to write their speeches? I’ll bet on the latter.

There’s not a snowball’s chance in hell that we’re going to hit that “magic” number. In my opinion, given the expectations revealed today for interest rates over the short and long term, it’s not even going to get close. Nonetheless, Powell and the Fed boldly said that they’re going to bring rates down at least three times this year alone.

Politically speaking they have no choice. Certainly inflation is not running at the 10% annual clips as they did prior but 4% to 5% isn’t the answer either. This country is still spending and printing money it doesn’t have as are our consumers. Bringing interest rates down only perpetuates that trend and brings a longer term perspective into real focus. Inflation is going to be hanging around for years. Get used to it, they have.

So What Have I Done

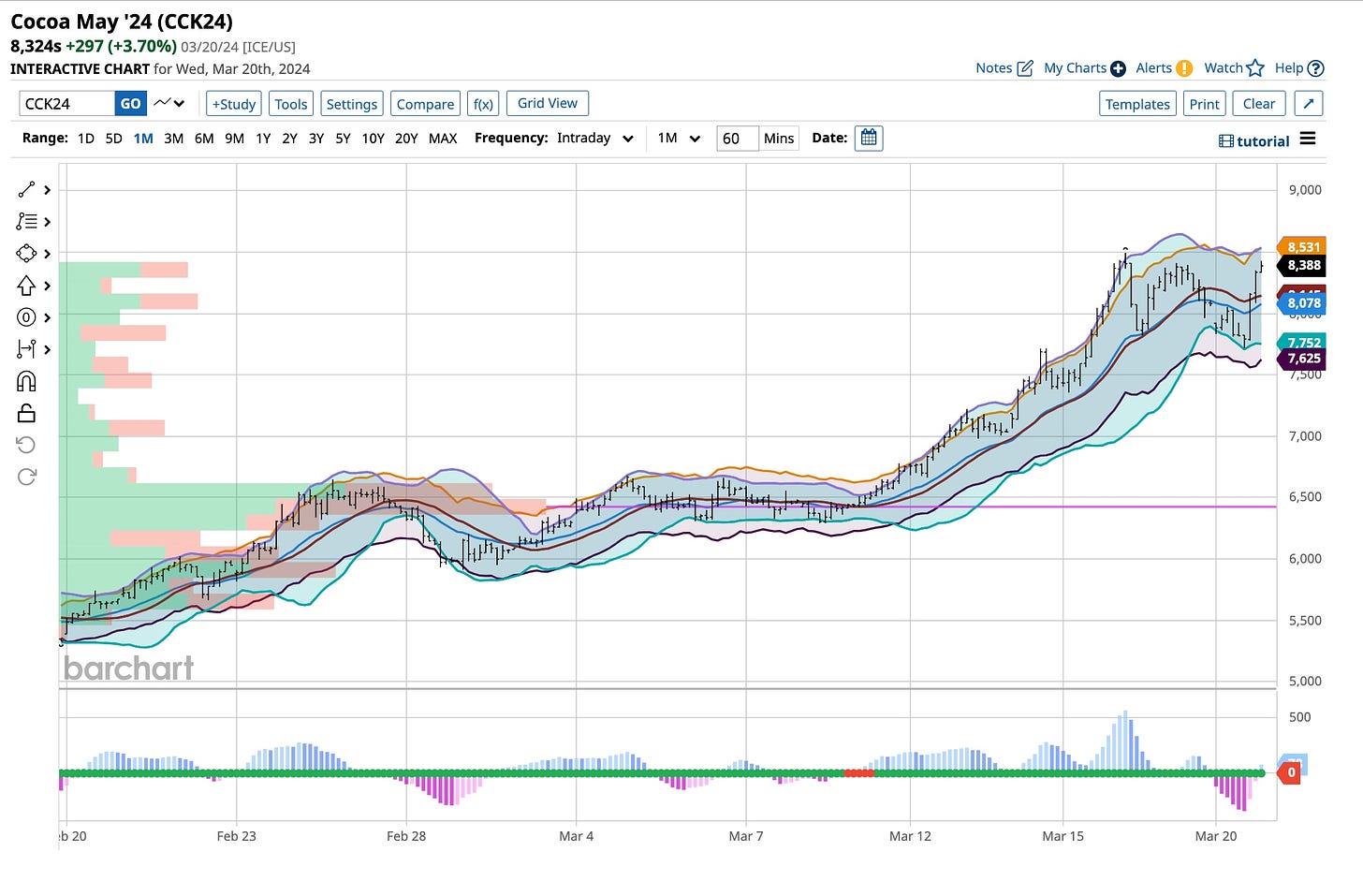

In all sincerity, not much. I have not had to other than increasing my ‘bets’ that rates are headed lower, gold is going higher, the Dollar will decrease in value versus the Yen and the price of a candy bar will end up on ‘Mars’ before Musk. Seriously, in watching Cocoa trade it’s inevitable.

The “poor man’s” metal have awakened with Copper and Silver leading the way. Both of them are subject to major swings so learning how to use stops, especially “trailing stops” is critical. Remember, no one predicted COVID-19 and the markets all heading significantly lower on a dime so hedge the unexpected. Being long ‘out-of-the-money’ 2024 VIX and crude oil calls going out “four to six” months protects the rest of what’s managed in the Roth IRAs.

Stocks, well I found a couple more that have been taken out to the woodshed by street analysts and as we all know, they’re biased. I wonder if they write their publications so the retail side of their operations can pile into these securities. I’m really a conspiracy theorist at heart but there’s just not enough time, or money, for me to pursue these at this juncture. Stay tuned folks as the only ‘index’ not to recover to its highs of 2021 is the Russell 2000 and it’s loaded with securities that will benefit from lower rates.

Well enough from me today on a day that will go down as being quite meaningless all things considered. I’m finishing off the last five of fifteen course segments so students will understand our ‘Foundation - Bricks - Mortar’ theme. Just practice, practice and practice more is the direction you should take as you become the “best damn trader or investor” you can possibly be. We’re just going to teach and show you how to do it.

“Everything I had to know I heard it from my radio.” “You had your time, you had the power. You’ve yet to have your finest hour”. Queen was amazing, especially when what was expressed made little to no sense until the words were studied. That’s kind of how I feel about the actions taken by the Fed today were interpreted. It’s hard to get people to understand that “declining interest rates” are not a good thing. That’s just not what people want to hear but down deep they all know that it’s true. “All we hear is radio ga ga, radio goo goo, radio ga ga. I just listen, watch and act responsibly, you should too.