There’s nothing more special that being raised Jewish and celebrating St. Patrick’s Day with my better half and her family. Having a “shot or two” of real Irish Whisky with her youngest sporting a “kilt” is tough to beat. He does have “good legs” so he can pull it off but realistically, I’m glad he’s wearing underwear. It’s a good thing that Purim isn’t until next weekend as “green” hamentaschen” just don’t do it for me.

John Wayne, the star of “The Quiet Man”, had more in common with his character's Irish roots than most movie fans realize. His role as Sean Thornton was loosely based on the heritage of director John Ford. Ford grew up in an Irish American household in Maine. His parents were immigrants from the West of Ireland and he ‘claimed’ he was born with the name “Seán Aloysius Feeney”.

The film's lead character Sean is an Irish-born, American-raised boxer who leaves the United States after accidentally killing an opponent in the ring. He then returns to his Irish hometown with the intention of buying his former family home.

Wayne's birth name was actually Marion Robert Morrison. The Morrisons were from Scotland, meaning that while the actor himself was born in Iowa, he has Scotch-Irish heritage through his father's side. Wayne's great-great-grandfather Robert Morrison was born in Co Antrim around 1782. He left Ireland with his mother, arriving in New York in 1799 and later settling in Ohio.

The actor is said to have loved filming The Quiet Man in Ireland and even brought four of his children along for a cameo. His sons Michael and Patrick and daughters Toni and Melinda appear in the horse racing scene.

Wayne’s “pilgrim” has a signature delivery to his dialogue that audiences find comfort in. ‘The Man Who Shot Liberty Valance’ is no different in this regard. He frequently calls Stoddard “pilgrim” throughout the movie, which was a significant insult during these times. However, Stoddard never calls him out for the name.

So Happy St. Patrick’s Day everyone and to you, “The Duke”, thanks for all of the good times you brought to the “big screen” for us all to enjoy. From the final words of a true Irish tune, “may you be in heaven an hour before the devil knows you’re dead”.

Now let’s take a look at a couple Russell 2000 securities. Keep in mind, the only index not to surpass its “all time highs” is the Russell. As a tribute to St. Patrick’s Day, this posting is provided without invoking the “paid” Substack feature. Everything changes on April 1st, April Fools Day and not as a practical joke. My best ‘start-ups’ began on April 1st and this one is no different. Stay tuned and my thanks to all of you who have adopted The Ticker early. We appreciate your opinions, enthusiasm and more, thanks.

Welcome To The Russell 2000 Index

The stock markets kicked off 2024 with robust gains, but one area is “trailing behind”, small caps. While the S&P 500 surged by about 8%, small-cap stocks have faced several sell-offs. Amid the most recent correction, investors are already eyeing potential entry points into the small-cap sector. They should as these small-caps will benefit the most as interest rates are lowered.

The Russell 2000 has only inched up 0.3% since the year began. However, over the past five years, the index has seen a respectable 31.5% increase. Historically, the start of a broad market rally is often led by small-cap stocks. Face it, from above the 2,400 level last seen in late 2021, this segment has seen the worst of times. Perhaps it is changing.

That hinges on several factors. The economy must steer clear of any type of recession and the timing of the Federal Reserve's interest rate cuts is crucial. Currently, markets anticipate the first rate cut no earlier than June. Many small caps are still focused on growth and would benefit from lower borrowing costs.

Another key consideration for investors is “company valuations”. As of March 8, 2024, the price-earnings ratio (“P/E”) of the Russell 2000 index stands at 27.89 which is still a little too high but there’s always a couple securities that catch my interest. Here are a couple you should investigate further. I like them all and in a very small way, they’re a piece of what I manage. Remember, it’s always good to do your very own due diligence.

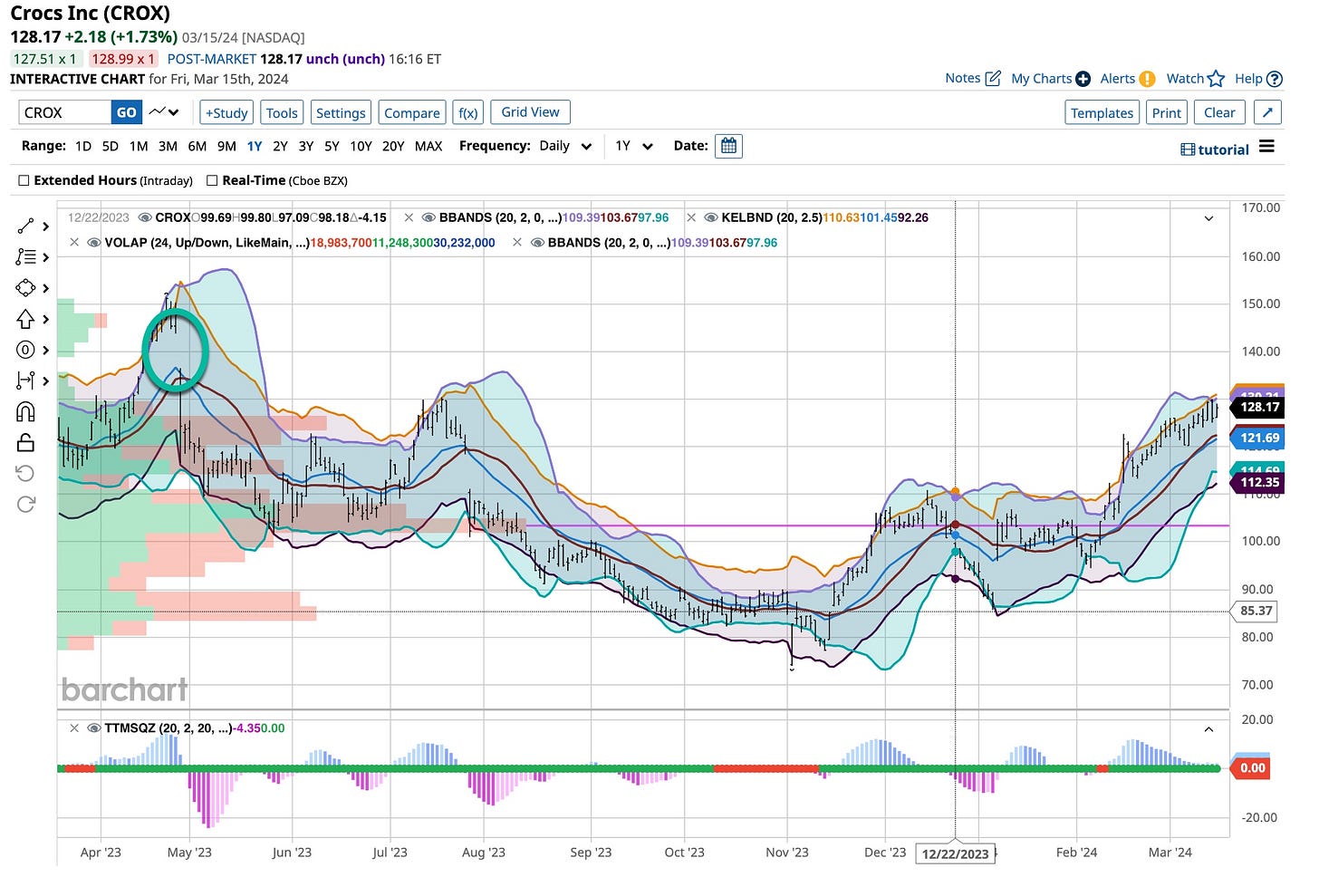

Crocs (“CROX”)

Crocs, Inc. is a global footwear company known for its iconic foam clog-style shoes. Despite fluctuations in popularity over the years, Crocs has demonstrated resilience and growth potential. Crocs built a strong brand with high recognition worldwide. Its distinctive clog design and comfort-focused approach have garnered a loyal customer base. The brand's popularity extends beyond its classic clogs to include a variety of footwear styles, including sandals, boots, and sneakers.

While the classic clog remains a staple, Crocs continually innovates and expands its product line to cater to evolving consumer preferences. This includes collaborations with designers, celebrities and brands to create limited-edition collections, as well as introducing new materials, colors and designs to appeal to diverse demographics.

Crocs has capitalized on the growth of e-commerce, leveraging its online presence to reach customers globally. The company's direct-to-consumer channels, including its website and mobile app, facilitate sales and offer personalized shopping experiences. E-commerce expansion has also contributed to revenue growth and improved profit margins.

Crocs has successfully expanded its presence in international markets, capitalizing on growing demand for its products outside the United States. Strategic investments in marketing, distribution and retail partnerships have helped it penetrate new markets and drive sales growth globally.

Overall, Crocs' strong brand, product innovation, diverse customer base, e-commerce growth, international expansion, financial performance, sustainability initiatives and resilience position it as an attractive investment opportunity in the footwear industry.

In the three months ending December 31, 2023, Crocs generated total revenue of $960 million, an increase of less than 2% compared to the same period last year. While the core Crocs segment saw double-digit growth, the HeyDude segment continued to face some challenges, experiencing a sales decline of over 18% in the fourth quarter.

For the full year, Crocs reported record revenue of nearly $4.0 billion, up 11.5% from the previous year. The operating margin improved by 230 basis points from 23.9% in the previous year to 26.2%.

Overall, the management expressed confidence stating, “we start the year 2024 from a position of strength and seize the opportunity to invest in several strategic key areas to lay the groundwork for sustainable market share gains."

For the current fiscal year, management expects revenue growth between 3% and 5%. While investors may not be entirely satisfied with this single-digit growth potential, Crocs remains on a growth trajectory. The company continues to be in growth mode, as reflected in market estimates. An average revenue growth of 5.2% and current EPS growth of 7.2% are expected over the next three years.

With an operating margin of 26.2% in 2023, Crocs is one of the most profitable shoe manufacturers in the peer group, even better than Nike demonstrating only 11.9%. Despite challenging economic circumstances, Crocs proves its resilience and its ability to deliver solid performance in difficult times.

Progyny (“PGNY”)

Progyny Medical is a company that provides fertility benefits solutions for employers, designed to support employees in their family-building journey. There has been an increasing demand for fertility services globally due to several factors such as delayed childbearing, lifestyle changes and advancements in fertility treatments. Progyny is well-positioned to benefit from this growing demand, as it provides “comprehensive” fertility benefits solutions to employers and their employees.

Progyny's business model is innovative in the sense that it “partners” directly with employers to provide fertility benefits. This strategy generates direct revenue through employer contracts and creates a strong network effect as more join in, potentially increasing Progyny's market share.

Progyny Medical is a leader in the fertility benefits space, with a “significant” market share and a very strong reputation for providing high-quality services. Its established position in the market can provide stability and growth opportunities for investors.

Progyny utilizes technology to streamline the fertility treatment process, providing a more seamless and efficient experience for both employers and employees. This solid emphasis on technology integration enhances the company's competitive edge and can contribute to its long-term success. Progyny has been expanding its addressable market by introducing new services and solutions, such as egg freezing and surrogacy support. By diversifying its offerings, the company can capture a larger share of the fertility services market and drive revenue growth.

Overall, Progyny Medical's innovative business model, strong financial performance, market leadership, focus on patient care, expanding addressable market and even its experienced management team make it an appealing investment opportunity for those interested in the healthcare sector and fertility services industry.

In a time marked by numerous economic challenges, there are companies consistently making their way to success. Last year, Progyny generated revenue of $1.08 billion, a 38% increase compared to the previous year. In the fourth quarter alone, revenue rose by 26% to $269.9 million.

But it's more than revenue reaching new records; the company's net income almost doubled compared to the previous year. For the entire year, net income amounted to $62.0 million or $0.62 per diluted share, compared to $30.4 million the previous year. In the fourth quarter, net income practically quadrupled to $13.5 million or $0.13 per diluted share.

Taking a closer look at Progyny's profitability, the company impresses with its gross margin and adjusted EBITDA. The gross margin improved to 21.9%, thanks to solid ongoing efficiency enhancements in Care Management Services. Adjusted EBITDA for the full year reached a record $187.1 million, a 49% increase from the previous year.

Another reason for Progyny's joy is the growth of its customer base, which grew to 392 customers by the end of 2023, a significant increase from the previous year's 288 customers. For 2024, Progyny Medical remains very optimistic, forecasting revenue between $1.28 billion and $1.31 billion and net income between $68.1 to $73.6 million. Adjusted EBITDA should range between $224.0 million and $232.0 million. Analysts are also confident about the more distant future, with total revenue growth expected to stabilize at around 20% through 2027.

Tactile Systems Technology (“TCMD”)

Tactile Medical is a company that specializes in developing and marketing devices for the treatment of lymphedema and chronic venous insufficiency. The total market for lymphedema and chronic venous insufficiency treatment is growing due to an aging population, rising obesity rates and increased awareness and diagnosis of these basic conditions. Tactile Medical stands to benefit from this growing market demand.

Tactile offers innovative medical devices such as the ‘Flexitouch’ system, which uses pneumatic compression to improve lymphatic and venous circulation. Its products are designed to provide effective treatment while being user-friendly and convenient for patients. Positive financial indicators such as revenue growth, profitability and strong cash flow make Tactile Medical an attractive investment option.

Tactile Medical's products have received regulatory approvals from agencies such as the Food and Drug Administration (“FDA”) in the United States. This ensures that the company's products meet stringent quality and safety standards, enhancing investor confidence. Tactile continues to expand its distribution network, both “domestically and internationally”. This expansion allows the company to reach more patients and healthcare providers, driving sales growth.

Tactile’s focus on innovative products, expanding market opportunities, strong overall financial performance and an experienced management team make it a very appealing investment opportunity for those interested in this “healthcare” sector especially at its current price.

Tactile Systems Technology has established itself as one of the driving forces in the constant pursuit of innovation and improvement in medical care. It’s been developing medical devices for treating chronic illnesses and has recently taken a path that is not only economically promising but also has the potential to improve the lives of many people.

Tactile Systems Technology has particularly specialized in treating ‘vascular diseases’ such as lymphedema and chronic venous insufficiency. Thanks to innovative therapy solutions, the company increased its revenue in the fourth quarter of 2023 by 5% when compared to the previous year, reaching $77.7 million. The company posted adjusted net profits of $8.9 million or $0.37 per share, surpassing market expectations.

The revenue growth of Tactile was primarily driven by an increase in sales and rentals of its lymphedema therapy devices, as well as a slight uptick in sales in the respiratory therapy segment. This success demonstrates its effectiveness and ability to adapt to the market's needs.

For 2024, Tactile Medical has also provided an optimistic revenue forecast of $300 to $305 million, representing an increase of approximately 10% compared to the previous year. Analysts are optimistic, predicting revenue growth of around 13% for 2025. In addition to promising business prospects, Tactile also stands out for its solid financial position. It's worth noting the high free cash flow yield of 8.9% asa compared to peers, indicating that the company operates efficiently and generates attractive returns for its investors.

When anyone evaluates securities it’s best take preconceived notions and put then in the “rear view mirror”. That’s what I’m doing here as Tactile is a direct competitor of my better half. Service is a prominent element of her success and Tactile is always a competitor she beats in the marketplace. Nonetheless, it’s time to buy Tactile as the price of it’s stock is going higher.

That’s all from me this week folks, it’s time to celebrate. We’re hitting the final stages of what I’ll call our “soft” launch but it’s been anything but that. It’s all your fault, you have adopted us knowing there is a “right way” to learn how to invest and trade. Over the last couple months we’ve developed a simple philosophy that includes foundation, bricks and mortar. The first two steps are built and they’re offered, ready to go. We’re working on the “mortar” that ties it all together. Thanks always for your patience and now your support. We’re happy to be there for you.

Well, what did you expect, it’s St. Patrick’s Day. In 1939 Bing Crosby made “When Irish Eyes Are Smiling” a song to remember. I might not have grown up wearing the “green” and I still don’t cheer for Notre Dame but face it, some things you cannot change. Besides I was a cheerleader for the University of Pittsburgh when, with Tony Dorsett, we beat the “Irish” in South Bend on our way to a National Championship in 1976 - 1977. Ah, those were the days my friend and frankly they’ve never ended thanks to you. Best always, enjoy your Sunday and week and stay tuned.