I had the pleasure to go back and forth with Sawyer Oliphant, chief bottle washer of QuantFarming this morning. While it is possible to “lead a horse” to water it’s not at all possible to be sure "the horse drinks”. Sawyer’s met my criteria of being consistent and despite his different style of “making money” what he represents compliments my own. That’s a good thing. Clicking his website and checking Sawyer out on LinkedIn makes sense. Do it and tell Sawyer that “The Ticker” sent you. Now it’s time to move forward with our regular show.

I’d Rather Be Early Than Late

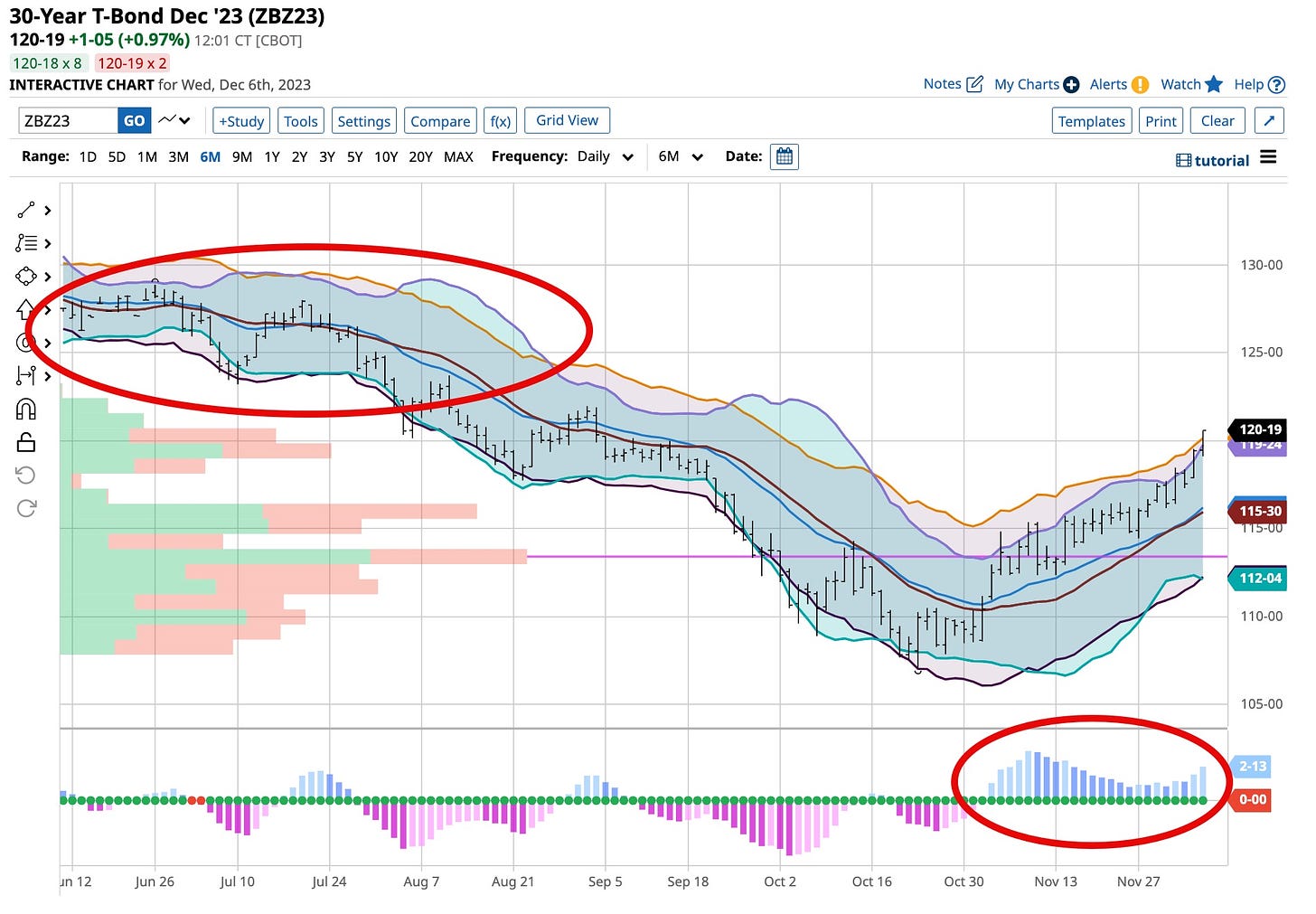

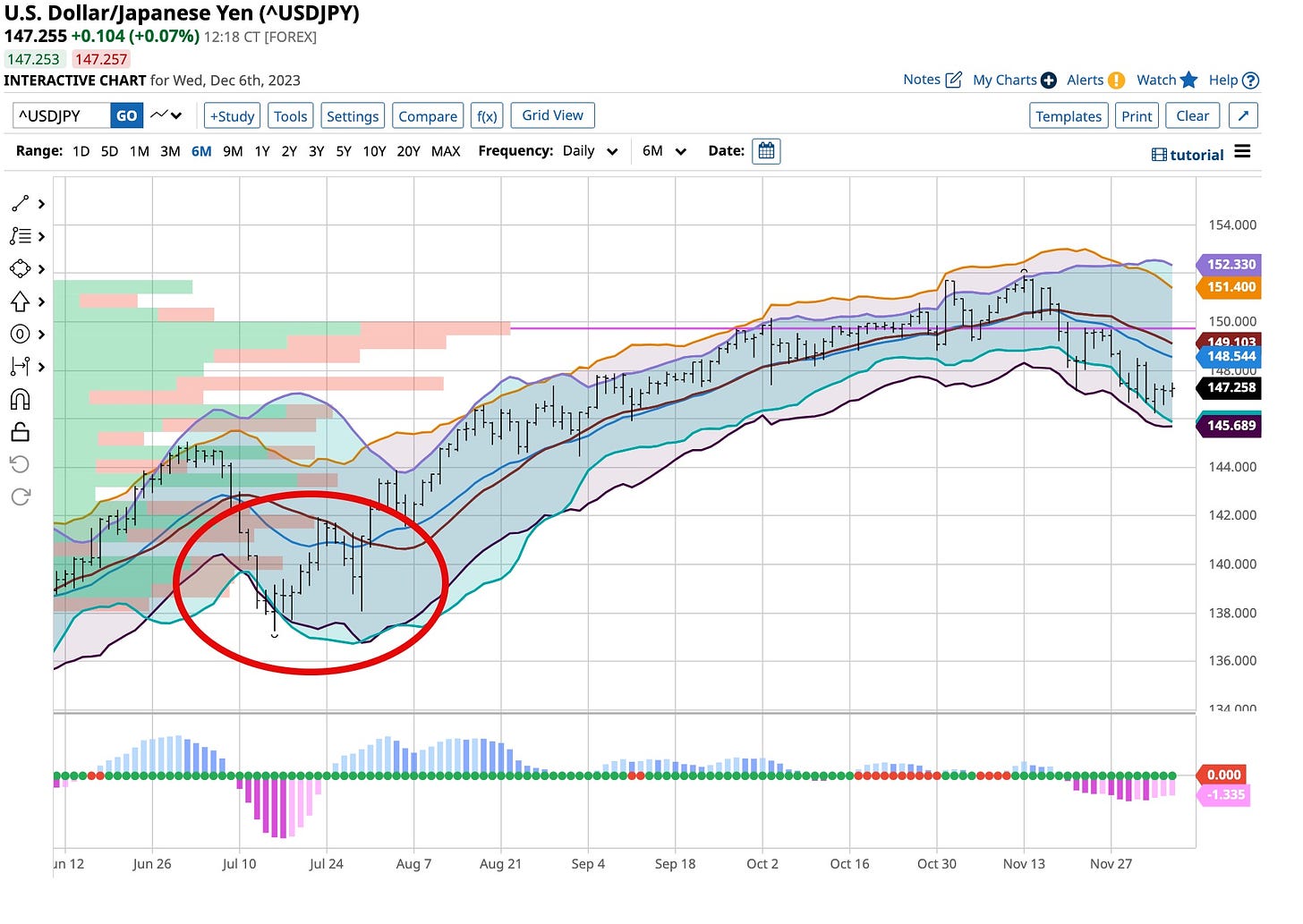

Sometimes, for all of you “fifteen minute” traders, my strategy simply doesn’t fit into your strategy. That’s OK with me and it should be with you too. I’m long ETF bond funds as well as being a firm believer that the Yen needs to head south. Those are the major “speculative” positions I currently maintain.

When it comes to my “cash” positions I’m long across the board in short, medium and long term bonds with a hefty position in gold bullion to hedge inflation. I’m a buyer of the “turnaround” stocks especially those that pay a “decent” dividend. I’ve suggested a few stocks to buy and I own them all. Another has been under accumulation and will be revealed to you in my regular “paid for” weekend article. Many of you have signed up for my “free” weekly Substack and the number of “paid for” Substack subscriptions is growing. Like me, everything good takes time but remember, the first month is free and all you need is one article’s recommendation to make and pay for your year.

I’m A Long Term Speculative Buyer On Weakness

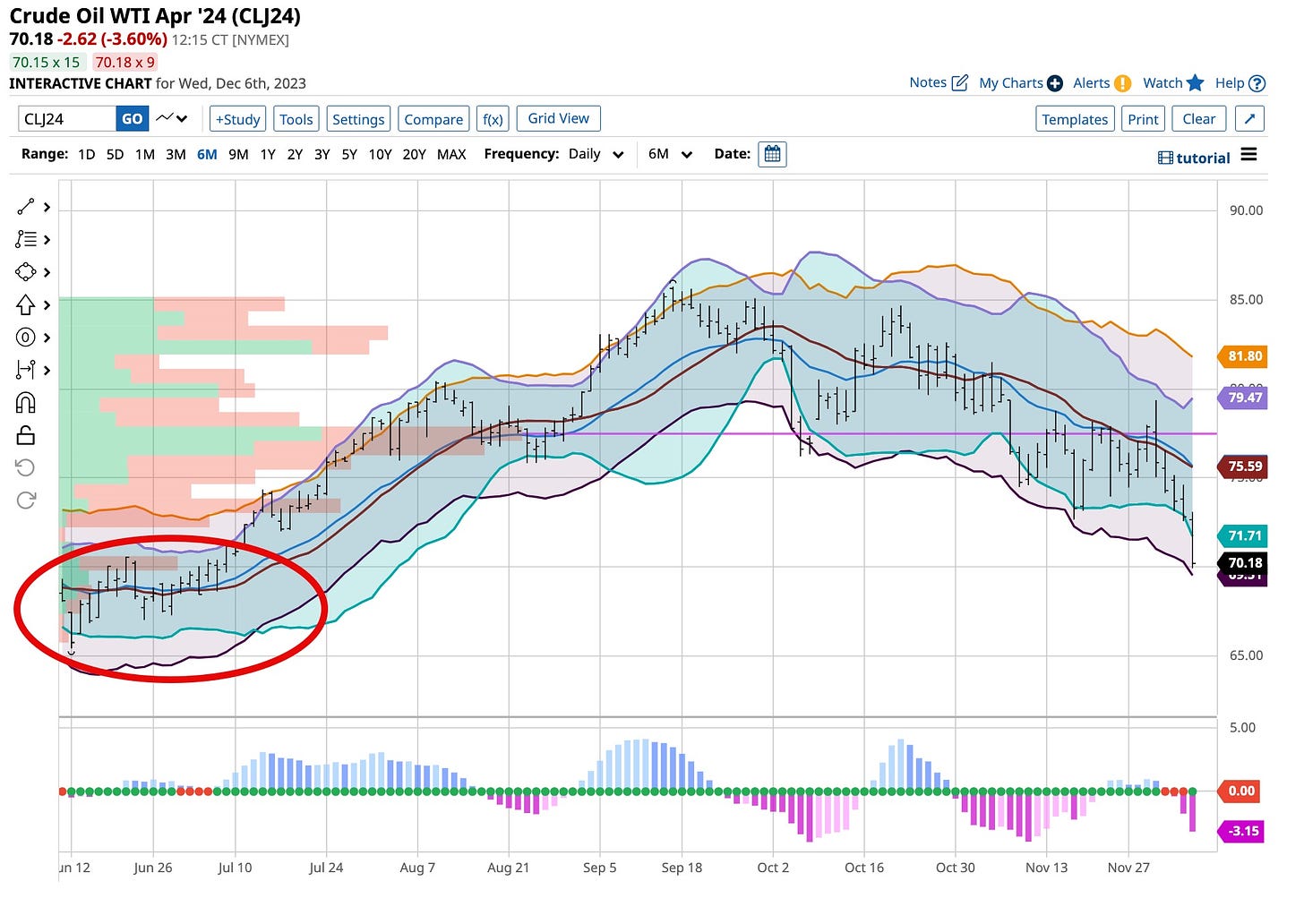

I’ll cut to the chase; I’m accumulating a long term position in July WTI 85 calls. My GTC orders are in and I’m happy to wait until they are hit. While I’ve looked closely at Natural Gas I’m not chasing it; quite frankly I’m looking for lower prices. At this time I’ll accumulate crude oil as the Middle East is on fire and our current administration doesn’t have what it takes to defuse the problem.

Otherwise, the softs seem to be in trouble. While I watched Cocoa, Sugar and Orange Juice “top” they are all too rich for my blood at this time. Maybe they are right for you as each of them helped to create the inflation we now see dissipating. Again, while it appears they are heading lower I’m content to just watch.

Powell Is Cornered

Admittedly I like Powell, not as much as I adored Volcker but it gets closer every day. He set his goals and stuck by them but there’s a problem; it’s an election year. Exactly how Powell and the Federal Reserve will act over the coming months is uncertain. In the short run the Federal Reserve will find it difficult to do anything. The “street” says rates are coming down and the “herd” is listening, so is John Navin.

Who the hell is John Navin you ask? John, a not enough well known Forbes writer is on Substack and LinkedIn. He’s pretty good folks and you should follow him. Like me he is not always right but he’s consistent. Take the time to click on his links, follow a bit of what he thinks. John is worth your time.

That’s it from me today. I’m working on my Udemy courses, getting the Ingram Spark books to the presses and waiting for an estimate from a vendor to “sweep” leaves from my yard. It’s a daunting task and I’m too old to do it myself.

“See Me, Feel Me / Listening To You” is as critical to Tommy and The Who as it is to each and every one of us. You have two ears and but one mouth; listen twice as much as you talk. You hav two eyes as well so read everything you can. Don’t just look for the articles that confirm your thoughts. Look for the opinions you disagree wih. They just might get you thinking differently. By the way, I’m a championship “Pinball” kind of guy. I heard Tommy years ago; he was right.