Being a person who reads or listens to the holy gospel of investment gurus twelve to fourteen hours a day, either they’re getting their information from a source unfamiliar to most or they’re making this stuff up.

All I heard Monday was that the (1) Fed was going to pause at their June meeting and (2) start cutting rates in July. Unless we can’t find a way to “deal” with raising the debt limit or a contagion of bank failures, the numbers we saw during the Savings & Loan crisis of the late 1980s, early 1990s that isn’t going to happen.

In watching the markets today there wasn’t a single indicator that confirmed what the prognosticators were talking about. From top to bottom, if what they were preaching about had legs we would have witnessed a much different scenario and outcome than what we saw.

Indices - Yes, they went nowhere. One would expect that if rates were going to stop going higher the reaction would be positive. More so, if they were going to start dropping traders would have lit the fuse for the next moon rocket. Despite that not always being the case, the novice Robinhood crowd would have thought this way but it didn’t materialize. What we got, reduced volume and a lack of any momentum in either direction, doesn’t equate with the soothsayer’s words

Gold - In a environment of this nature gold would have soared. It didn’t even with Bitcoin and the rest of the crypto world succumbing to yet another “blip” in their handling on the processing side of their industry. So far in the overnight hours no change to yesterday’s pattern has been noted.

Dollar - Much to my chagrin the “greenback” held its own against every major currency. On a simple supply and demand basis, if the interest rates offered are reduced the demand for the underlying currency declines. Again, didn’t happen.

Bonds - Another simple supply and demand equation; if the interest rate paid is going down the price of the underlying debt instrument goes up. It’s just math and like everything else; it didn’t happen either.

So where are we really? How bad are this week’s CPI numbers going to be? If there is a real concern that’s starting to filter into this equation its the resurgence of inflation. That’s what is reflected in today’s action, not a pause then drop in rates.

Here’s a couple of interesting patterns I picked up on today, one you are undoubtedly familiar with, the other only me and my Asian friends “on the ground” noticed.

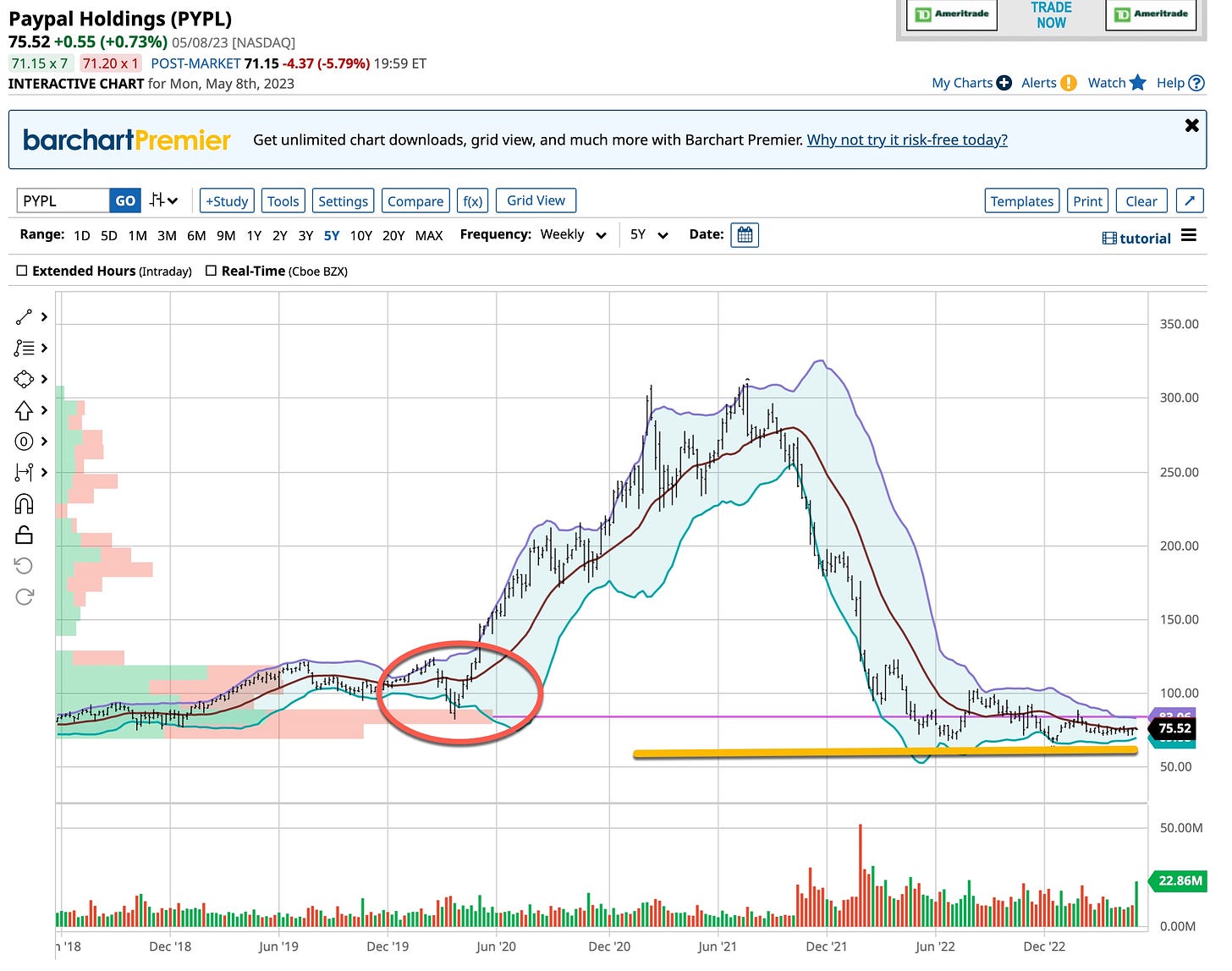

Paypal - PYPL

One of my best trades, both in and out happened in PYPL. It made sense to me to jump in early in the times of COVID for two reasons; (1) the world was turning to the on-line marketplace, PYPL’s strength and (2) they were offering a way that allowed anyone to buy Bitcoin on their platform. I remember buying PYPL around the high 80s then selling it around the time I first started shorting the Russell index in October 2021, a 3X bagger. I also remember making my only Bitcoin trade when they made it possible to buy, not sell, Bitcoin on their site. Again, simple supply and demand; you could buy Bitcoin but unless you owned it on the PYPL site you couldn’t sell it. When you put those types of microeconomic tools to work for you, trading becomes simple.

Today PYPL reported an earnings beat, albeit on reduced estimates, then raised it’s guidance. The stock got slaughtered; why? Are the markets going to take news of this nature and take corporate share prices “out to the woodshed”? It’s May for certain when this happens and it’s going to be interesting to watch what happens as others report. With respect to PYPL it’s on my radar and pretty close to my target price to reenter a stock with a solid product and management team on board. Peter Thiel and Elon Musk are pretty sharp entrepreneurs. Always nice to stick with winners thry have created.

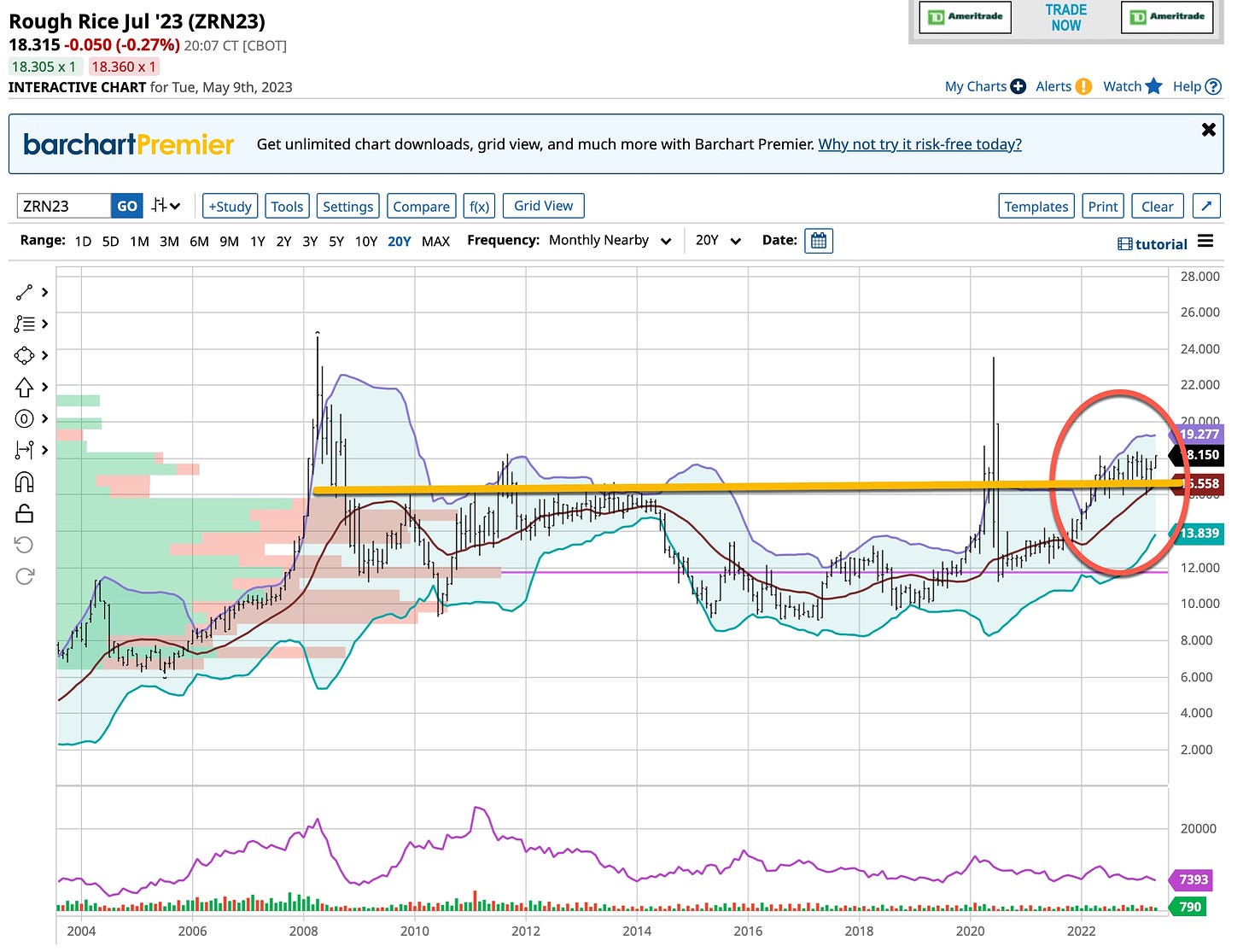

Rough Rice

OK, so you didn’t buy into the sugar trade; maybe this one will interest you. Lots of people around the world subsist on a diet primarily comprised of rice. That’s why farmers grow a lot of rice. So what happens when the harvest comes in even a little light; the price like any agricultural commodity goes higher. My ‘eyes on the ground” are telling me that there’s trouble bringing the crop in this year. Could Rough Rice be my next sugar; we’re long at 17.50 and will keep adding on any dips. You see there’s more to trading futures than watching your tick-by-tick charts and the indices. When we kick off The Ticker EDU educational courses in position trading join with us and learn; it’s a much less stressful way to trade; you might even have the time to rake some leaves and plant grass.

Working on the Biotechs as in my eyes they’re next. Most selections are going to be the well capitalized “big boys” but there’s going to be a few “wanna be” companies on the list that have caught my eye. If I’m going to put out what I’m looking to buy to this or any crowd it’s only going to happen once I’ve done my homework; simply stated, “I ain’t done yet”.

There’s much more to come from The Ticker and our developing educational side The Ticker EDU. Stay tuned and as always, let me know what you want to learn; I listen.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Thanks again go out to Danny www.mrtopstep.com . . . check him out; he’s worth your “click” and thanks to all of you who have adopted what is being created and presented; we’re humbled by the response and referrals. Again, let me know what you want to learn, I’m all ears.

Let’s end today’s commentary with a Dylan tune when he could still sing, ”Times They Are A Changin’” . . . they are and adapting to the “change” is imperative if you want to stay ahead of the curve. Trust The Ticker is helping you do just that.