August already; well at least the kids and grandkids will be heading back to school soon to learn; what they’ll be learning no one knows anymore but at least it will be a little quieter.

The “quiet” period for what we call markets is about to change. Take a deep dive into Apple’s earnings and you’ll see a slowdown of sales on the higher revenue side of the equation. The next couple quarters are quite important and what I’m reading, higher rates and that China still has “a cold” isn’t good. Let’s hope that AI resolves all of our ills but like any other boom and bust cycle, it looks like it’s time for the “bust”.

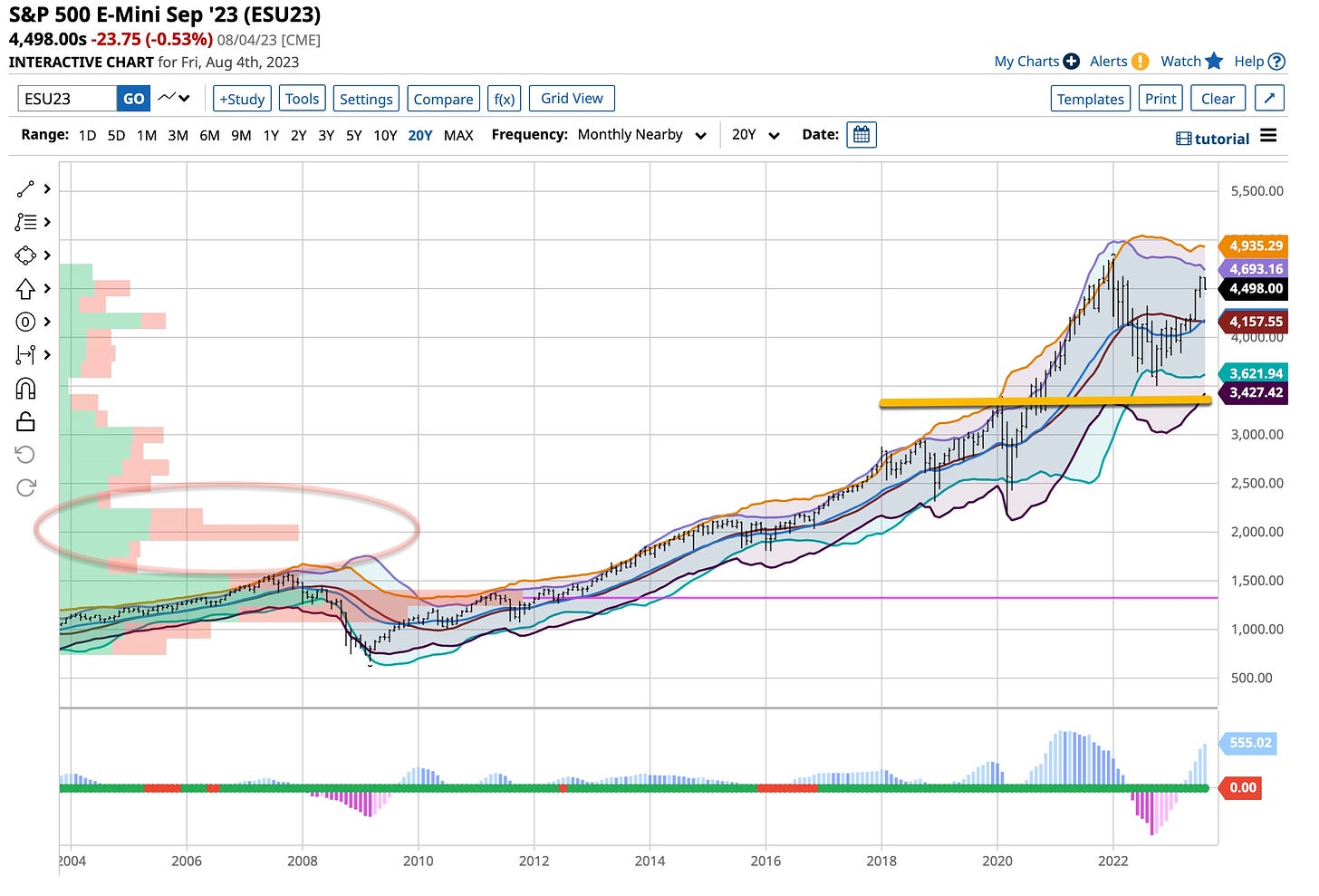

Returning to the Mean

One of the writers I follow is Lance Roberts and often find him on Investing.com. He gets it on “mean reversion” something I’ve spoken of any times; something that works in either boom or bust cycles. One of my favorite quotes from Lance came back in the days of COVID when he accurately and timely remarked, “there is currently a ‘Great Divide’ happening between the near ‘depressionary’ economy versus a surging bull market in equities. Given the relationship between the two, they both can’t be right.”

The true mean is around 2,907 but an ancillary, interim target of about 3,400 could be the beginning of some bottom fishing for me.

I’m here to bring you the “best of the best” and Lance fits that model. While you are at it click on Barchart and take advantage of the free month offered and learn. I hope you all enjoy the charts posted from Barchart. Give Barchart a try, just “click here”; get a trial for free at no risk. It just might be the best ‘click’ you’ve ever made.

When it comes to the actual “state of the market”, corporate profits are perhaps the best indicator of economic strength. This makes a lot of sense as asset prices should eventually reflect the underlying reality of corporate profitability, a true function of economic activity. Asset prices eventually reflect the underlying reality of corporate profitability and economic growth. They’ve been heading down. Is it time for stock prices to follow?

The market’s disconnect from underlying economic activity over the last decade was due almost solely to successive monetary interventions. Coupled with the “buy only” newbie traders, “investors” as they were loosely known just pumped stocks upward without bothering to understand why. It’s common for markets to become detached from the underlying economic activity for long periods as speculative excess detaches the market from underlying fundamental realities.

Forward returns will undoubtedly disappoint compared to the last decade. However, remember those returns resulted from a monetary illusion. The next consequence of dispelling that illusion will be challenging for investors. Standard returns will likely be substantially lower than witnessed over the last decade and average returns may be very disappointing to many. Let’s see if it’s reflected in the price of stocks that jumped far too high far too fast and now find it’s time to “revert to the mean”.

World Economic Pressures

Two measures of corporate and economic health flashed red on Friday as (1) shipping group Maersk reported a fall in global demand for sea containers and (2) advertising giant WPP said clients in the U.S. tech sector were slashing their marketing spend.

Maersk controls one-sixth of global container trade, transporting goods for retailers and consumer companies such as Walmart, Nike and Unilever. That’s a lot of boxes. WPP, the world's largest advertising group, warned that U.S. tech clients had pulled back spending in the second quarter. Caution exhibited among companies wrestling with higher borrowing costs and consumers tightening is in the pipeline. Marketing spending is the first to get cut when companies are worried about a strain on cash. I think maybe they should slash salaries of the higher ups but that’s not happening.

Apple on Thursday warned that its sales would decline for the fourth quarter in a row. Global firms like Nissan and Caterpillar recently warned of slowing earnings growth. The International Monetary Fund “IMF” said that it expects global economic growth to slow this year, expecting global growth to slow to 3% this year from 3.5% last year. The winds of change are upon us and blowing stronger. Who knows, maybe they’ll be reflected in the prices of stocks some already sent “to the moon”.

Is ESG Just a Passing Fad?

Big investors increasingly see Environment, Social, and Governance investing as an underperforming fad. Bloomberg conducted its latest industry survey of its terminal clients, the big banks, hedge funds, and other large financial institutions. About 90% expect the investment sector to underperform. 69% believe it is nothing more than a fad. The best quote was that “ESG has morphed from risk management to political activism for the left”. So true, so true; look out Blackrock; even its CEO Larry Fink stopped using the ESG moniker in his advertising and public statements.

I could not agree more. Despite recognizing the effects that ESG had in the markets it was apparent that their returns did not equate with the hype. There might even be an arbitrage opportunity out there, buy a basic industry sector ETF and short one that’s ESG oriented. People are starting to see that ESG was nothing more than a “general marketing” ploy. Perhaps were finally coming back to reality. Like anything else, this bubble popping will create a dynamic short in sentiment coupled with decreases in the price of these ESG forms of investing. Take that Target and Bud Light and thanks for the memories; some things never change. It’s time to quit following the herd.

Back to work writing.I’m just a “young” 68 years old looking to help you become the best damn investor or trader you can possibly be. Everyone learns at their own pace. If you pick it all up the first time , great if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

The theme of cycles reverting caused me to repeat Blood, Sweat & Tears “Spinning Wheel” one more time. Just checked the concert circuit finding that they are still out on tour. I wonder if they’re using their walkers. Best to you all as you enjoy or suffer through the rest of your summer. My VIX calls have doubled and the Yen is heading higher; otherwise I’m pretty much still on the sidelines except for a timely short on Apple; all good things come to an end.