But first, a tribute to one of the most unique individuals to both grace and deify this earth in his lifetime, Paul Reubens better known as “Pee-Wee Herman”. Life’s ups and its downs are usually self-inflicted, just ask any trader or investor when they’re on the wrong side of the curve.

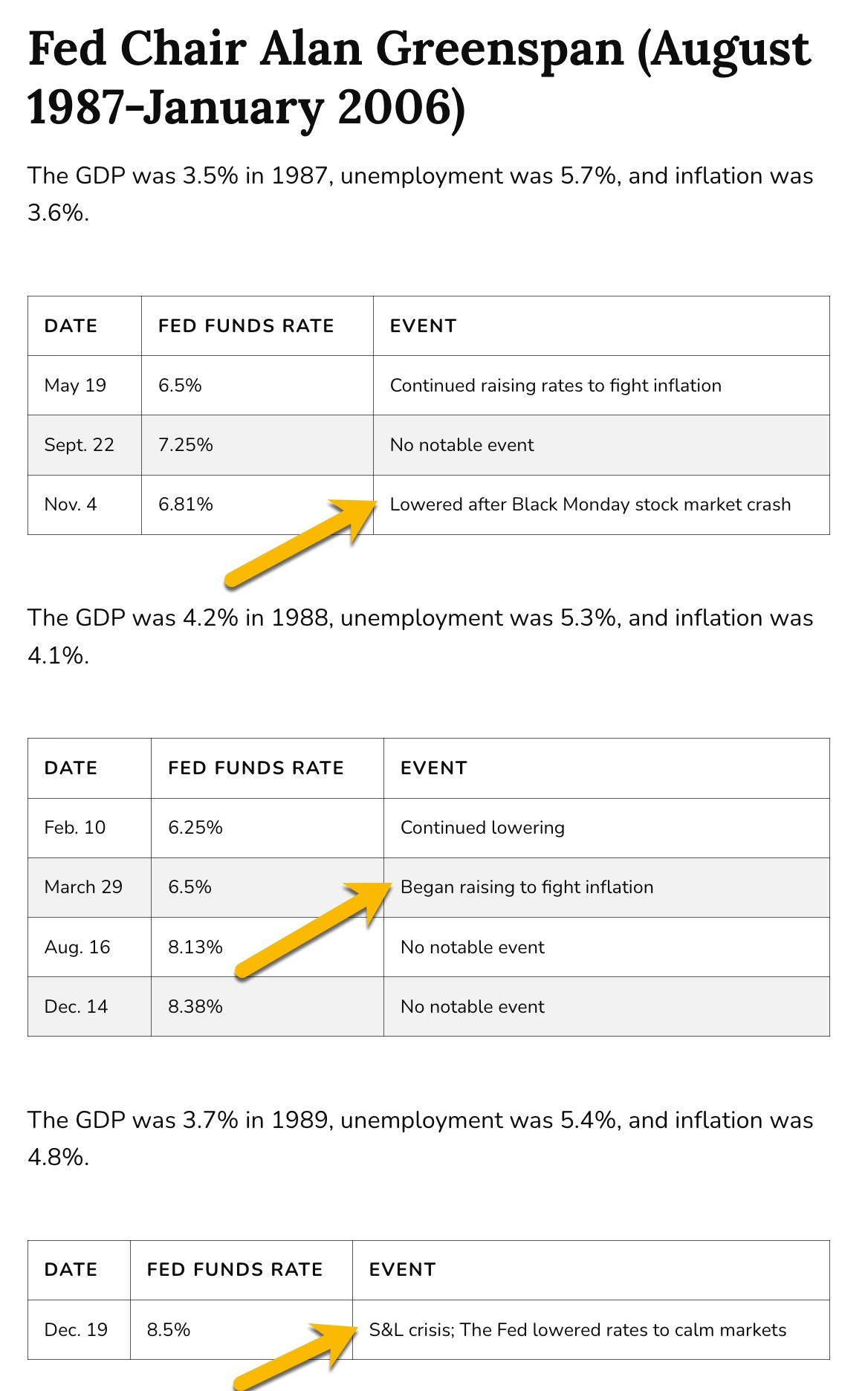

So are we on that infamous wrong side of the curve today? With Fitch lowering the US debt rating perhaps it’s time to take a good look at history, especially the period after Volcker called it quits and Greenspan took control.

The markets crashed in October 1987 and the Fed lowered rates to ameliorate future damage all the while creating a problem that manifest itself within two years with the Savings & Loan crisis. Sound familiar; do the middle market banks face the same fate as the S&Ls did. It’s certainly tracking in the same direction.

I’m posting today not just because the market is in the “crapper”. Markets worldwide started the decline overnight; we're just adding on. The VIX woke up & most markets have been schizophrenic all summer long. Maybe the buyers went on vacation. Maybe it’s all because Trudeau’s wife finally came to her senses and left home. Nah, there’s more than that to “what’s next”, just look at the political landscape here at home if you want answers. What’s really going on here?

The leading contenders for the 2024 election are battling it out to determine who the bigger crook is between these “Model T” aged candidates. If it were up to me, neither would be on the ballot. It’s not that it’s time for a change. It’s more so who can offer a solution that reunites what was once a proud Republic. It’s not Trump or Biden. Many like me are turning to Vivek Ramaswamy. It’s too early to support any candidate but he does impress me; so does RFK Jr. but he’s essentially precluded from “running” by Social Media cohorts. We’ve seen that scenario in the past; didn’t really work out for the country before, did it?

Between history repeating itself and a less than acceptable leadership component in Washington, we have “trouble my friend” just like Harold Hill did in the Music Man.

I’m long calls on the VIX with an October 20 strike price and long US bonds through a few ETFs. Other than a handful of low P/E solid dividend paying stocks I’m content to make 5% on short term T-bills. It’s not that I’m risk averse, it’s more like I’ve seen this movie before and I didn’t like the ending. Thin breadth with an expanding bullish sentiment forms “bubbles”; bubbles eventually burst. When, no one knows but when they do, the best buying opportunities appear; you just have to be patient.

Between the Texas heat, doing videos for the Udemy course and putting the finishing touches on what will be a complimentary 400+ page Amazon / Kindle publication, I’m exhausted. The book is the first of five planned, like the number used for the Bible. I think the first book should be called “In The Beginning” but I hear it’s been used. In any case it’s fun. When your work is fun that’s good. I’ll have snippets of everything available during the coming weeks and I look forward to hearing your opinion. It’s a labor of love and thanks in advance for your comments.

I’m just a “young” 68 years old looking to help you become the best damn investor or trader you can possibly be. Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

Between Robert Preston & Paul Reubens what more do we really need entertainment wise? How about a little blast from the past by The Beatles, “Magical Mystery Tour”. Seems like a good choice o me. These markets are living in a fantasy world that’s just starting to crack. Too many people are crammed into too few stocks; those excesses are reflected in too few indices. It’s a “recipe” for disaster and I’m a pretty good cook.