It is an interesting time in today’s turbulent world. I apologize again for not having the time I’d like to post more often. There have been some major changes in the way I select investments. For now, I can speak about three: Gold, Bitcoin, and Natural Gas.

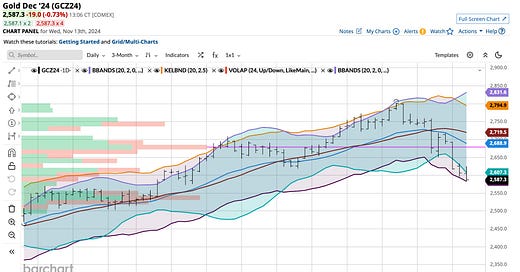

Gold Has Lost Its Luster

For me, I have had a plan in place since I “loaded the boat” with this precious metal at prices well under current market prices. As gold moved higher, I sold about 1% of my holdings every time it exceeded a “$200 threshold”. I now hold 5% of the total assets in my managed Roth IRA accounts in gold, down from 7 1/2%.

A while back, some predicted the sky was the limit for Gold and Silver. I listened, and I waited. I never bought as much Silver as I could, but I still hold about 1% in my Roth IRA accounts. Supply and demand are important, and the higher Silver rose, the level of production increased. I’m happy where I stand but realize, there’s a new investment that’s taking shape.

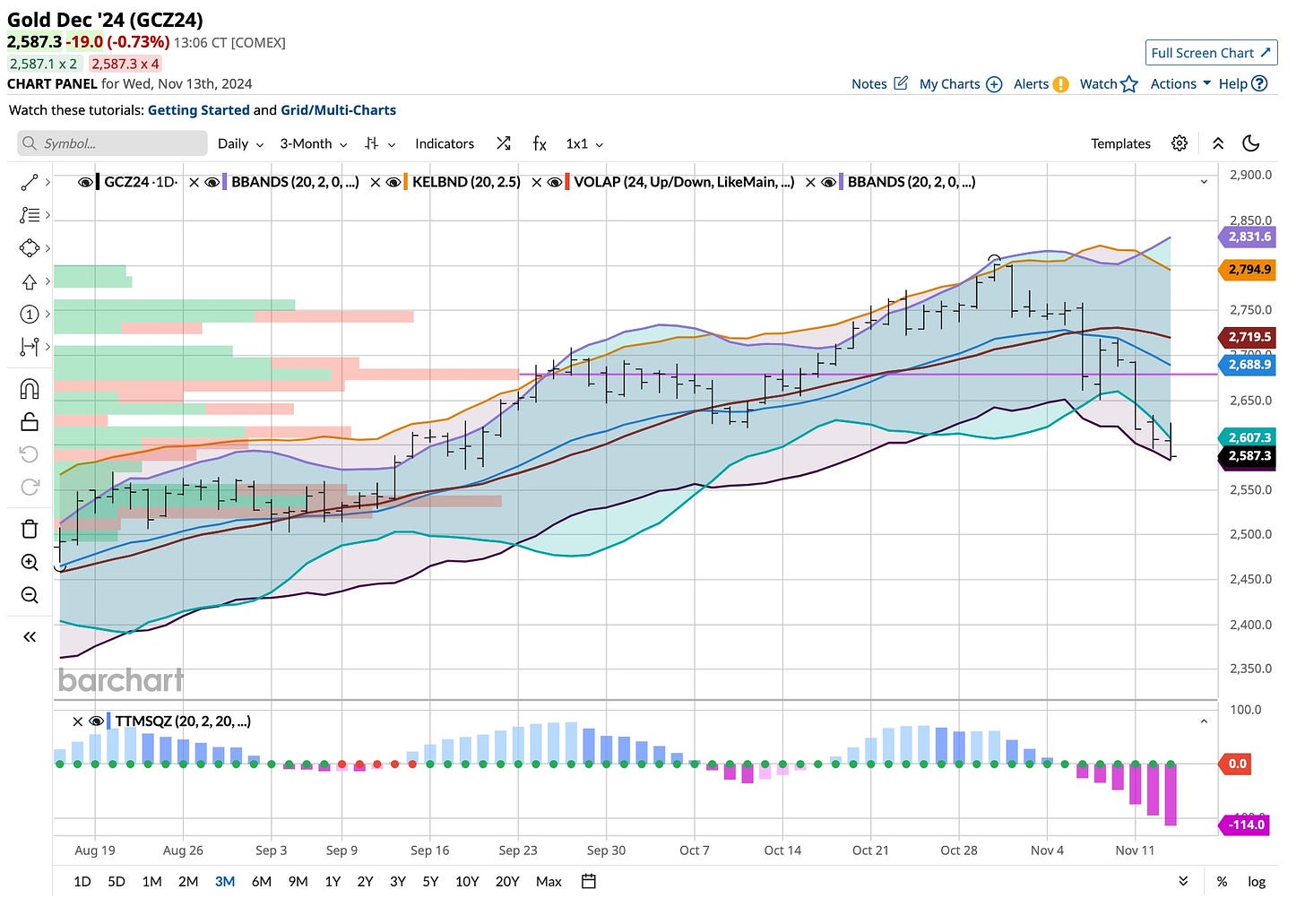

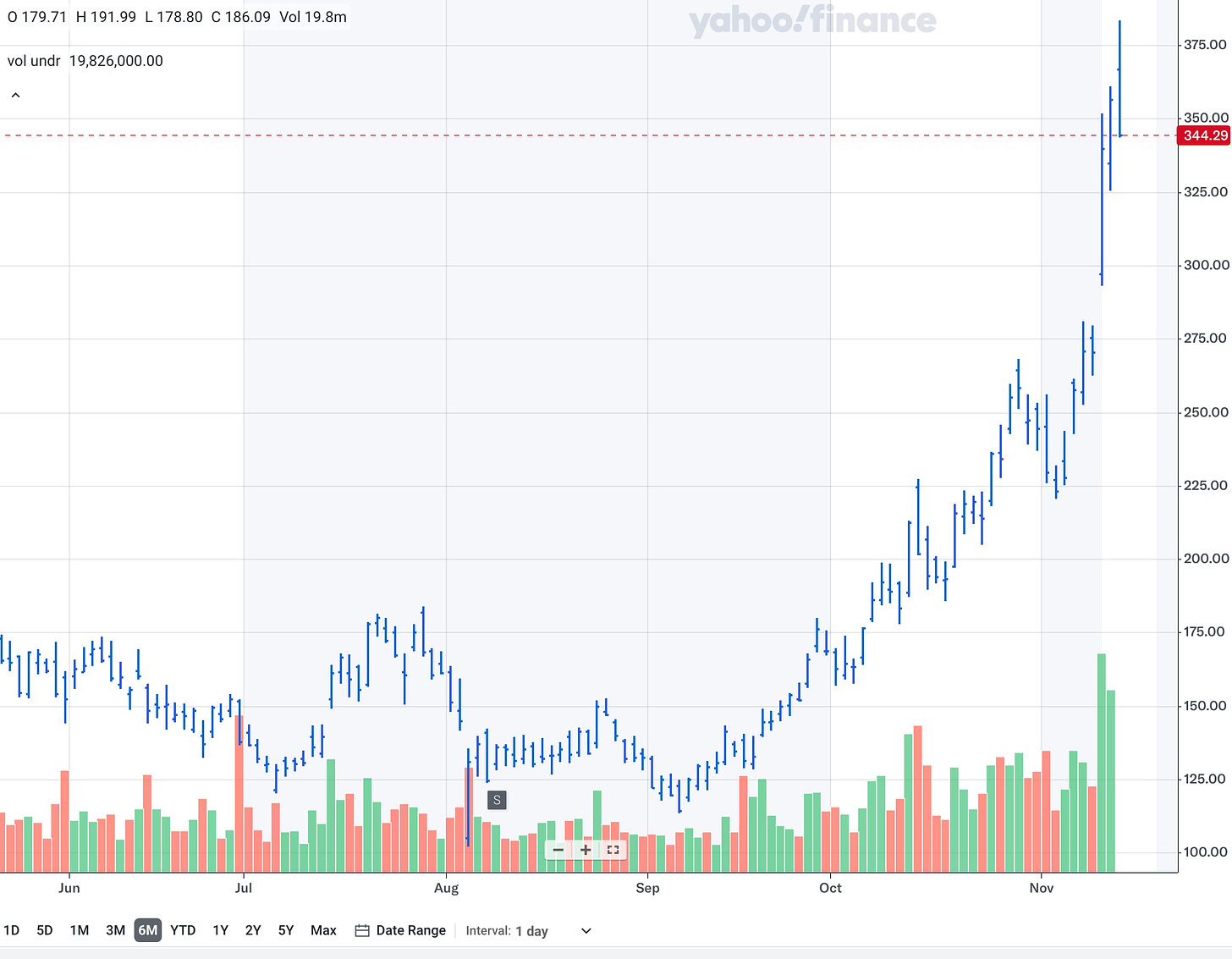

Bitcoin Might Be Getting Ahead Of Itself

I’ve been long Bitcoin twice in my career. The last one happened about three months ago when it became apparent that Trump would win. I did not simply buy “Bitcoin” futures. Like my gold bullion investment, I bought assets in Microstrategy (”MSTR”).

I’m up over $200 per share in my purchase and yes, I use trailing stops. No one knows when that tide will turn and I hate to give up profits.

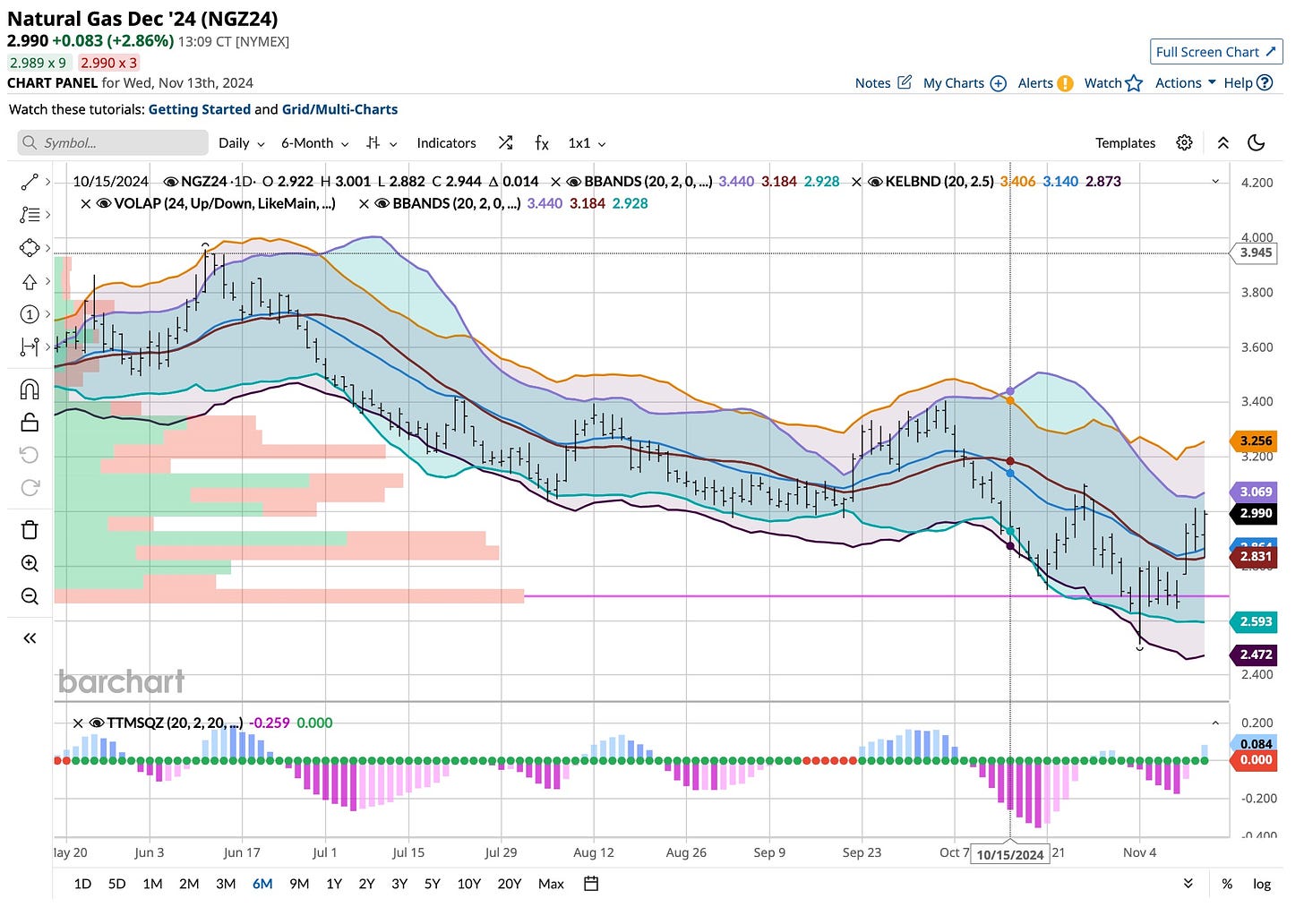

Natural Gas Is In Demand

Listen to the news, and you shall hear. Europe needs a regular natural gas supply not tied to Russia. I’m buying up the “future” here, happily taking call options and futures contracts six to nine months out.

Some things about how I invest never change. I like to buy and own time. Using this type of strategy has served me well in the past so it’s used here.

Back to work for me folks and remember, things change on a dime, so stay hedged and stay happy.

I’m going slightly mad, just like Queen did. My insanity is for a reason. I am on the sidelines here, with slightly less than 50% of my funds in cash, earning more than 5%. It makes sense to me as 25% of the portfolio is skyrocketing. Those who benefit from my judgment are happy. Who knows, maybe I’ll get a product out to you all where you get to experience what I do in real-time. For now, I’ll just listen to everything I hear and react to what I read. You should too.