I had the pleasure of attending an investment club meeting recently where I live down here in Texas. At the age of 68 I was the youngest attendee. It became apparent to me that Robinhood’s effect didn’t stop with Generation Z; anyone with a handheld device who can open an account and enter a trade is a welcome participant.

Over the last three years more than 30+ million have entered their first trade. Most of these people could only initiate trades on the buy side. I remember in early 2020 when PayPal enhanced its platform enabling users to buy Bitcoin. This one-sided, buy-only demand-driven, order entry process launched Bitcoin’s run from the $12,500 level; it was obvious that Bitcoin was going to run higher and it did. Supply and demand still have great differential meanings in the marketplace; it’s what “bubbles” are made of.

Given when people trade or invest, they only buy. It’s a natural human reaction; they think positively and want “things” to go higher. I’ve tried to mathematically measure this “Robinhood” effect to no avail, reliable data is simply not available. We are left with only a visual perception of the result; the indices surge to higher levels than they should. When this bear market began in 2021 the days of buy-then-sell at higher levels disappeared; they’re back. After a significant decline, surviving newly minted traders reappeared and again, the heavy hitters on the street are just sitting back and waiting. That day may very well upon us. In any case it’s getting closer every day as problem we created have yet to be solved regardless of what the “herd” thinks.

With markets again positioned to roll over, especially with this current administration flooding an inflationary cycle with more money, traders thinking the worst is over are going to be shellshocked once again. Too bad more people, of all ages, are unaware of the opposite benefits of hedging their portfolios with futures, ETFs and options. With one trade, an “opening short” position on the index of your choice, the purchase of an ETF geared to the short side or the use of put and call options, you can protect against periods of decline. In a downside, either speculatively or by hedging your underlying portfolio, as markets correct, investors and traders of all ages can participate; it only takes one trade. Many don’t even know a transaction of this nature is even available. Coupled with the “world is a rosy place” psychological euphoria that transcends time, most don’t even want to consider or even hear about it. Despite my being here to just teach, few take the time time to learn or even listen to what is preached. They’re just buyers willing to wait for the “moonshot” that seldom if ever happens.

Follow-Up - Recent “Wick” Hunting Adventure

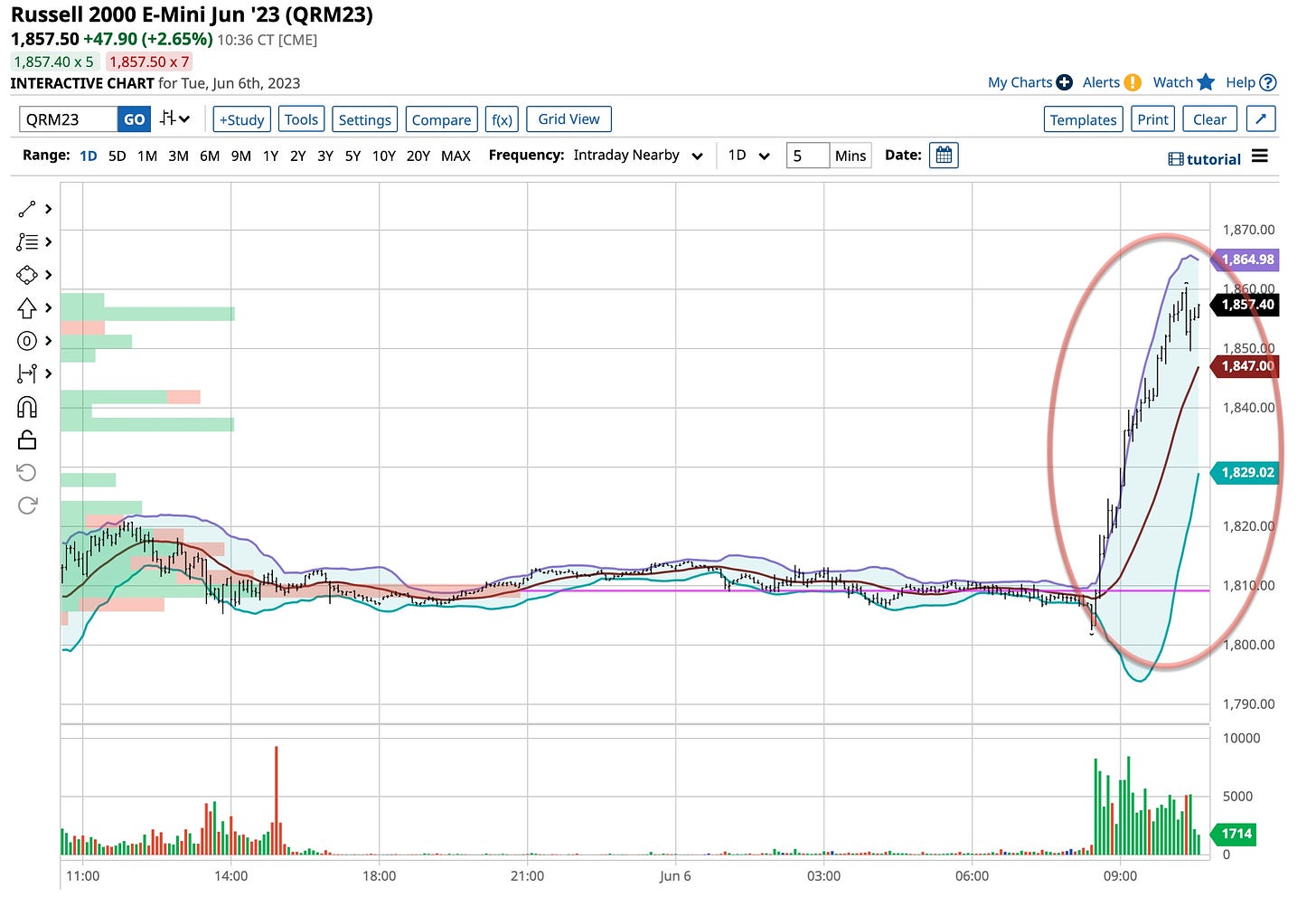

I’m going shopping today at “Parabolas ‘R Us”. Whether I’m right or wrong, I like the “odds” as I’m entering a “short” trade on the Russell 2000. As illustrated on the left hand side of the chart there’s nothing but buy orders. When they stop everyone looks to get out at the same time. The action that arises next, “sell” is often answered with “to whom”. I seldom trade and when I do it’s usually overnight. I’m truly a “midnight warrior”. Aberrations usually happen during more thinly traded times especially in the currency markets. The Aussies surprised many traders last night with an increase of 1/4 point in the continuing battle to fight inflation. RBA Governor Lowe’s statement was quite one-sided and dramatic. Hey Powell, are you listening? They’re listening in China as governmental requests for the banks to lower the interest rates charged to clients rang clear as did the Dollar’s increase against the Yuan. Time will tell but for now I’ll just be on the “I’m watching” side there.

Back to building a long lasting, at least as long as I last, publication that imparts upon you, my readers, what you can learn from others. That’s where I’m heading with The Ticker EDU. It’s a labor of love. Like everything else, after 55+ years of experience, it’s “in my head”. Developing a methodology of how to get it “out-of-there” into a logical format people of all ages can benefit from is a daunting task. What should I teach? How should I teach it? As a business person, it is essential that I’m compensated for my time and effort. I’m speaking with mentors I have worked with for most of my years of experience in this industry. It’s going to get figured out but like anything else, it’s going to take time. Until then, enjoy the posts on Substack and let me know what you want to learn. Position trading, options, using ETFs and commodity futures, are high on the list. Presenting my knowledge and this informative content, what the true educational market is, how much time people are going to spend learning and at what level are questions I’m seeking answers to. Let me know your thoughts and thanks for your patience.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

I couldn’t resist posting the following clip from my favorite slapstick comedians that reflects upon today’s investors and traders and what’s again happening in the markets; they’re probably rolling over; slowly we turned. Enjoy this Three Stooges clip . . . it’s an advertisement Robinhood should have been running for years.