Nice day down here in Texas. It was a “better Sunday” as Governor Ueda from Japan finally decided enough weakness in the Yen was enough. I’m convinced that interest rates in Japan must rise. That’s a good thing especially since chances are the rest of the world has to bring their rates lower. For me it would have been better if this had happened sooner than not but it didn’t. That forced me to “act” in a manner I do not suggest for others unless you have a very strong stomach and lots of money to cover margins on your position. That being said let’s take a look.

What Goes Up Must Come Down

I guess that remark should be prefaced with the word “eventually”. For me as I run my Roth IRA accounts that’s fine. There is always lots of free cash available and futures’ trading represents 10% or less of the account size. My venture into the Yen was well within that boundary. Here’s how it all happened.

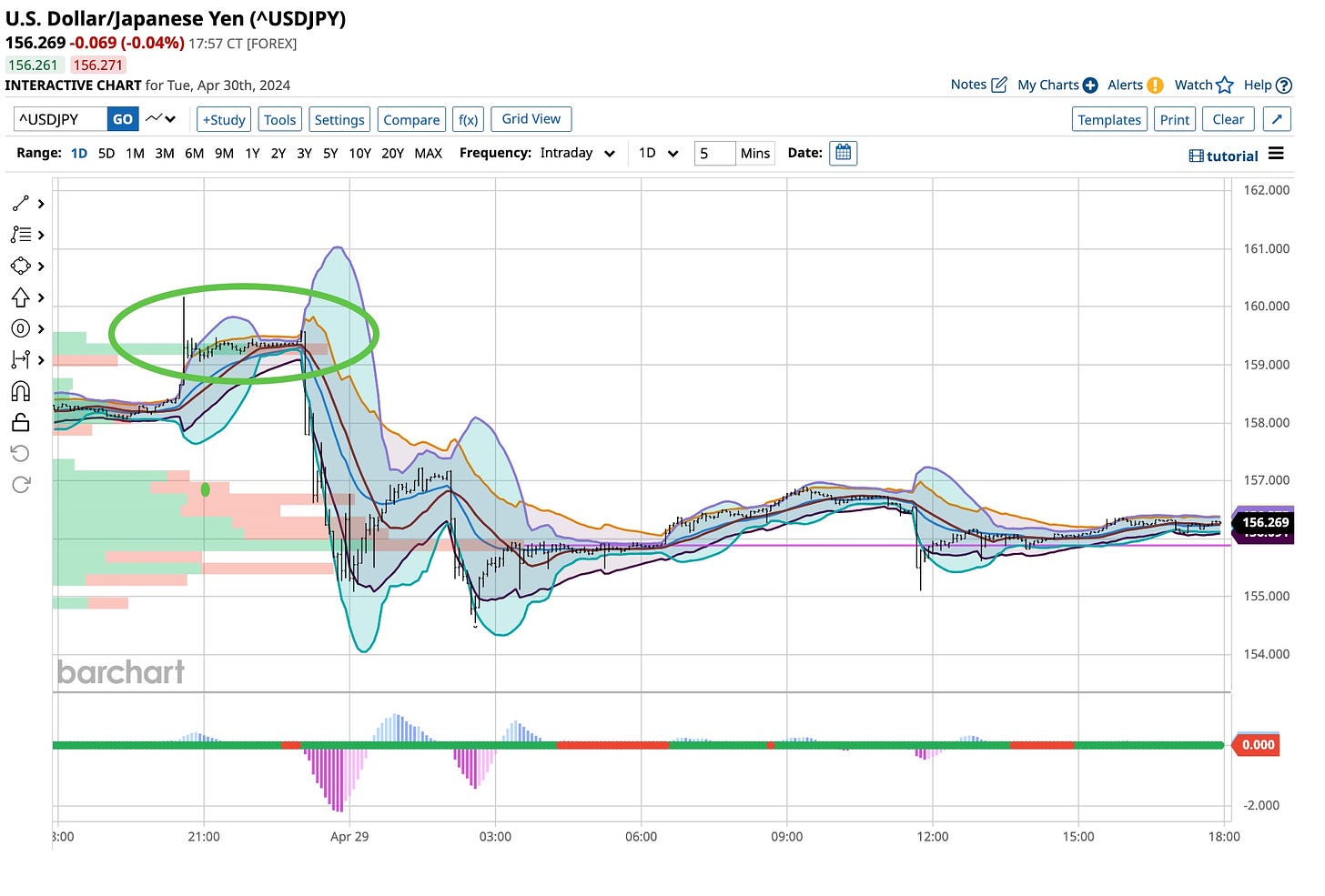

After booking a decent gain from the 150 to 142 level I ‘sat’ on my hands until the Yen went back up. I started my position as I usually do with one contract at 148.50. Things did not go my way so I added two more st 150.50. It still did not go in my way, I added three more at 152.50 so I’m now holding six total contracts. At least the average price was higher but I was still losing. I continued this doubling up a couple more times.

When the Yen kept weakening I added twelve more at 155.50 then Sunday happened and finally Ueda stepped in. Right before that happened I added another twenty-four contracts. That brought me up to forty-eight contracts then all hell broke loose. The Yen quickly fell back to the 156 level and my negative position quickly turned positive so I cut my position in half. Some consider actions of this nature lucky and I was just that. When currencies are in the forefront it’s more than luck, it’s work related to the fundamental world as we know it.

I’m a macroeconomist, geopolitically sound with a geoeconomic basis. I knew at some point everything would turn in my favor, I just did not know when. As I said before, I do not recommend trading in this way for just anyone. It’s not a “rule” you are going to read or see in my list of what to do. No, it is not but in my world it’s reality. I’ve got a “trailing stop” in place so if the Yen weakens I’m out with a small profit. If the Yen does continue to strengthen, this trade could be one of my biggest winners ever. Time will tell but protecting a profit is always important.

So What Else Is Happening

At Sunday night’s opening I bought a “bunch” of copper contracts after reading and evaluating the weekend inventory report. This kind of data is not something I share but you can follow my transactions if you like. I posted on LinkedIn and copied it over to The Ticker, both in our regular and “free” community. Same as before, the upside out of nowhere was a gift but the metals have come a long way. I sold almost all of the contracts at the close and again was lucky. A rule we follow is not to look a gift horse in the mouth and that’s what we were given.

I had to hit the eye doctor yesterday for some good and bad news. I’m pushing seventy years in age so these events are becoming more frequent. I had plenty of time to study up on Corn and started buying a few more contracts. It’s summer and I’m a ‘seasonal’ guy when it comes to agriculture. It’s next and I’ll keep buying for quite some time as the price hangs around this level. Do me a favor and keep using ethanol and eating cereal and corn-on-the-cob.

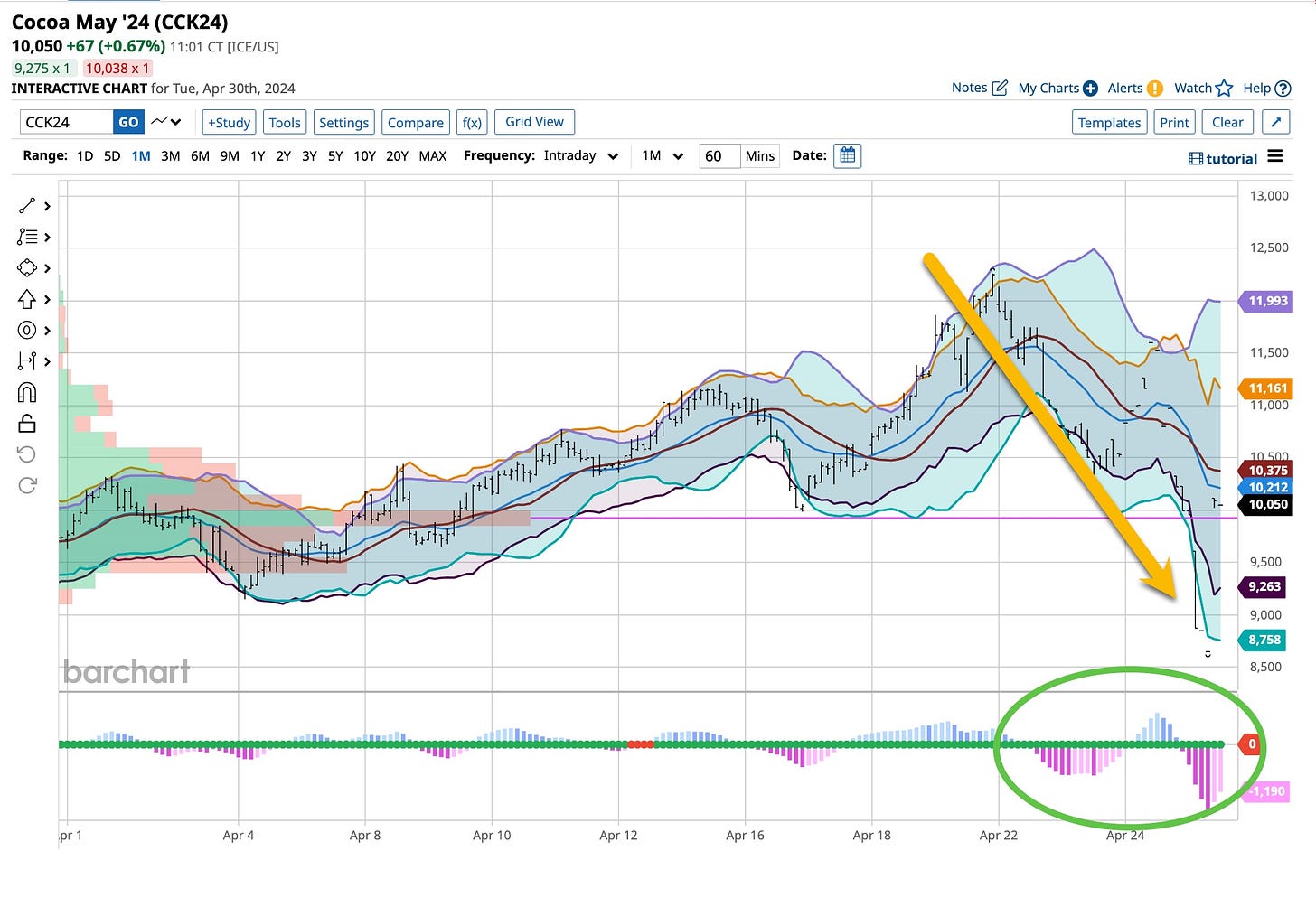

We finally got a “real” break in the price of Cocoa. After barely getting out of a short at much lower levels all I’m doing here, like I do with Orange Juice is watch. Futures are sometimes too rich for my blood and I sit on the sidelines but that does not mean I’m not watching.

That’s enough folks. It’s time for me to do some work with Mahdi and Micah. While we knew The Ticker was going to grow we had no idea exactly how that was going to take place. Now we do and these two eaerly adopters are going to be a big part going forward. My sincere thanks to all of you for supporting our site, especially Mahdi and Micah as without their assistance there’s not enough time in each day for me to write.

The Zombies came out with ‘Time Of The Season’ in 1968, a date we are going to hear a lot about as summer progresses. Kind of hard to believ that more than 55+ years this song is still listened to, especially by me. I’m a seasonal kind of guy especially when it comes to trading futures and buying downtrodden “brand name” stocks. I’m happy to write “all-about-it” as you are reading what I write. Thanks for following what we are doing as our objective is giving back to you wahat we’ve experienced.