The best way to describe “what’s happening here” comes with an “asterisk”; history left unchecked will repeat itself. That’s exactly what everyone from our Congress to the administration is doing; so why not you? You’d fit right in.

Congress “kicked the can” out to November 17th just to keep our government funded so we can legitimately pay our bills. They will take up the Ukrainian “problem” before then but like always, they’ll take their eyes “off of the ball”. The administration forgot to determine who is getting rich in the Ukraine and how much they are pilfering. Like I said before, history repeats failure and between the Congress and our administration they’re doing everything by the book and simply “turning their heads”. I guess it’s part of their overall costs, eh? Shut ‘em down; shut ‘em all down.

So What Am I Doing

While figuring out how best to let you all know when I take or harvest a position, the actual mechanics of doing so remains illusive. With that in mind here is where I stand as of Friday:

December VIX 20 Calls - Used a trailing stop earlier in the week eliminating 75% of my holdings leaving the remaining 25% in the portfolio for free. It’s one I will watch closely so stay tuned. If I make a change I’ll probably post to LinkedIn. I am starting to watch the March 2024 contract but for now they are a little pricy.

December & March Yen Futures - Average price of entry, expecting the Yen to move towards the 125 level, is about 149.00 now. I still hold an equal number of December 150 puts to hedge my position but the Japanese are seeing the numbers they want to see and undoubtedly will protect the Yen over 150. It’s history time here and there are many reasons I’m positioned as I am. I’m a patient person; you should be too. What is going on in China, missing every number it possibly can, is worth watching.

Gold - A long position primarily in the April 2024 contract kicked off a little early last week but I’m known for that. Added another 10 contracts earlier during the week and a few more at the Friday lows. I’ll continue to add more contracts for quite some time. I’m still down about ten points on my futures position. I’m just starting to build it as again, history repeats and rates are not going to stay high forever.

Buy TLT - Just keep buying it as they are throwing the baby out with the bathwater. Might be a year or two but I’ll sell what I’m taking in at a much higher price. Yeah, I was early here too and I’ve paid the price. On average I’m down about 5%. That’s OK I’ll wait, how about you?

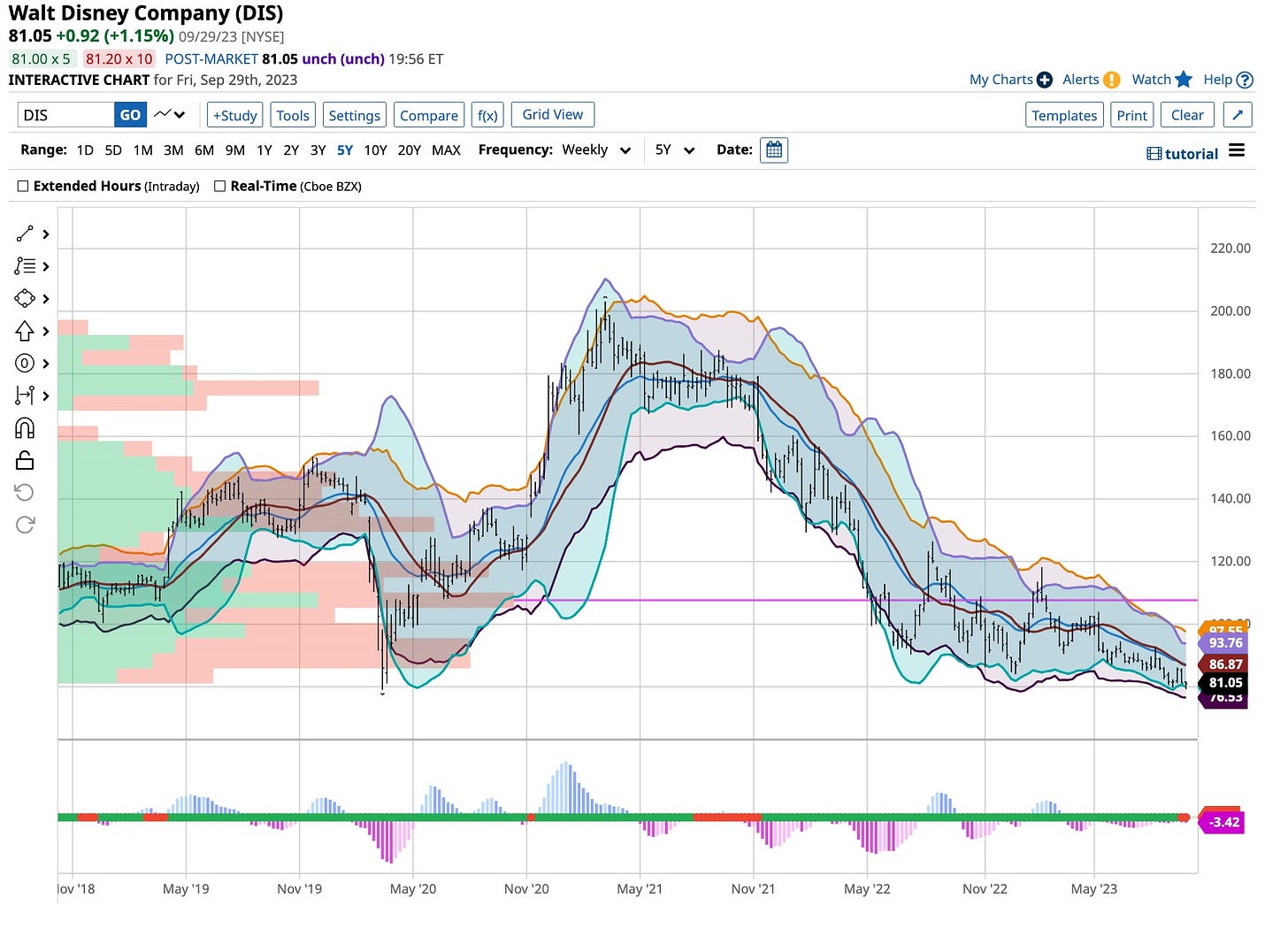

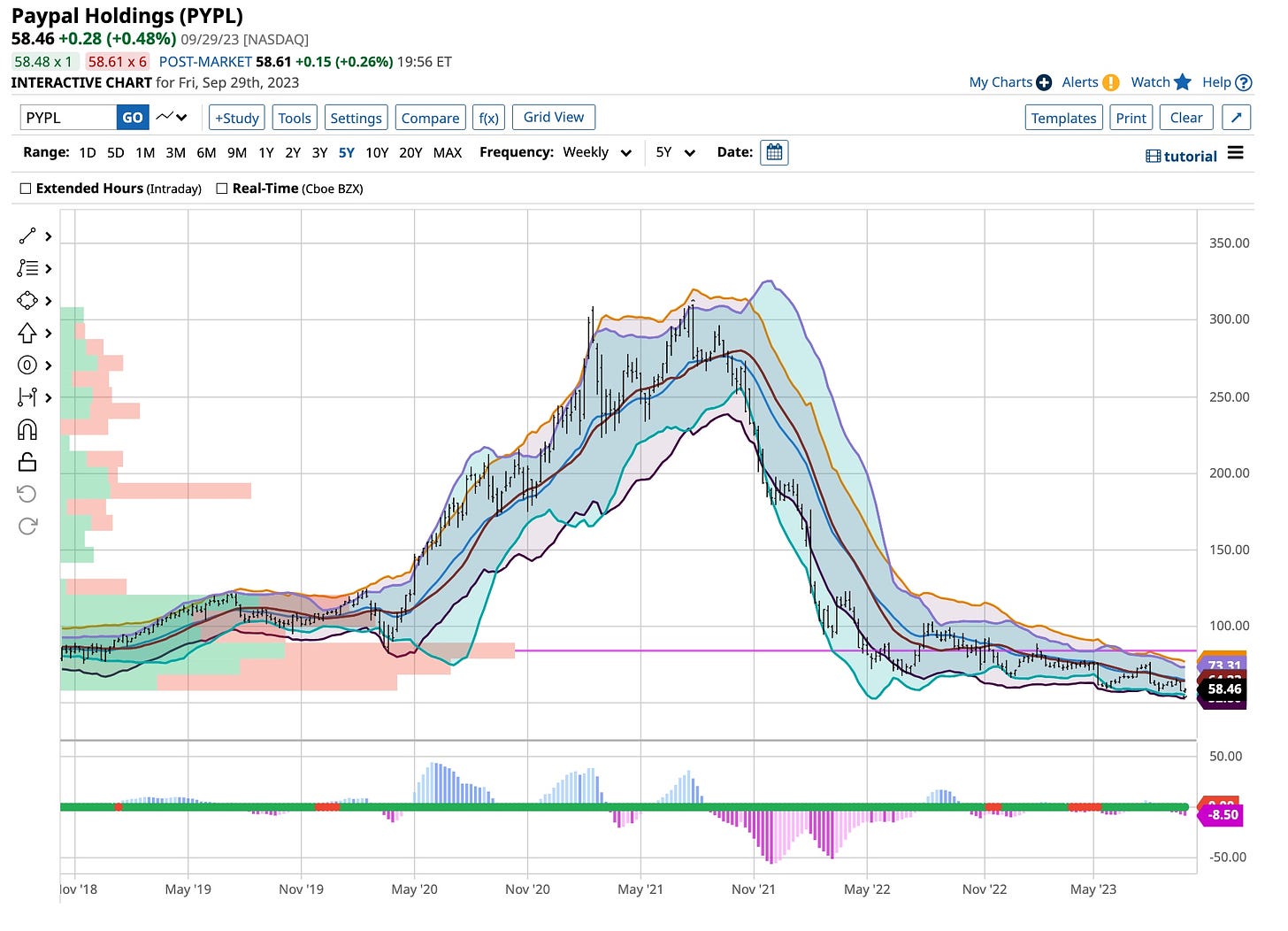

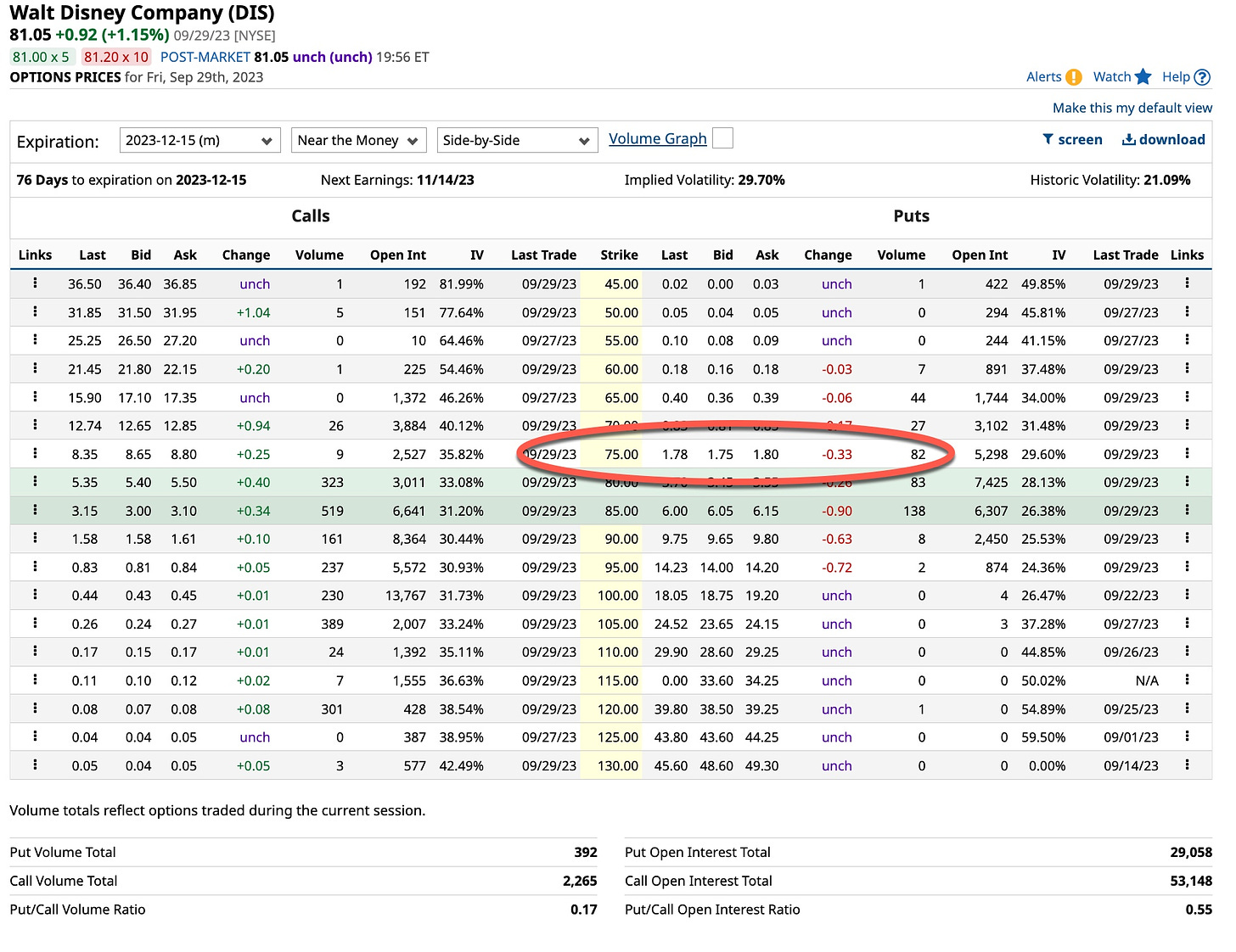

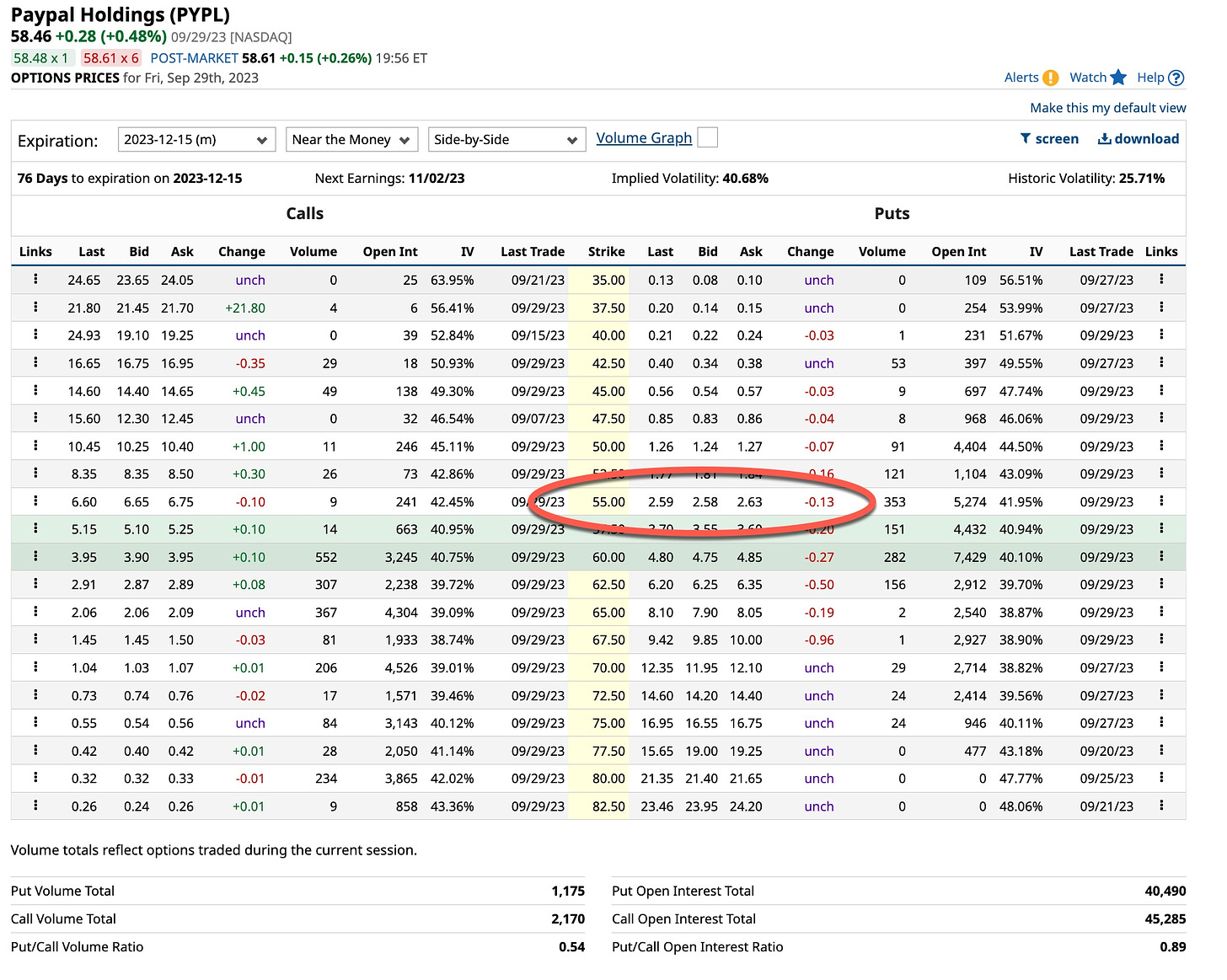

Other Stocks - Many of you have asked what else I’m buying. Let’s stick with the here and now and look at a couple “bottom feeders” I’ve picked, DIS and PYPL.

If nothing else I’m consistent in what I look for; strongly branded companies that for one reason or another are hitting their lows and are out of favor. I’m a buyer of these securities. How I buy them should be part of your plan; I use “out-of-the-money” puts to accumulate what others are throwing away because the “street” tells you to. I don’t listen to the street and neither should you.

So which puts am I selling “naked”:

Again, consistency rules. I’m selling December “naked” puts five points below the current price of DIS and three points below the current price of PYPL. I often use Roth IRA accounts to better manage these trades for a couple reasons. First, margin comes into play. Even though it’s charged there’s more than enough short term, less than one year government paper, paying me well over 5% interest and second, it’s no guarantee I’ll ever be obligated to buy these shares at these prices. In other words it’s possible that all I’ll ever record is a short-term gain from these “naked” puts expiring worthless. Ah, yes, my kind of trade. Maybe Elon Musk and Peter Thiel are doing the same thing with PayPal. It would make sense to buyout PYPL and take it all private as Musk, and probably Thiel, are heading in that same direction with “X”. Musk’s patient and you should be too. He’s listening to others on LinkedIn. You should too.

There’s more but again, read the book, then the next three or four books and you’ll get the idea; longer is better; always has been and always will be. The final revisions are on the publishers desk. They expect it to be in the Amazon & Kindle depository soon, I’ll keep you in the loop. I’m putting together a “collector’s version” with our friends at Ingram Spark featuring a dust covered version available to those who support “The Ticker” here on Substack. By pledging to “the cause” you’ll get a signed copy when it becomes available. Who knows, by then I might have actually figured out how to do it.

Until then you’re stuck with me. As noted I have a lot to say and teach to you, the tens of thousands currently following me here on Substack and on LinkedIn. I promise to keep on talking and writing as long as you promise to keep listening and reading; and above all learning and telling your friends. I’m having a good time here trying to show everyone the “right way” to learn how to invest and trade. I hope you are enjoying.

Do you remember “Eyes Wide Shut”? It’s one of my favorites but then again Kubrick is my all time favorite so it makes sense. Based on the 1926 novella “Traumnovelle” all Stanley Kubrick really does is allow history to repeat. Like “A Clockwork Orange” you have to watch it from start to finish. It was Kubrick’s last film but put Nicole Kidman front and center. Great filmmaker that Kubrick; take the time to watch his entire film collection. It’s well worth your time and you just might learn a little about why I think and write the way I do. Either way you’ll enjoy it.