I’m posting a bit more than in the past. The reason is simple. I have something to offer that is of benefit. I’m 70 years old with more than 57 years of direct experience in the securities industry. Experience matters.

It’s All About Revenue

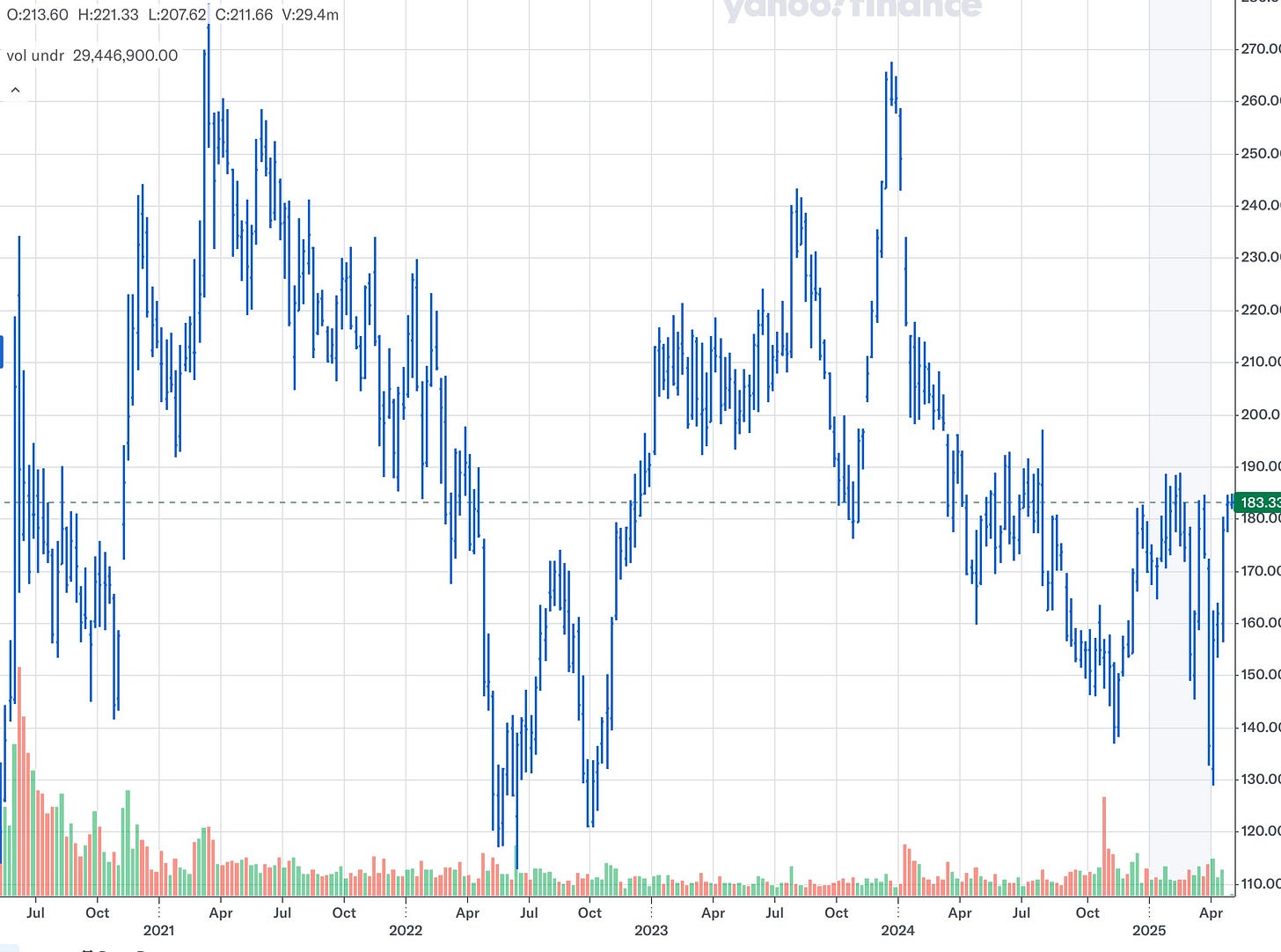

I like to buy “good stocks” when they are “down.” One of the best examples is Boeing (“BA”). If you have followed me, you know this one has been on my radar for over a year. I’m often early picking turnaround stocks, but seldom wrong in my timing. To date, I’m up over 30% in my BA transactions, thanks in good part to putting time on my side. In particular, with the use of option “gamma,” I’ve sold naked puts when the stock has tanked and covered calls when it’s hit interim highs.

It takes time for revenues to build. It takes cash to get there. Boeing offers both and is a security with a very rosy future. It seems that the worst is behind Boeing, and the sky is the limit. How high, no one knows, but for the purposes discussed, given there are a few remaining questions, options will prevail in my strategy as putting time on my side has produced the indicated returns.

What Good Dividend Stocks Provide

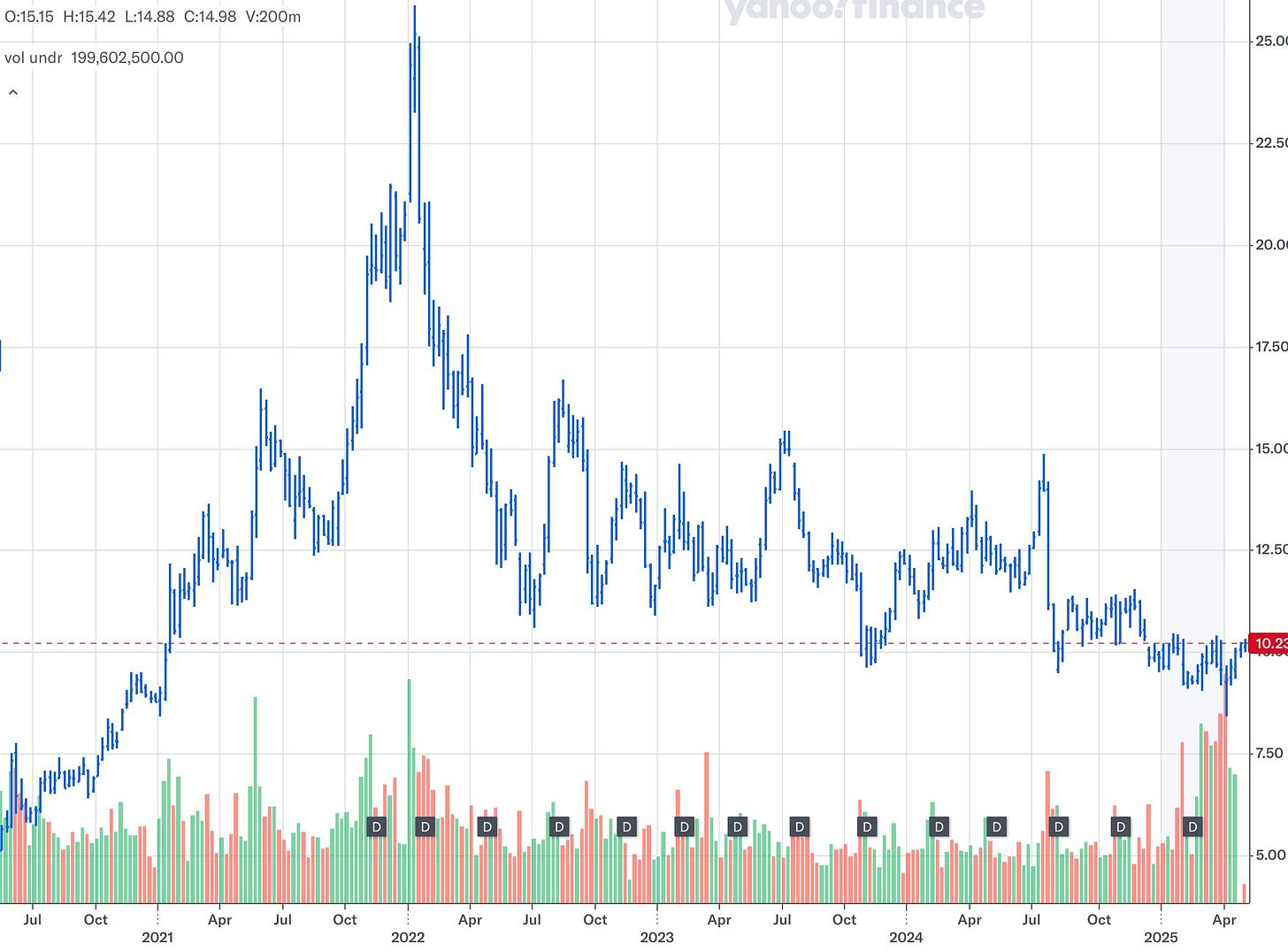

Have you jumped on the Ford (“F”) bandwagon? Sure, there have been a few sleepless nights, but again, using “gamma,” I’ve been ahead of the curve. The Ford family is a cautious group. They like their 6% dividend. I do too, especially when this overall rate is higher than I can earn in cash. That makes it easy to sell naked puts when it drops and out-of-the-money call options against existing shares held.

I’ve mentioned “gamma” a couple of times. It’s an important option related function I follow. Over the coming weeks I’ll discuss this further but for now, when the “gamma” number runs, the herd is usually moving in the wrong direction. Take advantage of their failures and go against their mistakes. It works.

On The Radar

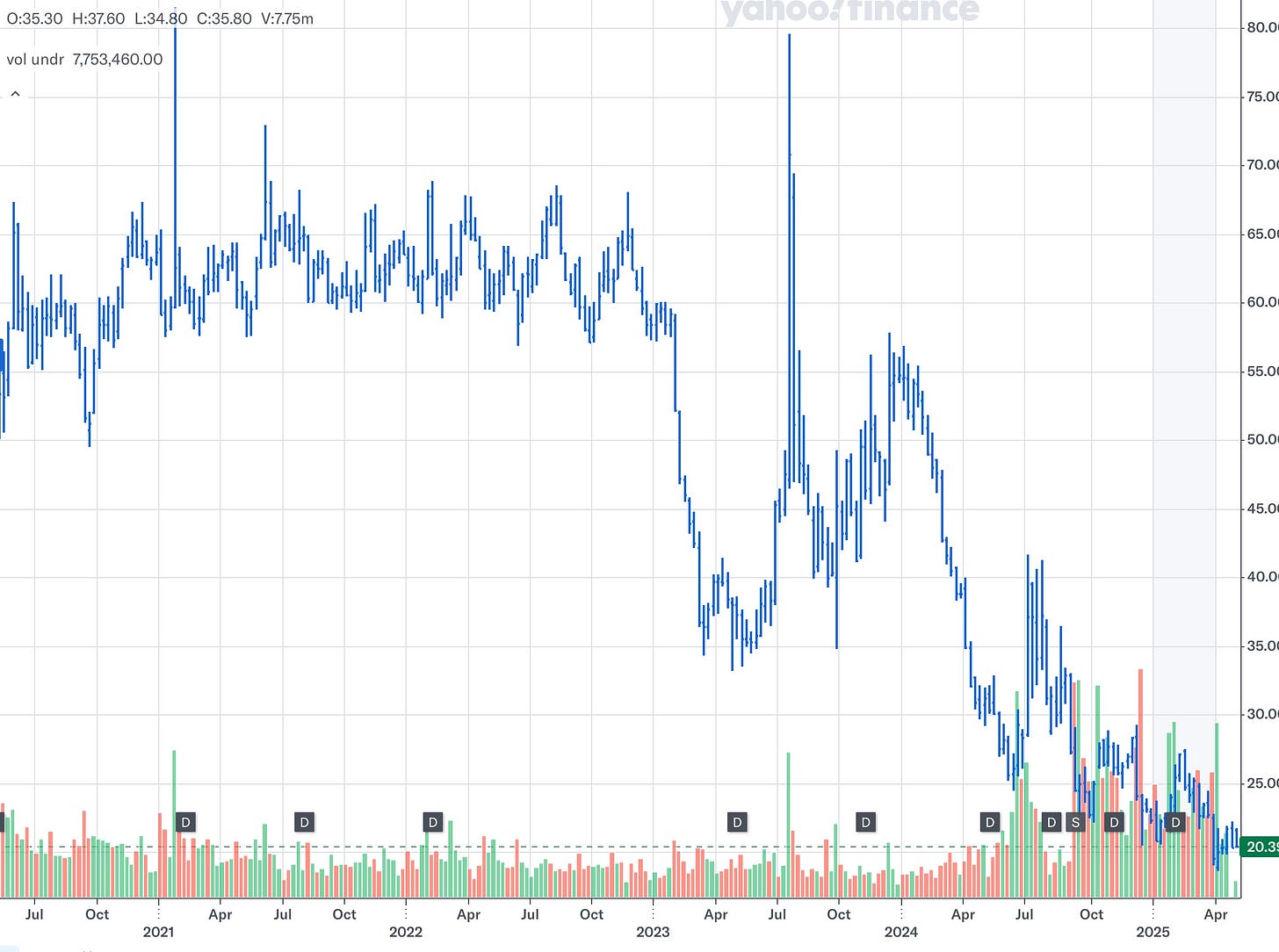

Other than buying up longer-term Natural Gas futures, I’ve been monitoring Sirius XM (“SIRI”). I’m waiting for Warren Buffett to speak this weekend to determine if his position is a strong a it was prior. I like the stock, just like I like most entities where I use their product. Time will tell, but the price is right.

Lots happening in the great State of Texas. After completing a consulting project, I’ve selected one more to fund and develop, and an entity to work with. Stay tuned.

David Bowie was real. His songs had a message. If you listened, it was apparent that he understood what was next, “changes.” Change is good. Being able to identify it is even better. I have a simple philosophy: buy low and sell high. I buy good stocks when they are low and put time on my side using options. It’s not that hard if you are a good long-term investor.