It’s the end of a very interesting year. Artificial Intelligence took hold as did the high flying “Internet” stocks of the late 1990s. Is that an omen of disaster, who knows but remember, I call myself and this publication ‘The Ticker” for reason. These markets are alive, they have a “heartbeat”, one we all need to listen to and watch. While few are as obsessed as I am about doing just that, I post.

In short I’m a worrier. That does not mean I’m not an investor or trader. When push comes to shove I’m a hedger and have been so forever. Producers and consumers both make and use “things”. They always have and they always will. While staying ahead of the curve is important, ensuring returns, just like Buffett and the late Charlie Munger do and did, is paramount. Unlike those who only post their “winners” on Facebook or other social media “promoters” I’m happy to tell you when I’m wrong. Better yet, I’ll tell you why as everyone learns better from their mistakes.

So let’s take a look at last year and exactly what happened, where we were “invested” and a short story about where we are headed. Both this article and my upcoming year end post this Sunday are free. That’s right I’m not going to make you pay to read it. I want many people, trader or investors, to open their eyes and ears to that “space that is between your ears” and soak it all in. Times “they are a changing” but that’s always the case; you have two ears and eyes, use them instead of your one mouth and you will see better results.

What A Year 2023 Was

Face it, every year is different from the last and few are similar to the next one. That’s a good thing, right? I think so as in my life “change” is a good thing and that’s what we saw last year. I expect the same next year. How about you?

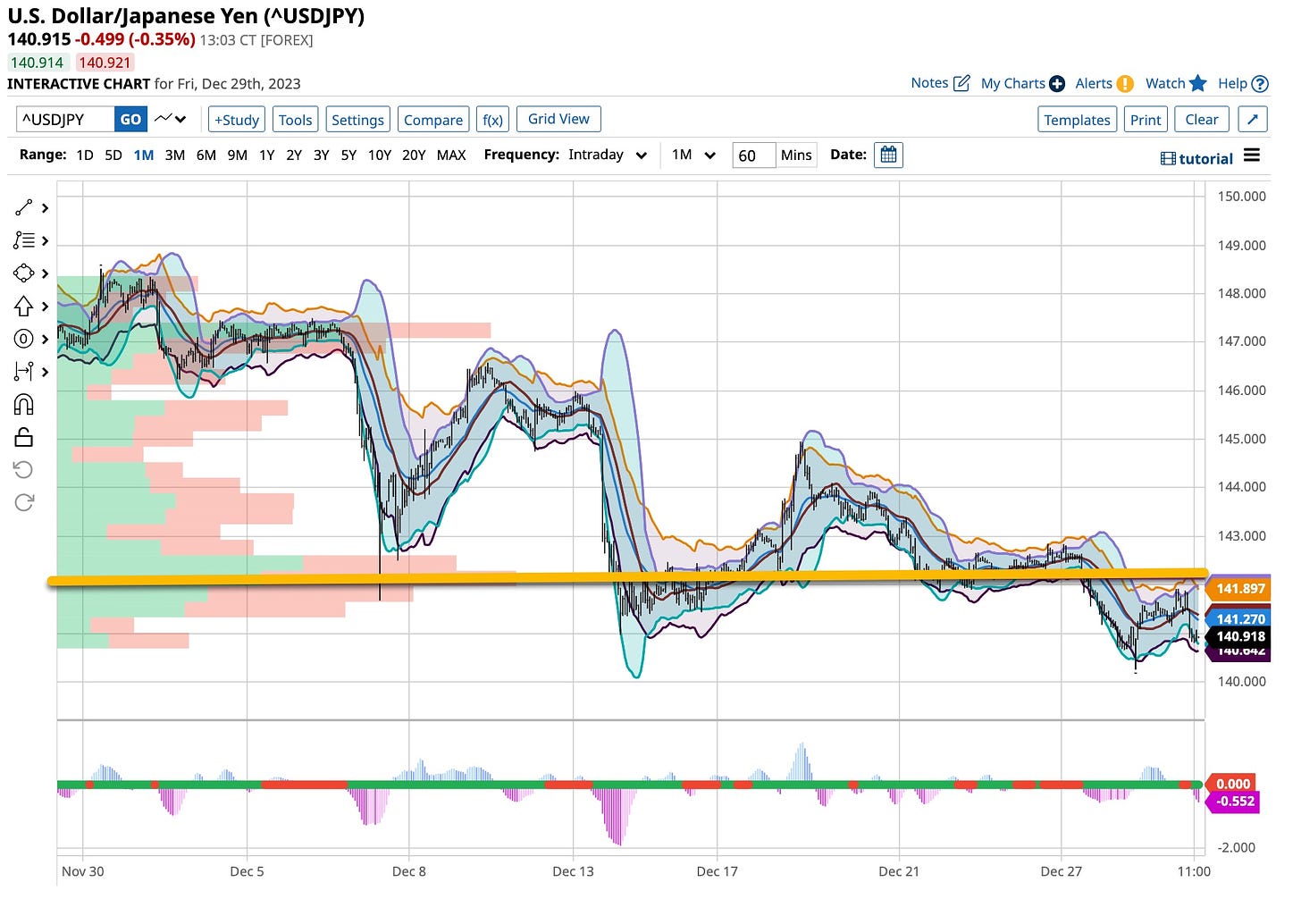

It seems that the Federal Reserve has accomplished it’s goal. Rates have topped and it is time to start bringing them down. I’ve been an interest rate buying demon for years. Not enough people listened a while back but they did so recently. My largest holding remains in this arena, both short and long term U.S. Governments and that simply is a good thing. I’ve added a plethora of solid, higher dividend paying stocks, turnaround candidates and, given my basic “hedge” philosophy, oil producers. So far so good but one investment I made is catching the interest of everyone, the Yen especially versus the U.S. Dollar. In short, what goes up must come down and what went down must come up. Buy when they sell and sell when they buy. When you are able do that with a single trade take advantage of it.

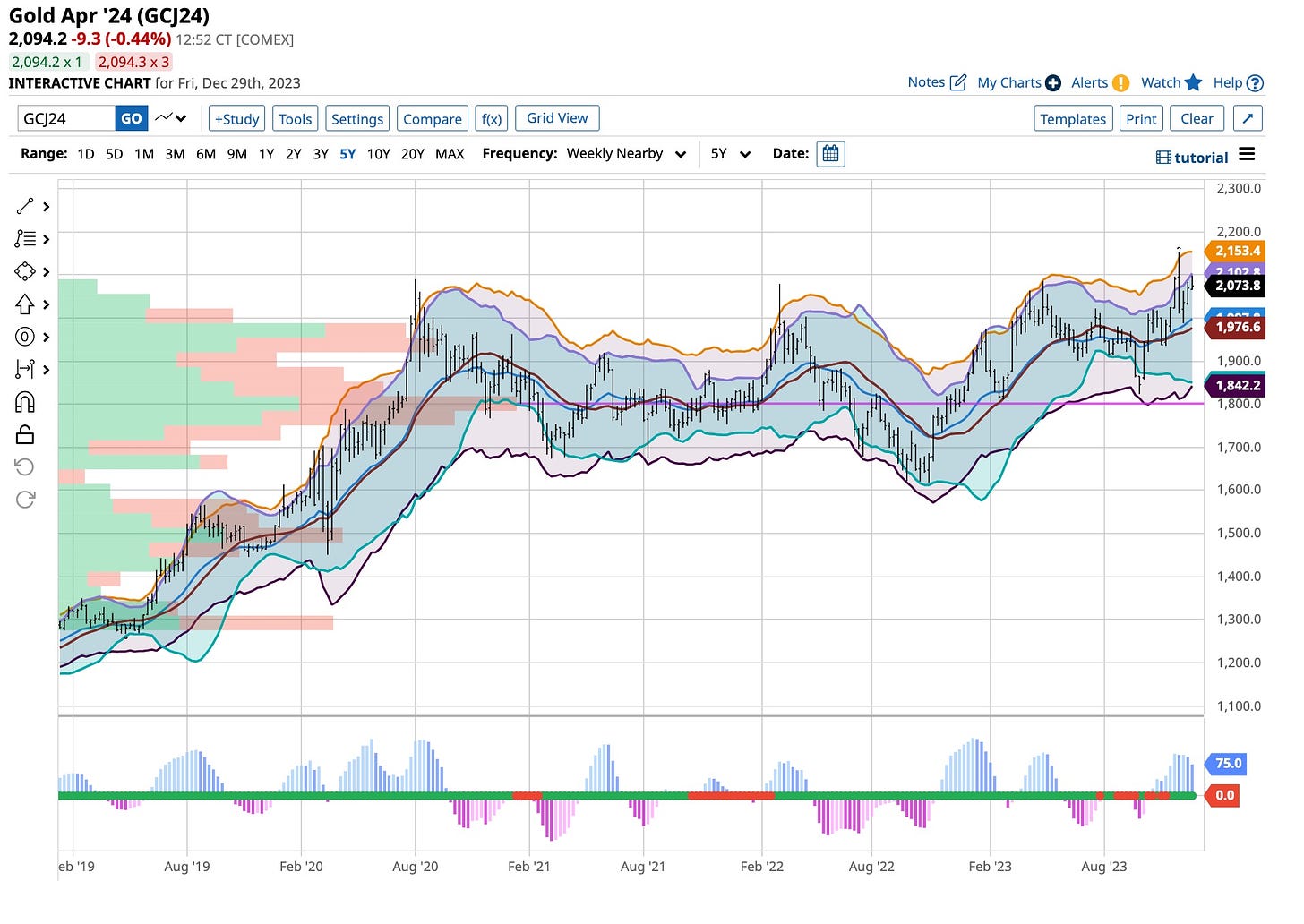

While I believe gold is heading higher as interest rates decline I’m not a buyer at this level. I have a large holding in gold bullion and have been waiting for this day. Go to higher levels gold, please. I’ll be selling half of my total gold holdings all the way up if it does. No one wanted it lower when I bought it. Yup, buy when they sell worked like it usually does.

So tried and true practices do have their benefits. That’s why I’m both a long term oil call buyer. It’s a hedge and besides most others, including my favorite, the “street” is professing oil heading lower. I hope so as I’ll be happy to add a few more call options. You should too.

Then there’s my last hedge, the markets. A couple years ago I made a small fortune on buying VIX calls. Just ask my candy supplier, follower and friend Brandon Donahue if you have any question; he’ll tell you. Well, I’m back. Not to the same degree as before but I’m long the 2024 March VIX 17 calls and the position is growing. If I were you I’d watch both and this thread as well for more.

Tom Smothers Was My Hero

What can I say, I was a child of the 60s. Besides that like many of you I thrive on basic controversy and that’s what the Smothers Brothers delivered. There are some things in life that simply cannot be replaced and Tom Smothers is one of them. Going to miss you Tom, rest in peace. Thanks for helping to make me a bit of what I am today

It’s a holiday weekend folks and family comes first, that is after I get the grass cut, the Udemy courses, all seven or eight of them filmed and the “infamous” first edition of “The Ticker’s Bible” approved. Remember, this and this weekend’s postings are free. That doesn’t mean you can’t join all others who have “paid” our annual fee of $99.00 to join. They not only get to keep in better touch directly with yours truly, they are going to receive a signed, dust covered, first edition of my book. Such a deal, eh?

So my best to you all and since you can never wish each other “Happy, Healthy New Year” enough times I say it again here. May you and yours have a happy and above all a “healthy” new year. If you have your health you have it all.

“Time may change me but I can’t waste time”. Prophetic to say the least as were many lyrics David Bowie brought to our attention. Think about it, we are a “function” of the world we live in. We can assess what’s transpiring but as they’ve said, “man plans and God laughs”. It’s true. Doesn’t make a whole hell of a lot of difference in reality. We’re but a “speck” in this universe we live in. Our opinions matter even less so enjoy your time as well as anyone else. Have a happy, healthy year folks and stay tuned. Sunday’s article is a pretty good one.