I have a couple minutes as I put together my introductory course(s) for Udemy. It’s a labor of love similar to assembling the book series. I’m seeing a pattern develop and want to bring it to your attention.

Basically, I’m a risk averse investor and trader when appropriate. As a macroeconomic theorist taking geoeconomics and geopolitical theory into the fold I see a tremendous reason to be careful.

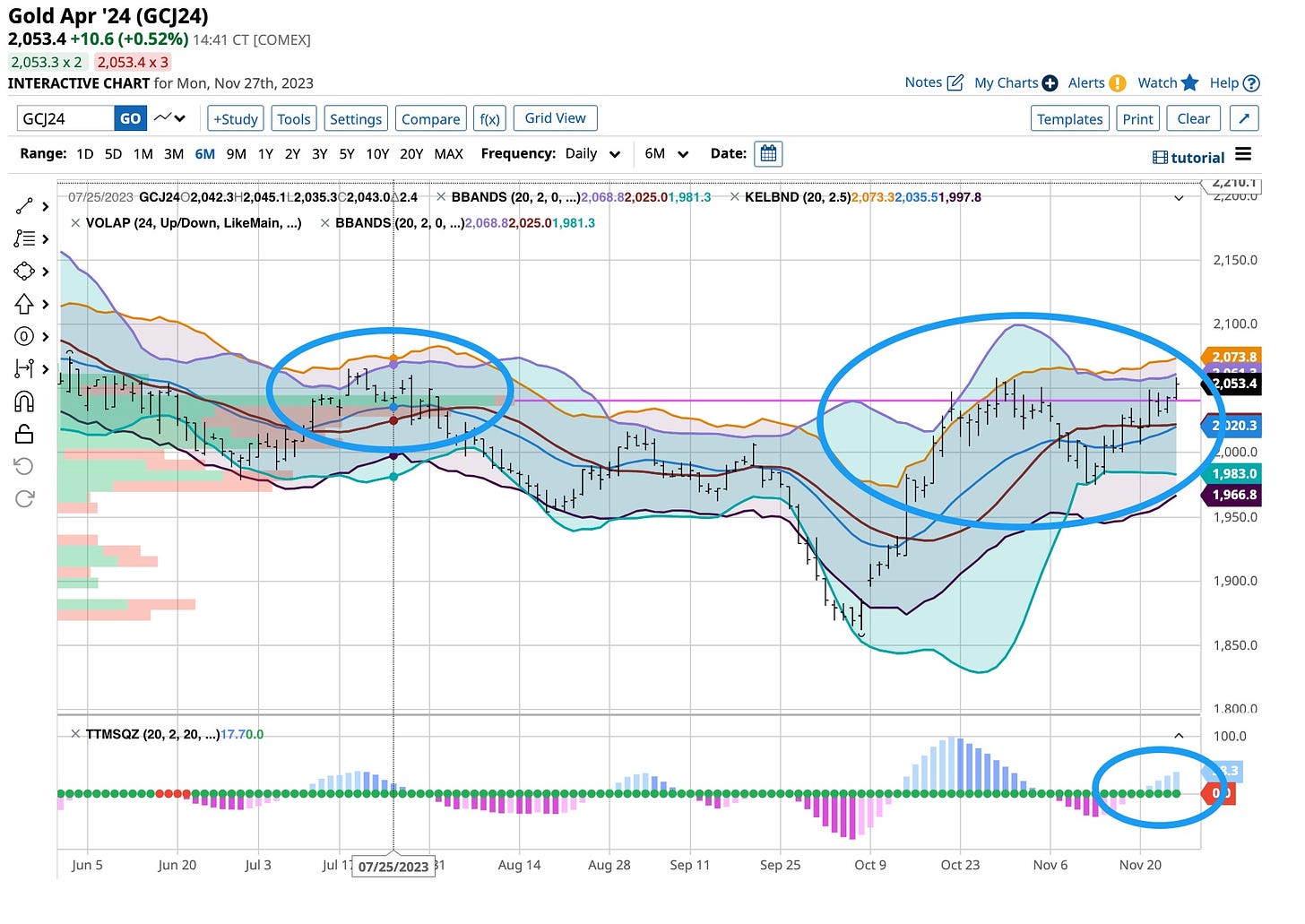

I can’t believe the number of investors, traders and every day people, some eloquently speaking their beliefs, who think gold is “going to the moon”. While they may very well be correct, holding upwards of 10% of the actual bullion in managed portfolios, it seems best to avoid “buying at a potential top”. I could very well be wrong but that is OK with me. If gold runs the way many think it will I’ll be a seller of the bullion when it goes higher.

So I started out speaking about hedging and that’s a technique I’ve used since birth. I see good reason to hedge. Whether it involves product pricing or simply taking steps to avoid missing a trend, hedging is a safer way to approach a longer term viewpoint.

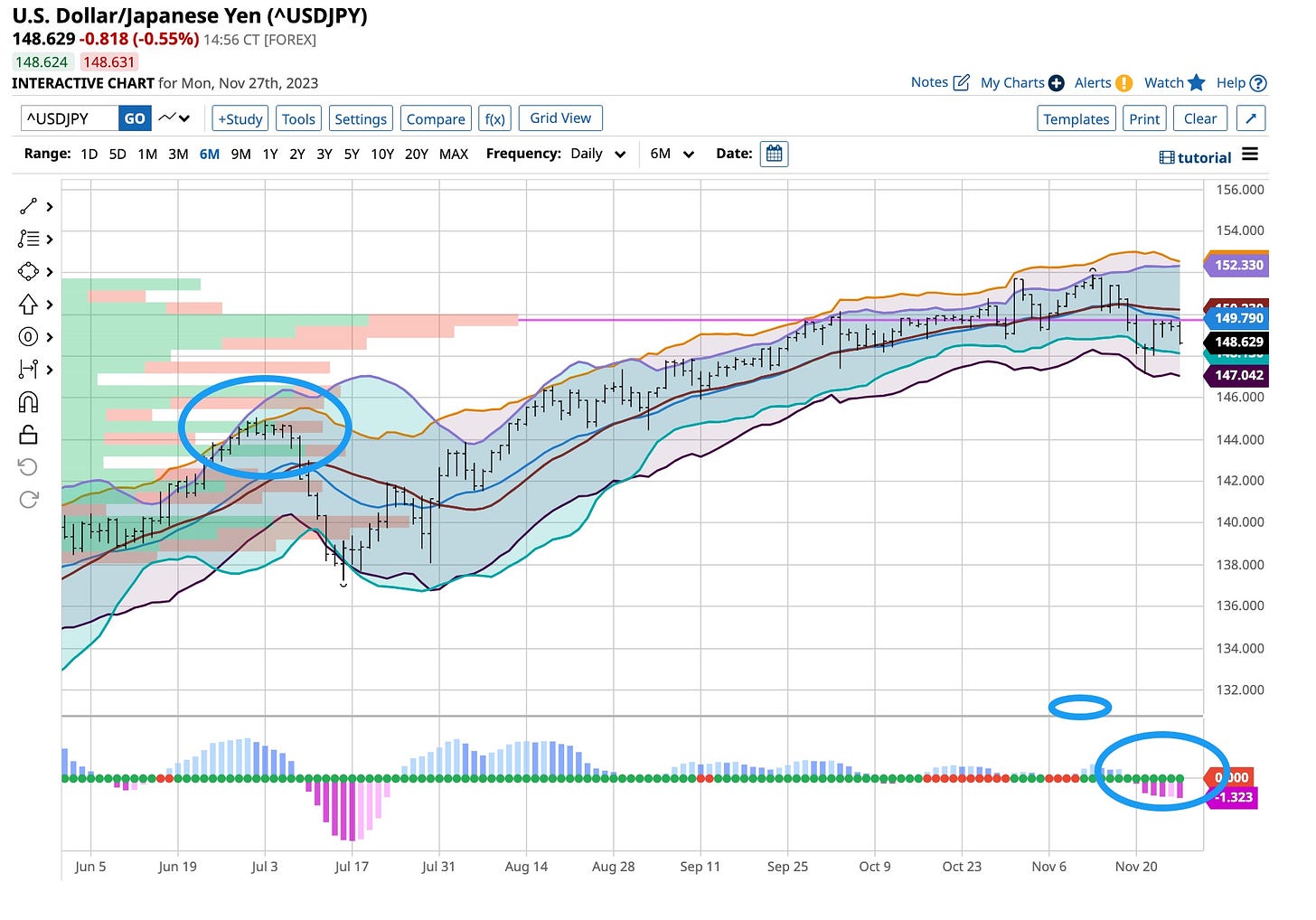

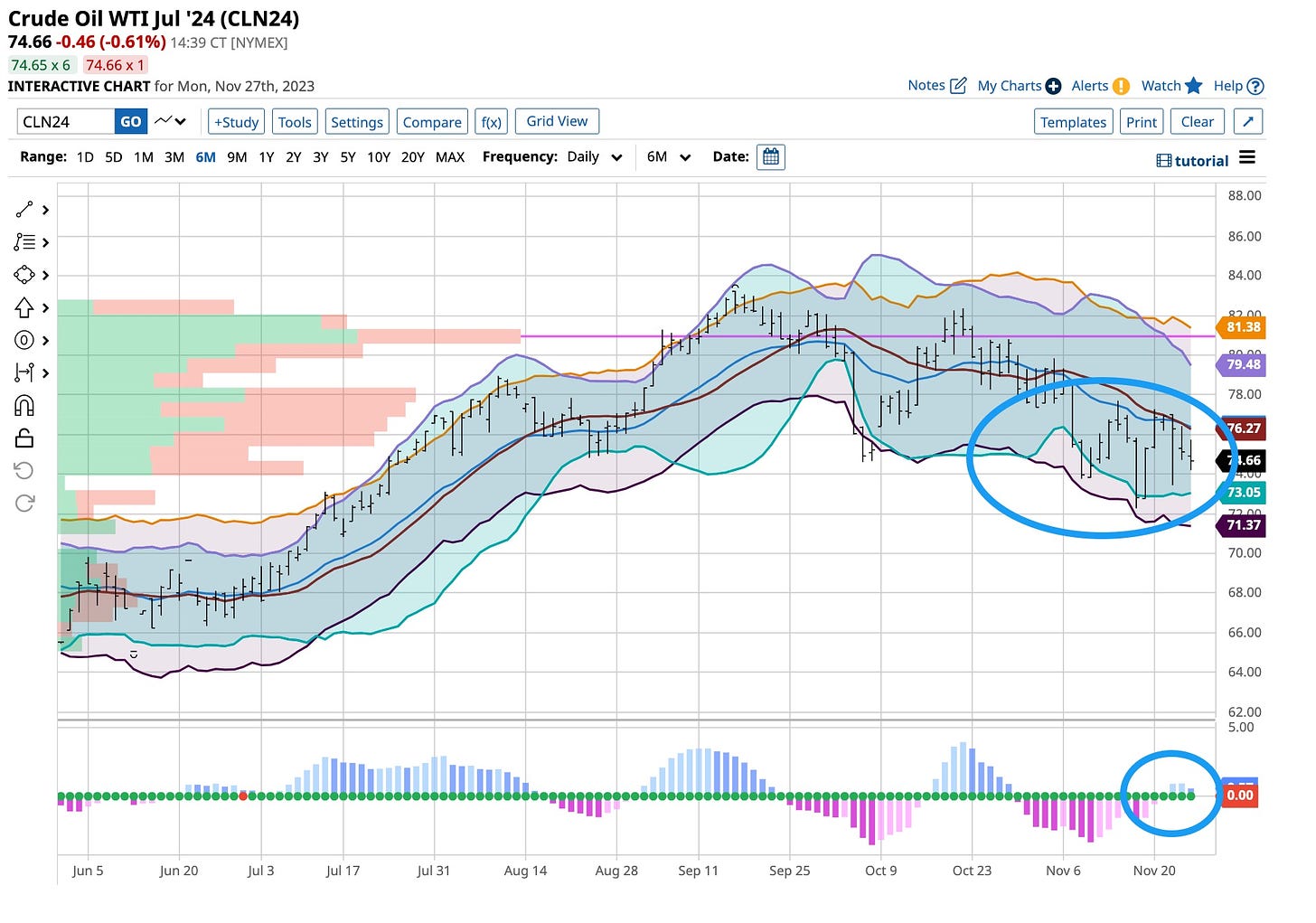

So take a look at what I’m doing. My perception is that interest rates, especially in the long term, have peaked thus I’m long the GOVT and TLT ETFs. Quite frankly, I’m very long these positions. I’m equally long the downside of the Yen. I hold these large positions as a speculative hedge. It’s. an election year and the battles have just begun. So one may ask, why I’m buying longer term WTI 85 calls?

That’s the hedge. I like to buy when others are selling and that’s on the table as Saudi Arabia is not in control of “its flock” of OPEC participants. Buy when they sell and sell when they buy is a watchword I follow. Everyone was throwing out the Yen and longer term treasuries with the bathwater. I was buying these instruments up as my belief is that the Dollar is headed lower. We have a ton of debt to place into markets over the coming months and I’m not impressed by how Yellen is and will handle it so I’m hedged.

If the Dollar decreases everything I own will increase so in essence I’m hedged against what I believe is gross mismanagement. I’ve seen it for years, everything is great until it isn’t. The world is a “rosy place” until it isn’t. That does not mean I’m sitting on the sidelines otherwise.

I like stocks that the street, for one reason or another has beat up. I’m a good dividend buyer especially in those industries who do well in recessionary times. Above all, as I have said before, I’m boring and boring has earned me over 5% for a very long time on what is considered “boring” short term treasury paper. I’ll take it and you should too.

It’s good to be boring and it fits. Whatever you do in life don’t write books or develop Udemy course(s). Yes, they along with my Substack articles are a labor of love. There’s a couple posters on LinkedIn and Substack that are worth following like me. Like me they are not always right. Like me they are consistent and that’s what counts.

No, as Billy Joel sings, “these are not the best of times”. His “Summer, Highland Falls” is one of my favorites. In essence in my life nothing ever changes. The signals do tend to repeat themselves over and over again. It’s an election year folks, a critical one. It may very well be the most important election you will ever participate in but we’ve all heard that before, right? I’m hedged and happy to hold the positions I do. More than likely I’m right and will come out smelling like a rose but either way I’m not going to ever get hurt buying at bottoms.