They’re out again. You can see and hear them on the chat room boards; it’s time to go, go and go; it’s “moonshot” time. No it’s not. Just like they sounded a little while back, as the markets tumbled downward, breaking support level after support level on the way down, the “newbie” traders started predicting the inevitable just “sell everything” scenario. That didn’t happen either. There’s more to making money in the markets than reading and reacting to a chart. Seldom does anything “go to the moon” or “drop to zero” although the latter has a much greater probability of happening due in part to ”who’s running the ship”, not because of the chart pattern.

We don’t chase rocket ships and we don’t catch knives. Both are far too “extreme” for our “pacemakers” but those day traders, swing traders and scalpers are ready to try. If only they assessed changes in macroeconomic conditions before trying to predict tops or bottoms they might have a better chance as to what to do as these patterns emerge. Those who for the last many years have only seen prices appreciate, were stuck in the “it’s going to bounce” mode and to a degree still are. Remember however, after recent market declines they turned full circle, predicting nothing but gloom and doom. Sure, trends change but if this newly minted subset would just learn to sell the upside rips and buy the sharp declines, they’d be much better off. They are not going to so let’s take a “stab” at what they should be looking for, overbought and oversold conditions. Maybe in time they’ll learn before they go back to waiting tables; that’s why I post.

Dead cats don’t just bounce once. I’m a cat lover at heart, it bothers me when people think that downside is a one-and-done type of event. That’s the reason why the double and triple bottom technical chart patterns form and are often followed. Augmented by a reverse head-and-shoulder or cup-and-handle pattern, it’s easy to see, bottoms get revisited before reversing course. So do tops, or interim tops such as those forming in today’s markets. The macroeconomic geopolitical world is asunder. The S&P 500 P/E Ratio is now in the overbought area. It seems to me that it’s getting closer and closer to beginning a run to revisit recent bottoms especially if the inflation rate stays high and China can’t figure out how to rid itself of the horrors of the COVID pandemic it helped to create, along with its friends who tried to cover up its origins.

Traders normally have a positive outlook. Seldom do traders start with an expectation that things are really bad out there. In addition not enough people know how to enter a “short” a position. Being able to initiate a “sell” position before buying it back at an expected lower price is commonplace for all futures traders. Listed equities require a trader to “borrow” shares to “sell short” before the order is approved for entry. Such is not the case with futures. One of the courses in development deals with using futures, why they’re a good instrument to invest in, hedge and trade with and how exactly you can use them. It’s a work in process so stay tuned but it’s one you must consider. I’ve been a futures trader, a hedger “since birth” so to speak. I look to control risk, not to create it. Stick with me; it works.

Catching a falling knife or buying a rocket ship usually comes with disastrous results. At the same time they come with lessons that will last a lifetime. I’m here to teach you those lessons; I’ve been through them all and trust and hope my words of wisdom will save you a bit of the hell I’ve experienced in this industry in our past experiences.

So back to putting these courses together. Researching them, constructing them and putting them to pen is the easy part. No one reads anymore so I’m stuck with taking the written word and making it visual. It’s a learning process so thanks for all of you being patient, including my better half. She’s a damn good editor as well.

Remember, I’m just a “young” 68 years old. Everyone learns at their own pace. If you pick everything up the first time through, great but if not shoot me out an email at david@thetickeredu.com so I can further help. Again, let me know what you want to learn, I’m all ears.

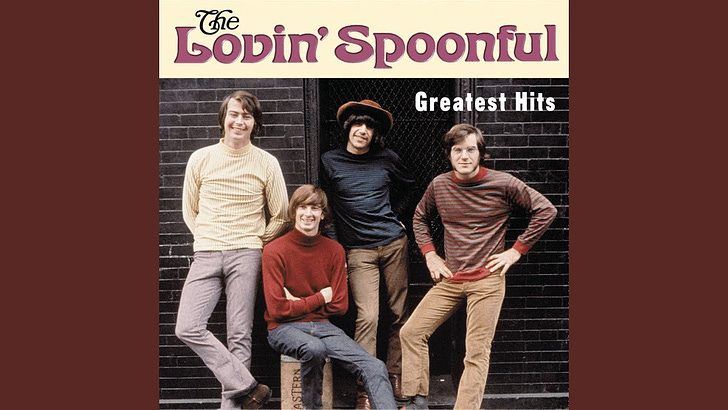

Hope you are enjoying the start of summer. It is far too hot down here in Texas but we’re used to it. The Lovin’ Spoonful were as well with their classic “Summer In The City” so just kick back today and enjoy Juneteenth. Have other countries dedicated holidays like this? Going back in history, slavery was broadly utilized but I can’t find other countries celebrating its being abolished.