First off, Powell looks pretty good today, doesn’t he? Quite frankly, in the eyes of most he should. Are you watching this? Did you hear him talk about a “potential recession” not being a “high probability”? Did you see the averages run higher along with bonds, gold and oil? Are you watching the Japanese Yen head towards the 137.50 level? Come on people, you have two eyes and ears and you should be watching and listening right now. It’s important, be like Nike and “Just Do It”.

Understand Why I Hedge

I’m not writing on Substack for my health or just to be heard. There’s a great deal of long term experience about the way I approach investing. I am a hedger. No one ever knows, with absolute certainty what’s going to happen next. It’s a game of probability and one I’ve played well for years. If you are a regular reader over time you are going to learn from my posts. If you are a “paid subscriber” you are going to receive accurate long term recommendations usually available on the weekends. Sign up today for only $99.00 annually and I’ll surprise those who live in the contiguous 48 United States and send you a signed, first edition of "the infamous “The Ticker’s Bible” so you’ll learn a bit faster. It’s worth it so become a paid subscriber then contact me directly anytime. A lot of people already have so join the crowd. Now back to my hedging argument.

At this point in time I think the Yen is headed to 137.50 then 125.00 against the Dollar as the “tea leaves” are aligning as they should. I think bonds are headed higher as well so I’m long two ETFs, TLT and GOVT. These two positions comprise the largest part of my current positions. I’m not going to rake in the highest returns but I’m going to outperform the averages. More so I’m going to sleep at night albeit 3:00 AM CST as I like to watch Europe open. So what about the hedge side you ask?

Here’s The Hedges

Usually I use option contracts to hedge. Remember, no one, I repeat no one knows if the markets are going higher or lower. With that in mind, when something goes down I buy its options. If something soars to ridiculous heights I sell options. The VIX and WTI are ridiculously low. While not delving dramatically into the March VIX options I will admit that my position in the July WTI 85 calls is just about complete. I’m long and strong the options below $1.00 a call option and suggest you take a look and copy.

Otherwise, holding a short position on the Russell Index hedged the positions I have on the several stocks, many high dividend paying ones, that comprise about 15% of the money I manage. I closed that out earlier today. Search backwards through my many publications to see the ones I’m buying but it’s the same old philosophy. Buy the ones that have been taken out to the “woodshed” and wait. Brand name stocks are going to revive themselves or they’re not “name brand” stocks. This weekend’s post will deal with one in particular as well a couple higher dividend payers. I’m like Warren Buffett in many ways but in particular I’m very consistent in my overall investment approach. I suggest you become consistent as well. It works.

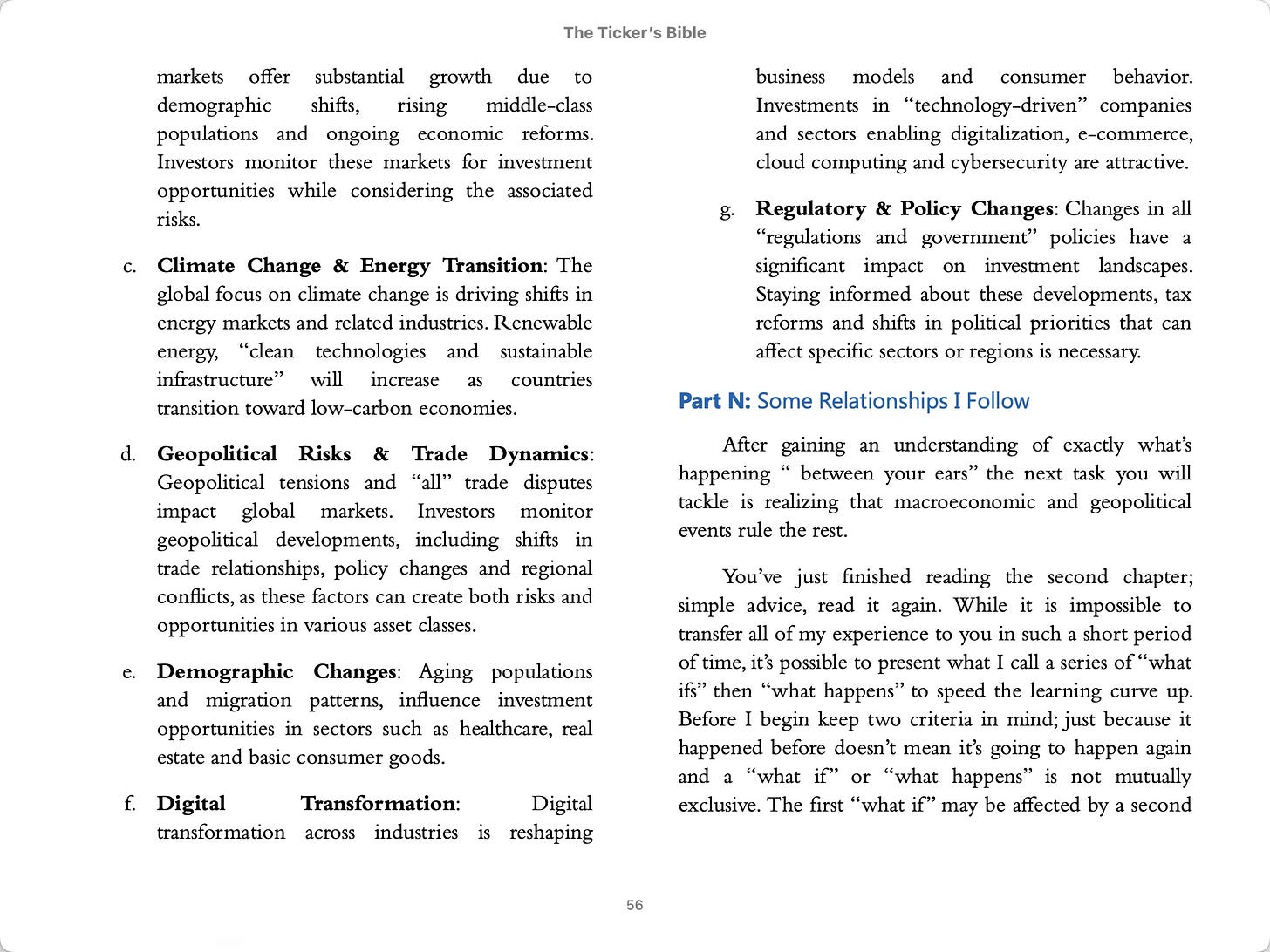

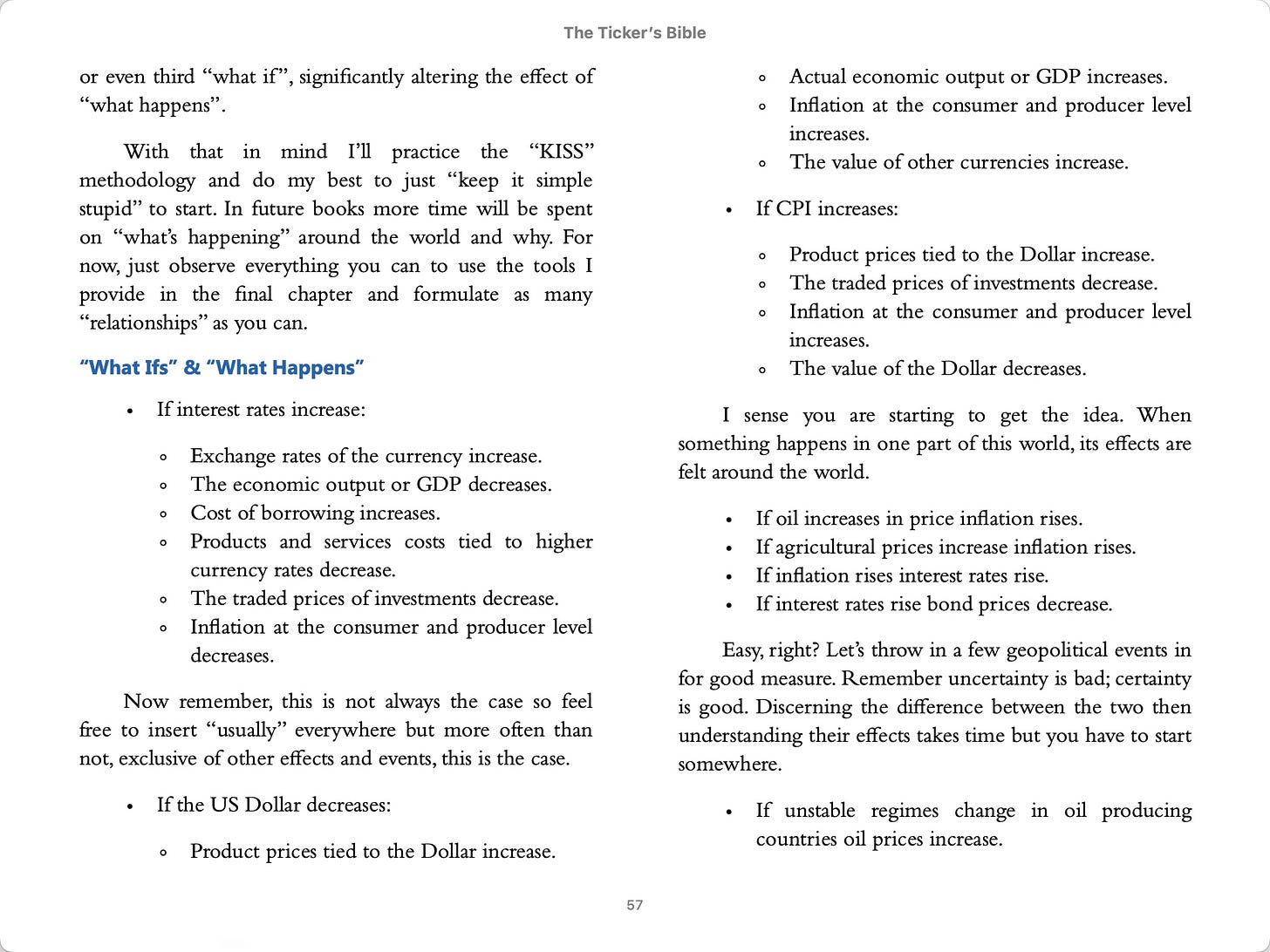

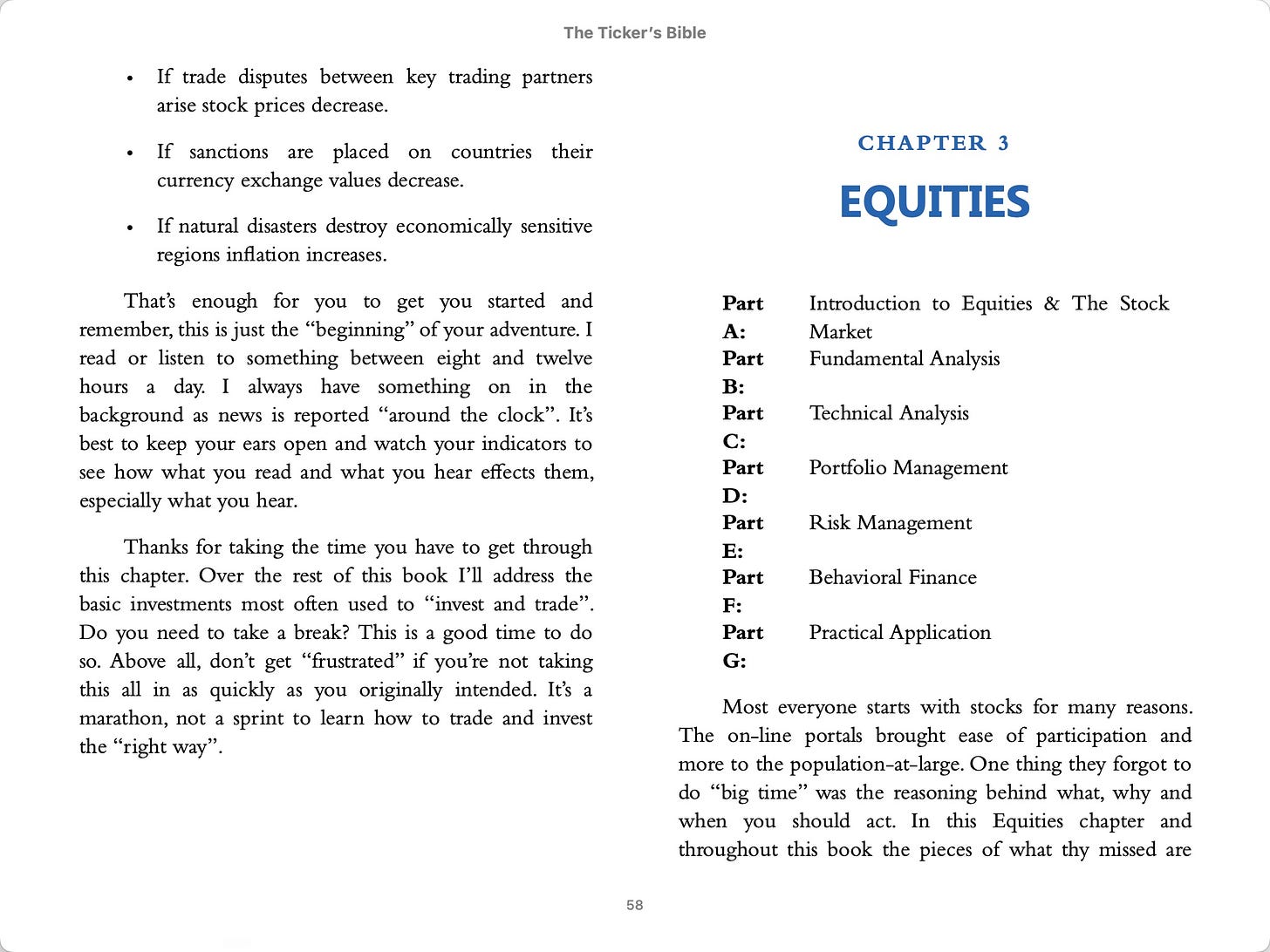

Book Excerpts Help

From the electronic version I’ve posted pages 56 to 58 below. Start reading “Part N” where I talk about “Some Relationships I Follow”. Trust me, it looks simple but really it’s not easy to learn and practice it. Remember, learning the “right way” how to just become the best damn investor or trader you can be takes time. It’s a marathon, not a sprint. Take the time to read this excerpt and get ready for the book to be published and my paid article this weekend. They are both well worthwhile.

That’s it for today folks. Remember, buy cheap like my better half and I did yesterday at Goodwill. In our neck of the woods Goodwill offers a 50% “seniors” discount every Tuesday so we shop. We picked up an electric operated leather chair in almost perfect condition yesterday for $12.50. There’s two ways to make money, first you go out and make it and second, don’t spend it. It’s like hedging; give it a try and let me know how you’re making out.

I practice what I preach. Whether I’m buying stocks when everyone is throwing them out with the bath water or simply shopping at Goodwill it works. Today I watched and listened to Jerome Powell. If you didn’t shame on you. First hand knowledge rules my world and it should play an important part in yours. The “Eyes Wide Shut” theme by Dmitri Shostakovich says more than I could ever suggest. Enjoy it, enjoy the seventh day of Hanukkah and get ready for Christmas. You got a gift today from Powell and he could not have wrapped it better.