It’s Friday, another week, winning trades for all sides and the news out of the Middle East just gets worse and worse. If you haven’t noticed folks there’s a real war going on there, one our country really doesn’t fully understand but who am I to judge. I’ll leave that up to the “big guy” and his merry men and women who print notecards for him to use when calling on those asking him questions.

The markets are a little different. Reviewing what is transpiring one gets a better idea of “what’s next”. Holding a long term position is a good thing. Interest rates are lower and the Dollar is weaker. Gold is going higher and Natural Gas is doing its usual thing so I need to ask, “what me worry”?

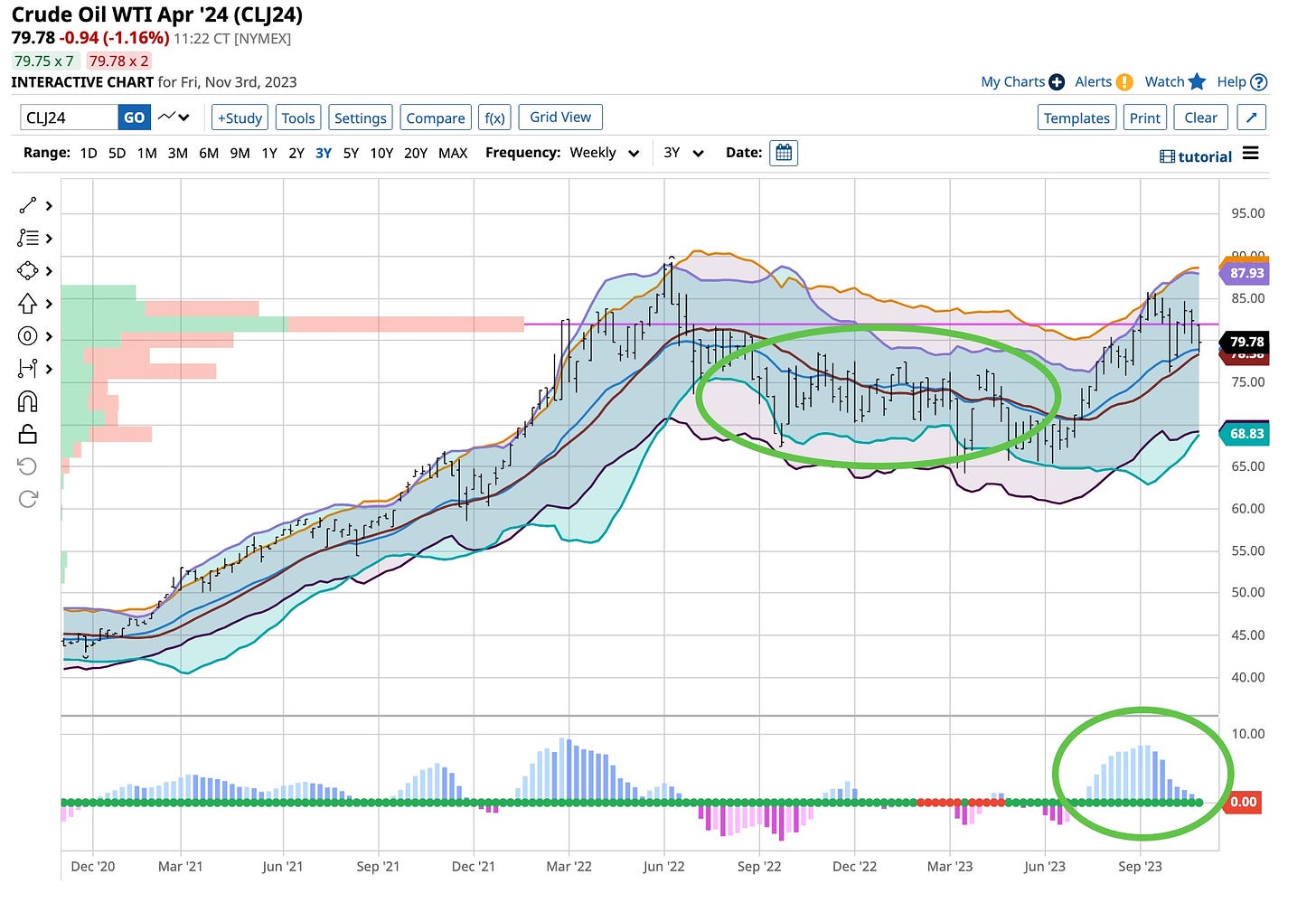

Even Orange Juice went my way but there’s a lot of news this week to react to and that is what I’m doing. It’s time to look at crude oil and the VIX. When I trade either one I use options. Face it, they can both change on a dime, neither are part of my long term plan and the world we live in just keeps changing. So here’s what I see and how I react to the charts and tables that follow. Remember I’m a longer term “Position Trader” so April is my target month. Let’s start with Crude Oil.

If you follow me on LinkedIn you’ll know that last night, after the Steelers won, I read the news and it was bleak. If the war continues to expand the Strait of Hormuz comes into play. The price of crude would spike so I put the following on my list, to watch.

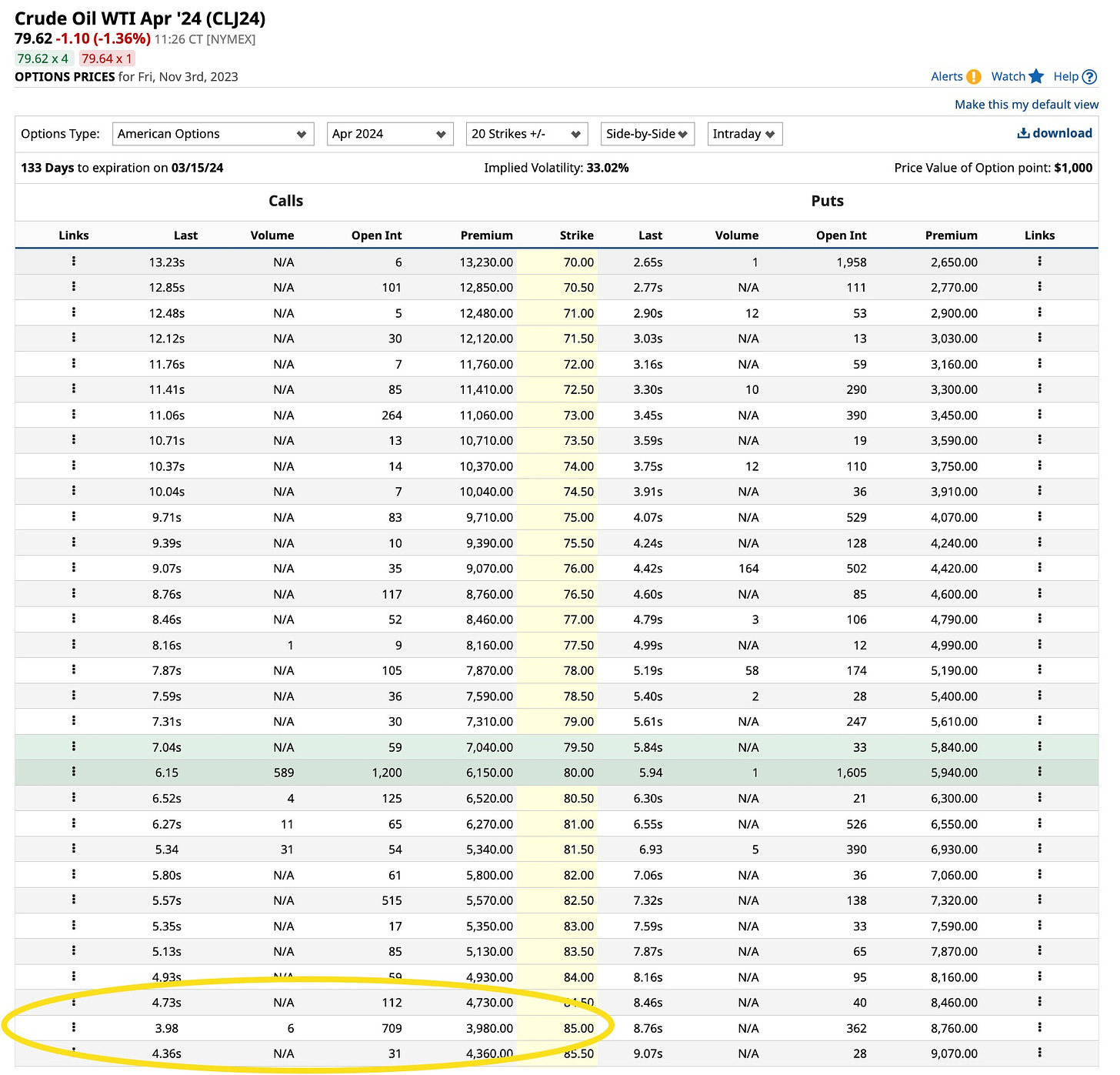

So if the price of crude oil has the chance to run higher chances are it’s going to go a lot higher. I’ve circled the $85.00 calls for April and have a good to cancel order in at $3.75. It’s probably not going to be hit today unless crude drops a couple more points but there’s no rush, it’s an April call and I’m willing to wait. I’m looking at the same thing for VIX April trades.

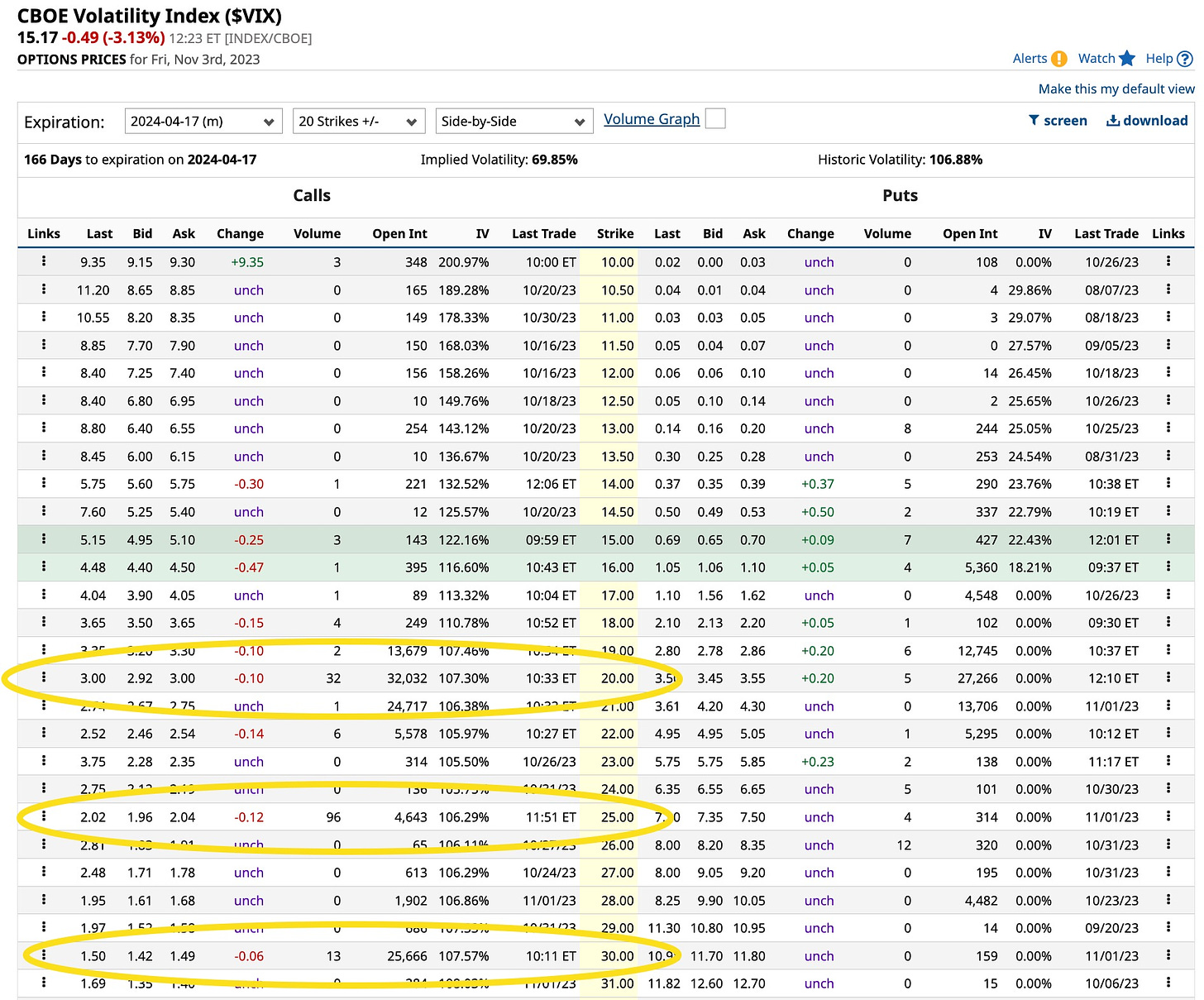

These are actively traded options; just take your pick. I’m looking at the April 20 calls and my good to cancel bid is in at $2.50 for 10 contracts. As you watch what’s trading is like feel free to watch the 25s or the 30s but by all means, trade the ones with strong open interest. It’s easier to get “in and out” successfully. Great name for a hamburger joint, eh?

I use Barchart; you should too. Here’s a link if you want to sign up. It’s worth it and if you need to set up your charts as I do just ask.

I’ll catch up with you Sunday night with a “paid for” article, one I’ve been working on most of the week. I hope to have verification of the Kindle book being ready and hope that is the case. Udemy taking shape as is the glossary and index for the dust covered version of the first book. It’s in Ingram Spark’s hand and I’ll let then do their thing. In the interim take advantage of what the markets and the world give you and think long term, it works.

Remember folks, as Mick Jagger sang on the Ed Sullivan show almost 60 years ago, “Time Is On My Side”. It certainly was for him and should be for you as well. I don’t look at things with a short term horizon. Unfortunately too many people do. When they are right you hear about it. When they are wrong, they disappear. Everyone has built a better mousetrap. I remember the “Mousetrap” game from the 1960s. It worked well as long as you rolled the “right number” on the dice. Day, swing, high frequency and the “usual” traders don’t always get their dice to come up right. Too often “snake eyes” rule; lengthen your horizon.