Without a doubt, patience is a virtue that every great trader or investor understands. Not only do they understand it, they employ it. Remember, “patience” is when you’re supposed to get mad, but you choose instead to understand.” No one knows who said that but it doesn’t matter. It’s true. Sue Bender remarked “when it comes to patience, we don’t have to change old habits; we can build better ones.” Change is good. We all go through periods of learning. Learning anything is a marathon not a sprint. Tolstoy said that “the two most powerful warriors are patience and time.” If you take time to add in “self-confidence” you have a pretty good idea what makes a solid investor or a trader. It’s not possessing mystical capabilities. It’s simply having the ones that work and patience is high on every list.

Bottom Fishers Like Boeing

Boeing’s origin dates to 1916 when the American timber merchant William E. Boeing founded “Aero Products Company” after he and U.S. Navy officer Conrad Westervelt developed a single-engine, two-seat seaplane, the “B&W”. Known for its commercial airplanes, defense and space products, Boeing has been a key player in “shaping” the modern aviation landscape.

The company's stock performance often reflects broader trends in the aerospace and defense sectors, as well as specific factors affecting the company itself. Factors such as aircraft orders, delivery schedules, technological innovations and all geopolitical events influence the company's stock price.

In recent years, Boeing faced significant challenges, notably with the grounding of its 737 MAX aircraft following two fatal crashes. The grounding affected it's finances but has also raised questions about the company's safety protocols a regulatory oversight. However, Boeing’s been working diligently to address these issues, including making changes to the 737 MAX and improving its safety procedures. Let’s hope they solve a few problems around cabin doors opening and engines dropping off in the future as well. Anything that could go wrong has and for investors like me that’s a good thing.

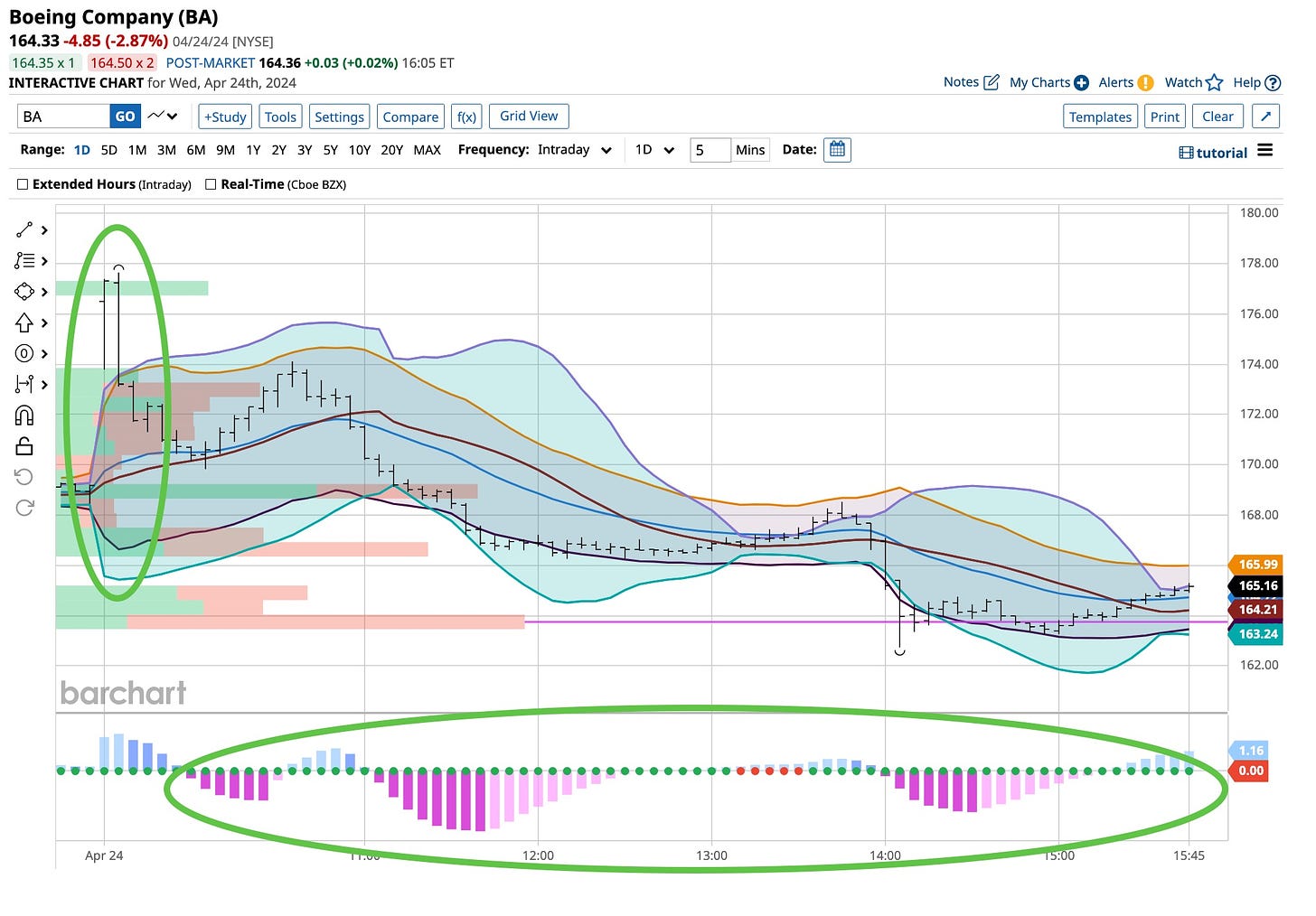

Investors often keep a close eye on Boeing's quarterly earnings reports, as they did today, to provide insights into the its financial health and its outlook. Furthermore, developments in Boeing's defense and space segments, contracts and partnerships, influence investor sentiment.

Boeing remains a significant player in the aerospace and defense sectors, but its stock performance is influenced by a combination of many things. Overall industry trends, company-specific factors and broader economic conditions prevail, as does timing any trades or investments. Interested investors or traders must conduct thorough research and stay informed about developments in the aerospace industry before making better informed investment and trading decisions. In today’s day and age, everyone needs to be patient. The stock’s price has declined and surged in the past. This “brand name” is going to repeat this action again in the future. The question is always the same, when?

Some early morning traders, those who watched Boeing beat today, on both the top and bottom line, thought the worst was over just like Tesla (“TSLA”) experienced after its report yesterday. Such was not the case and within the hour, Boeing’s chart was a bit more like Netflix’s. We’re still on the sideline and happily so. In our opinion time is necessary if Boeing is to resume its leadership trend. Change in management at the top is required as well. We’ve watched this “high flyer” making a pretty rough landing approach but it’s not yet on the ground. We’re patient and you should be too.

Looks Like The Trend Is Growing

Hey Zuckerberg, you did great in the first quarter but from what we see and what you are telling us the future is not quite a rosy. I’m confused, in the past you’re a ‘big shot’ when it comes to political election time and that’s where we’re heading, right? Guess not as your stock looks like a carbon copy of Netflix. How low can the price go

It’s down close to $80.00 a share after hitting it’s highs a Boeing reported early this morning. Are they related? Not at all, they just reported on the same day. I am not a follower of META but I do use everything it sells. I made a fortune being short from the $320 level on down but did not participate in the upside. Zuckerberg is not one of my favorite leaders. That’s a criteria I follow diligently. Perhaps why I like Berkshire Hathaway. I just wish Warren liked ”In-And-Out Burgers” better than whoppers.

Trends are changing folks and the important thing to do is identify the trend. We do our best to teach you how to do that in our courses. It takes years of experience to get an idea of what to watch for and how to apply it. It’s a marathon and not a sprint but we see many of you running along with us and learning. Tell all of your friends, hell tell your enemies too. We’re here to teach you what we’ve experienced and what we know. All you have to do is “open your ears” so we can pack information in there.

In 1972 I saw Ben Vereen in Pippin on Broadway. He, along with the whole cast began with “Magic To Do” and it left an impression with me. If I had a dream, a wish or any other goal in life, it was to star on Broadway. I never made it, I had the “two-left feet” syndrome but two of my high school costars did make it. I settled being a cheerleader at Pitt and a Saks 5th Avenue ramp model with my Dad. In reality I’m thrilled to be on this stage with you as this wonderful life of giving back and teaching makes me more than happy. I hope it’s working for you as well.