I first want to thank everyone for realizing that Rome was not built in a day. It’s been a pleasure to post my thoughts here. After a couple of months of “choosing” the best way to keep you all informed, I’m happy to report that we’re close. It takes time to do things the “right way,” and that’s what it is all about. Thanks for your patience.

It’s a busy investment, trading, and hedging time. I’m a simple person when it comes to making decisions. In short, I let the opportunities find me versus looking for them. If there is one rule I follow, it is “buying when they sell and selling when they buy.” It works, and if you are following me, you know it is true.

Nvidia Trade

A couple of weeks ago, Nvidia (“NVDA”) reported its earnings. I sold naked puts and calls, twice as many calls versus puts, all out-of-the-money, and waited. I thought the AI market was overheated and expected a pullback. Since then, I have covered all of my calls and still hold all of my naked puts. It’s called a “hedge,” folks, and it works when the markets remain “range-bound”. I’ll happily take in Nvidia stock around the $100 naked put level, but more than likely, my naked puts will expire worthless.

Still Buying

Three stocks in particular, including Amazon (“AMZN”), the Trade Desk (“TTD”), and Boeing (“BA”). The “dollar” stores and soon the convenience stores are in trouble. The buyers of the world are pulling back. It shows that they are saying no to buying extra items. Amazon rules and will continue to rule the retail marketplace so when allowed to buy a long-term winner you’ll find me there.

TTD is another company I’ve watched grow for years. Are you watching more shows on your “boob tube” that are streamed into your “living room”? I know you are, and TTD does as well. They efficiently control this space. They sell to major agencies that represent the “big boys” in the marketing world. They are beating Google at their own game and they are just getting started,

Boeing is my type of traditional “brand name” entity that, once revenues start flowing, will head higher. When I do not know, no one does, but I will keep selling naked puts below the market and buying the stock when it tanks. I am also a seller of covered call options against the position I’m building. Name-brand companies survive and thrive. I am on board this one and you should be too.

What Else

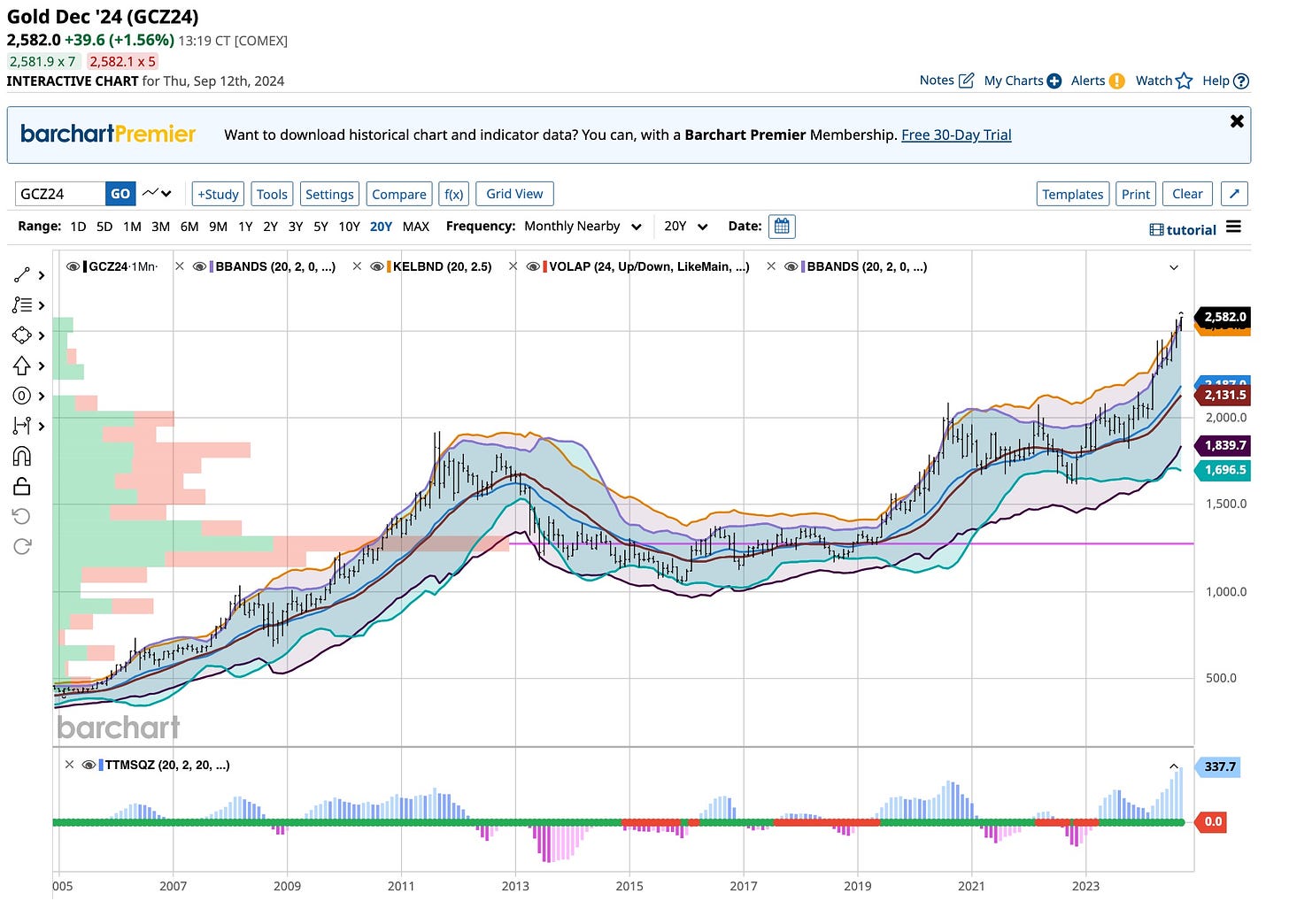

I’m long actual gold bullion and have been for years. It’s a great hedge, and given rates will head lower it’s ready to move to the $3,000 or higher level. I have Silver Futures in there as well and this metal will follow.

I’m still a buyer of higher-dividend-paying stocks, and that’s never going to change. I see the Federal Reserve once again behind the curve, and normalcy is about to appear in the interest rate markets. While I still hold a sizeable cash position, it’s earning 5% so I’ll wait. On the debt side, I’m moving to the lower side of the maturity curve with lower interest rates on the horizon.

Otherwise, I’m a hedger using long-term VIX and WTI Crude calls to cover what I’ll call the unexpected. It’s not a huge amount, but recently, I turned 1% of my portfolio into more than 4% of my portfolio as the “herd” jumped on the VIX too late, like they always do. I bought when they sold and sold when they bought. In part, I was lucky, but in reality, I was prepared.

Keep Watching

I care about you, and the fact that tens of thousands of you are watching and reading what is posted is important. As we make changes to The Ticker, we will grandfather in all of you who have been allegiant to what we’ve been doing as we build forward. Stay tuned and enjoy the changing of the leaves.

Time may change me, but I can’t change time. I can’t predict change, but I can hedge to make sure my assets are protected. Some just buy puts. I often use naked puts and calls so time is on my side. I use longer-term VIX calls to protect against inevitable events but I always keep some powder dry. Opportunities find me often when I’m not looking but having cash available leaves me ready.

.