It is hard to believe it’s been more than a couple of years to get a “message out” that there is a “right way” to become a “better trader and investor”. More importantly, it’s how that message hits you that makes all of the difference in the world. It’s taken The Ticker time to figure this all out as well. While I would like to “teach” the whole world I realize that is not possible.

There are many of you who no matter how much you think you know, the true essence of knowledge remains outside of your grasp. I’d love to be able to change that. I doubt that I can until you are ready to give The Ticker the chance. While I hope you do I am not going to wait for that to happen but I’m here in case it does.

More importantly, some have already ‘adopted’ my boring, long-term position trading and investment style that incorporates hedging. Regardless of how “right” anyone can be, there’s always that “out-of-nowhere” event that brings you back to reality. I am old enough to remember everything beginning with the OPEC oil embargo, the Dot.com bubble, and the 2008 financial crisis. What’s next, there are many theories out there.

One thing for certain is what The Ticker members are asking for. More education but this time they’re looking at “1-on-1” tutorials. They’re the smart ones and we’re happy to oblige. We’re going to have an Independence Day deal out next week but those here and on LinkedIn will see it later this week. It’s on our website so check it out. We are serious. It’s not for everyone, especially those who know, or at least think they “know” more than me. Otherwise, sign up and get time directly with The Ticker. It’s priceless and $1,500 of value can be yours for just $247.

So What Else Is New

Well, if you were already a member of The Ticker you would know. As I said, it’s been a couple of years and it’s time to change things around. I used to post my thoughts on LinkedIn. That’s pretty much stopped as those who followed me there are either here or better yet they’re The Ticker members. Now it’s your turn. That's right all of you who follow me on Substack can hear my “thoughts” before I post them. I’ll never give you a summary like other posters of what you should have watched or listened to. No, I am not interested in recaps. I’m interested in your learning and that doesn’t happen from recaps. It happens from postings and articles like this one that hit The Ticker.

How About That Volkswagen

Volkswagen is combining forces with Rivian.

Volkswagen (“VOWG”), the German carmaker, announced a major investment plan in Rivian Automotive Inc (“RIVN”), an American electric vehicle (EV) maker. This partnership, which could see investments reaching $5 billion by 2026, forms a joint venture for sharing knowledge on EV architecture and software. This news boosted Rivian's shares by 36.3% in after-hours trading.

The collaboration will fast-track Volkswagen's plans to create software-defined vehicles, with Rivian providing its existing intellectual property rights to the joint venture. The automotive industry is currently navigating through unique challenges. While EV startups are dealing with reduced demand due to high interest rates and limited funds, traditional carmakers are trying to master the production of battery-powered vehicles and advanced software.

That’s all well and good but in my eyes, there is something more. I’ve always been apprehensive about the EV industry. I never saw a way, for those producing electric vehicles, to service them. I did see Ford and General Motors enter the field with servicing their vehicles in mind but they ran into “roadblocks” so to speak. It’s a newly created industry, filled with problems that car dealers and insurance providers did not fully grasp. I’ve been waiting for someone to take the action we see today. My question is, who’s next?

I’ve been a believer in Ford for years but there are many Ford-type entities in today’s market. We have the German manufacturers, Stellantis, Tata Motors, General Motors, Toyota, and more. The fact that Volkswagen took the lead means nothing more than these entities will have to follow.

There’s more to this story but bringing it to your attention is a necessity. It’s a real game changer that everyone needs to put between their ears and watch. For years I thought that Tesla was a target of Ford and in my opinion, it still is but uncertainty rules, as does multibillionaire owners. I’ll be on guard for what’s next and you should be as well.

A Couple Oldies But Goodies

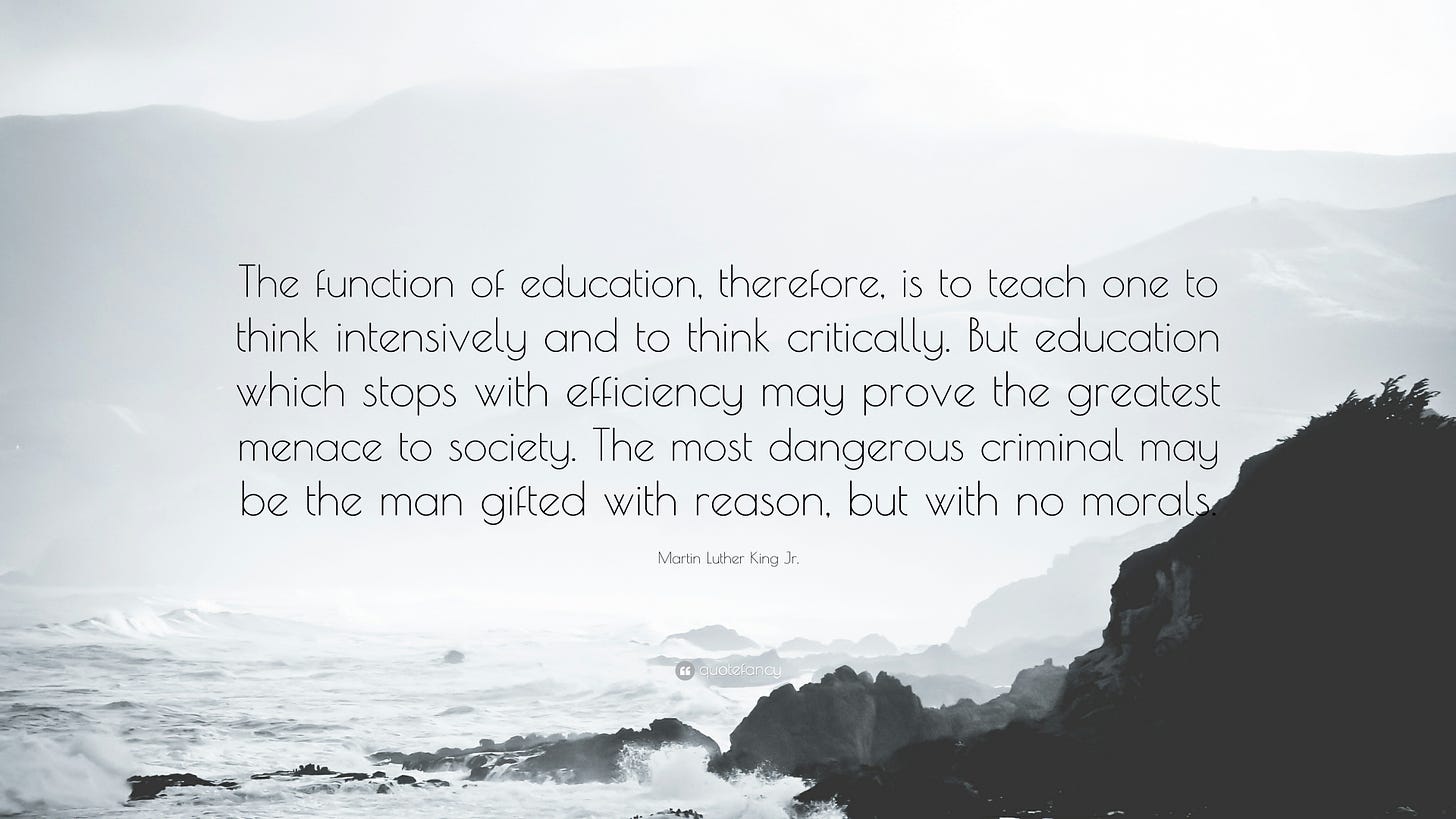

Delta Air Lines (“DAL”) is an airline company that has a fleet of approximately 1,273 aircraft. It was founded in 1924 and is headquartered in Atlanta, Georgia.

It announced a solid increase in its quarterly dividend, $0.15 per share, a 50% increase over previous distributions. The distribution will be on August 20, and shares must be held before July 30 to be eligible to receive it. I like dividends, especially ones that are growing. Money doesn’t grow on trees unless you are Janet Yellen then it just grows in mushroom patches.

First-quarter earnings per share beat estimates. On July 11 it will present its accounts and EPS is expected to increase by 9.06% and revenue by 8.66%.

In its favor, it has solid operating performance and cost management. With a market cap of $32.03 billion and a very attractive P/E ratio of 6.3, it is trading at far too low of an earnings multiple compared to its sector. Its shares are “undervalued” and 95% of those “watching” it rate it a buy. Me too.

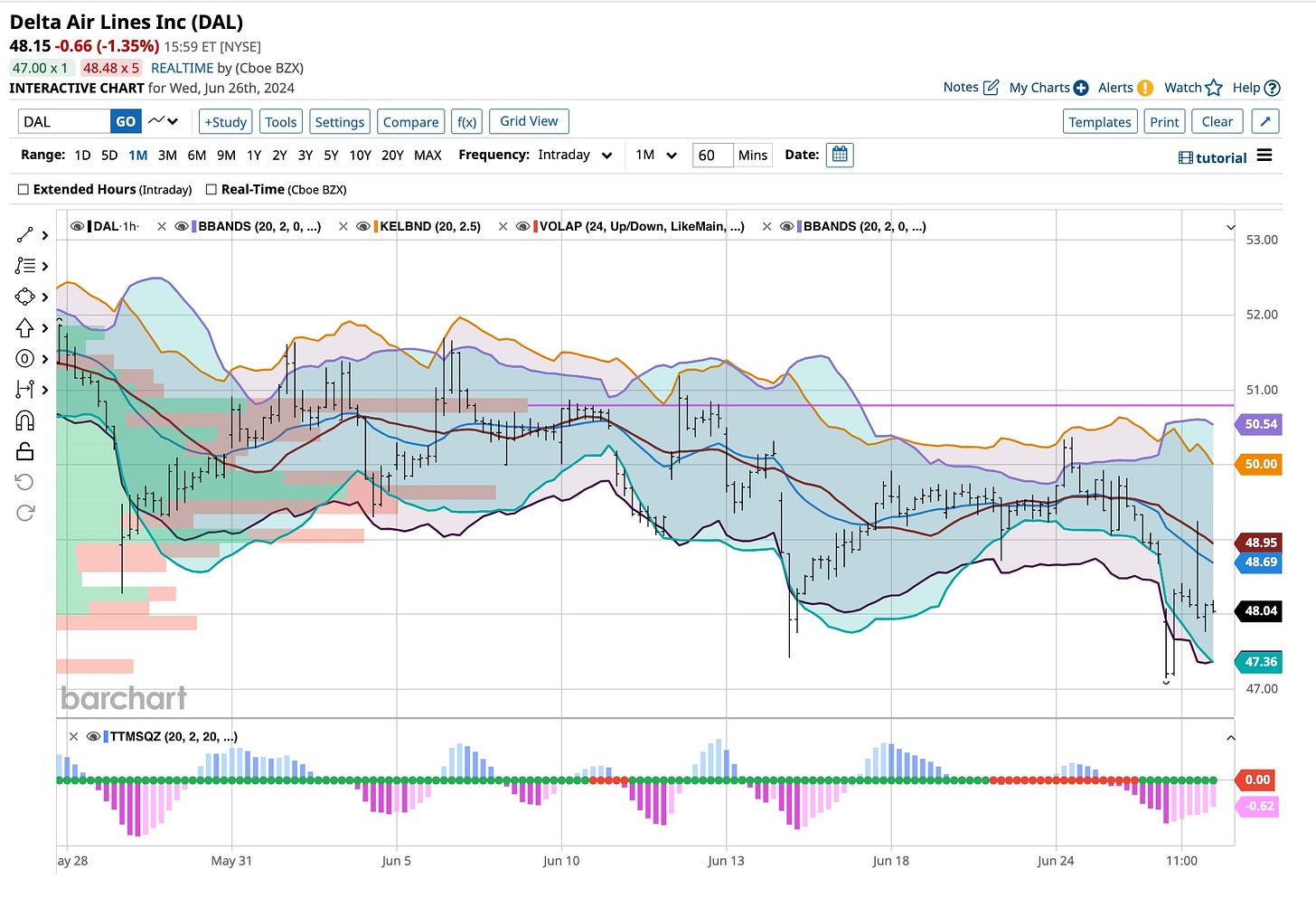

Schlumberger NV (“SLB”) is a blast from my past that I bought cheap and sold high. It is time to buy it again. Aren’t cycles wonderful? It’s fighting for the lead in the supply of technology for the energy industry worldwide. The company was formerly known as Societe de Prospection Electrique. It was founded in 1926 and is headquartered in Houston, Texas.

Its dividend yield is 2.41%, a far cry from the 15% yield of four years ago but prices per share did skyrocket. It reports on July 19 and for the current fiscal year, it expects EPS growth of 17.8% and revenues of 12.2%. It’s back and the price is right.

Its recent acquisition of CHX was a strategic move that will strengthen its “portfolio” and improve its exposure to future growth markets. Of note is revenue growth, margin expansion driven by its international positioning and artificial intelligence solutions, and that it trades at a discount to historical valuations.

In addition, the company's commitment to distribute more than 50% of its free cash flow to shareholders reinforces its attractiveness to investors. It has 95% buy ratings and no sell ratings. I’m on board and you should be too regardless of who ends up the winner of the debate but if it’s Trump, that’s even better.

Get Ready To Rumble

Enjoy the debates. Look for an update from me on Nike before it reports on Thursday and do yourself a big favor. Join us at The Ticker. For a mere $247, less than a 1/4 point move on a 1,000 share purchase, you get more than $1,500 of instant value. You get me and more, you get to learn and that’s priceless.

Like The Moody Blues, “I Know You Are Out There Somewhere”. Chances are you are here on Substack. Perhaps on LinkedIn but for certain you are somewhere. Everybody is. All we need to do is meet and you’ll discover there is a “right way” to operate in the financial world. It starts with a strong foundation. I’m not timid, there’s a “right way” to learn. A strong foundation allows for bricks and mortar to build upon it. No one is ever right 100% of the time. Better investors and traders know that basic consistency is the key to success and planning is the operative word. Give it a chance, what do you have to lose except losing money thinking you can do it yourself? Join The Ticker and let us show you how it’s done.