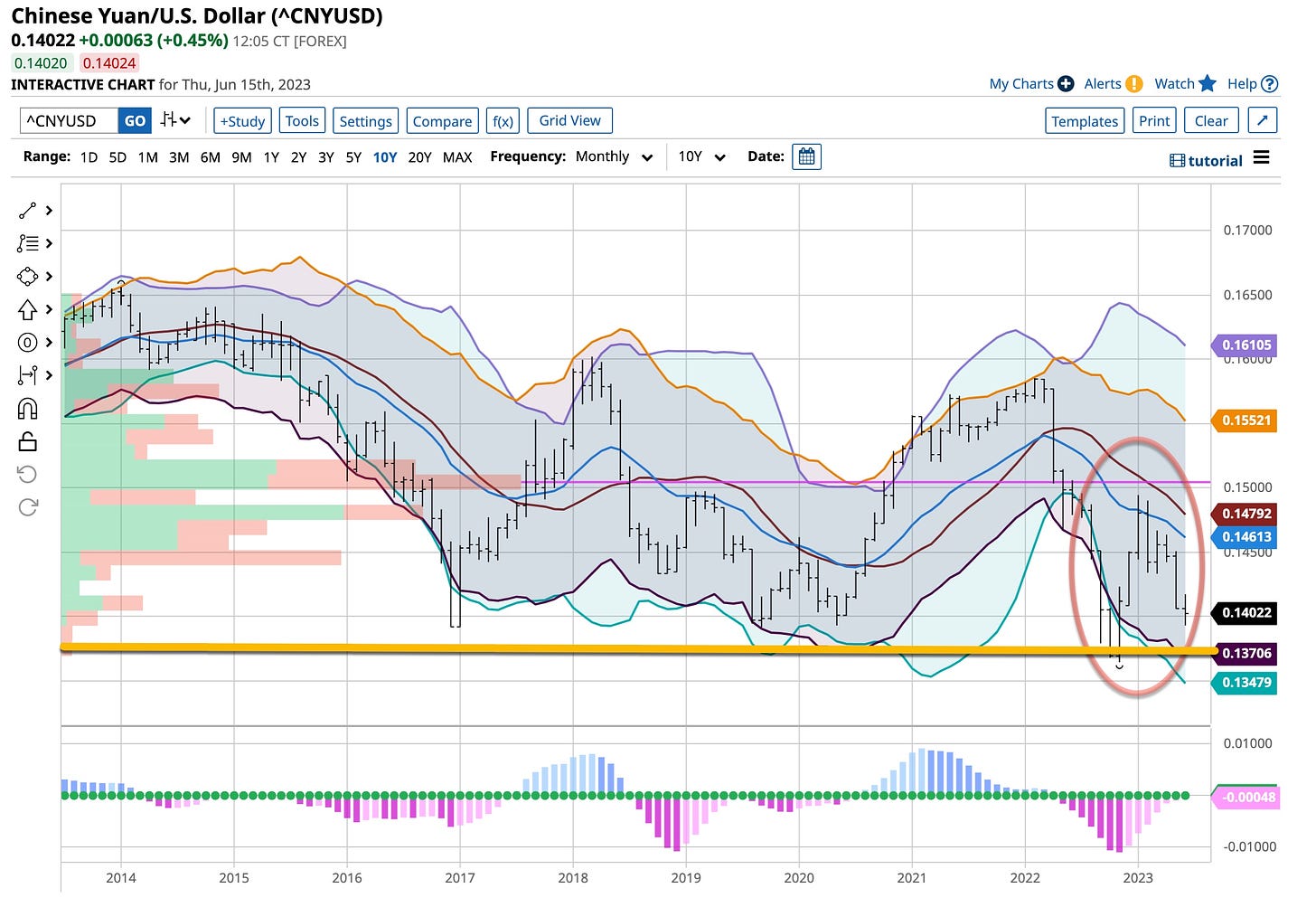

A “funny thing happened” on the way to the collapse; interpretations of a plethora of news was treated with utter disregard presenting me, a long term position trader with a “wick” opportunity, to look to add to my short Yuan position. After running up post many negative announcements, the Yuan reversed course now declining more than it had earlier advanced. But enough of the trading opportunities, beginning today then continuing through Sunday I’ll talk about the topic of “relationships” enlightening all with what I’ve experienced over 55+ years in the currency markets. Back to the news.

Labor Unrest In China

What happens when workers' pay is cut and plants are shut down in China? Surging to a 7-year high, strikes are becoming more prevalent as the demand for what’s being produced, inside and outside of China decreases. China has recently reported, exports have tumbled and are expected to fall further as economic downturns across the world gain momentum. Face it, inflation is the key driver of monetary policy in Europe and the United States, both of which are fighting to reduce its impact.

Chinese factories produce upwards of a third of globally manufactured goods. Supply, chain disruptions are expected to follow as the forecasting of future demand becomes more difficult in China. With factories looking to reduce costs, one variable, its labor force is vulnerable. Another political headache exacerbated by production capabilities coming on worldwide to compete with Chinese capacity. The headaches for Chairman Xi continue to build.

Factory Output / Retail Sales / Fixed Asset Investment Miss Expectations

Despite increasing by 3.5% China's industrial output slightly missed its expectations. Retail sales jumped 12.7% versus an expected 13.6% increase. Fixed asset investment expanded 4.0% in the first five months of 2023 versus expectations for a 4.4% rise. It seems that China’s 1st quarter economic rebound has clearly lost momentum leading to some key interest rate cuts.

Property Investment / Sales Fell At Faster Pace

Property investment from January to May in China dropped at a 7.2% rate versus last year’s reported numbers. The property sales by floor area declined 0.9%, versus a 0.4% fall in the first four months. New construction starts measured by floor area fell 22.6%, after a 21.2% drop in the first four months. Funds raised by property developers were down 6.6% after a 6.4% slide in January-April. Things aren’t good, are they?

China’s Youth Unemployment Hits Record High

China’s youth unemployment rose to a record in May according to the data released Thursday by the National Bureau of Statistics. The unemployment rate for workers ages 16 to 24 rose to 20.8% in May, a record and well above the high set in April. The overall jobless rate for people of all ages in cities was 5.2% in May.

China Cuts Medium-Term Loan Rates

China's central bank cut the borrowing cost of its medium-term policy loans for the first time in 10 months on Thursday as expected as its stimulus measures ramp up to shore up a shaky economic recovery. These cuts pave the way for future reductions in China's benchmark lending rates next Tuesday. The People's Bank of China (PBoC) lowered the rate to 2.65%, from 2.75%.

Recent data has shown China's recovery is stalling as its domestic and global demand falters and the crisis-hit property sector fails to gain any traction, raising expectations that authorities need to do more to spur growth and keep a lid on unemployment. The problem China has revolves around other global central banks raising interest rates to combat inflation. That could lead to additional capital outflows from China.

I’m just reporting to you what hit the news wires over the last day or so. Remember, I’m a long-term position trader. My primary background is in the currency segment; it’s the most predictable. These “relationships” create cyclical patterns that in most cases run for years. Inherently when interest rates are increased, underlying values of their currencies increase; it’s a simple supply and demand equation. Investors seeking a better return on their investment move to where rates are higher. Many other factors compliment the overall decision making process and given the time I’ll address those over the next few days. Until then, let’s see what action, if any, the BoJ takes tonight as a busy week of central bank activity comes to a close. Confusing to a degree but for me, a great tool to teach from.

Alright folks, one more night to go. Working “day and night” as I’ve been on this very busy week takes its toll. Remember, I’m just a “young” 68 years old and trust me, the lack of sleep has a tendency to make the “crystal ball” cloudier.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

Lionel Ritchie had the right idea with “All Night Long”. From my favorite book of all time, “The Fountainhead” by Ayn Rand, Roark says ‘choose whatever work you decide to do carefully; for the next 60 years or so of your life that’s what you’ll do”. While it’s important to make money, enjoying how you made it is equally if not more important. I love what I’m doing, always have and appreciate you, my followers who are as well. Big weekend of learning in my core field of currency trading coming; stay tuned.