I miss Allan Meltzer. From his days of teaching at Carnegie-Mellon to his time as the President of the Shadow Open Market Committee, he was a man of truth.

Like Meltzer, the only Federal Reserve Chairman that was worth hs weight in gold was Paul Volcker. The rest were either too political or pompous. I liked Powell in his early days, but over time, he just missed the mark or failed to observe the obvious.

He’s doing so again today by not lowering rates. Is he too slow again today? I think he is, but then again, everyone on his clown ship of fools is.

I’m Buying For Lower Rates

Maybe I’m redundant. Perhaps I’m conservative, or perhaps I’m just consistent. The fact is that it’s time for lower interest rates. It’s not time to fire the whole Federal Reserve, but it is time to take action. Yellen and her mushroom harvest pretended that interest rates and inflation were under control. They were not. Short-term rates were too high and are too large in size. While they paid upwards of 5 1/2% they were ‘quite useful” to managing short-term money.

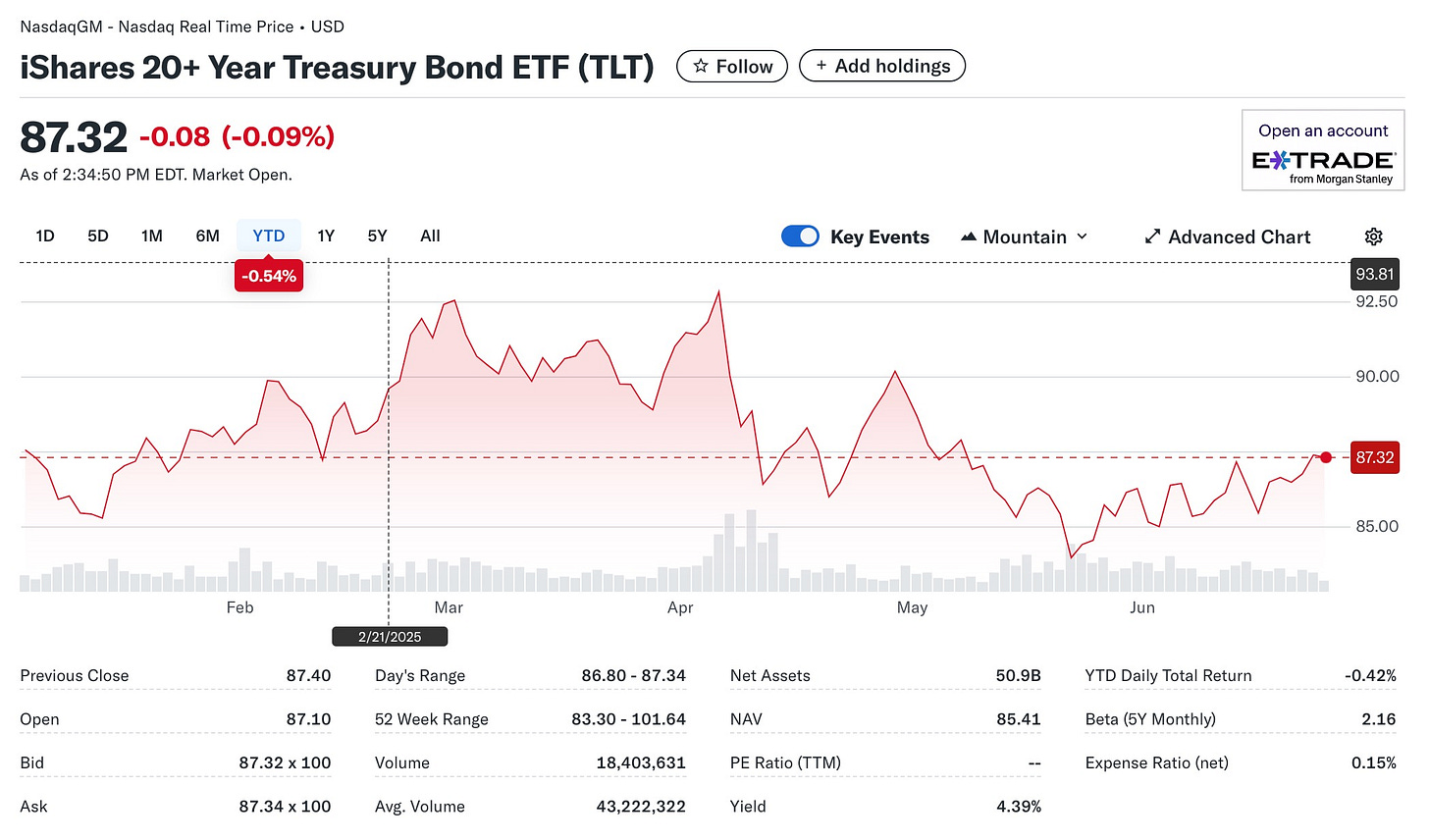

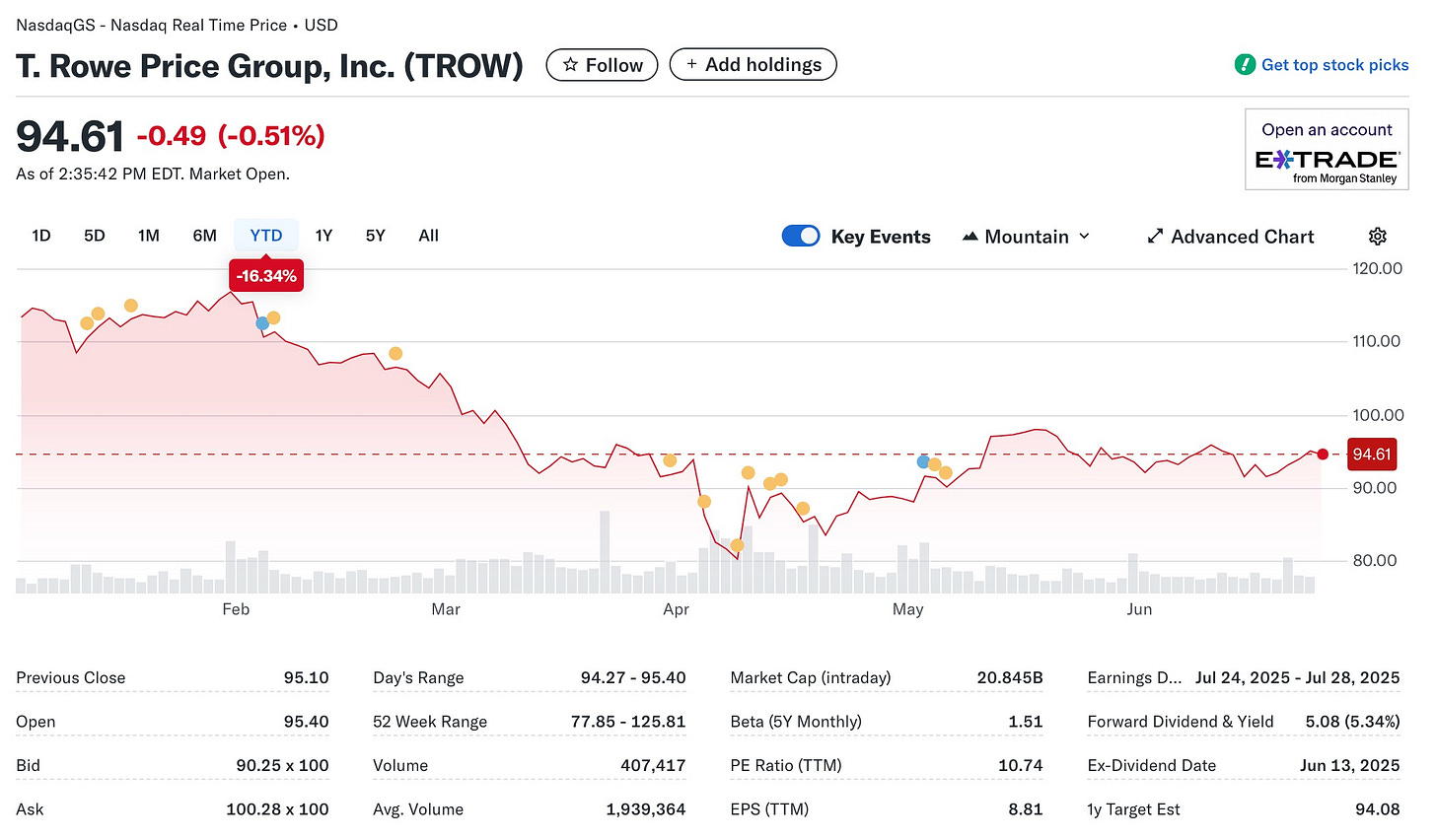

Today, it’s time to buy long-term. For me, that’s TLT, T. Rowe Price, and the 30-year bond futures and options. For any of you who actually follow what I post, you know where I stand. I’m into these three for a couple of months. For those of you who do not read what I write daily, start. If not, I’m going to have a loaded B-2 bomber stop by your house and drop a few large bombs.

Aerosmith was right. Nothing like “love in a elevator”. What goes up must go down. All we need to know is when. Rates are coming down. Powell is going away. It has a way of happening, just like old times. But for the Democratic pressures remaining in the interest rate judgment consortium, this all would have happened. But remember, Powell is just cautious, too slow, too.