It’s a busy day down here in the “Lone Star” state of Texas. If you were watching my LinkedIn post last night you would realize that these markets are alive all day long. In my experience that is not always the case but these are turbulent times. They remind me of the late 1970s / early 1980s when politics ruled and changes in administrations at the top were likely.

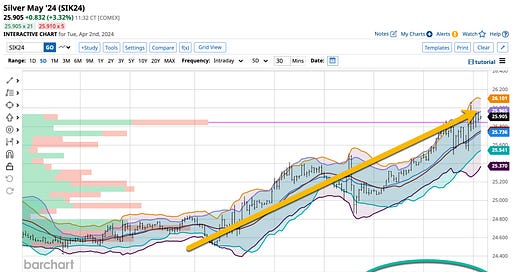

Last night I posted about the metals, silver in particular and the following chart spells it all out. As Yogi Berra would say, “it’s deja vu all over again,”, just like being back in Denver in 1980.

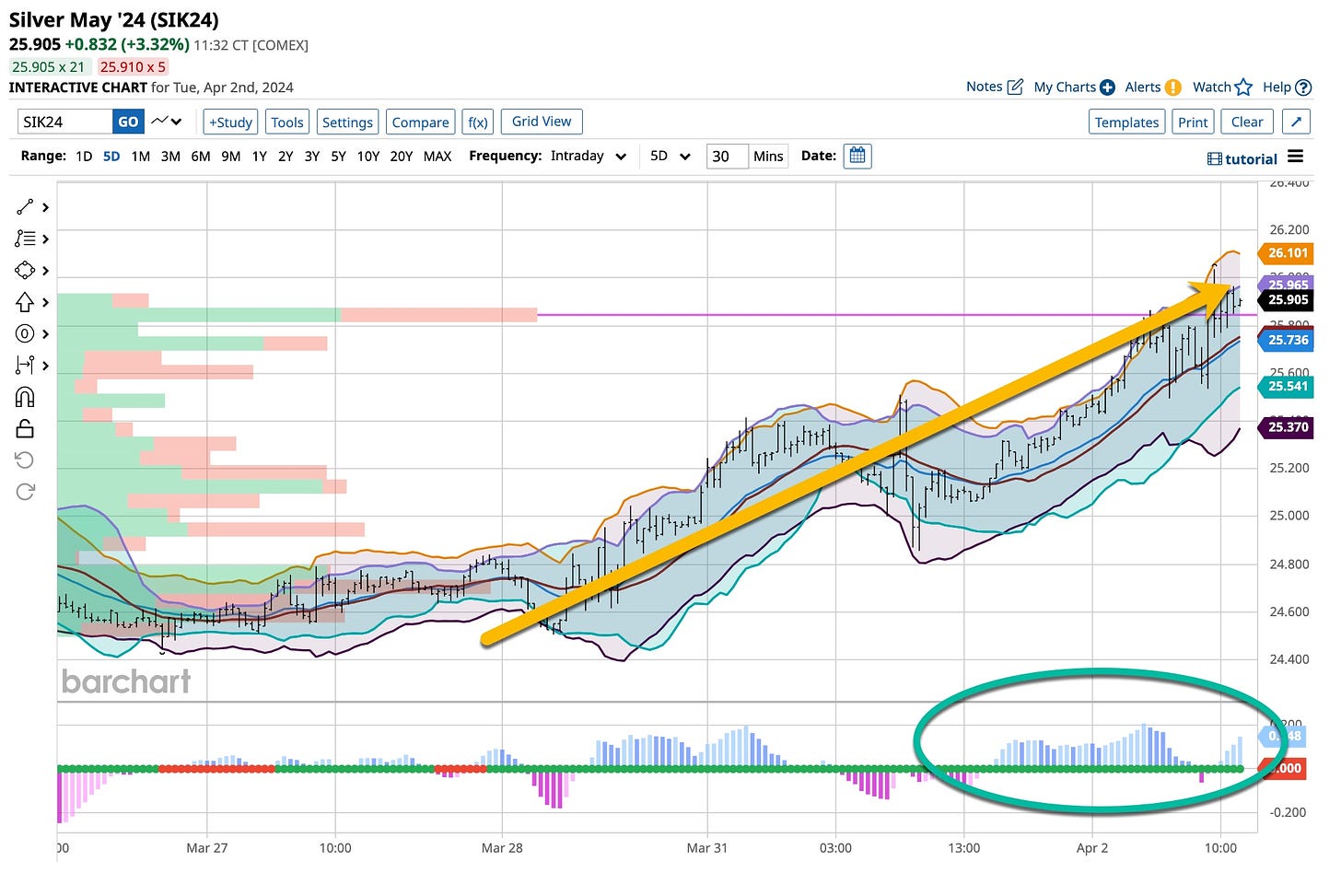

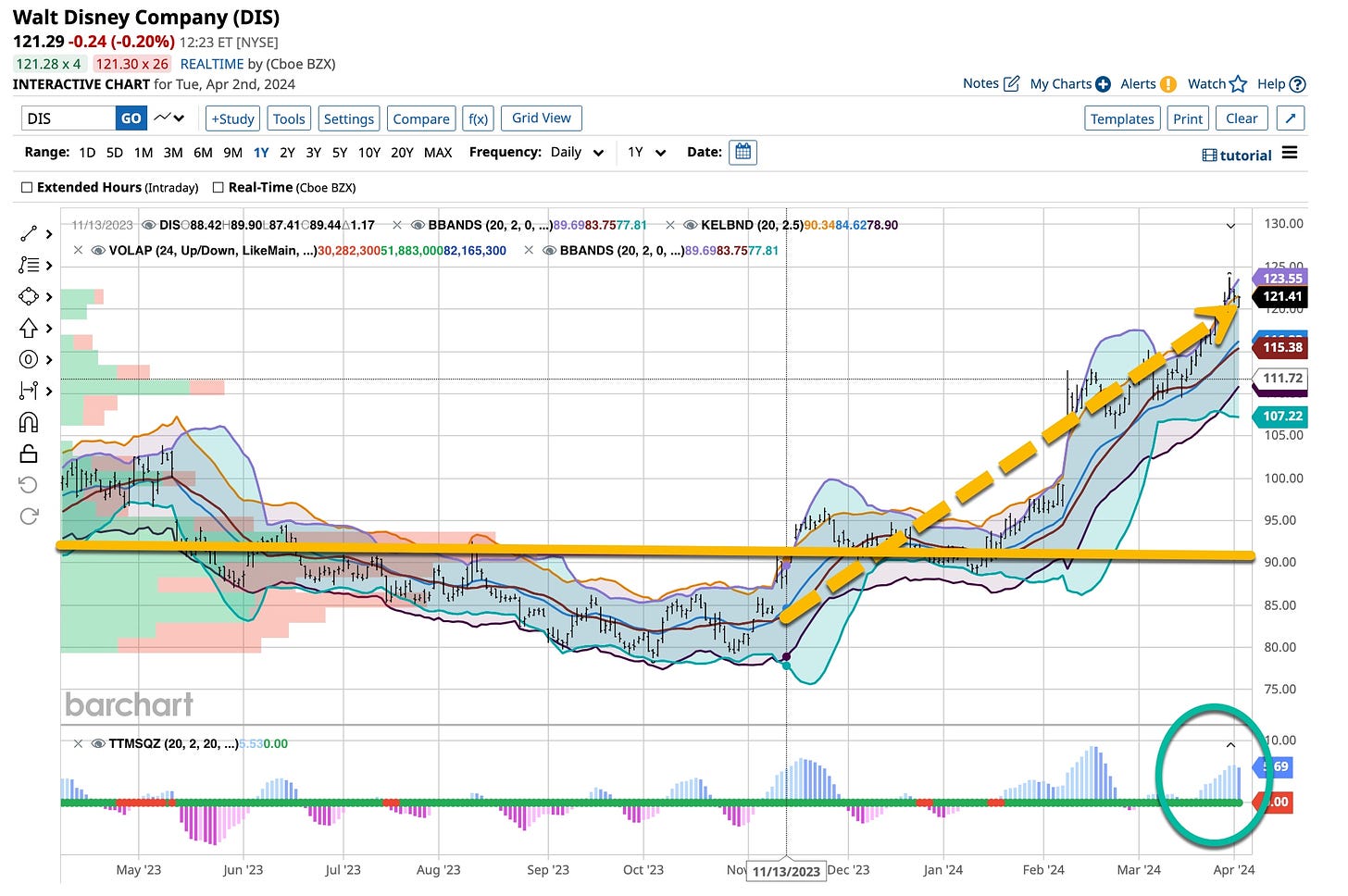

Hedging Disney Just Makes Sense

Like I said, it’s busy so I may be a little briefer than usual. Keep your eye on silver but more so keep your ears and eyes open to the Disney annual meeting tomorrow. It is like being in the “Wild West” and anything related to the battling parties can happen.

I’m long Disney from right below $80. I’ve rebalanced the position earning a little less than 50% as it’s moved higher. I don’t like to give up profits, ever. For that reason I did the following:

Bought 2024 April 5th 121 Puts

Sold 2024 June 21st 140 Calls

The cost of buying the put options was equal to what was received selling the calls. In essence, for absolutely “no cost” I’m hedged. If Disney drops I’m out at the market. If it runs I’m looking at adding another 25% to the upside. Hedging works and it is very important to learn. Jump on board at www.tickeredu.com and do what others do, just learn how to become the “best damn trader or investor” they can possibly be.

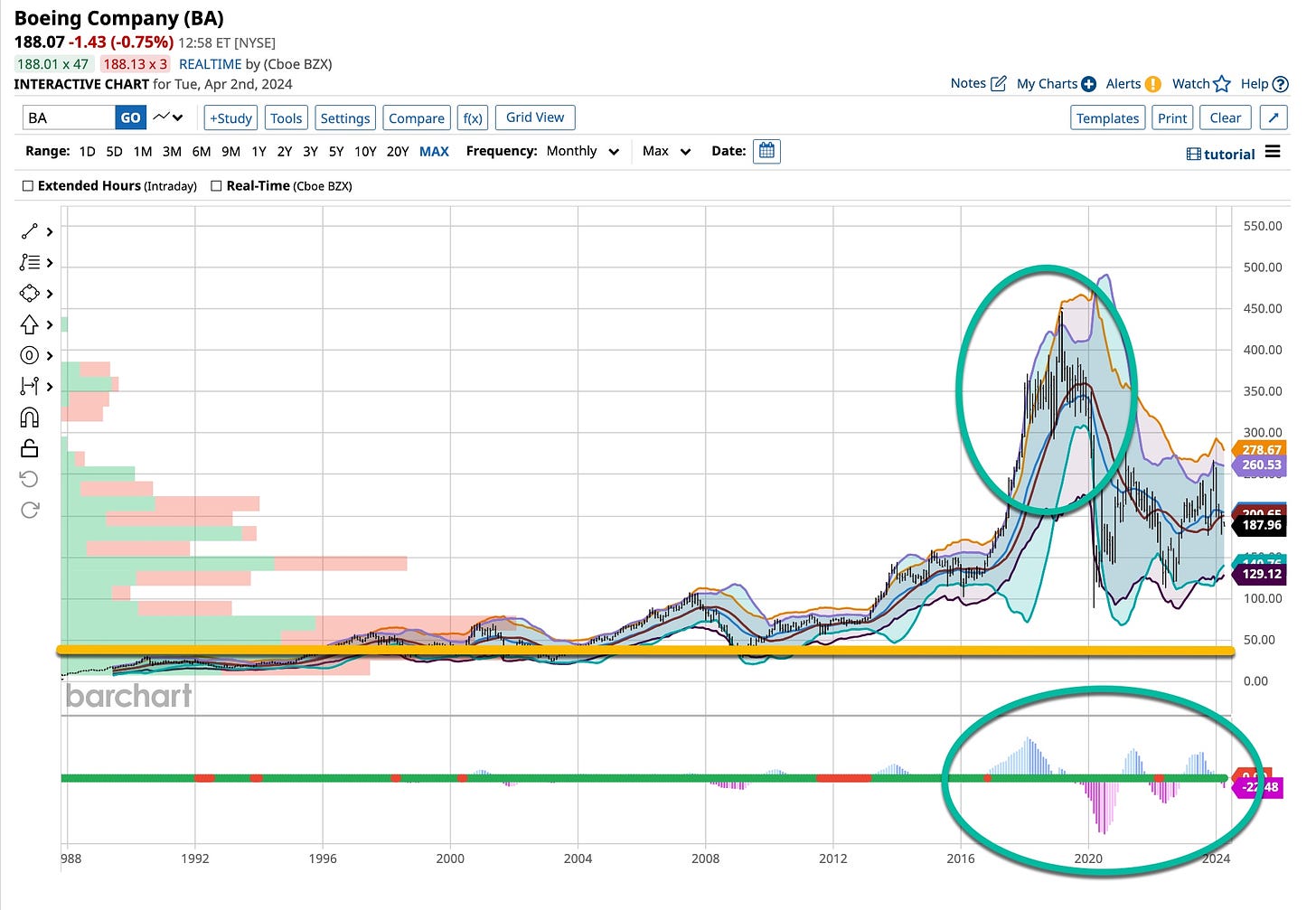

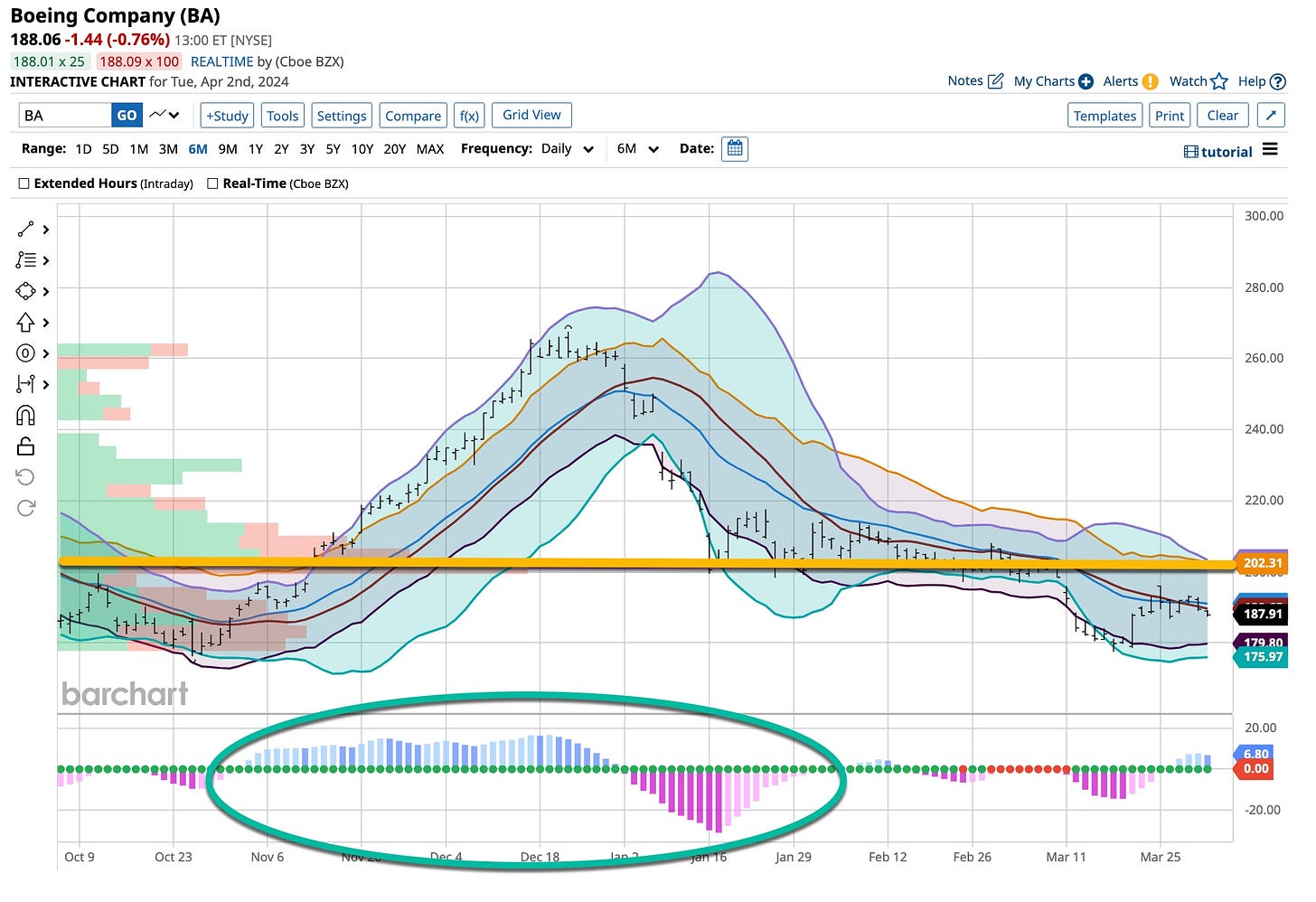

Start Watching Boeing

What goes up must come down and vice versa. I can’t begin to tell you how many times I’ve applied this rule to one stock in particular, Boeing. Take a look at the following to start watching what I’m keeping my ears and eyes open to.

Boeing has always snatched victory from the jaws of death. Like doors blowing off of planes, it’s always grabbed death from the jaws of victory. It’s obvious that changes are ongoing at this company but for me it’s too soon to act. It’s time to watch and listen to “what’s happening” something we do and teach more often than not. Stay tuned.

I don’t have much more for you at this time. it’s busy and I’m going back to work on making sure www.tickeredu.com gets done, the “right way”. There’s more than enough out there for all of you to buy and enjoy so join us. You’ll be happy you did.

Back to David Bowie for me as “Changes” are apparent. It’s hard to believe that I was listening to this tune in 1971 while being in high school. Fifty-three years later it still has meaning. We teach fundamentals. As a long term position trader / investor with a bend towards hedging some things never change. Macroeconomics, geopolitics and geoeconomics change daily and everyone needs to keep their eyes and ears open. That is what we try to teach at www.tickeredu.com and we know you are listening.