Wow, what a coupler weeks this has been. There’re a couple prior points to remember as you traverse the unknown:

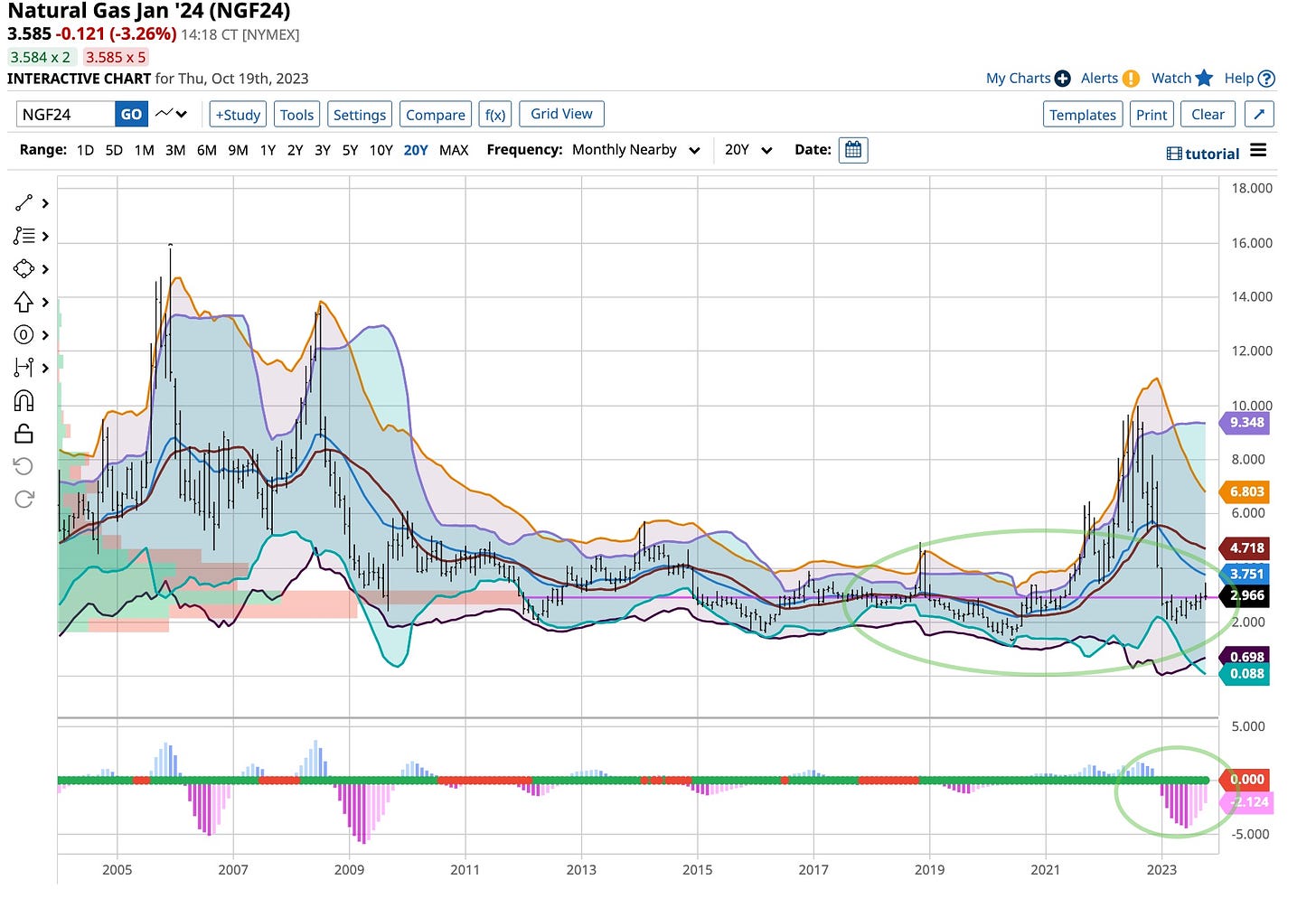

Greed Kills - I got lucky with my initial purchases of Natural Gas. Storage numbers came in light last week and the contract and options soared. Not having a crystal ball I took profits then when Natural Gas declined I bought a couple further out contracts and options. I was early but that brings me to today’s premise.

Keep Your Powder Dry - Given last week’s storage numbers were too good to be true, not being positive but again, winter is coming I expected exactly what happened today and storage came in hot. Traders reacted and my entry points of last Wednesday were once again available. It’s a long winter so I doubled up on my higher level futures and options purchases and now I do what I do best; sit and wait.

Buy When “They” Sell - /if anyone out there can tell me who “they” are I’m all ears. A while back this information could be followed. That’s not true today. Nonetheless the firepower was available to “double down”. It’s still available but some of it is going to go to “TLT” for what is my third round of entry and it’s twice as big as what’s at risk to date. Someday it is going to turn, especially if the world continues to disintegrate.

Bonds = TLT to be exact is getting crushed. I’m down about 7% on my purchases to date but that’s OK. My biggest wins have come from buying as others were selling. I do not recommend this strategy for everyone but when upwards of 60% of the money I manage is tied up in earning 5%+ acting in this way works. If you question that look at my Gold purchases. Oh look, it’s up again today post being down overnight. I like the overall trend and while avoiding “tooting my own horn” it’s good to be right.

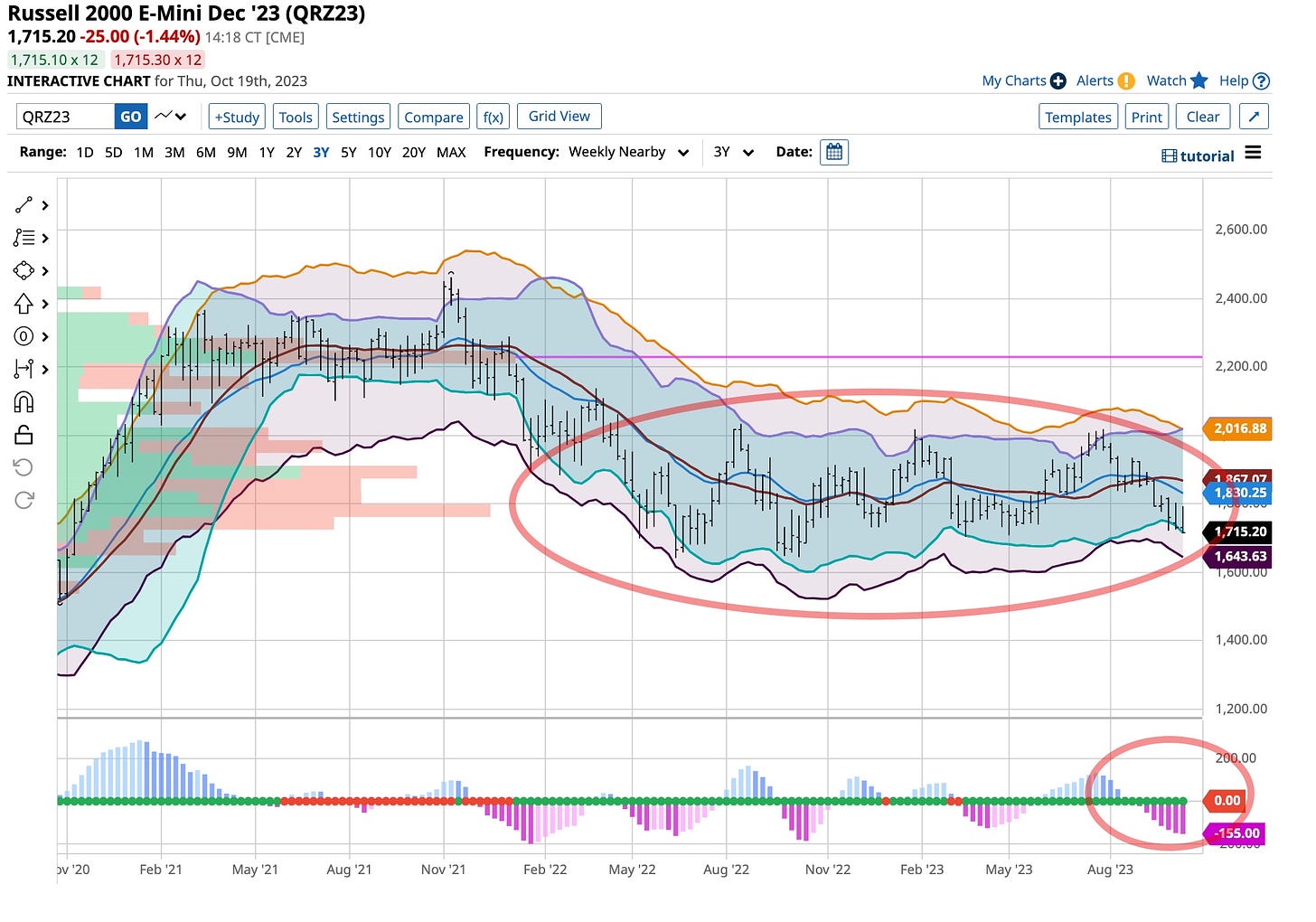

Otherwise still short the Russell and missed an opportunity to add to that position so it is small. Heavily long in Japanese Yen, pretty much at a breakeven there but sooner than not Ueda is going to shift. Still long VIX 20 calls, all profit. and I’ll let them run for a while. Short a couple, three, January Orange Juice contracts and to be honest, no one really knows what’s going to happen there but given it’s reaching new highs I will take the risk.

The World Has Problems

Is it the end; probably not but no one really knows. I know some of our service people are in Qatar and others are on their way. The US has a few “big” ships off the Lebanon coast supposedly to help with the rescue of our citizens but I wonder. Recently we’ve just paid for their release; guess the sheer number and amount demanded is just too high, eh Joe?

Are we on the brink of World War III, perhaps. Wrong leadership in place for certain but what do I know. At least Eisenhower’s Military Industrial Complex is happy but how long can our military supporting our economy last? Your guess is as good as my own so take some time to think about it as yields go up, our ability to pay our debts decreases and oh yeah, who’s really making the high level decisions we are subject to? I’m listening.

Back to the yard and the books. Both are a labor of love but it’s garbage day tomorrow. It’s time to rake what’s fallen and put the leaves into recycle bags as instructed. Save the world they say; I wonder if “they” are looking at the big picture as everyone else is?

Back to what’s become one of my favorites, R.E.M. and “It’s The End Of The World As We Know It” and I don’t feel fine; you should not either. I’m watching quite a few of the “new” day, scalp, swing, AI, ML and Algo traders. Some are pretty good and they will be featured sooner than not. I must say however that years of experience, and a few technical indicators rule. I do not like what I see and have reacted to recent trends in the macroeconomic and geopolitical realm. That me; it does not mean it’s right for you but do me a favor and at least think about it. Best always and remember just keep some of your powder dry and oh yes, buy bonds then buy more.