Sitting back thinking about how best to speak of what’s happening in today’s world I’m torn between Mr. Rogers or Bill Murray. Having a naturally optimistic outlook on life it is a “wonderful day in the neighborhood”, I just wish it didn’t always feel like it was “Groundhog’s Day" every time I turned around. “Here we go again” best describes the next couple weeks when it comes to raising our infamous debt ceiling. Investment and trading wise, the direction markets next take is pretty well “baked in” as well.

Those who know me understand I like to “rant” every now and then. Well just sit back then and get ready as it’s coming. From the debt crisis to geopolitical influences, from a slew of “Fed Talk” rhetoric to the “big guy” himself, consider this my best attempt at emulating Howard Beale. His scene from “Network” you know the part where he goes off preaching “I’m mad as hell and I’m not going to take it anymore”, that’s how I feel. I’ll have notes and a script as I record this week’s “Sunday Night With George” but I really don’t need it. The wheels on this bus go ‘round and ‘round. Problem is that this bus never goes anywhere. Let’s see if tonight’s dissertation changes that; doubt it but I’ve got to give it a try.

Last Week

It’s not that last week was uneventful or as my doctor might say, unremarkable; more so it’s best to ask what did you expect? Consumers who are becoming more frustrated than before are downbeat on economy: The Michigan Consumer Sentiment Index just hit a six-month low. In addition it’s now predicting a higher inflation rate for a longer period of time; the highest it’s been in twelve years 12-years. CPI came in better than predicted but that’s expected; just do the math. Lower front-end months are replacing year old higher back-end months and reflecting progress but 5% is nowhere near the Fed’s 2% target. There’s still lots of work to do. The Bank of England raised rates 1/4% but the decision was not unanimous.

Fed Speak Friday

Federal Reserve Governor Philip Jefferson represented that he wants a “goal of full employment” coupled with a mandate for stable prices. He continued that bringing inflation “the most insidious of social diseases” down is still the biggest problem. It looks like full employment isn’t his first choice.

St. Louis Federal Reserve Bank President James Bullard is guardedly optimistic that the Fed’s effort to tame inflation is working despite monetary policy being at the low end of what is necessary. Interestingly enough he cites that the “pandemic money” is mostly spent. That’s almost an oxymoron in that COVID checks helped create current inflationary problems requiring the Fed’s current policy. Higher rates are an economic drag but are working yet he can’t guarantee that rates are done going up. What course do they teach at the Fed where its members learn how to talk out of both sides of their mouths.

Chicago Fed President Austan Goolsbee seeks balance, slow inflation without causing a major recession. I don’t think anyone would disagree with his perceived outcome. He goes on saying that progress is being made but inflation is still too high. No one really has an answer here folks. It’s going to take years to work through the problems we created.

Next Week

If you think last week was uneventful wait until next week. Tuesday brings us a retail sales report followed by Thursday’s jobless numbers. I’ll do my best not to just sleep through both and trust those of you who plan on day, scalp or swing trading through the summer are looking for part time jobs as perhaps lifeguards. At least on the beach you can work on your tans and enjoy the view; be careful that you identify what you’re looking at correctly and use the right pronouns.

General Markets

It’s like being back in October 2021 when the Russell first told us the “bear” was on it’s way. This stock rally, if you can call it a “rally” is skipping smaller companies. It’s a sign that investors may be bracing for economic turmoil ahead. The Russell Index is down about 1% this year while the S&P 500 is up 7% year-to-date. Small cap stocks are struggling since the onset of the March U.S. regional bank turmoil. The Russell 2000 is down 7% since March 8th. Small caps being out of favor often signals an impending recession. Small caps waiver ahead of economic weakness. The Russell 2000 usually lags the S&P 500 by about 4% post economic cycle peaks.

We’re likely headed into a recession sometime in the next 12 months; I’ve been saying that for a while but believe the handwriting is on the wall. In a recession, small caps underperform. The small-cap S&P 600 P/E ratio is at 13 against a 10-year 18.2 average. To me that means start looking. In addition, U.S. equity fund outflows were over $5.7 billion last week down for the 7th week in a row. Due to disappointing earnings and future statements, along with the U.S. debt ceiling fiasco, I might get a chance to do something I’ve wanted to do for a while; buy. Remember a basic rule, buy when they sell and sell when they buy; it works.

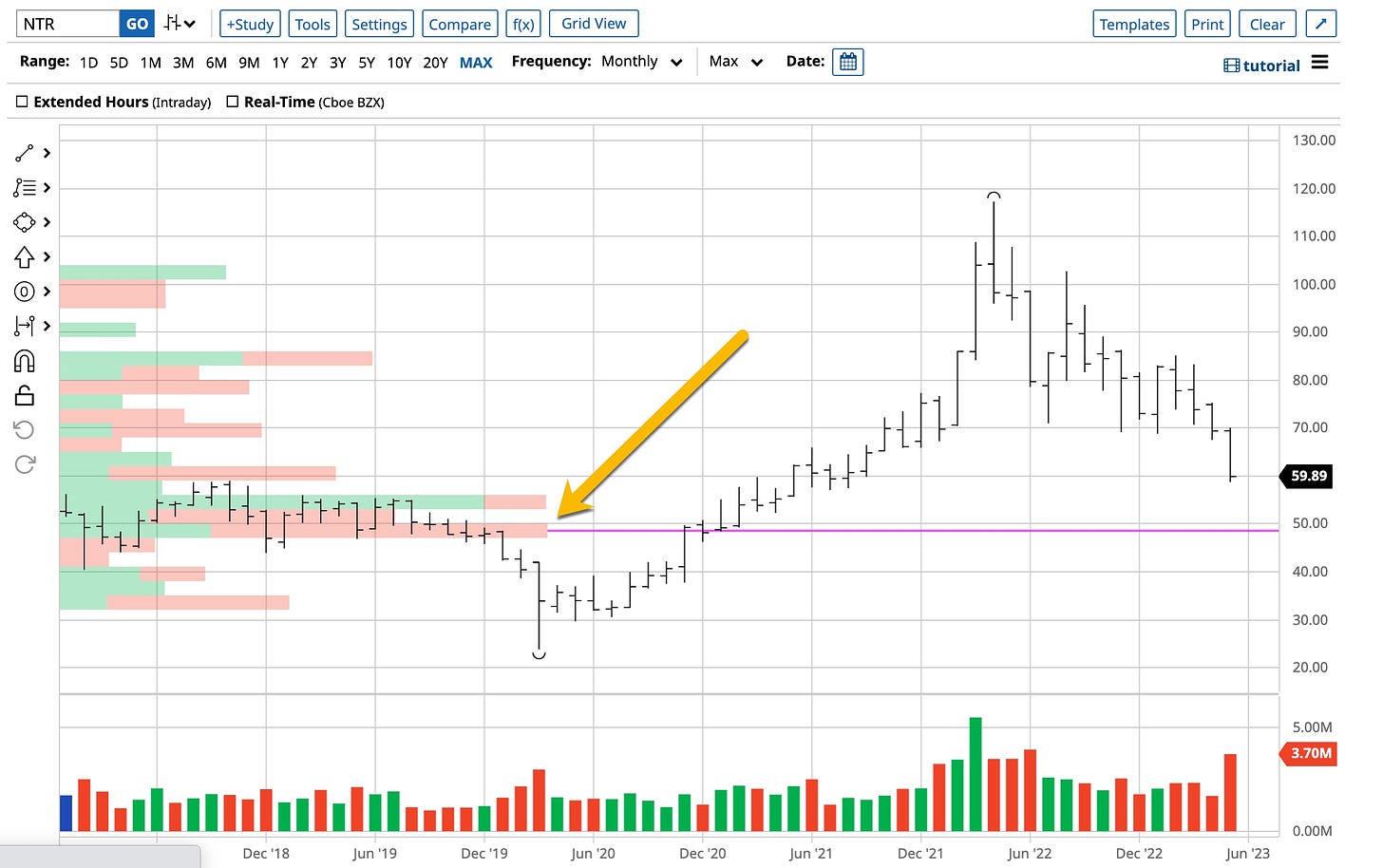

NTR – Buy

Here’s a very well managed company I’ve had my eyes on for quite a while, Nutrien. It missed its Q1 EPS estimate of $1.51 by $0.40 coming in at $1.11. Revenue came in at a “paltry” $6.11 billion versus the consensus estimate of $6.39 billion. It’s selling for less than half of it’s all time high set just a year ago so what would entice me to look and pull the trigger now?

Farmer demand is re-emerging and this is an attractive entry price point. Increased signs of (1) farmer engagement / procurement after a lengthy period of dormancy; (2) depleting NPK inventories across key channels; (3) gradual stabilization in key price benchmarks; and (4) most recently, a widespread flush of street / investor expectations. That’s the best signal any stock could ever hope for.

I love buying stocks that the “street” is kicking to the curb. It might be a little early to 'call the bottom' on a geopolitically entangled, weather-amplified cycle but the recent pullback in NTR provides an attractive entry point for long-term investors of which I am one. Hell I just had two successful trades in Sugar and Rough Rice so I should stick with the agricultural segment, right?

Rough Rice

It should go higher folks. Look at the red oval on the left hand side of the chart. Water moves from higher to lower points. The yellow line signifies the “higher” point, the

”HVN”, high volume node. The circled portion exhibits where the lower volume nodes “LVN” reside. Solid support underneath. Lots of people in this world live on rice. Any shortages or problems with the harvest could propel it higher. Chart looks good so I’ll wait and see. There’s more than day trading the E-mini; listen, learn and give it a try. Oh by the way, charts like this are available for free on Barchart. When time allows I’ll put together a course to teach you how to use them.

History Debt Ceiling Crises

This is the section where I realize I’m old or at least older than most of you. I’ve been through more than my share of politically originated problems and this debt crisis is just icing on the cake.

There have been numerous fiscal crises in the history of the United States. When it comes to what we are currently going through Congress usually has failed to pass a timely budget or the.debt ceiling was not raised resulting in the U.S. “defaulting” on its obligations. They usually play out at the same time.

·Since 1976 there have been 22 federal government shutdowns due to failures to arrive at a budget. But we have never experienced a true “default”. The debt ceiling has been raised 78 times since 1917 and now stands at $31.4 trillion. Since 1995 there have been three debt-limit crises that resulted in economic and political consequences.

1995: GOP Revolution / Blunder

In the 1994 midterm elections the Republicans picked up eight Senate and fifty-four House seats. You might even remember the “Contract with America” legislation that sought to balance the budget. Clinton vetoed it leading to a short five day government shutdown. Gingrich threatened not to increase the debt limit. Clinton responded with a second veto leading to a twenty-one day government shutdown. Republicans caved and passed Clinton’s budget and simultaneously lifted the debt ceiling. In a 1995 ABC News poll, 46% blamed Republicans and 27% blamed the Democrats leaving a little egg on their faces.

2011: Budget Reductions & Reforms With Financial Chaos

Sixteen years later a similar scenario once again arose. In 2011 a post-election Capitol Hill power shift occurred. In 2010, during Obama’s first term in office Republicans gained seven Senate and sixty-three House seats. The House then demanded a deficit reduction package to raise the U.S. debt ceiling. As the deadline neared domestic and international financial markets turned chaotic. The S&P 500 fell by 17% and bond rates spiked. The S&P’s rating agency actually reduced the U.S government’s rating resulting in higher interest rates on that debt. With two days left before a formal default Congress passed the Budget Control Act of 2011. The Act reduced spending over a ten year period by $917 billion and the debt ceiling was raised.

2013: Plenty of Nothing

In January 2013 the debt ceiling was once again hit and extraordinary actions to fund spending kicked in. The Treasury stopped payments into retirement funds of federal workers and $5.7 billion was borrowed from trust funds such as Social Security. These extraordinary measures exhausted themselves by mid-October 2013 and the U.S. could not borrow any more money to pay its bills. Republicans wanted budget cuts targeting Obama’s Affordable Care Act and shut down the government for 16 days. Republicans lost support and caved the day before the government officially defaulted.

Risks Today

The 2023 crisis that is unfolding is like 1995 and 2011 all preceded by an election that flipped only the House majority but different as the Republicans only have a four-seat majority today. Long standoff risks are huge and will grow over time.

The CBO states that there is a significant risk of default within the first two weeks of June. Debt limit meetings have been postponed until next week with the CBO hoping for more negotiating time. The Treasury can probably finance government operations through end of July with available cash and extraordinary borrowing measures. If we last through June 15 quarterly estimated tax payments should carry us through July.

Distressed Credit Markets

Funding operations for the September 2023 fiscal year are $1.9 to $2.2 trillion, higher than $500 billion available tax receipts and extraordinary borrowing sources. Default would result in distressed credit markets, disruptions in economic activity and rapid increases in borrowing rates.

Powell knows that historically, the public debt drama will drag on. An agreement will be reached around the end of May. Once approved the Fed will start the printing press providing liquidity. The Treasury will issue bonds for most of the amount but liquidity in the financial markets will decrease. June and / or July markets may fall due to this low liquidity. There will be more problem banks, recession risks, and the real estate markets will struggle.

Federal budget expenditures will increase by 13% more than the year before. Based on the above, a few conclusions can be drawn; (1) The Treasury will borrow money in the markets at higher rates; (2) this will lead to a credit crunch; leading to a drop in U.S. indices. The 2-year / 10-year bond inverted yield curve historically signals a market collapse. The handwriting is on the walls; you just need to know how to read between the lines.

I warned you that this was going to be a “rant” and for good reason. Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself as you are witnessing..

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Thanks again go out to Danny www.mrtopstep.com . . . check him out; he’s worth your “click” and thanks to all of you who have adopted what is being created and presented; we’re humbled by the response and referrals. Again, let me know what you want to learn, I’m all ears.

History repeats itself . . . let’s hope for a better outcome than what’s contained in this one. Happy Mother’s Day and best always for a great week no matter what you’re up to.