Where do I start? Not being one to believe everything that’s reported out of China, a little more fuel was “spilled on that fire” last night when Chinese FDI, Foreign Direct Investment, year-to-date, year-over-year was not reported as expected earlier in the morning. Seems that would be a critical macroeconomic number to review given the information coming from earth’s “Red Giant” has failed to impress as of late. Maybe Chairman Xi forgot to “hit the button”. Let’s hope that’s the only button he forgets to hit. Far too often, regardless of where in the world it occurs, countries entrenched in economic turmoil too often resort to supporting their military industrial complexes to spend their way out of chaos. Again, let’s hope that’s not the case. Given the Taiwan issue, coupled with a perceived weakness in our current administration, one can only hold their breath and watch.

Articles about China’s problems have proliferated on the news wires. Bond markets put Chinese and global rates on opposite paths. They are outwardly speculating on cuts in China against hikes in the U.S., prompting banks and Chinese companies to prepare for the worst, a weaker currency as Beijing rolls out more stimulus.

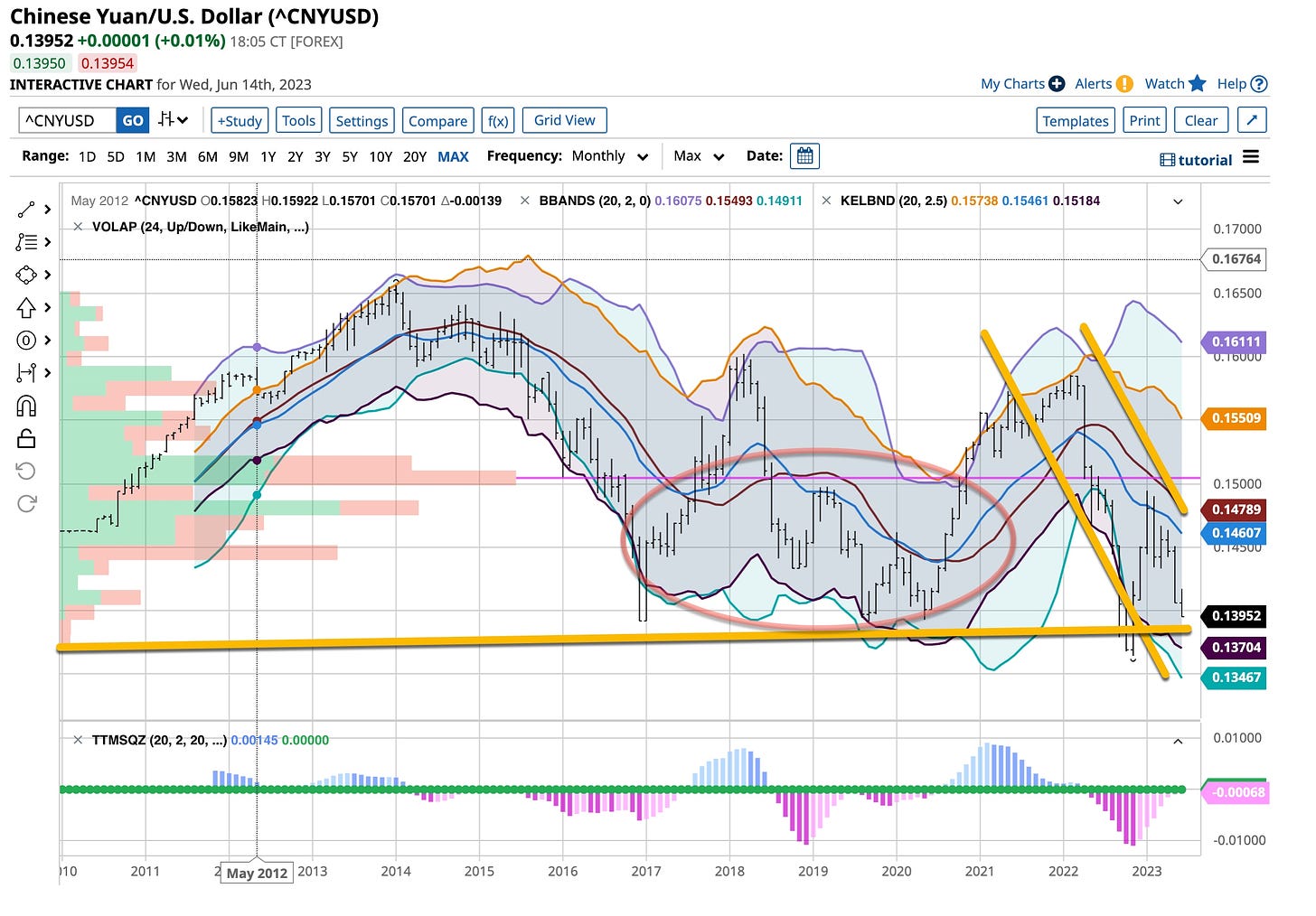

The Yuan, although experiencing a “dead cat” bounce today crashed through the $7 level in May and has continued to drop. China's post-pandemic economic recovery has faltered, to say the least exacerbated by weak demand at home and now abroad. J.P. Morgan downgraded its year-end Yuan forecast, from $6.85 to $7.25 per dollar.

The People's Bank of China (“PBoC”) is accustomed to dealing with weakness in its currency and they’re currently exhibiting that. The Yuan has lost nearly 4% so far this year to $7.16 making it one of the worst performing Asian currencies in 2023. Some investment banks expect the Yuan to end the year even lower.

This week China cut its reverse repo rate and another short-term commercial bank cash rate, signaling further policy easing is on the way. Chances are that the PBoC will cut the costs of medium-term loans Thursday then cut its benchmark lending rate next week, I believe on June 20th but don’t quote me on that, we have enough to watch between now and then.

Goldman Sachs published a report suggesting an “L”=shaped recovery in the property side of the Chinese macroeconomic sector. It’s hard for me to “bank” on anything they say post the economic debacle of 2007-2009. Besides, they’re always looking for new business in China so to say the least, their “tentacles run deep”. Nonetheless, they are just reporting what the world already knows; property stocks in China are not where you want to put your money.

Goldman Sachs suggests the property sector accounted for about a quarter of China’s overall GDP as of 2021 so it is something to keep your eye on. I’m not experienced or able to understand the China markets as well as others; I’m just reporting on what I’m reading and it doesn’t look good. In the past Beijing engineered an economic “up-cycle” geared towards propping up this sector. Seems that the ultimate results didn’t warrant the investment. Are we witnessing a crisis similar to our own financial crisis, partially self-inflicted with real estate being the underlying culprit in China? Might very well be; history does repeat itself, often in different places around the globe but in essence, it’s the same old story.

So What Did The Fed Do

Right from the horse’s mouth, here’s what the Fed just issued, statement wise:

“Recent indicators suggest that economic activity has continued to expand at a modest pace. Job gains have been robust in recent months, and the unemployment rate has remained low. Inflation remains elevated.

The U.S. banking system is sound and resilient. Tighter credit conditions for households and businesses are likely to weigh on economic activity, hiring, and inflation. The extent of these effects remains uncertain. The Committee remains highly attentive to inflation risks.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5 to 5-1/4 percent. Holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy. In determining the extent of additional policy firming that may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lisa D. Cook; Austan D. Goolsbee; Patrick Harker; Philip N. Jefferson; Neel Kashkari; Lorie K. Logan; and Christopher J. Waller.”

The initial reaction to the pause, followed with the hawkish sentiment of “we’re not done raising rates yet” reverberated with an initial downside move in the indices, a bit of a recovery Dollar wise, Gold and Treasuries retreating, giving up today’s gains and other contracts, tied to the Dollar retreating. What did you expect? Now it’s time to listen to a little “Powell Speak”. I’m impressed; he’s even starting to look like Volcker.

Click here and listen for yourself. The best way to learn is first hand. In my estimation Powell is what we need at this present economic time; “damn the torpedoes full speed ahead” albeit a slight break so to assess how much higher and how fast rates need to go but rest assured, rates are going higher and staying there for a much longer period of time.

Alright folks, it’s been a busy day and it’s going to be a busy night with lots to watch. I am just watching and reporting in this week. Yes, I initiated a small position on the short side but more than likely I’ll just sit back and let it ride unless the markets, for absolutely no reason head higher. Working “day and night” as I’ve been on this very busy week takes its toll. Remember, I’m just a “young” 68 years old and trust me, the lack of sleep has a tendency to make the “crystal ball” even cloudier.

Everyone learns at their own pace. If you pick everything up the first time through, great but if not email me at david@thetickeredu.com so we can further help. Again, let me know what you want to learn, I’m all ears.

How about a little lesser known Jerry Garcia and the Grateful Dead singing “China Doll”. I only saw the Grateful Dead a couple times and honestly don’t remember too much. Interesting reflection of the times shared growing up. I’m sure we’ll play a few of their tunes at my upcoming 50th high school reunion. Be well; catch you tonight.