It’s a nice day outside. I should be doing a little yardwork, but with the grandkids off this week for Spring Break, we’ll take advantage of their age and energy and finish our winter clean-up this week

Until then you’re stuck with me so sit back, enjoy my thoughts and realize, money in supply makes a difference.

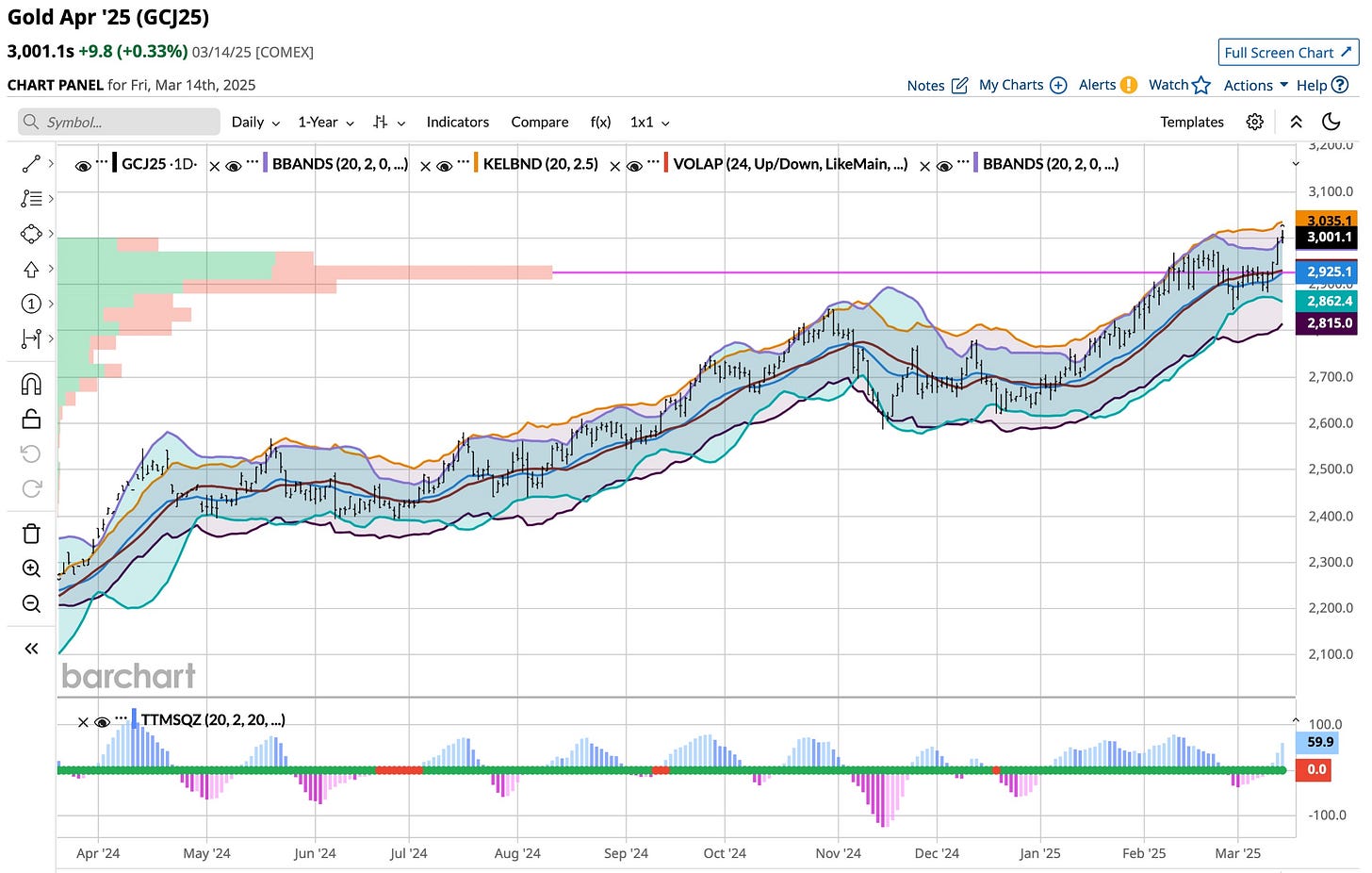

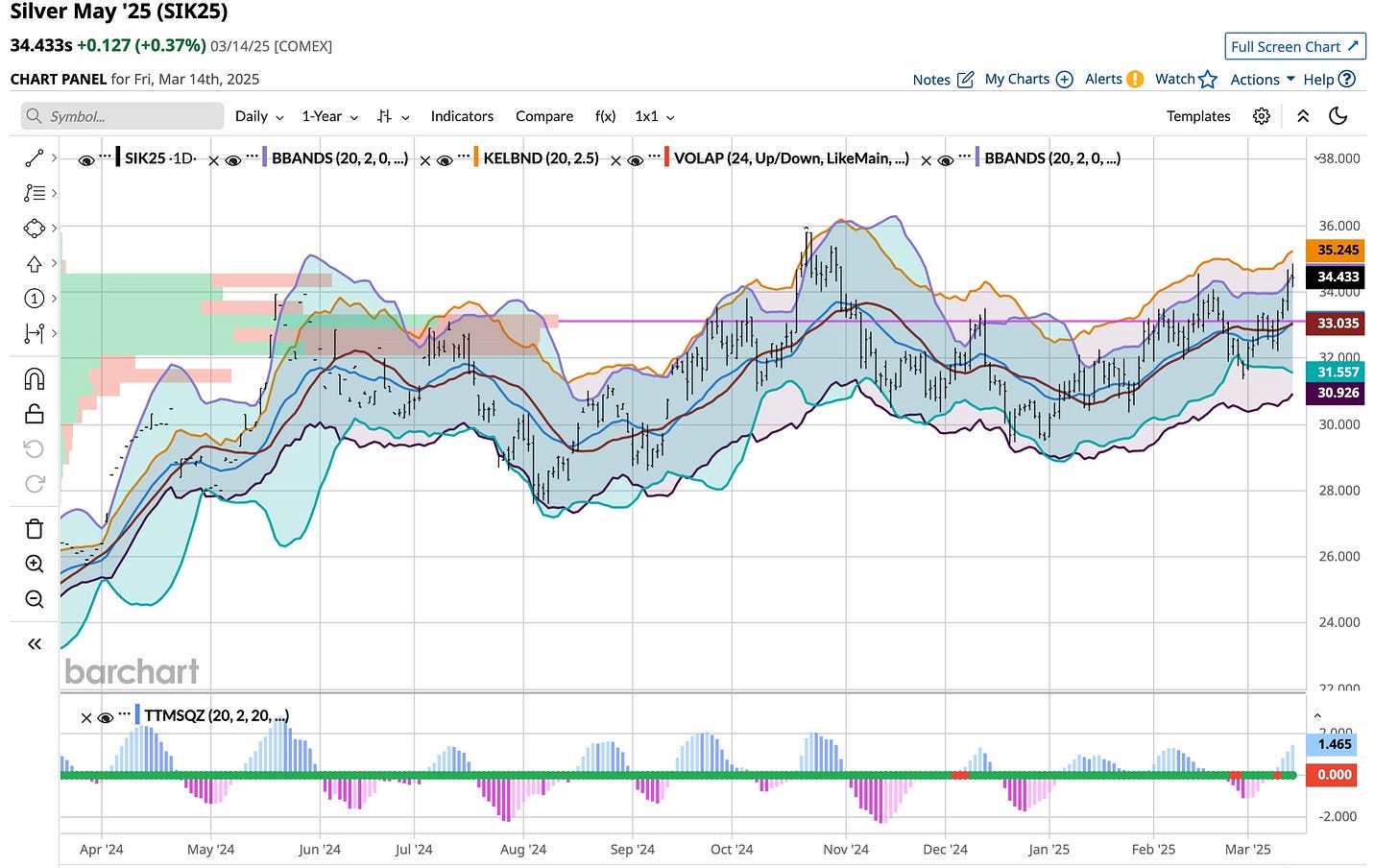

Gold & Silver Roar

All told, in the managed Roth IRA accounts, about 5% in gold and 7 1/2% in silver are both solid investments and great hedges. I like hedges. So does the rest of the world. I can see where these entities will go higher due in part to the gross uncertainty that abounds. To me, it’s not uncertainty, it’s a realization that Yellen is history and so are her mushrooms.

The Value Of Puts

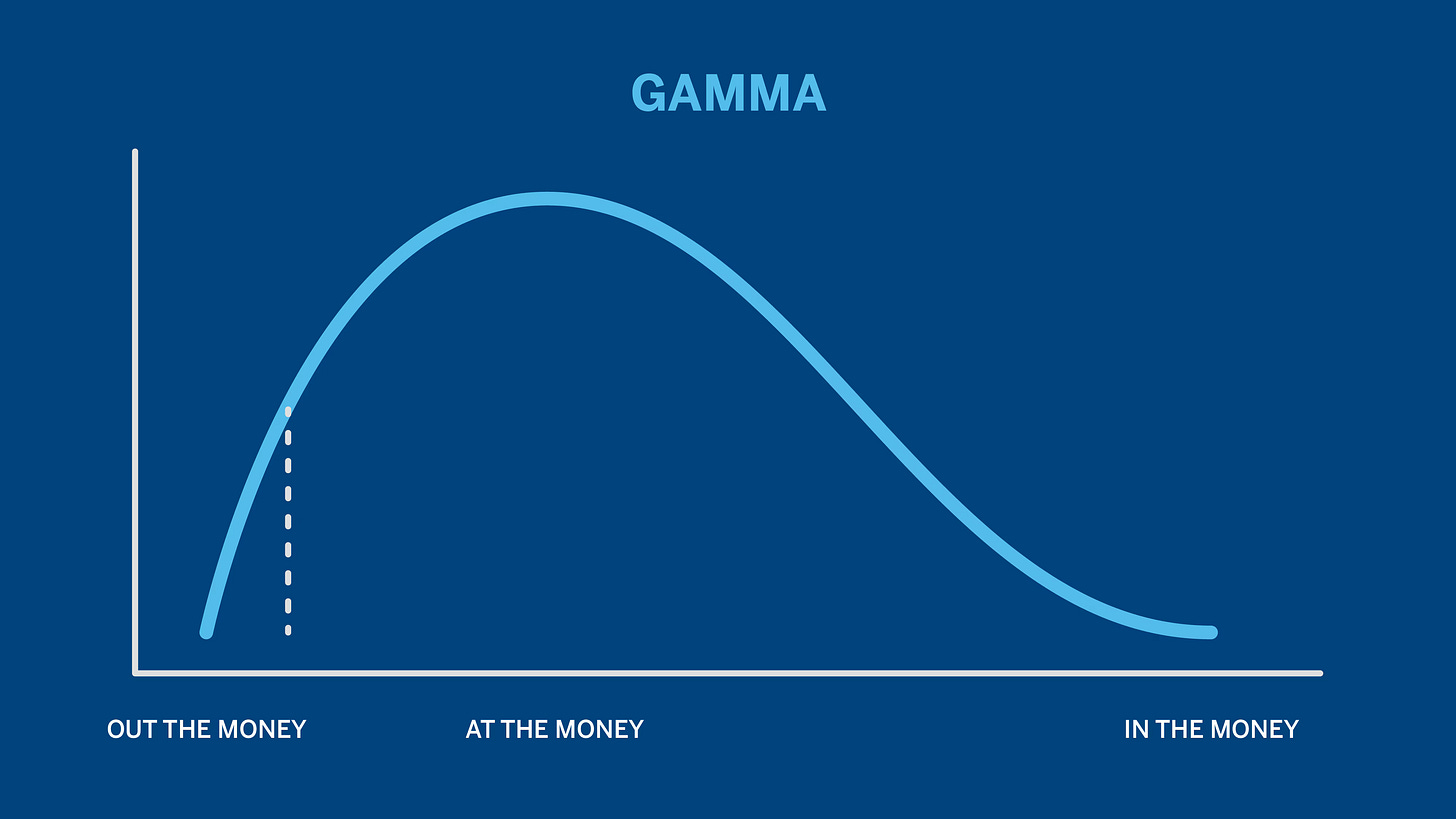

Most traders think that options are risky. If they are employed incorrectly, they are. I use long puts as insurance. I use short puts to add to existing positions below current market prices. The “Greeks” rule my decision making. In particular “gamma”.

It works. Insurance is a good thing. I’m long several brand name equities, all with solid increases even though these positions have not moved. It’s all due to gamma. When stocks of this nature post higher gammas, whether short option calls or long option puts, my attention is piqued.

Remember, the herd is most often wrong. Their incorrect assumptions can be watched using gamma. When it is too high, they are usually wrong. It’s a great indicator and it should be part of your strategy.

Stanley Kubrick was a master. Any of his films were masterpieces. In particular, his Clockwork Orange and Dr. Strangelove are my favorites. I’m a sarcastic person and one that easily laughs at myself. I also seek situations that others simply do not see. I’m pretty much in cash right now. When you pump money into an economy, you get inflation and often rising asset prices. When you stop spending money, asset prices fall. Guess what’s happening now? Downsides in markets are good things and that’s all happening in front of your screens. Don’t fight it.