When it comes to rules we follow our own without question. In many of the articles posted on this thread, we talk about actions suggested then taken. Rebalancing any portfolio is essential. Using ”Good-Til-Cancel”and trailing stop orders to initiate or end trades are advanced tools for many. They are important to learn and incorporate into your regular activities as soon as you can. Taking our courses will get you started but in reality, our “One-On-One” online tutorial sessions are the best answer we can provide to your becoming the “best damn trader or investor” you can possibly be. As time allows check out www.tickeredu.com and jump on board. It’s the best way we can teach you the “right way”.

Dollar General Provided Great Examples

Remember, you have to keep your ears and eyes open at all times. That actually began yesterday when Dollar Tree reported. Did you take the time to watch and then listen to their earnings report? I did and reacted. Rome was not built in a day and we have proven that with what we are assembling to teach you the “right way”. It takes time but there are some great lessons to learn this week.

Premarket, Dollar General issued the following release:

Dollar General forecast annual sales above Wall Street estimates on Thursday, banking on higher demand from inflation-hit customers buying groceries and essentials from the discount retailer’s stores. Shares of the company rose about 6% in early trading, after falling nearly 45% in 2023 on rising costs and stiff competition from bigger retailers.

But higher prices and borrowing costs have prompted budget-conscious consumers to cook more meals at home, helping Dollar General record stronger footfall at its outlets as shoppers hunt for lower-margin, needs-based goods, over pricier general merchandise. “With customer traffic growth and market share gains during the quarter, we believe our actions are resonating with customers,” CEO Todd Vasos said in a statement.

Vasos’s strategy - to focus on the basics, like more employee presence at stores, greater customer engagement and expanding private-label brands - has helped stabilize Dollar General’s business. Over the last few quarters, Dollar General and rival Dollar Tree have struggled with rising costs linked to their supply chains, labor and raw materials, while facing tough competition from retailers like Walmart and Chinese e-commerce platform Temu.

Dollar Tree’s shares fell more than 15% on Wednesday, after it forecast weak sales and profit for 2024 and laid out plans to shutter 970 of its Family Dollar stores. “Dollar General has a much rosier outlook than Dollar Tree. Dollar Tree’s challenges with Family Dollar were years in the making, while Dollar General has embarked on an aggressive effort to add more frozen, refrigerated and fresh produce,” eMarketer senior analyst Zak Stambor said.

Dollar General forecast 2024 sales to grow between 6.0% and 6.7%, above analysts’ estimate of 4.4% growth to $40.33 billion, according to LSEG data. It still sees annual per-share profit between $6.80 and $7.55, compared with estimates of $7.55. Its fourth-quarter net sales of $9.86 billion surpassed estimates of $9.78 billion. It also reported an estimate-beating profit of $1.83 per share.

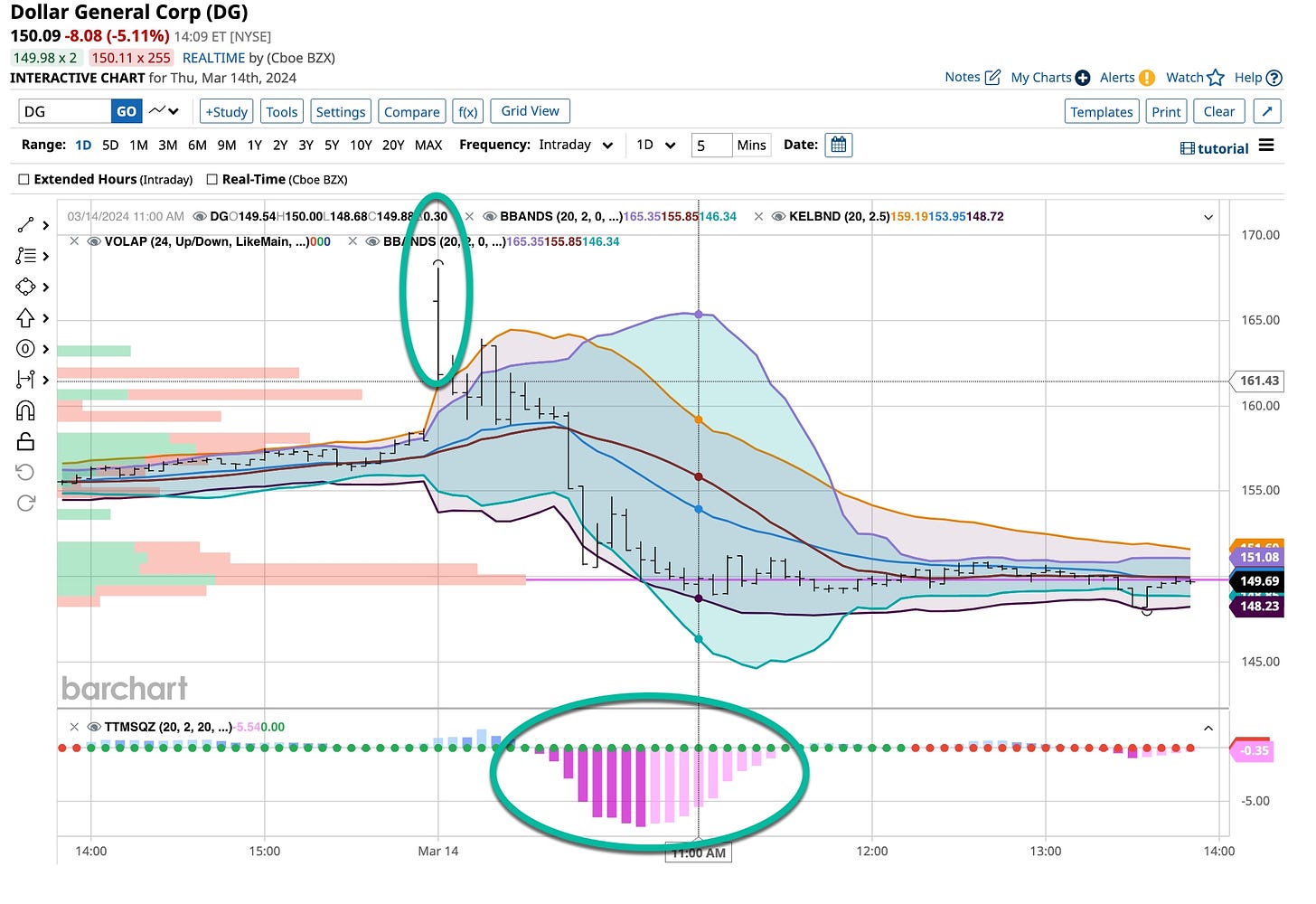

Did you react to what you just read before the market opened? In the way I trade, I didn’t have to do anything except watch as “GTC” orders to sell and rebalance were set at $162.50 and $167.50 and my position in Dollar General was reduced. They were both hit and the money is sitting in my account, more than likely to find a home in the near future in ACHR and NTR.

Then Management Talked

Did you listen to the Dollar General earnings dissertation? Someone did as the “early” upside quickly disappeared. That made our plan even better. With the “GTC” sales above yesterday’s close the total position in Dollar General was effectively reduced in half and the remaining shares were covered by three series of puts. Now a couple are going to expire tomorrow and next Friday so some decisions need to be made but for now, the remaining DG shares are hedged, the downside is protected. It would have been a better decision if the corporate heads had just kept their mouths shut, eh?

Trailing Stops Preserve Profits

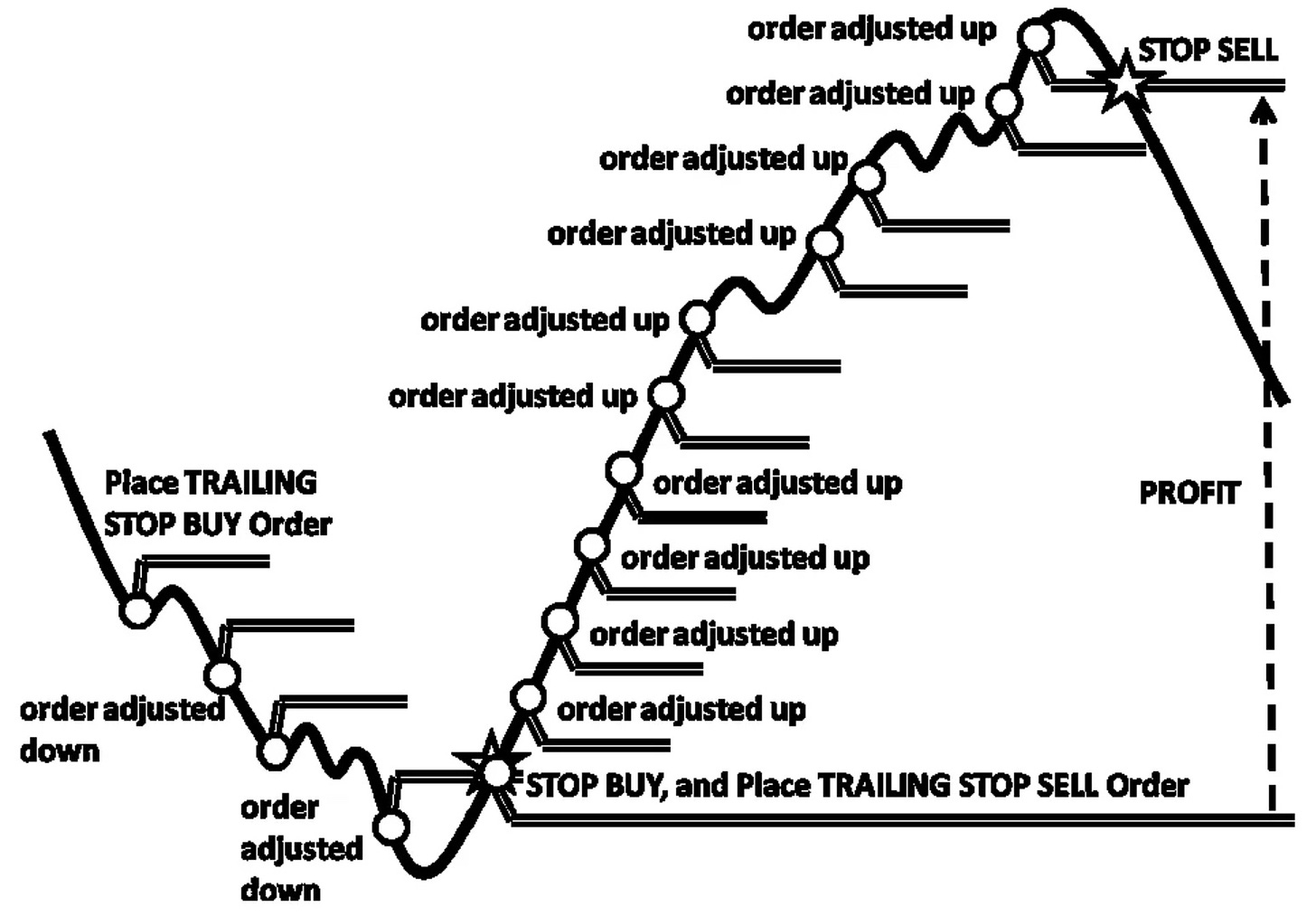

Silver, and above all Copper are seasonal trades. A couple dollars fell into our coffers last year when for no reason whatsoever Natural Gas moved higher. It was almost too much too fast so the use of trailing stops came into focus. What goes up usually comes down, at some point and by “rule” we don’t want to give back the profits made. Such a philosophy ruled then and we never looked back. Natural Gas is known as the “widow maker” for good reason. While it is time to look at the lower prices being posted, we’ll stick with the 2024 October futures and options and so far, despite trying to “buy in” at lower prices with “GTC” orders we’ve not been successful, I’m partient, I’ll wait for the prices and risk I’m willing to take hit. Same thing is going on in the ‘Corn’ market but I depend on Barchart for that information. You should too.

So what about Silver and Copper. Both share similar technical patterns. Silver’s seems to want to move higher. From my initial entry into the ‘Copper’ market the position is up big time. Too much too soon so the use of “trailing stops” is in play. Do not “ever” look a “gift horse” in the mouth and happily take profits. You’ll never go broke taking a profit.

So What Else

That’s an easy one. Thanks to you we’re off and running with our courses. Let us be a bit more clear on the actual terminology, we’ve crawled and now we’re walking but we are getting ready to run. That’s a more accurate description.

Jump in any time to watch and realize what we’re illustrating on www.tickeredu.com is constantly changing. What is not changing is the way we teach. Remember, we want you to become the “best damn investor or trsder” you can possibly be, the “right way” and that comes from www.tickeredu.com.

Back to work for me as between my “One-On-One” online tutorials and my two slave drivers pushing me faster than I can react, there’s work to do. Face it there always will be as you, our loyal readers chime in with ideas that are second to none, thanks.

Freddie Mercury and Queen with their “Don’t Stop Me Now” song and video says it all for me. I’m having a great time giving back my years of experience. I trust you are as well as our numbers of followers here and on LinkedIn are exploding. Seems like a good time to get our message out to the masses and despite hating social media that’s the direction we’re heading and it starts soon. Thanks for all of your patience. We are using one of my favorite dates, April 1st, April Fools Day to embark on and achieve all of the goals we seek to accomplish. That marks about a year that I’ve been “live” here on Substack and tens of thousands of you have followed my more than 200+ posts. My sincere thanks and stay tuned, we’re just getting started.