I love it when someone, anyone takes what I write to heart and formulates opinions based upon what they read and experience. It’s even better when we take the issues further and talk about their effect on the “globe” as we know it. That’s the important part to me, someone else’s opinion and thoughts based upon our discussions

Well, Mahdi Nikpour has done it again. He must be a student, eh? Yes he is but he is also someone I have learned from and you should as well. It is interesting that he is essentially based in Iran, a sworn enemy of Americans. To me, nothing can be further from the truth and this fact should be aware to you. Do we collaborate, yes we do. Are we always on the same page, no we are not and both are good things.

Let’s take a look at what we came up, mostly from Mahdi, as overall, the following is interesting. Remember it is a “big world” out there and the smaller any of us can make it the better. Give it a try. Trust me the whole world will appreciate it.

Energy Rules The Whole World

The Carbon-Oil Tango: A Geopolitical Dance with Uncertain Steps

Welcome to the dance floor. The carbon and oil markets are the two dancers, locked in a complex, ever-shifting tango. Their moves are influenced by the music of politics, the whispers of economic realities and the ever-present threat of actual geopolitical upheaval. Let's take a peek at backstage and see what's fueling their performance:

Carbon Market:

Record Trading Volume: The global carbon permit market reached a record €881 billion in 2023, highlighting its “growing importance” in the fight against climate change.

EU ETS Price Fluctuations: While EU ETS prices have fallen from €100/ton highs in 2023, they remain a significant factor for European companies.

Emerging Markets: Continued expansion and development in North America and China's ETS offer promise for future growth, but their trajectories may be influenced by local political and economic factors.

Focus on Permanence and Nature-Based Solutions: The need for permanent carbon removal and “nature-based credits” remains strong, offering potential opportunities amidst broader market uncertainties.

Oil Market:

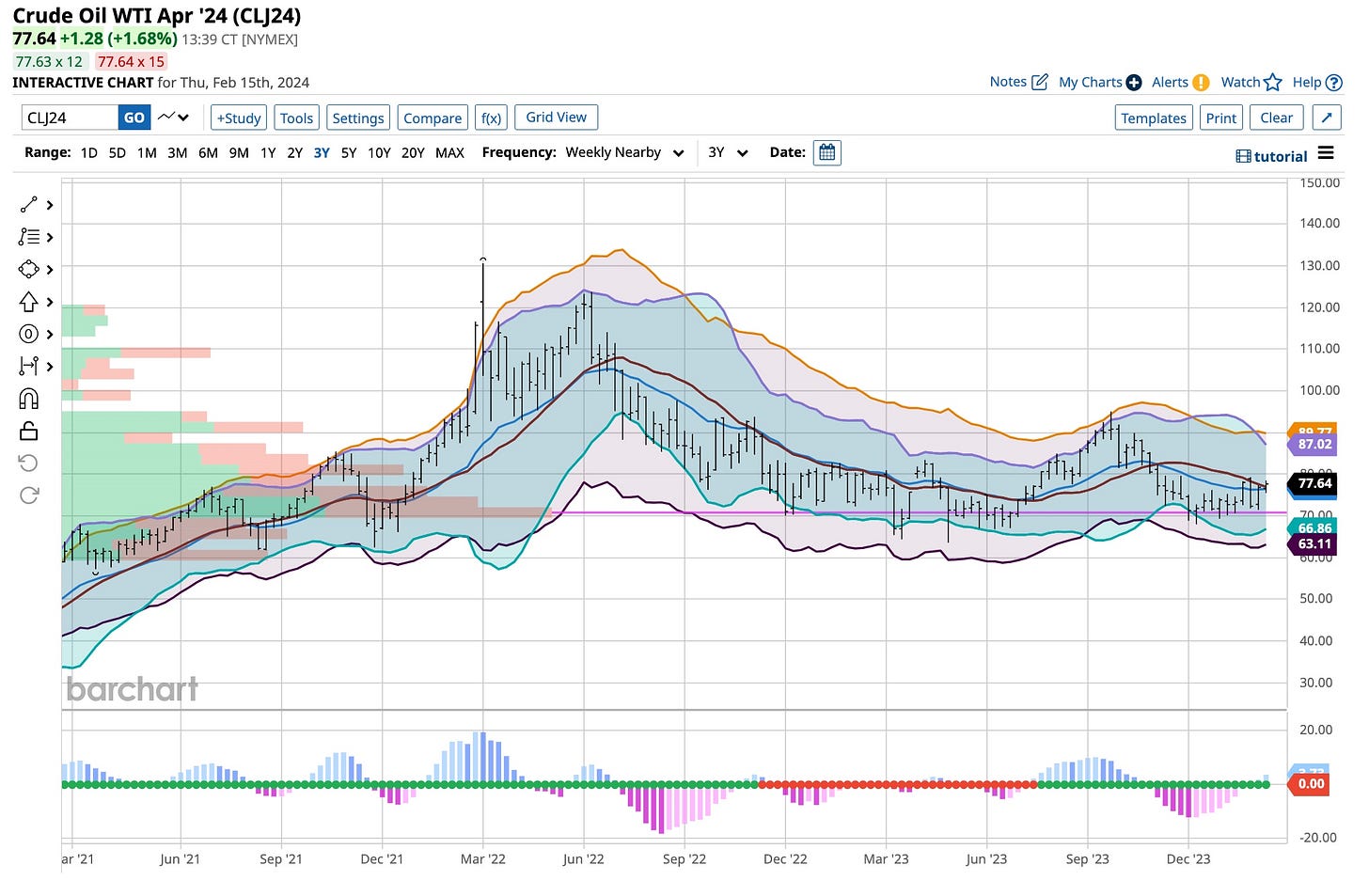

Inventory Build Pressures: A larger-than-expected build in US crude oil inventories pushed prices down a little bit, but concerns about the gasoline supply and potential future tightness offer counterpoints.

Global Natural Gas Glut: Ample storage levels and “milder weather” forecasts keep natural gas prices under pressure, impacting revenue for all major producers.

Geopolitical Tensions: The ongoing conflicts in Ukraine, Middle East and the Red Sea crisis add layers of “uncertainty” to the oil market and threaten to disrupt supply chains and trade routes. Can oil market veterans handle what can only be identified as an unpredictable choreography?

Looking at the latest tensions in the Middle East on one hand and the latest bullish moves on the other, I can sense a new bullish trend in action. But we have to wait and see if the Middle East will fold, bluff, or raise the stakes.

The Interplay:

It's not just about solo moves; these dancers are “deeply connected” with each other. Strict climate policies, like carbon pricing, can push them in new directions, with oil demand dipping and carbon prices rising. But geopolitics and trade wars can throw a wrench in the plan. Even economic growth, that “fickle partner”, can influence their steps, leading to periods of sluggish demand.

Geopolitical Considerations:

This dance floor is crowded with international players. The American response to the Ukraine crisis and the ongoing Middle East conflicts plus Houthi Red Sea drama are like spotlights, casting long shadows on the performance. These events could reshape alliances, disrupt trade and ultimately, impact energy prices for carbon and oil. Don't forget the emerging markets as they challenge the carbon tax choreography with their own stance. All backstage dramas add a whole new layer of complexity to the rhythm of the dance.

Key Takeaways:

The carbon market faces headwinds from EU ETS fluctuations but seeks a long-term potential, especially with a focus on permanence and nature-based solutions.

The oil market experiences short-term pressures from “inventory” builds and a possible push from geopolitical tensions, but “longer-term” factors like potential supply tightness and technological advancements can alter the picture.

Geopolitical events like the Ukraine conflict, Middle East conflicts, the Red Sea crisis and trade tensions add significant layers of uncertainty to markets, making predictions more challenging without question.

In an analytical view, the future of carbon and oil markets remains “intertwined” with complex geopolitical dynamics evolving on an global basis. While short-term volatility is likely, long-term trends point towards:

Carbon Market Growth: As the world strives for net-zero emissions, the demand for carbon offsets is likely to increase, driving “carbon market” expansion. However, its trajectory will depend on effective policy frameworks and geopolitical cooperation.

Oil Market Transition: Technological advancements and climate policies will likely accelerate the transition away from fossil fuels, impacting oil demand and prices in the long run. However, the pace and nature of this transition will be influenced by geopolitical developments and energy security concerns, which are getting higher day by day.

Hell, that’s pretty good Mahdi. You took the lead in trying to explain to me and those reading what you’ve stated of some of the reasons why Oil has “decoupled” itself from Natural Gas. All I am looking to do is to find a bottom in this natural gas market. I’ve been very familiar with the Carbon Offset market since it’s inception about a decade ago, It is still in its infancy. Despite numerous attempts, I have not yet found any type of correlation with anything, not the Euro or energy prices. This might help but from where I sit, this new transition to a cleaner world comes at an expense. Just what that is I do not know at this time. Remember, I’m just looking for a bottom in the natural gas markets. So far I do not have that answer but every little bit of help is appreciated. What do any of you think? Let me know and thanks.

Back to writing, filming and publishing. As stated before, I have the electronic version of “The Ticker’s Bible” ready to ship. Email me at david@thetickeredu.com and a copy will be sent to your email address is you are a paid Substack member. Otherwise, back to work for me and as always, my best to everyone.

There’s not anything tied directly to what’s happening today. Sure, Mahdi is right on point. You should give it a try as well. With that in mind I’m just going to dig into my memory bank and play one of my favorites, The Clash and “The Magnificent Seven”. We have had a lot of talk about the “magnificent seven” driving the market to higher heights. There’s even talk that that group is falling apart but not the Clash. They were great in the 1980s and those of you familiar with “The Clash” remember them to this very day. Love the beat and the message. If I were in your shoes I’d look at all they did. As a matter of fact, that is exactly what I’m going to do. Be well and keep reading.