As a student of The Federal Reserve and The Depression I’ve learned a lot over the years. Credit for most of my macroeconomic prowess belongs to my mentor, Allan Meltzer, who with Karl Brunner founded the Shadow Open Market Committee and served as its Chair from inception in 1973 until 1999. I was blessed to study under him at the Tepper School of Business at Carnegie Mellon University. He taught me in a way I seek to teach others despite his being on a mathematical plain five miles above any I had ever met. He was able to “keep it simple stupid” and relate his thoughts in a way that then novices like me could understand then apply it. Enough of some of the history of how my core interests and skills developed other than to say thanks Allan; you’re missed.

So everyone’s now talking about a “Fed pause”. Maybe it will happen, maybe it won’t. There is strong evidence that it will but like always the (1) timing remains uncertain and (2) what actions, whether additional tightening or loosening of rates, will follow. Since history repeats itself let’s take a look at the four to five years when Volcker took charge, the decisions he made and the results he achieved.

Volcker’s Early Years

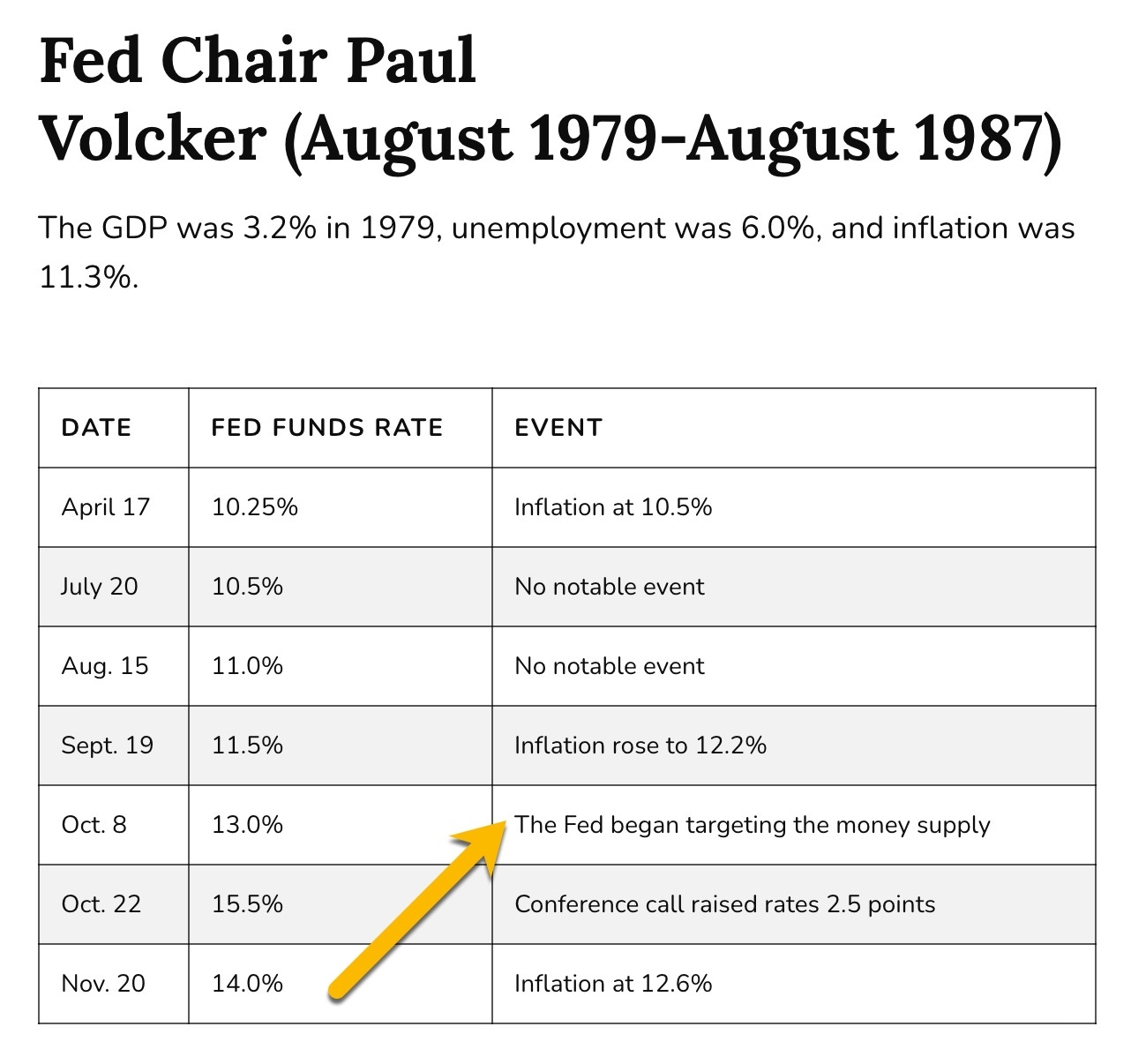

People are often surprised to discover that Volcker was appointed by Jimmy Carter in August 1979. Most associate his years in office under the Reagan administration but if there was something Carter got right, this was it. With inflation continuing to rise he began targeting the money supply later in 1979 raising rates almost 5% a little more than two months after taking the reigns at the Fed.

Volcker in 1980

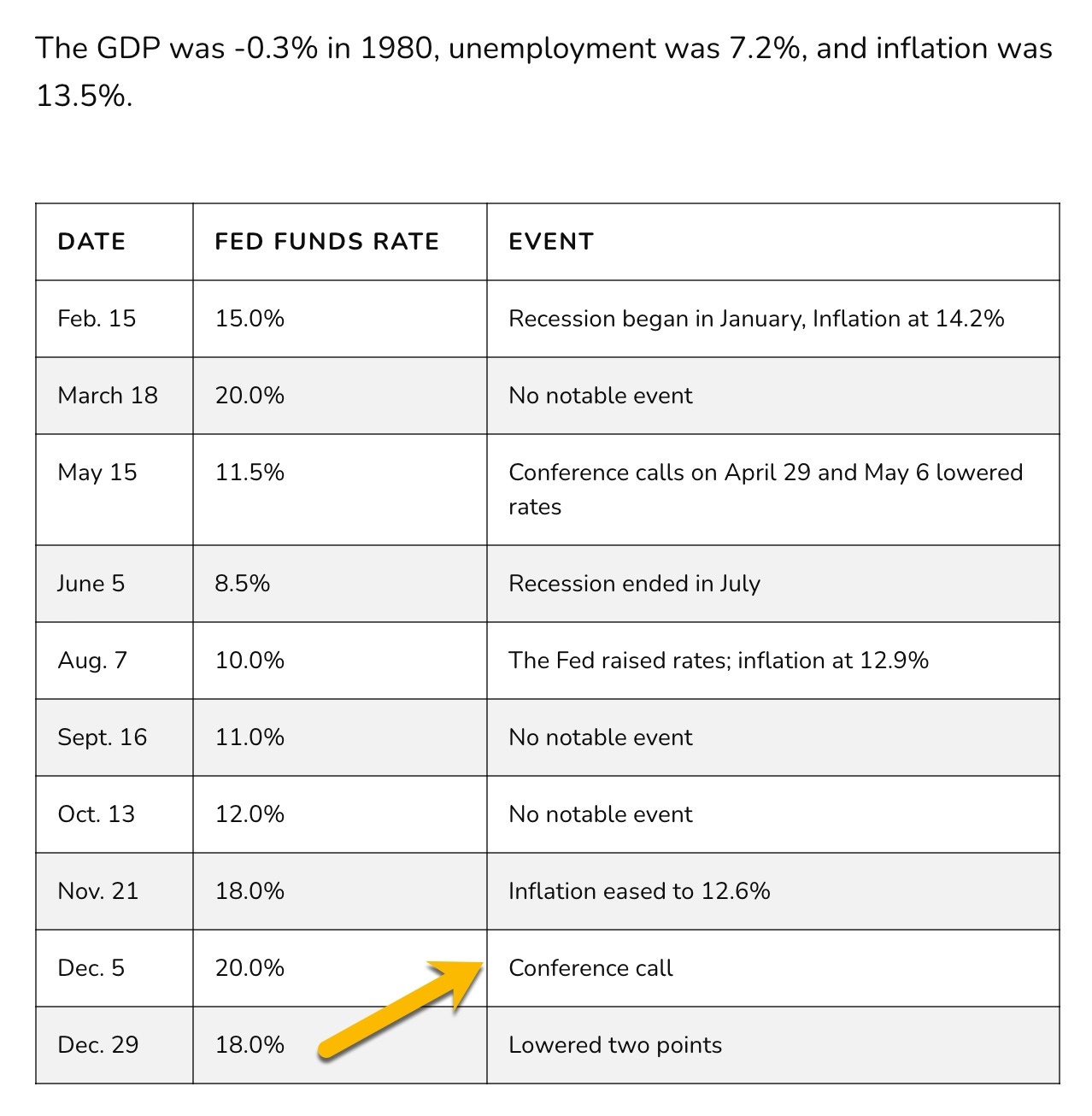

Relentless in his efforts to control inflation, which had risen to 14.2% by early 1980, in March the Fed pegged the Fed Funds Rate at 20%. The United States had entered into a Recession so Volcker paused in June 1980 dropping rates to less than 10% effectively ending the Recession but not inflation. My first ever “The Ticker” article appeared in April 1980 when I recommended buying 30-year Treasury Bonds and selling them a couple months later for an astronomical profit; those were the days. You see, you could buy U.S. Treasury bonds on margin, “10% down”, and despite the extremely high interest costs of margin, the precipitous gains far outstripped the costs.

Seeing that inflation remained economically ever present later in 1980 Volcker took rates back up to 20% in what I call a “shot across the bow” but it is significant to note that in the interim period, he “paused”. Maybe that’s what Powell is looking to do but if history repeats itself, and it usually does, if inflation remains persistent Powell, like Volcker will take them back up. We’ll see, time will tell but in today’s world of flowing information, we’ll know far in advance.

The 1981 - 1982 Volcker Years

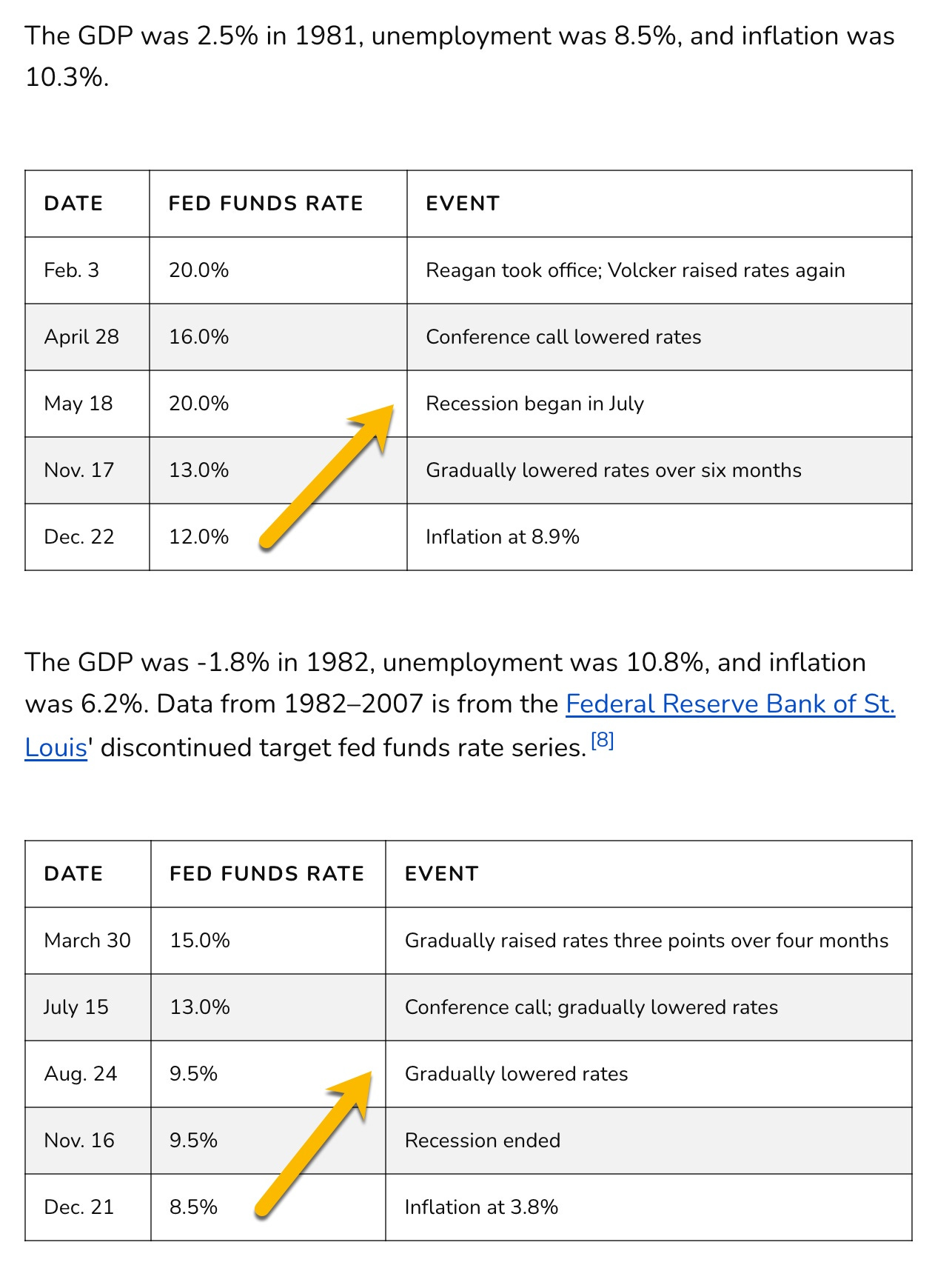

When Reagan took office in early 1981 Volcker took rates back up to 20% benefitted by the actions of Treasury Secretary Donald Regan and a U.S, Congress that had the foresight and ability to lower taxes. In May 1981 the place to be once again was long the 30-year. Another Recession began in May 1981 this time bringing inflation down with it. Unemployment soared but with the tax cuts the Recession came to an end in November 1982. Are you watching Jerome; you too Congress?

The 1983 - 1984 Volcker Years

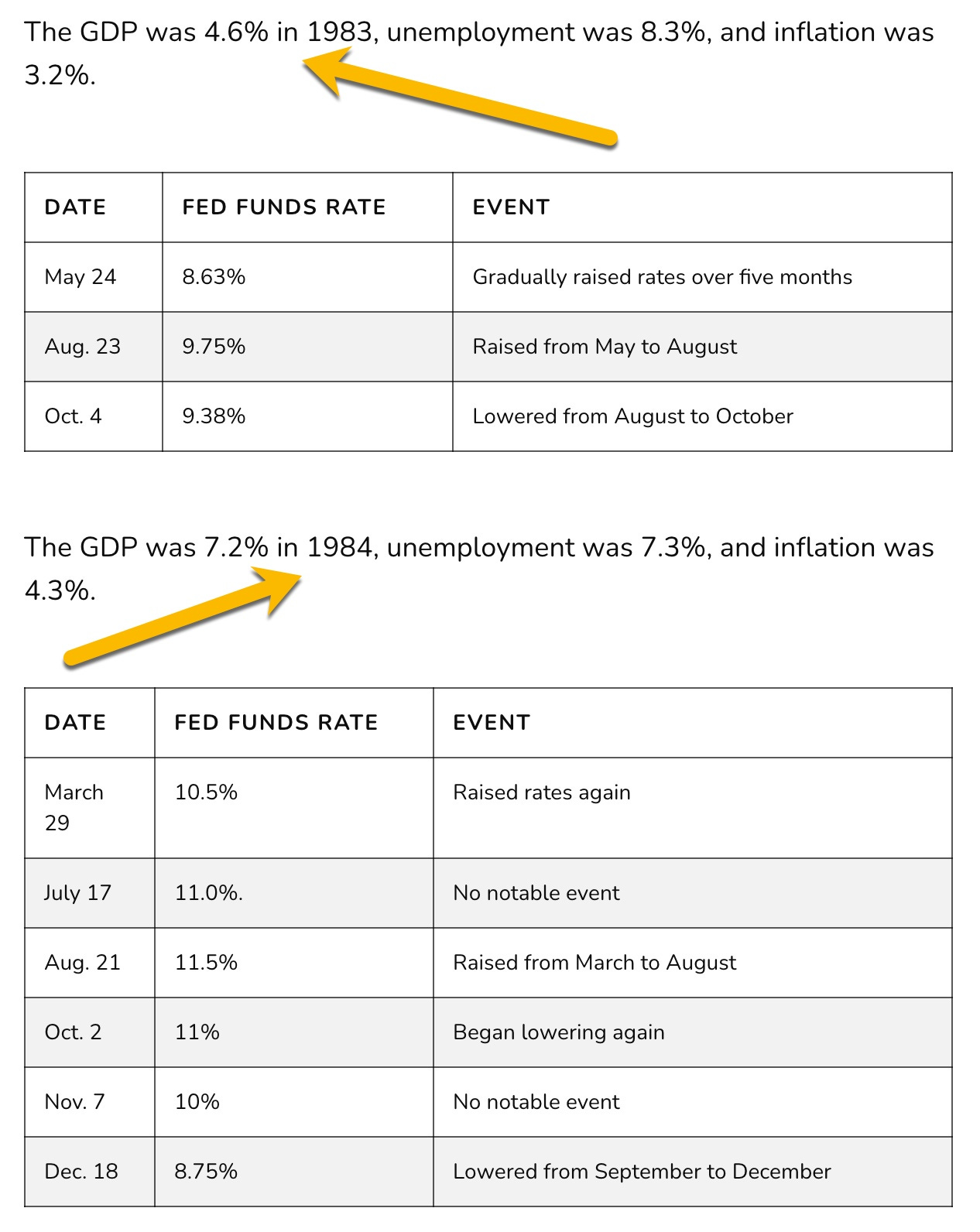

The combination of tax cuts coupled with lowered rates ramped GDP and brought the unemployment rate down significantly. It is during this period however that Volcker didn’t lose sight of the true battle; continuing to fight inflation. He took rates back up into the double digit range then slowly reduced them as inflation came under control.

Volcker was the only Fed Chairman that Meltzer ever had anything good to say about. So far my sense is that he’d speak highly, yet cautiously about Powell. Volcker had a bit more “damn the torpedoes, full speed ahead” in him and didn’t really care about how he came across when speaking publicly. Powell is pretty good at “smoothing the edges” when it comes to delivering his post meeting comments while addressing the macroeconomic world. We’ll find out soon if Powell is as good of a Fed Chairman as was Volcker. There’s a lot more to manage macroeconomic wise today as there’s a “new kid on the block” today; its name is China and remember, “we made them what they are today”.

Hope you enjoyed this post. I’m just a young 68 years old; my Dad became a broker when I was 13. It’s time for me to ‘give back’ to all of you what’s in my head. It’s not always pretty but it’s based on history . . . and history, unchecked, repeats itself.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at dzimmer@substack.com so we can further help. Thanks again Danny www.mrtopstep.com . . . check him out; he’s worth your “click”.

More for the “wishing and hoping” part of Dusty Springfield’s 1964 hit, let’s hope that Powell follows Voelker’s strategy. This inflationary fight is going to take years. Let’s hope he stays the course.