Honest, it did. How about you? Coupled with what has become normal market action the extra time was spent just getting ready for the “penultimate” launch of teaching everyone to invest and trade the “right way”. It’s been an absolute labor of love folks and one intended to just benefit you. Thanks for your patience and stay tuned.

Keep your eyes open for a few “announcements” over the coming days and thanks. To those of you who are “paid” Substack members, you are going to get better offers than you ever imagined. It’s only fair and that’s a word we live by. So let’s take a quick look at today’s “action”, if you can call it that, and bring you up to date with what’s going on in my world investing wise.

It’s Truly A Leap Day

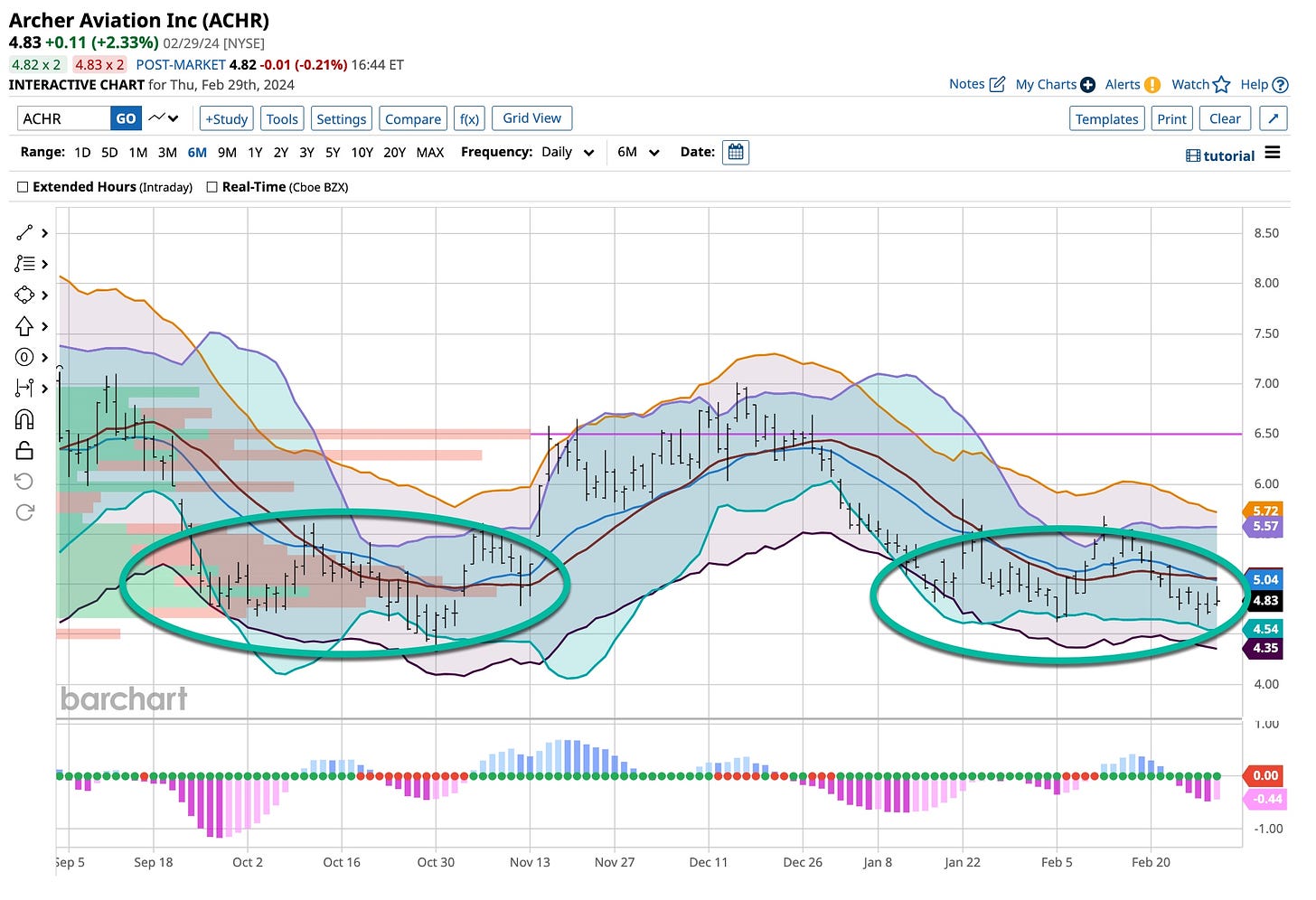

In all sincerity, not much has changed. I remain an ardent believer that interest rates are going to head lower in the United States and higher in Japan, “eventually”. I’m a very patient long-term investor and hedger and that’s not going to change, neither is my plan. So I’m long bonds, earning 5%+, looking for the Yen to head towards 125 and happy with my turn around and dividend oriented portfolio. I’ve been betting on oil to go higher with a couple stocks and happy with all of my speculative picks, even ACHR that’s down 10% from my original recommendation. Like always, as I always rebalance the winners, I’ll add to this position. Dollar cost averaging works. Give it a try.

Check this thread out over the weekend, Sunday night more than likely, as even being as busy as I’ve been I’m listening to the “big boys” and they’ve turned their attention to Europe. They were right about Japan so like you should be doing, I’m listening.

Futures Wise I’m Buying Copper

Face it, when it comes to seasonality my history looks back decades. Copper has a way of performing so I’m accumulating 2024 May contracts slightly below its current level. I’m a bit afraid of Cocoa but realistically, it’s just come “too far too fast” to hold these levels so I’m watching but that’s all I’m doing, watching. If it sets another new high I might short a couple contracts. Hopefully I’ll sleep a little better this time as I did not sleep well the last time.

A Little Bonus

Putting together a course to teach you the “right way” took far more time than I ever expected it would. To compensate you for waiting the following excerpt comes from a review segment found in our Education Horizon course series. When announced you will be the beneficiary of this knowledge and more. If you take advantage of what we announce you’ll discover that essentially you’ll be signing up at no cost. That’s right, you are going to learn and become the “best damn trader or investor” you can possibly be for “free”. I like free and you should too so stay tuned and look for our offer. Until then enjoy the following.

Segment #1

Question #2: Which Emotions Are More Important?

Answer: Negative and positive emotions are important but without a doubt, having self-confidence is critical to every aspect of becoming the “best damn investor or trader” one can possibly be.

Negative emotions have a significant impact on overall investing and trading decisions. Emotional reactions lead to impulsive choices, increased risk-taking and irrational behavior often resulting in financial losses. To mitigate the impact of most negative emotions on investing and trading, individuals focus on developing their emotional intelligence, practicing self-awareness and implementing self-regulation strategies. These include setting clear investment goals, adhering to well-defined strategies and not being afraid to seek support or advice during emotionally challenging times.

Better risk management techniques, something important to everyone, minimizes the potential impact of emotional reactions on financial decisions. It’s always best to start with the “negative” emotions. Most find it is easier to identify then attack the “demons” that are “detrimental” to your investing and trading success. While many others exist it’s best to understand all of the negative emotions of boredom, depression, doubt, fear, anger, anxiety and greed.

It’s important to understand the positive emotions you possess as everybody has the potential to improve upon what helps to make them tick positively. Take more of your time to discover yourself starting with a deep breath and a good hard look at these emotions. These are the “must have” overall emotions everyone needs to possess to make them “tick” investing and trading wise.

Remember, you are here so you can become the “best damn trader or investor” you can possibly be. You also understand that the journey you are embarking upon is a marathon and not a sprint. The most important positive emotions to address are commitment, introspection, self-control, heightened awareness, being realistic, patient, adaptable, responsible, being a creative thinker and always exuding basic self-confidence.

The most important positive emotion to possess is self-confidence. By definition, self-confidence is a belief in one's own abilities, qualities and judgment. It involves having a positive and assured view of yourself, your capabilities and believing you can be a success and meet all challenges. Individuals with strong self-confidence have a realistic and positive self-image. This trait enables them to approach tasks, goals and interpersonal interactions with a sense of assurance especially for those inherent to becoming a successful investor and trader. Developing self-confidence involves recognizing and building upon all of your strengths, setting and achieving realistic goals and facing challenges with a positive mindset. It is a dynamic trait that can be cultivated and enhanced through basic self-awareness, learning and personal growth but it takes time to be the best of anything you can possibly be.

I care a lot about emotions. That’s what makes everyone tick. You might think you are different but trust me you are not. Emotions get everyone into trouble and that’s why we start there. Sure, we’re going to dig into macroeconomics, geopolitical events and geoeconomics but first we start with what’s happening between your ears. It’s the best way to learn the “right way” so dig in and read what we write and get ready to listen to how we teach it. But always remember, we appreciate your time, patience and support as we reach our goals. You all have been great.

Emotions are important and not just to Mariah Carey. Emotions are important. They always will be especially when it comes to investing and trading. If you have a strong control of your emotions your are ahead of the curve. Not making mistakes is half of the battle. Face it, everybody has their demons. It is how you deal with them that sets you apart from the crowd. That’s why it’s important to handle your negative emotions and “keep them in check”. Everyone has positive emotions and they’re easy to build on but handling the negatives, like caring for a “troubled child” is what really counts.