I am a fan of history. Prior intuition and thought is often expressed in much that I read and listen to. It’s not always right but being able to consider the ramifications that come with history we’re better able to predict the future.

Many others compare differences in the yield curve, some look at “triple crosses” or MACD convergences and divergences. Me, I look at events, predictions that should have been more strongly interpreted when originally recited. As a long-term student of our beloved Federal Reserve, historically speaking there’s a lot to learn from.

With that in mind, today’s article deals with President Dwight Eisenhower’s Military Industrial Complex speech of 63 years ago and the inflation conundrum faced by our Federal Reserve during the 1970s. What a “fool we have been” to allow either event to resurface and control a future outcome but we have so they are both worth revisiting.

The Military Industrial Complex

On January 17, 1961, Dwight D. Eisenhower ended his presidential term warning the nation about the increasing power of the “military industrial complex”.

His remarks, issued during a televised farewell address to the American people, were particularly significant since he served the nation as military commander of the Allied forces during WWII. Eisenhower urged his successors to strike a “balance” between a strong national defense and “diplomacy” in dealing with the Soviet Union. He did not suggest arms reduction. He acknowledged that the bomb was an effective deterrent to nuclear war. However, being cognizant that America’s “peacetime” defense policy had changed since his military career, Eisenhower expressed concerns about the growing influence of what he termed the “military industrial complex”.

Before and during the Second World War, American industries successfully converted to defense production as the crisis demanded. Out of the war, what Eisenhower called a permanent armaments industry of vast proportions emerged. This conjunction of an immense military establishment with a large arms industry is an American experience Eisenhower warned stating, "while we recognize this imperative need . . . we must not fail to comprehend its grave implications.” Eisenhower suggested that we must guard against the acquisition of unwarranted influences. “The potential for the “disastrous” rise of misplaced power exists and will persist,” he continued. He correctly cautioned that the federal government’s collaboration with an alliance of military and industrial leaders, though necessary, was vulnerable to an extreme abuse of power counseling all American citizens to be vigilant in monitoring the military industrial complex.

Ike also recommended restraint in “American consumer oriented habits”, particularly with regard to the “environment”. "As we peer into society’s future, we, you and I, and our government must avoid the impulse to live only for today, plundering, for our own ease and convenience, the precious resources of tomorrow," he said, stating that "we cannot mortgage the material assets of our grandchildren without asking the loss also of their political and spiritual heritage." We did both; shame on us.

Smart man, he was right and sixty-three years later we’re paying the price of his words every day. So when we reach out and wonder where we went wrong it’s easy to return to his words and ask ourselves why we didn’t listen.

Are The 1970s Back

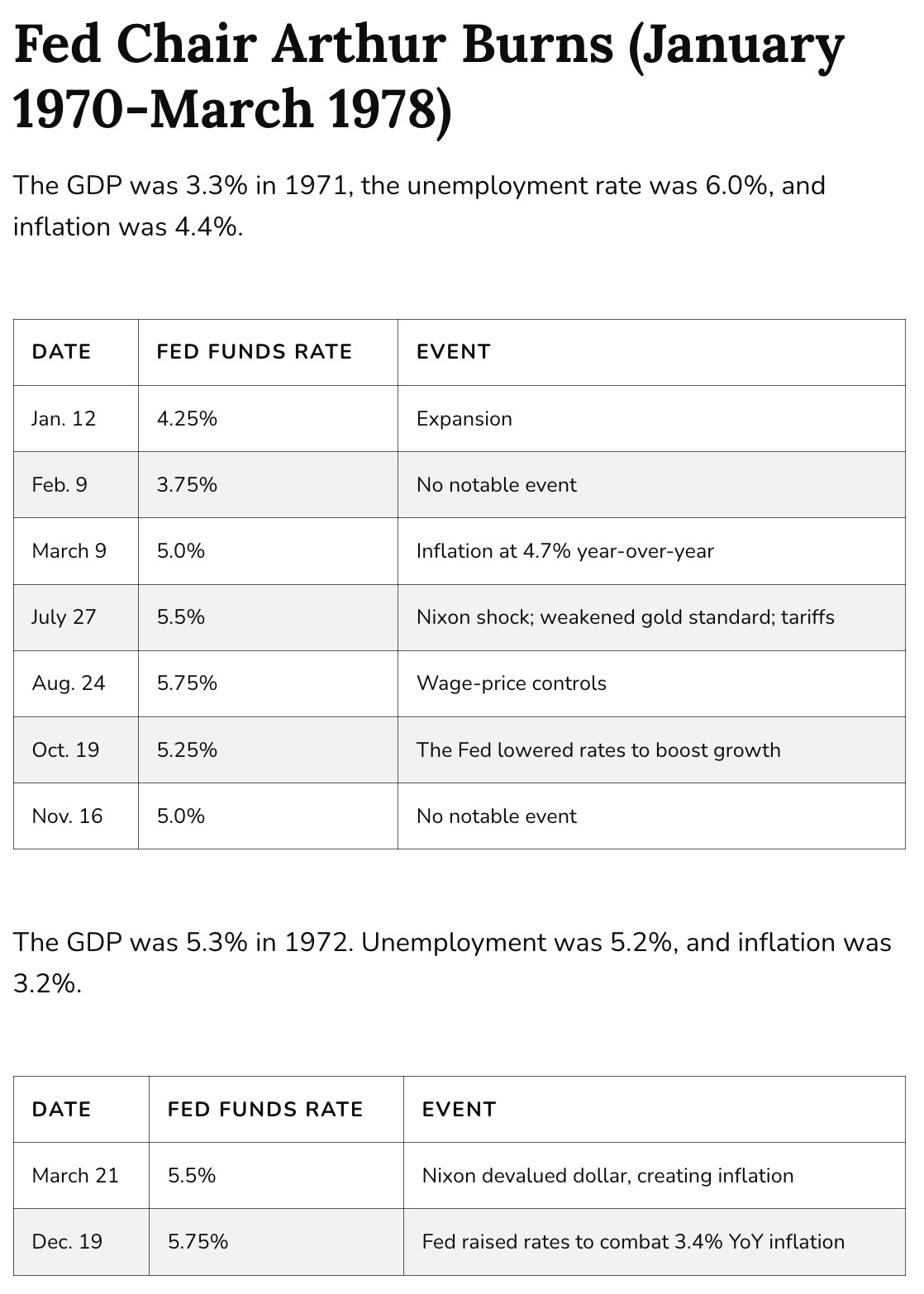

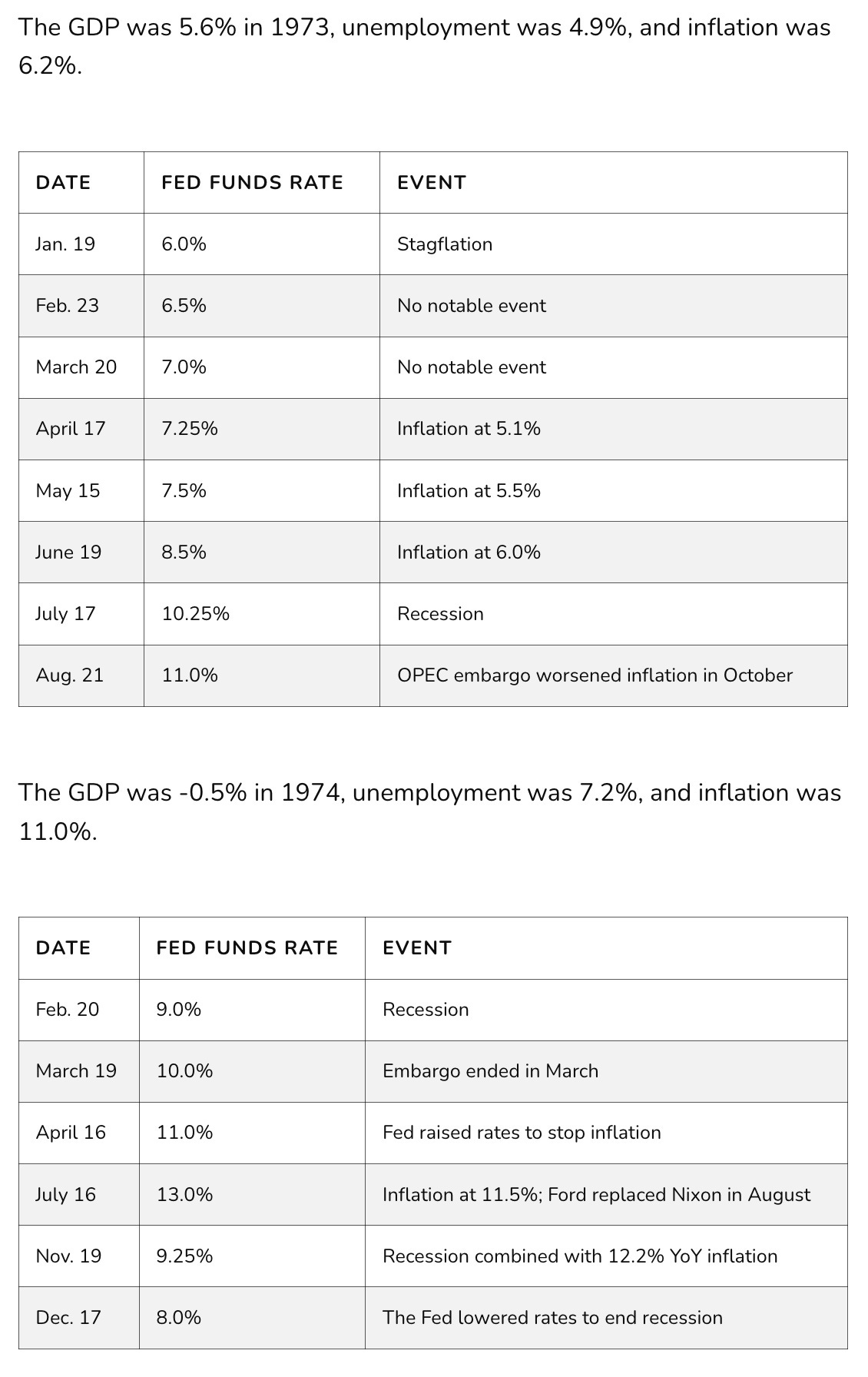

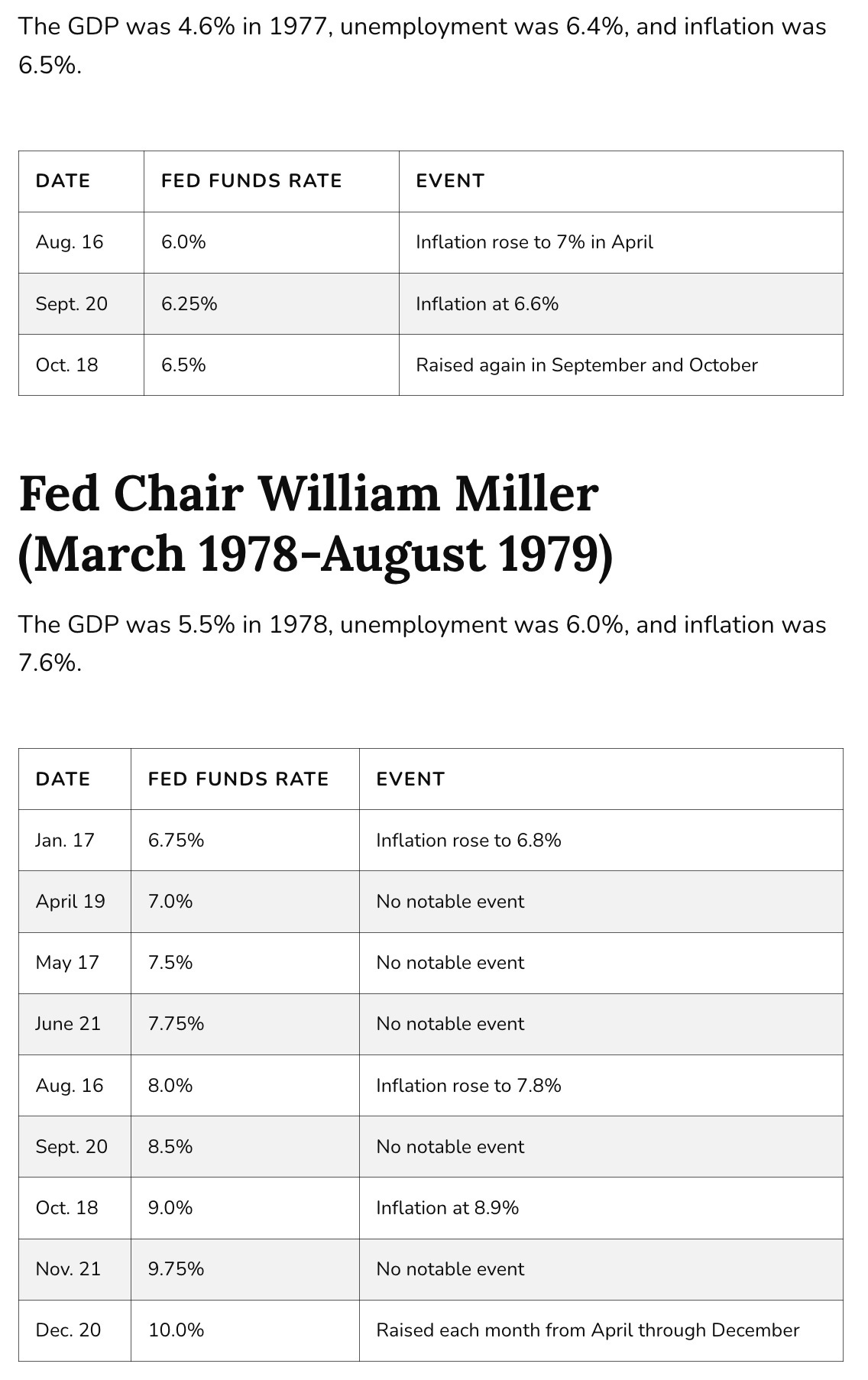

It all started with Federal Reserve Chairman Arthur Burns in January 1970 and ended in 1979 with Federal Reserve Chairman William Miller right before President Jimmy Carter appointed Federal Reserve Chairman Paul Volcker to “address” the economic problems we then endured.

Through the early 1970s we did not face off directly with “OPEC” and the inflationary effects of rising gasoline prices. That was about to change.

By the middle of 1974 that had all changed and inflation reached 11.5% as Ford took over from Nixon. He stuck with Burns and the rest of the 1970s were etched in stone.

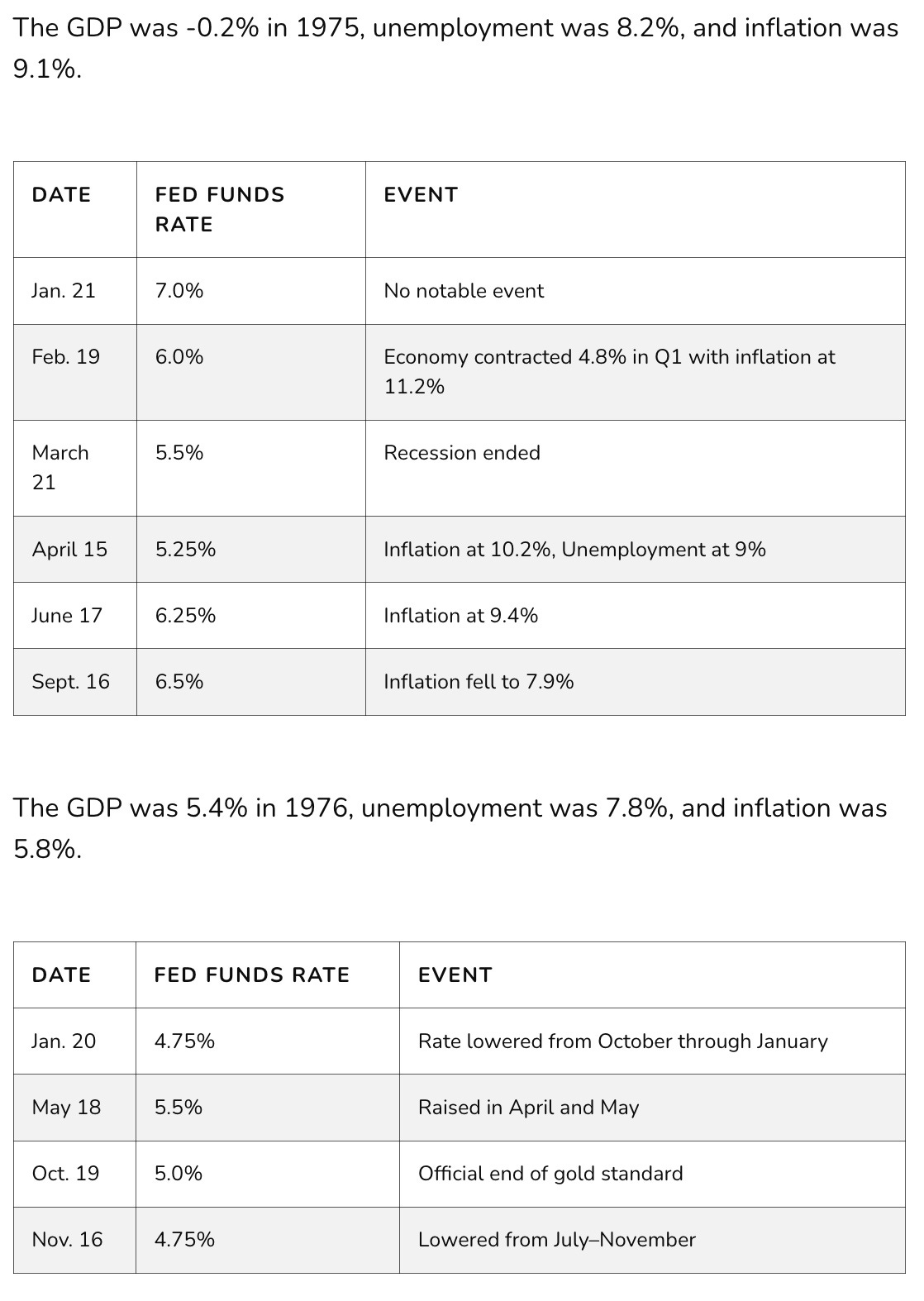

Recession turned back to growth but in essence unemployment remained high as did inflation. In short, the “economy” was out of control and rapid up and down shifts in the overall expectations prevailed; the Federal Reserve couldn’t control it’s own house and it showed.

The Federal Reserve continued to “play” with interest rates in hopes of restoring our economic growth. Rates were on a roller coaster also being raised when inflation did not go away during this period; bringing in Federal Reserve Chairman Paul Volcker and a change in the administration did the trick but it took about four years, a large tax cut and more to claim success against inflation. We’re back.

As I have suggested in many prior articles and again today, we are at a “crossroads” as we were in the 1970s. Administrations have spent far too much money over the recent years and inflation raised its “ugly head”. There’s no way to help the “middle” and the “lower” classes with a tax cut as there is nothing left to cut. While the Federal Reserve raised rates to keep inflation in check, recent developments in the Middle East raises the specter of the 1970s making an encore and the prices we pay at the pumps and for our regular grocery basket purchases are going to find it hard to decline as expected.

For me, other than my “stand-by” basic investment strategies, I’m long the March 17 and June 18 VIX calls. This is a fictitious market where but a few securities that make up the overall index continue to surge higher like they did during the Internet bubble in 2000. The day of reckoning is coming and like all bubble bursts it will be short and quick.

That’s it folks. My labor of love continues and your support has been extraordinary. I work each day until I start making mistakes and realize it is better to get some sleep. I find myself up part of the night as this is a 24 / 7 world. What I see is what I report and from my perspective, we need an administrative change. What do you think?

In 1967 I was twelve years old. I was against the Vietnam War right after my neighbor across the street from where I lived was killed in action. Years later is was Kent State and Alison Krause’s death that confirmed it was time to end a conflict we Americans had no reason to continue being part of. Buffalo Springfield recorded “For What It’s Worth” in 1967. I listened to the words then and they “ring true” today just like Ike’s military industrial complex speech. It’s about time we should listen to or own words and take the action necessary before it’s too late.