No one can deny, it’s good to be right. It’s never good to be greedy. By rule, we like to take a piece out of the middle. Seldom does anyone pick the “bottom” entry point then exit at the top. It’s not realistic but reacting along that continuum is. Using “trailing” stops is one method to guarantee your participation as well. That’s what this week has been like for me in the copper futures market.

For a blow-by-blow report follow me currently on LinkedIn. There’s an additional site on its way but for now, that’s where you can “read all about it”. It’s a busy day for me as The Ticker is growing, reaching out in ways we never anticipated all thanks to you. Without further ado let’s talk a little more about “greed”. It’s a killer and for certain a negative emotion one needs to control to be successful trading or investing.

Greed Kills

Greed is a very complex emotion often associated with an insatiable desire for wealth, possessions, power or status. It's rooted in a constant craving for much more, even at the expense of others' well-being or societal values. Greed can manifest itself in many forms, from basic individual desires for material possessions to corporate or societal pursuits of profit without regard for ethical boundaries.

Greed stems from a sense of scarcity or lack, driving most individuals to accumulate as much as possible to fill that void. The more one acquires, the greater the desire for even more, creating a perpetual cycle of dissatisfaction. This insatiability can lead to unethical behavior, exploitation and disregard for consequences, both for oneself and for others.

In society, greed can have a profound effect, fueling economic inequality, corruption and environmental degradation. It can distort priorities, where “short-term” gains are prioritized over “long-term” sustainability or collective well-being. Additionally, greed can “erode” trust and cooperation, fostering a culture of selfishness and individualism rather than empathy and mutual support.

Despite its negative connotations, greed isn't always inherently evil. In moderation, it drives ambition, innovation and progress. When it’s unchecked, overall greed is often becomes destructive, undermining personal relationships, societal cohesion and ones ethical integrity. Recognizing and managing its basic impulses is crucial for fostering a more equitable and sustainable world especially when trading and investing.

Technically Speaking Reversion To The Mean Works

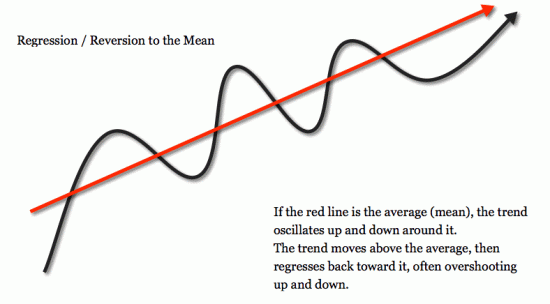

"Reversion to the mean" is a statistical concept describing the tendency of a variable to move back, or revert, toward its historical average or mean over time. This concept is commonly observed in various fields, including finance and economics, especially in trading and investing.

In financial markets, for example, assets often experience “periods” of extreme growth or decline, driven by factors like investor sentiment, economic conditions or company performance. Over the longer term, prices tend to return to average levels. This mean reversion phenomenon suggests that periods of overperformance / underperformance are typically followed by periods of more moderate performance.

Mathematically, reversion to the mean can be understood through regression analysis, where the relationship between all variables is assessed and deviations from the mean are analyzed. The principle is often depicted “graphically”, showing how data points tend to cluster around the mean value over time.

It's important to note that reversion to the mean doesn't guarantee that a variable will return precisely to its average value, nor does it imply that past performance predicts future outcomes with certainty. Instead, it highlights a tendency for extreme values to be followed by more moderate ones.

Understanding reversion to the mean is essential for those making informed decisions in various contexts, such as investment strategies, risk management and performance evaluation. By recognizing this statistical phenomenon, individuals and organizations can better interpret data and adjust their expectations accordingly. We use it all of the time and you should too.

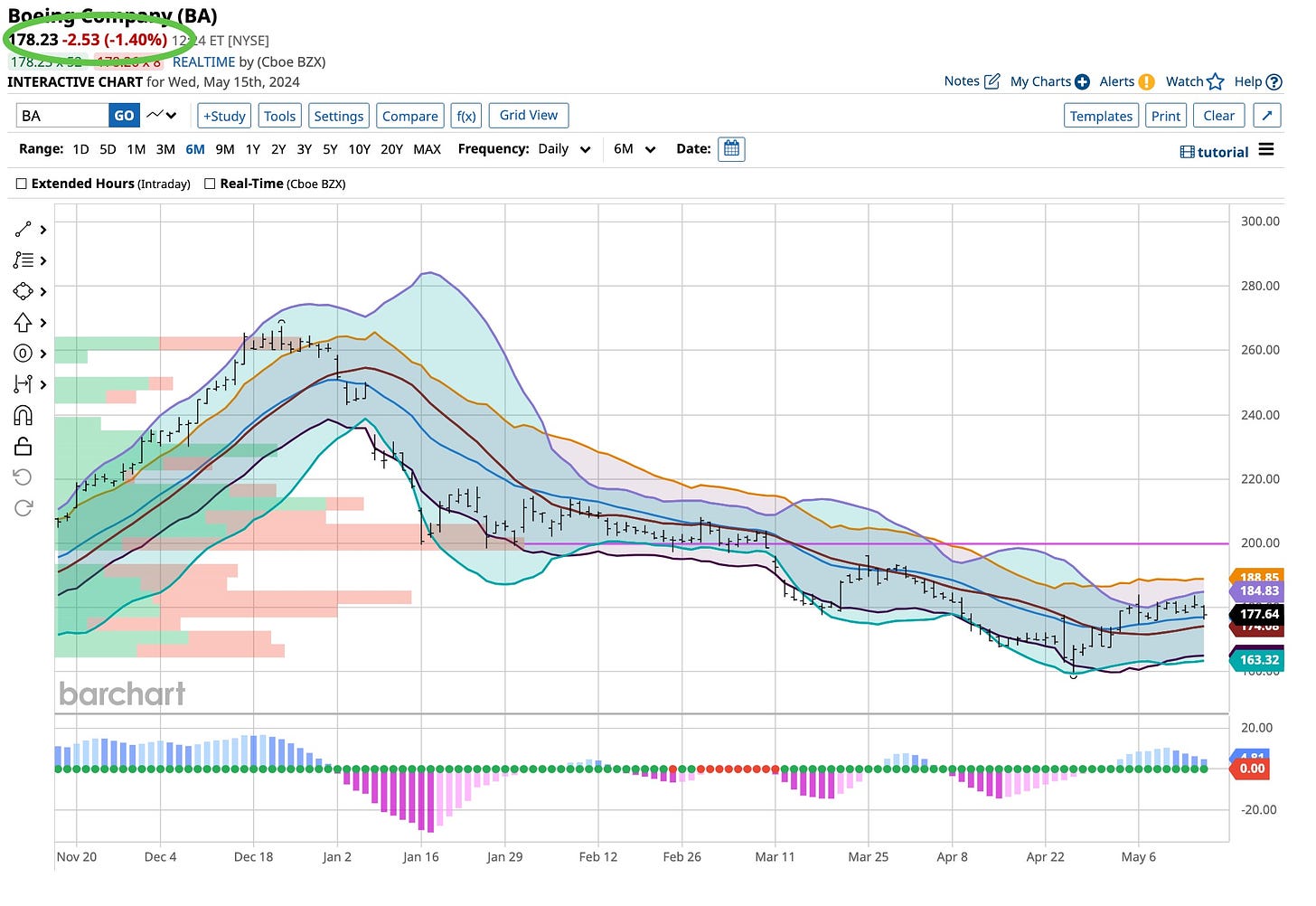

We’re Accumulating Boeing Stock

It’s important that you know what we are doing and why. There’s few examples that fit that scenario better than our accumulating the “brand name” stock of Boeing.

Boeing is one of the world's largest aerospace companies, known for its production of commercial airplanes, defense products and space technologies. One issue affecting it is the grounding of its 737 MAX aircraft following two fatal crashes in 2018 - 2019. These tragedies led to investigations into the design and certification of the aircraft, as well as scrutiny of Boeing's safety protocols and corporate culture. The grounding resulted in significant financial losses, halted production, delivery delays and several compensation claims from airlines. Yesterday latent criminal charges were revisited. The best time to accumulate a downtrodden “brand name” entity is when the chips are down and the worst of times is being reported. That’s what we perceive at this time and you should too.

We have a simple rule to follow. Buy when they sell and sell when they buy. It does fit in well with our greed discussion and technically mean reversion. When we can teach concepts with real world examples we do it. It’s for your benefit so thanks for reading.

The Beatles released “Hello, Goodbye” in 1967. I understood its meaning then and it’s just as important today as we buy when the herd sells and sell when they buy. Face it, the herd is usually wrong. They are just playing the “meme” game again and that can only end in tragedy. History does repeat itself but these stocks are far too rich for our blood. We’ll just sit back and maintain our philosophy of buying “brand name” stocks when they’re down and watch the “newbie” traders go up in flames like they always do.