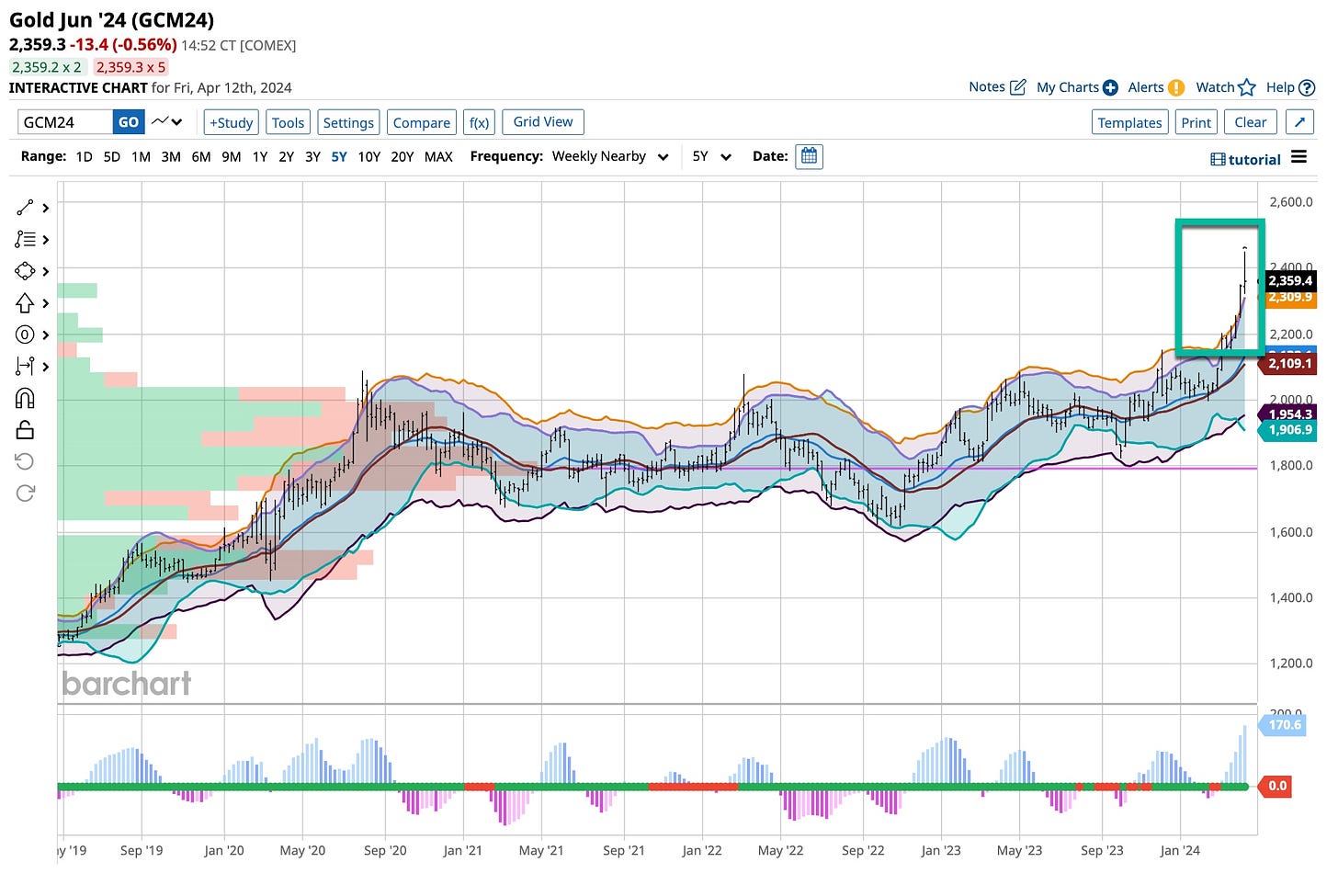

Are you watching the metal markets? I’ve talked about my desire to reduce my gold bullion position that’s up more than 65% but until today I didn’t have a chance to do so. I did part with 1/2 of 1% of the gold bullion held in managed accounts at the $2,400 level. Although gold reversed, I still haven’t seen the overall consolidation I’m looking for. With that in mind, despite today’s ‘ups and downs’, I’m still holding on to most of the position.

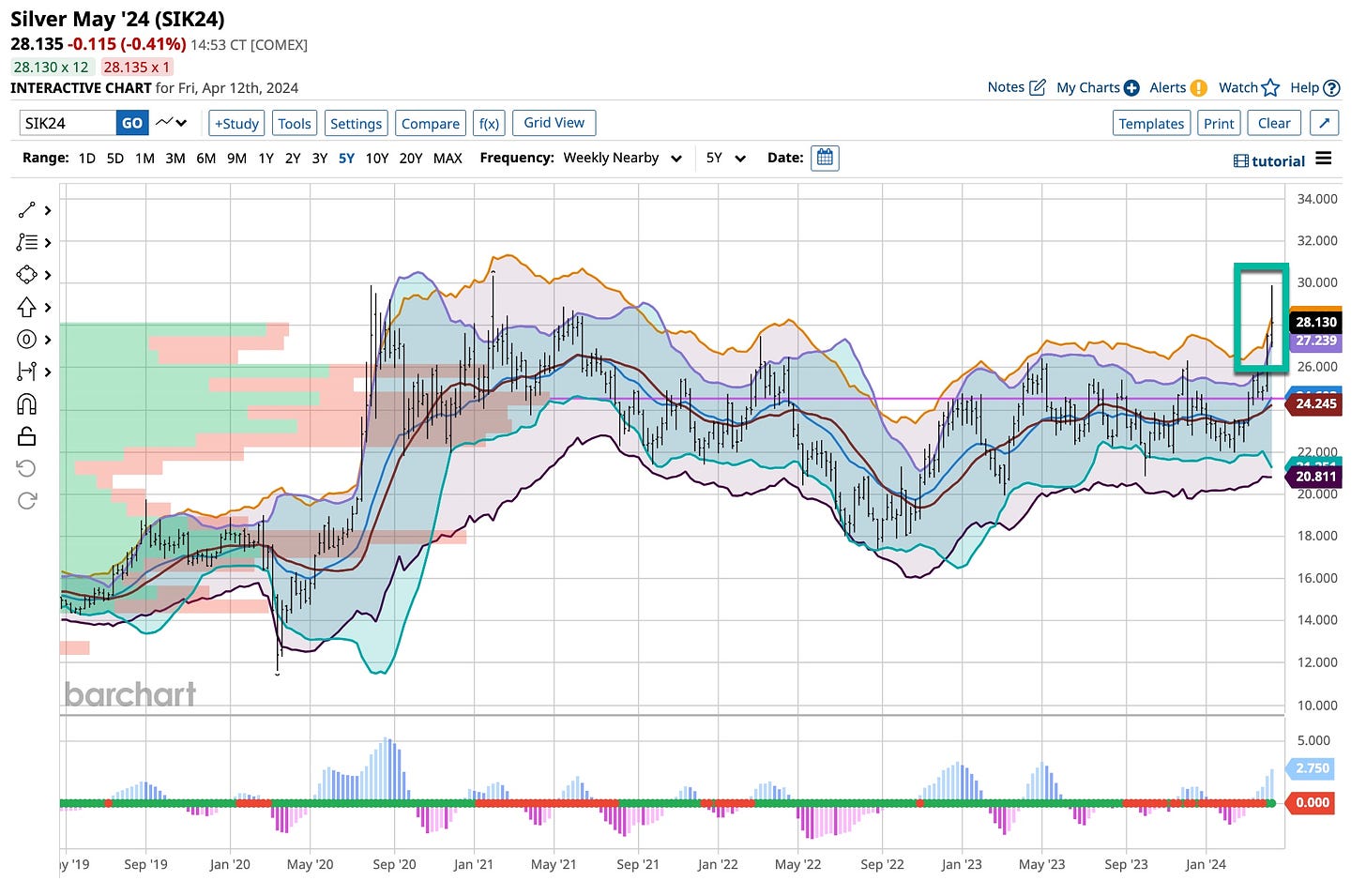

Using technical analysis I entered into the copper markets in the low $3.80 range and have been long silver for about six to seven points. Copper did consolidate from $4.15 to $4.00. Its rise has been prolific as well perhaps putting in an interim top today but inventories of the metal are lower than normal this time of year. From my perspective, China’s on the sideline except for what’s being spent military wise. Consolidation in price is a good thing but in the markets I watch, it’s just not apparent despite today’s expanding range.

Being a firm believer of using trailing stops to protect profits, they have been entered for silver and copper but are in litle to no risk of being triggered. Overall, despite the run both have experienced, the upside, especially for silver, remains intact.

A bit of an extra highlight “song wise” here today with Queen’s “Don’t Stop Me Now”. It’s time for The Masters this weekend and trust me, “nothing” gets in the way of that except perhaps my better half’s son’s 30th birthday. I do remember my ‘30th’ birthday. It was great, super celebration. I had no problem turning thirty. It was until my ‘31st’ birthday that it all hit and bothered me, i was getting old. How about you.

We’ll be publishing a “paid” article this Sunday night, naturally after The Masters, and it’s a good one. It’s earnings season. The markets, bonds, futures and more are looking for direction. That’s a good thing and why hedging matters. Maybe Iran will hit Israel this weekend. Might be that Europe could lead in the race to lower interest rates. The Japanese might even realize that they need to bolster their currency and raise interest rates sooner than not but who knows. They are operating like “tomorrow” will never come but we all know better, it will.

If you have time this weekend check out what we’re doing at The Ticker. It is a labor of love and one we’ll continue to improve upon as our Library & Webinar series along with our third course is published. That’s why we’re offering The Ticker for $247.00, our introductory price. I’m doing as much as I can, basically working until my eyes get a little bleary, to bring you the “best damn” investment instructional site ever. Yes The Masters gets in the way but what can I say. It’s a pleasure to watch these guys play on one of the greatest courses in the world in a tournament that’s second to none.

What happens when you put Gene Wilder, Terri Garr, Marty Feldman and Peter Boyle together in a movie directed by Mel Brooks? It’s kind of like having Graham & Dodd over to share a couple “Whoppers” with Warren Buffett. It’s alive and without a doubt it’s going to stay that way. In 1981 I started writing “The Ticker” and I named it “The Ticker” because the markets are alive. Sometimes they are more “active” than not but their heartbeats need to be listened to. We’re coming into a very turbulent time. The Fed has its hands full, macroeconomics, geopolitics and geoeconomics are about to collide. I’m a long-term position investor but I know that anything can arise simply “out-of-nowhere”. That why I hedge and you should too. \