Another new year is upon us. It’s great to live in the “middle” of the country where we celebrated two new years events. Between Times Square and Nashville fireworks were heard especially when Lynyrd Skynyrd played in Nashville. Let’s just hope none of the negative shenanigans we feared would surface took center stage.

I rattled a few “chains” with the S&P 500 P/E ratio I follow. Push comes to shove, the one I follow is above 30. Others follow numbers that approach 27. As Hillary Clinton said “what difference does it make” and in this case she’s right. They’re overvalued in either case so “deal with it”. The market as I evaluate it is too high. Earnings as we see are not growing fast enough. While the market could go higher, those I’ve known for years think there’s trouble brewing. I’ll stick with what I’m doing as we embark upon 2024 but stay tuned as the times they are a changing.

S&P 500 P/E Ratio

While an investor by trade I’m a teacher at heart. It would be nice if more people took the time to listen but in reality tens of thousands already are. If you’re not one of them sign up here on Substack or on LinkedIn. I’m just getting started.

The P/E ratio is a classic measure of a stock's value. It indicates just how many years of profits it takes to recoup an investment in the stock. The current S&P 500 10-year P/E Ratio is 30.9. This is 52.9% above the modern-era market average of 20.2, putting the current P/E 1.3 standard deviations above the modern-era average. This suggests that the market is grossly overvalued.

P/E ratios can only go so high. To justify a P/E ratio that is consistently above its own historic average for long periods of time, the US stock market must not only continue to grow, but would need to continue to grow at a continuously increasing rate. If rates have peaked in an inverted yield curve market and decreases are becoming more likely than not, it is unlikely to happen. The Federal Reserve is not inclined to lower rates if “things” are good. What do they know that we do not?

P/E ratios are a fundamental stock valuation analysis and are most commonly looked at for individual firms. The P/E ratio is an actual ratio of a stock price divided by the firm's yearly earnings per share. P/E is best calculated using the last reported actual earnings of the company. The same analysis can be done to the “entire” stock market. By adding up the price of every share in the S&P 500, and comparing it to the sum of all earnings-per-share generated by those companies, you can easily calculate the P/E ratio of the US stock market. That’s too complicated for me so I’ll just trust my source as being accurate.

The ratio has risen over time and particularly since around 2000 when technology and growth stocks became increasingly dominant. One cannot compare today's market to the 1800's so it’s best to try to determine what the natural rate of increase here should be. Rates are coming down and lower interest rates generally justify higher valuations. They reduce the cost of capital and increase the “present value” of future cash flows. I think that may very well justify the position of many speculators, especially those who own the “AI” stocks but I’m an “old timer” at heart. There must be more to this story.

Trust me, I’ve looked for an answer to this dilemma for years. When the “COVID-19” pandemic hit it was easy to close your eyes and buy. It helped to have the guidance of The Motley Fool as their analysis of what to buy separated the wheat from the chaff. They weren’t much help when the markets topped in November of 2021. They bought into the analysis of higher P/E ratios. I did not and with interest rates about to soar I finished selling the equities I bought and didn’t look back.

Now with interest rates potentially “plunging” perhaps this newest analysis is correct. I don’t know but I’m certainly going to give it a hard look. Maybe the market becomes a “buy” if the P/E ratio drops to 20 versus the lower level that triggered my earlier 2020 buy. It’s going to take me some time to watch and listen to what others think but I’ve done it for years and there’s no reason to change anything now. Stay tuned, I will keep you in the loop as I uncover the answer. Now let’s review what’s happening as we kick of 2024.

Nothing’s Really Changed

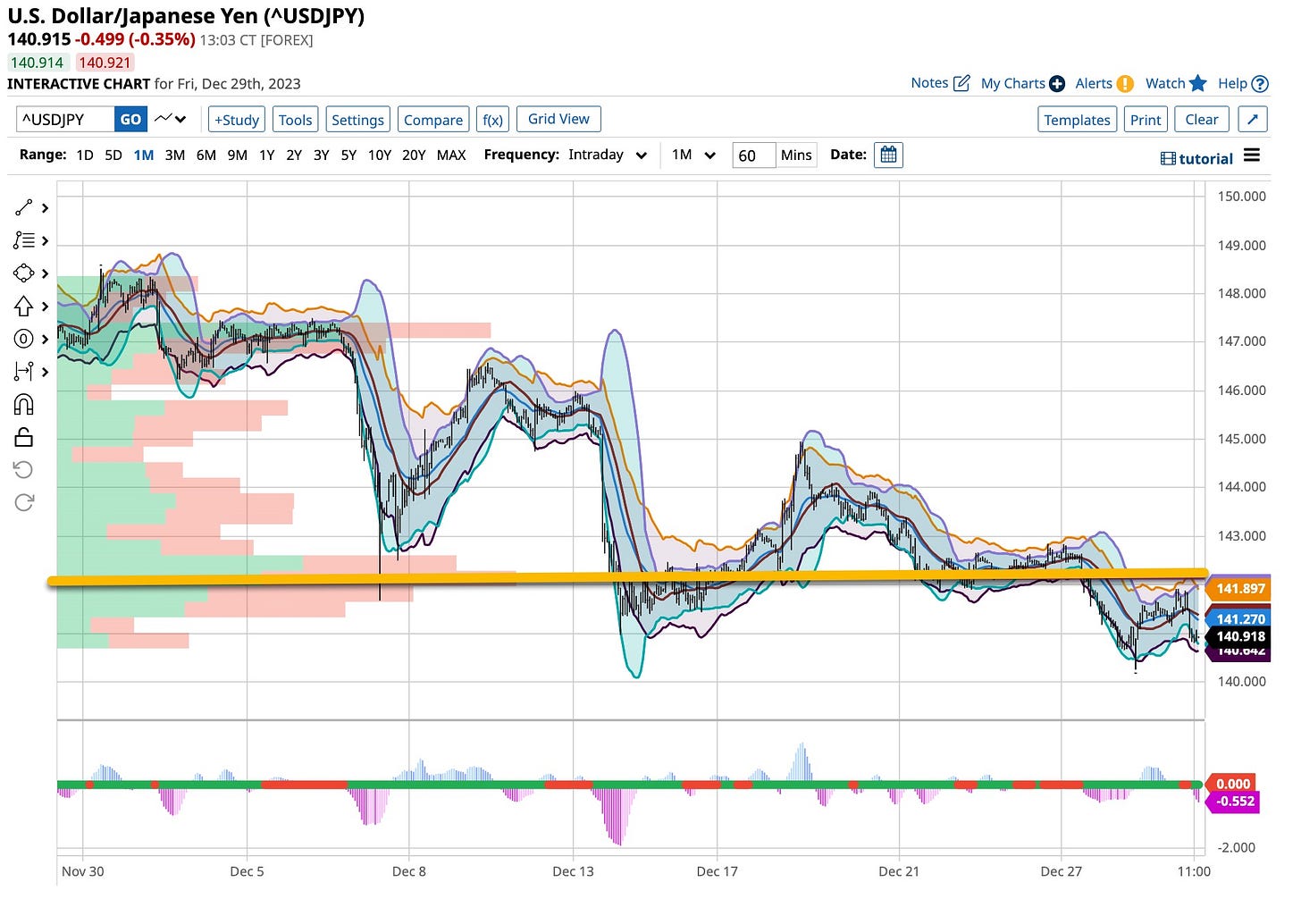

For those of you looking for the seas to part as the moon moves closer to the earth you are reading the wrong thread. As I’ve said before and reiterate again, I’m boring. I’ve been long bonds, short the Dollar versus the Yen, a buyer of “turnaround” and higher paying dividend stocks and more. I’m not going to rehash it all, just go back and read what I’ve posted. Nothing has changed but the prices; they are higher than my entries and that’s a good thing.

I’ve been playing around in the futures and options markets employing a strategy of just selling when they buy and buying when they sell. With that in ind, here’s a couple positions I’m working with.

Although a bit different than Sugar and Orange Juice, it is my belief that Cocoa has seen its top. I’ve been watching this one for months, sitting on the sideline as I have essentially sat on my hands. That changed last week and I’m short at 4,300. I thought it was going to vacillate around that level but I was wrong, it fell. I’ll keep both “eyes” on it and “ears” close to those in the marketplace as I’m not going to give up profits. I am still not sure if it will follow Sugar and Orange Juice but my sense is that Cocoa is going to come “back down to Earth”.

Can you believe the sheer amount of attention Gold has received over the last couple months? As stated, I see when they buy so right now I hope all of the prognosticators are right. In the Roth IRAs I manage Gold bullion makes up a bit less than 7% to 8% of the portfolio. I’ll be happy to reduce that percentage in half if gold soars.

Over the last month or so I have had many investors ask me how to protect against the upcoming decline in the Dollar. At the same time, I’ve been watching Governor Ueda look for an opportunity to raise rates in Japan. It’s a very simple solution and with my entry at the 150 level I’m killing two birds with one stone. The Dollar is headed down and the Yen is headed up. For those of you who are “paid” members of Substack and those who are actually paying for my market timed advice you are more than welcome to “bother” me at david@thetickeredu.com.

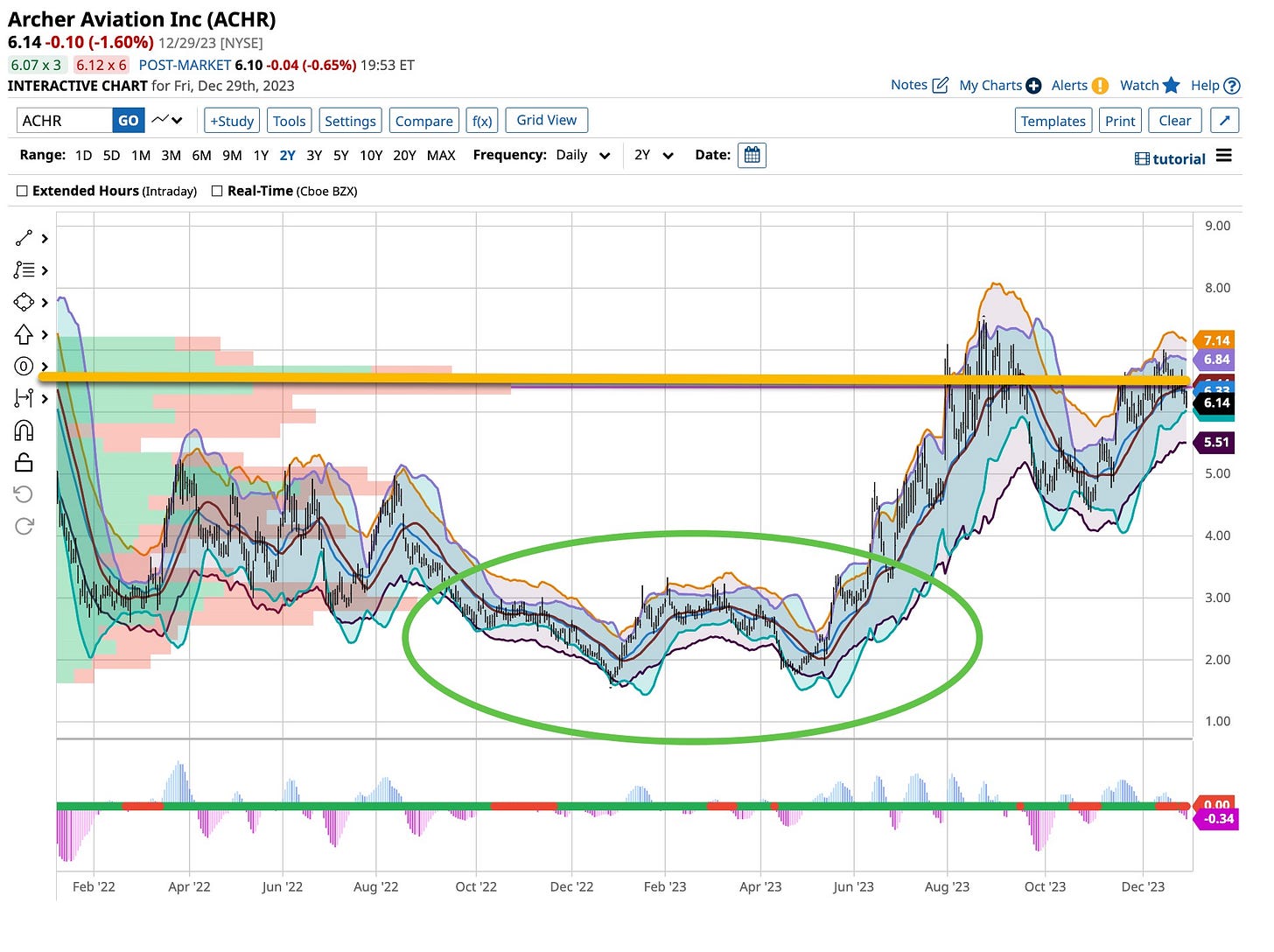

There’s more but I thought I’d conclude my 2024 introductory article with a new one, a speculative stock I bought a little of earlier last year, adding a few more shares over the last couple months and find it of interest, Archer Aviation.

Archer Aviation Inc (NYSE:ACHR): Q2 Institutional Holders: 138 Q3 Institutional Holders: 189 Percentage Growth: 36.9% YTD Return: 235%

Archer Aviation, is a “trailblazer” in the aviation industry, “revolutionizing” air travel through the development of electric aircraft. October of this year marked a significant milestone for the company, as Stellantis (“STLA”), a U.S. automaker acquired over 12.3 million shares of Archer. ARK Investment Management, is nicely supporting Archer's ambitions to build and design “cutting-edge” electric aircraft. Notably, the company is still in a pre-revenue stage, which is not uncommon for firms in their early stages of development, particularly in the high technology sector.

The company reported $460 million in cash and equivalents, versus total liabilities of just $175 million. This healthy liquidity ratio grants flexibility to concentrate fully on research and development, which is crucial for a company in the technology-intensive aviation sector.

Another positive indicator of the company's financial management is the significant reduction in its cash burn rate. In the third quarter, cash burn fell to $51 million, well below its average burn of over $100 million in the previous four to five quarters. This reduction in expenditure reflects efficient cost management and strategic planning,

ARK Investment Management is not the only “institutional” investor on board , Two Sigma Investments, JP Morgan and many more were all holding positions in Archer at the end of Q3 as well. I’m on board as well and suggest you take a look.

Well, welcome to 2024 and thanks for everything all of you did for me in 2023. There’s a lot more coming from The Ticker EDU in 2024 so stay tuned. In the interim sign up and enjoy what we have to offer. Udemy courses are on their way, the book looks great and it’s a new year where The Ticker EDU is about to take flight. Trust you will be on board with a happy healthy new year had by all. Best always and thanks.

Sinatra was the best. “Come Fly With Me” says it all. Not just because I’m telling you about Archer Aviation and what’s happening at The Ticker EDU, there’s more. It’s a new year folks. Everyone is excited about something new, right? I am and 2024 looks like a good bet. Maybe Powell has the magic bullet to pulling off a “soft lading”. Seems to me that regardless change is in the air politically and more. People are not stupid and with a political year before us admit it, it’s going to be fun. So once again, happy healthy year to you and yours and thanks for everything you have done for me. Stay on board as The Ticker EDU is just taking flight.