I’m a bottom fisher, especially in the energy segment. Patience is a virtue. It must be part of any investment, trading, and hedging plan.

Over time, the oil and gas industry has proven itself. Trump recently put a tariff on the steel and aluminum industry. To make the best steel, you need the best coal. With that in mind, and based upon price, I’m a buyer of Peabody Energy Corp (“BTU”).

Why Peabody Energy

Peabody Energy Corporation is one of the largest private-sector coal companies in the world. It focuses on the exploration, mining, and sale of coal for electricity generation and steelmaking. Headquartered in St. Louis, Missouri, Peabody operates coal mines across the United States and Australia.

Here are some key points about Peabody Energy:

Coal Production and Operations: Peabody is known for its large-scale coal mining operations. The company operates both surface and underground mines, with a focus on high-quality coal reserves that can be exported to international markets, particularly in Asia.

Financial Health: Peabody has faced financial challenges over the years, particularly due to the volatility in coal prices and the industry’s ongoing decline in the face of environmental concerns and the shift toward cleaner energy sources. However, it has continued to be a significant player in the global coal market.

Environmental Considerations: Peabody, like many coal companies, has faced significant criticism due to the environmental impacts of coal mining, particularly in relation to greenhouse gas emissions and land reclamation after mining operations. The company has been involved in various efforts to address these issues but remains a central figure in the broader debate over coal’s role in energy production.

Bankruptcy and Restructuring: In 2016, Peabody filed for Chapter 11 bankruptcy protection, citing a significant debt load and declining coal prices. The company emerged from bankruptcy in 2017 after restructuring its debt. Since then, Peabody has made efforts to streamline operations and improve profitability.

Market Trends: The global demand for coal has been declining, particularly as renewable energy sources gain ground. Peabody, however, remains heavily involved in coal exports, especially to countries like China and India, where coal remains a significant part of the energy mix.

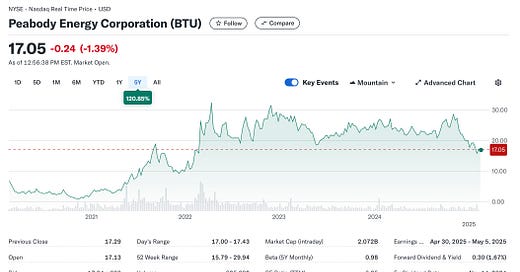

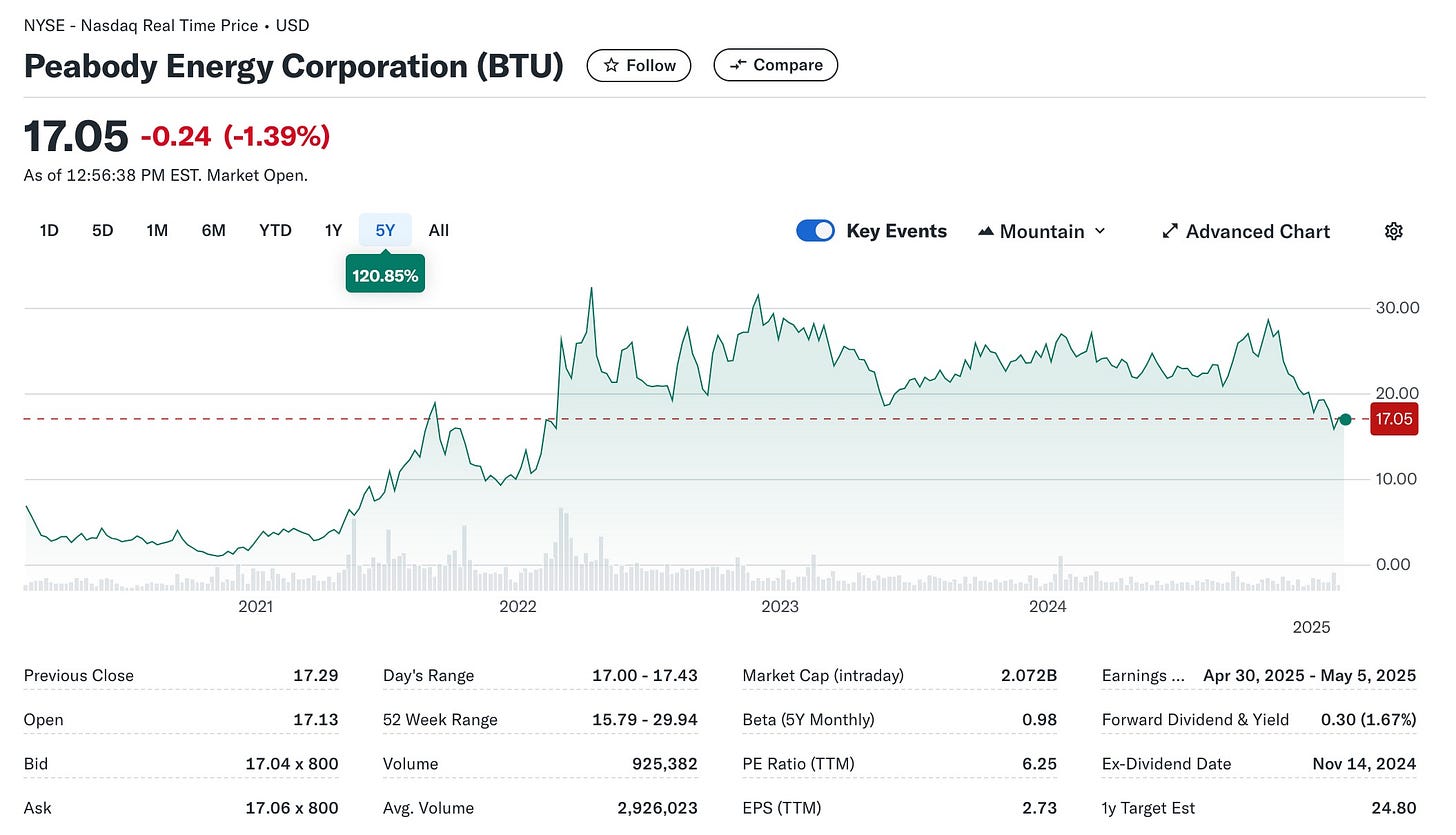

Stock and Investment: Peabody's stock has been quite volatile, reflecting the broader trends in the coal industry, including fluctuating commodity prices and regulatory pressures. It has attracted both speculative investors and those with a longer-term view on energy markets, particularly in countries still heavily reliant on coal.

Again, patience works. It makes sense to add coal to the portfolio, especially since the price of BTU sits around where you could buy it in 2022. A small dividend is payable, but it’s not enough. Let’s see what happens in Trump's world.

Do y’all remember Loretta Lynn? I know I’m pushing you a bit, but a little country is good for the spirit, just like owning a little coal. Down here in Texas, country is big. It works more so in the folk side of rock and roll. Coal works, too. I’m not sure if coal is going to be as big as natural gas, but buying energy at its bottom works. Take a look and let me know your thoughts. Best to all, as always.