For me, it all started off when it was obvious that Trump was going to defeat Harris. I jumped on Microstrategy (“MSTR”) around $130 a share, endured the criticism of few of you, and now find the position being a great hedge mechanism.

Trump is back. In following what the market gives us, I’ve turned my basic attention to the energy markets, Constellation Energy (“CEG”) and Ovintiv (“OVV”). They both make a lot of “common sense” if you are listening to what Trump intends to do, and what the markets seek.

Nuclear Energy Is Key

Constellation Energy Corporation (“CEG”) is a leading U.S. energy company focused on renewable and sustainable energy production. It primarily operates as a supplier of carbon-free electricity, natural gas, and other solutions for residential, commercial, and industrial customers.

Constellation is the largest producer of carbon-free energy in the U.S.. Significant investments in nuclear, solar, wind, and hydroelectric power aligns with global trends toward renewable energy and decarbonization. Federal and state policies supporting clean energy transitions, such as tax credits and subsidies, benefit Constellation's growth prospects.

With a substantial fleet of nuclear power plants and renewable assets, Constellation has a competitive edge in the energy market. The regulated nature of its operations provides stable cash flows, which can be appealing for long-term investors. CEG is a key player for investors as it contributes to reducing carbon emissions and meeting climate goals.

Investing in CEG provides exposure to the growing clean energy sector. While risks exist, its leadership in carbon-free energy production and “decarbonization” trends make it an attractive long-term investment for those who prioritize sustainability and growth.

It’s Time For Natural Gas

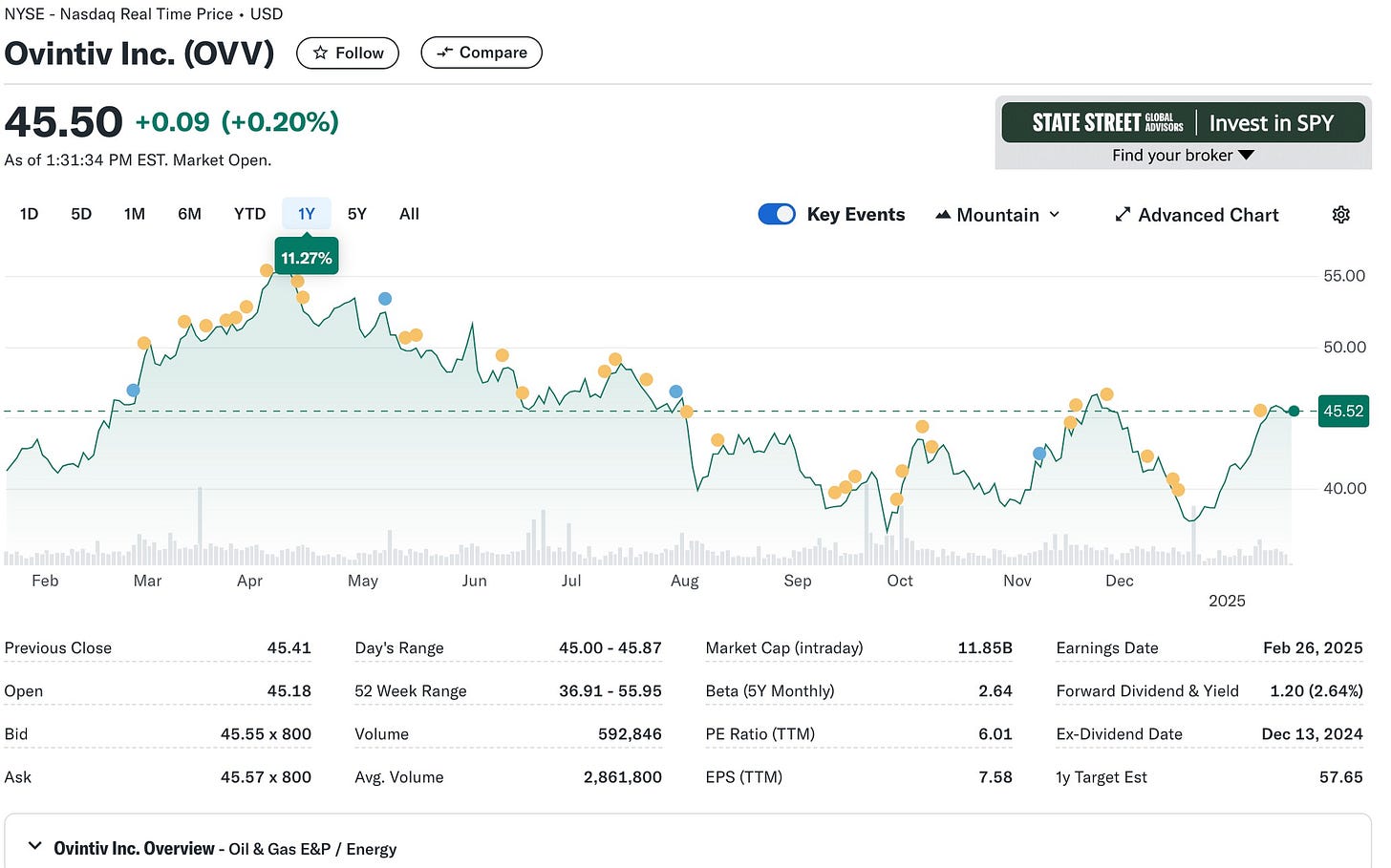

Ovintiv Inc. (“OVV”) is a prominent North American energy producer headquartered in Denver, Colorado. The company focuses on developing a diverse portfolio of oil, natural gas liquids, and natural gas assets across multiple basins.

Ovintiv operates in key regions, including the Permian Basin, Montney Formation, Uinta Basin, and Anadarko Basin, providing a balanced mix of production and growth opportunities. Ovintiv reported strong production figures across its assets, with plans to invest significantly in these plays to bring additional wells online.

The company declared a quarterly dividend of $0.30 per share in November 2024, reflecting its commitment to returning value to shareholders.Energy markets are subject to fluctuations due to geopolitical events, supply-demand dynamics, and regulatory changes, which can impact Ovintiv's financial performance.

Investing in Ovintiv offers exposure to a diversified energy portfolio with a focus on oil and natural gas production. The company's strategic investments and commitment to shareholder returns present potential growth opportunities.

It was not a miracle that Trump won the election. It was “common sense” as we voted for change and change we have received. I’m a long term investor. It’s time to fire up a strength we’ve exhibited in the past. Europe and Asia need natural gas. With the LNG platforms in place, we can deliver that. With AI needing a viable energy source, it’s a good time to look at nuclear energy. The crypto world is clear. Trump is not someone to cross “swords” with. It’s as easy as “cutting the cake”. It’s time to get on board.