Lions and tigers and bears, oh my. We’re not talking about football team mascots, no we’re talking about the world we live in. From climate change to EVs, from civil wars to regional conflicts, everyone has an opinion. The “fake news” will tell you not only what to think but why. You are smart, think for yourself and act accordingly. Out of chaos comes calm. I sense the same will happen again, as it has in the past. Stick to your guns and what you believe.

This morning on LinkedIn I had the pleasure to interact with several “old timers” and a couple “newbies”. Damn those newbies are fun. They’re consistent too. You see they will “pop-up” when things like Bitcoin hit interim highs. Did you ever wonder where they were when it was going lower? That’s right, they were hiding in the shadows and you didn’t see them. They’re back and like always they think the world is changing; it isn’t. The “old timers” will stick with what they know but different than the “newbies” they’ll listen to what everyone says. That’s how we got to be “old timers” and believe me, it works.

So What’s New

Not a lot so most of whom I’ve responded to I’ve done it on LinkedIn. Success takes time and a belief that what one is doing is right. With that in mind let’s review a few of the positions held:

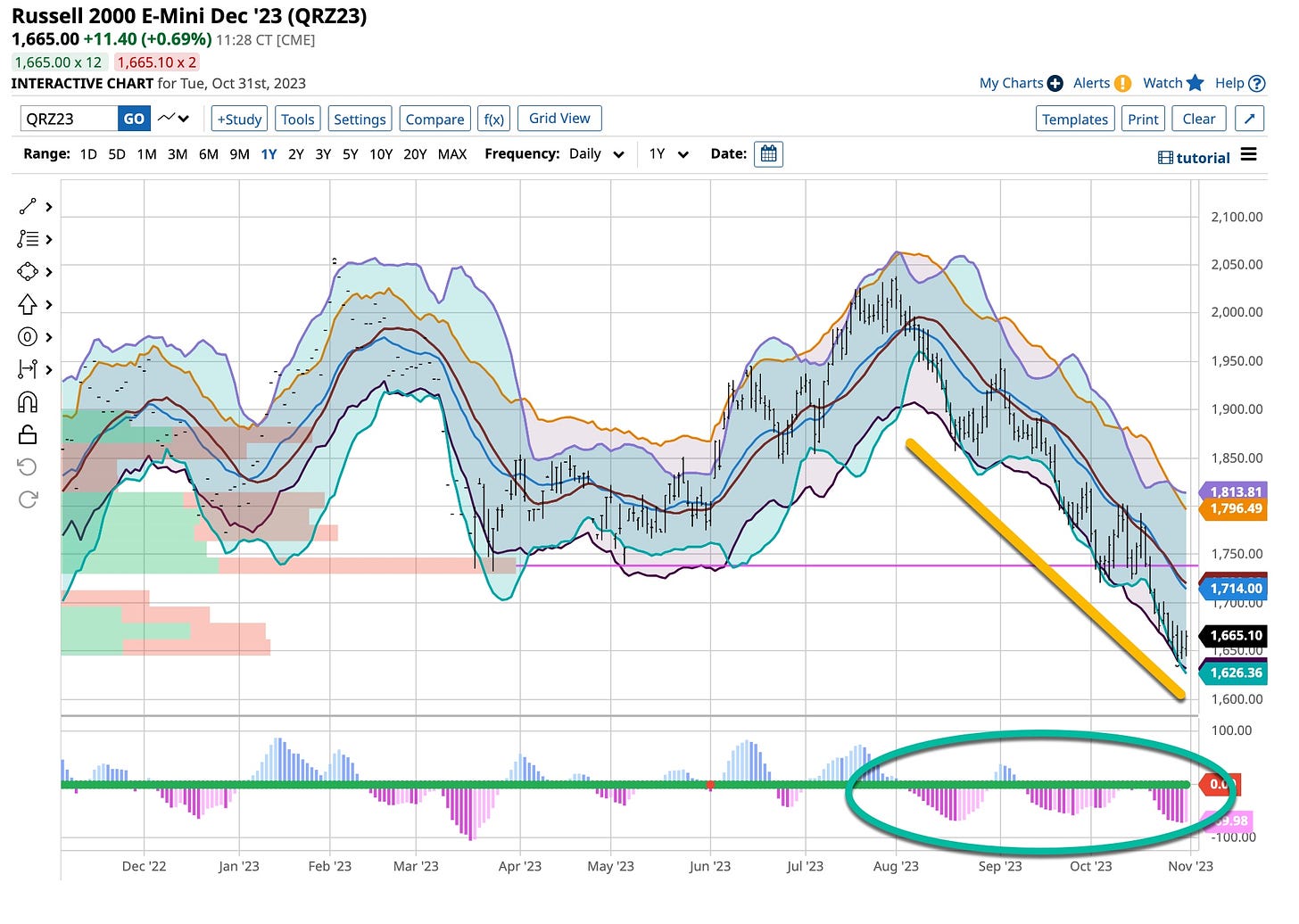

The Russell Index has to head lower. On days of upticks I add a contract or two to the short side. I started doing this around the 1,900 level. My target is around 1,000. So far so good so no real reason to change.

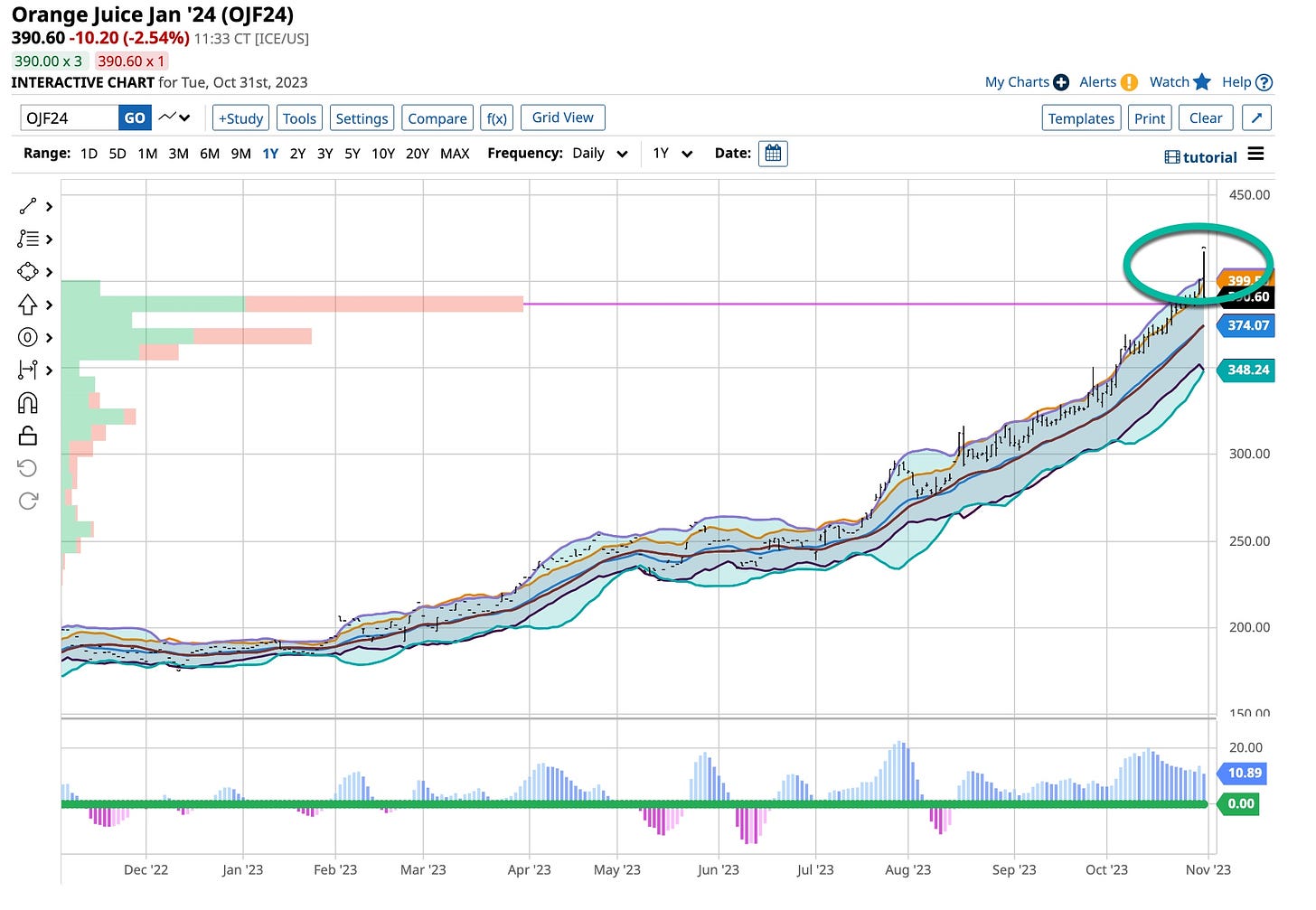

Orange Juice has done its thing on the upside, I hope. With the addition of three short January contracts this morning I’m sitting with an average price of $3.95 for this one. I think it’s heading lower but I could easily be wrong; that’s why it’s a small position.

I’m down a ittle more than 1% on my Japanese Yen trade and will short more at 152.50 if that level is hit. It’s a big position and one that has to change over time. My target is the 125.00 area and I’m patient. It’s going to happen but no one knows when.

I’m down a little more than 4% on my TLT ETF purchase and will continue to buy the long bonds for quite some time. Rates are not the underlying cause of inflation. Over time it will be the cure. Stopping the government from spending money would help.

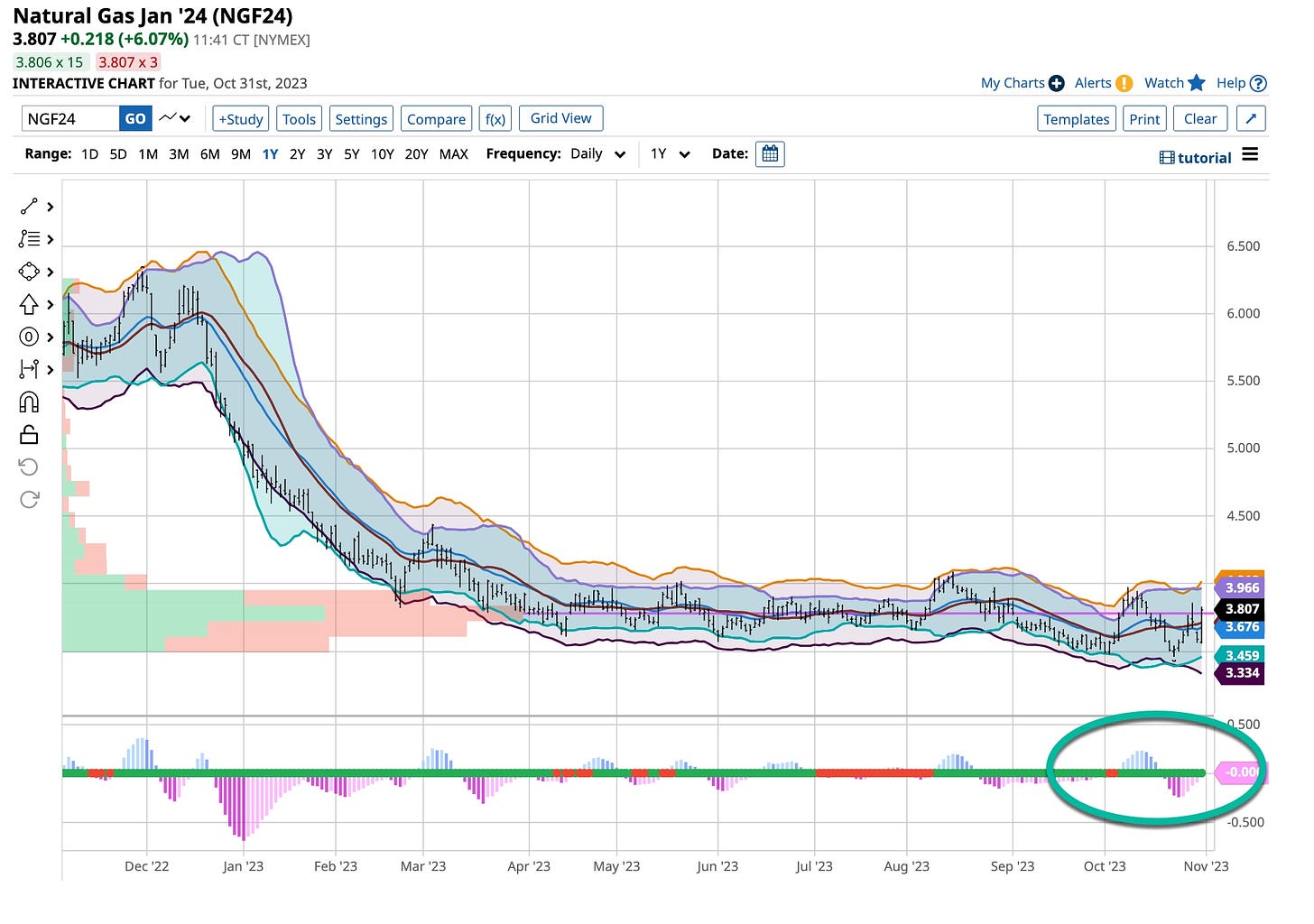

It’s Natural Gas time but as originally mentioned that’s a seasonal trade for me. It is the “widow maker” and everyone should be aware of that. Nonetheless it’s winter and it’s cold down here in Texas. I’ll use stops and trailing stops at times later in the year but for now, let’s see where it goes. It can change on a dime; remember that.

I’m still long Gold, haven’t been stopped out there and with the world turning a bit off kilter on it’s axis I’ll stay in the trade that started when everyone sold at lower levels. Still holding a few March 20 VIX calls but they’re what’s leftover then moved from a successful trade started when the markets were much higher. That’s it for now; how about you?

The book, Udemy and my appearances on Substack and LinkedIn are doing well. I am formating the book for publication on Amazon / Kindle tomorrow. The hard cover is set for review next week. It’s going to be dust covered and will include a glossary and an index. It makes sense as right now it’s going to sell for $59.99 and quite frankly it is worth it. Anyone who signs up to watch this Substack thread and lives in the United States will have a signed copy shipped to them for free. If you live outside of the states we’ll charge for postage.

Lions and Tigers and Bears, Oh My, The Wizard of Oz predicted the future way back in 1939. Hitler was at work then. Nothing has really changed, has it? Dorothy, Toto, the Tin Man and Scarecrow knew what they were talking about. While a firm believer in free speech I have to ask myself what the hell is going on in our basic institutions of higher learning. Maybe it’s just the “fake news” telling you what to think? I think there is more but what do I know. The next step by our administration will tell us a lot but honestly, who are you to believe? Be like me and just keep watching. There are a lot of lions and tigers and bears out there.